Advanced Micro Devices, Inc. Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Advanced Micro Devices, Inc.

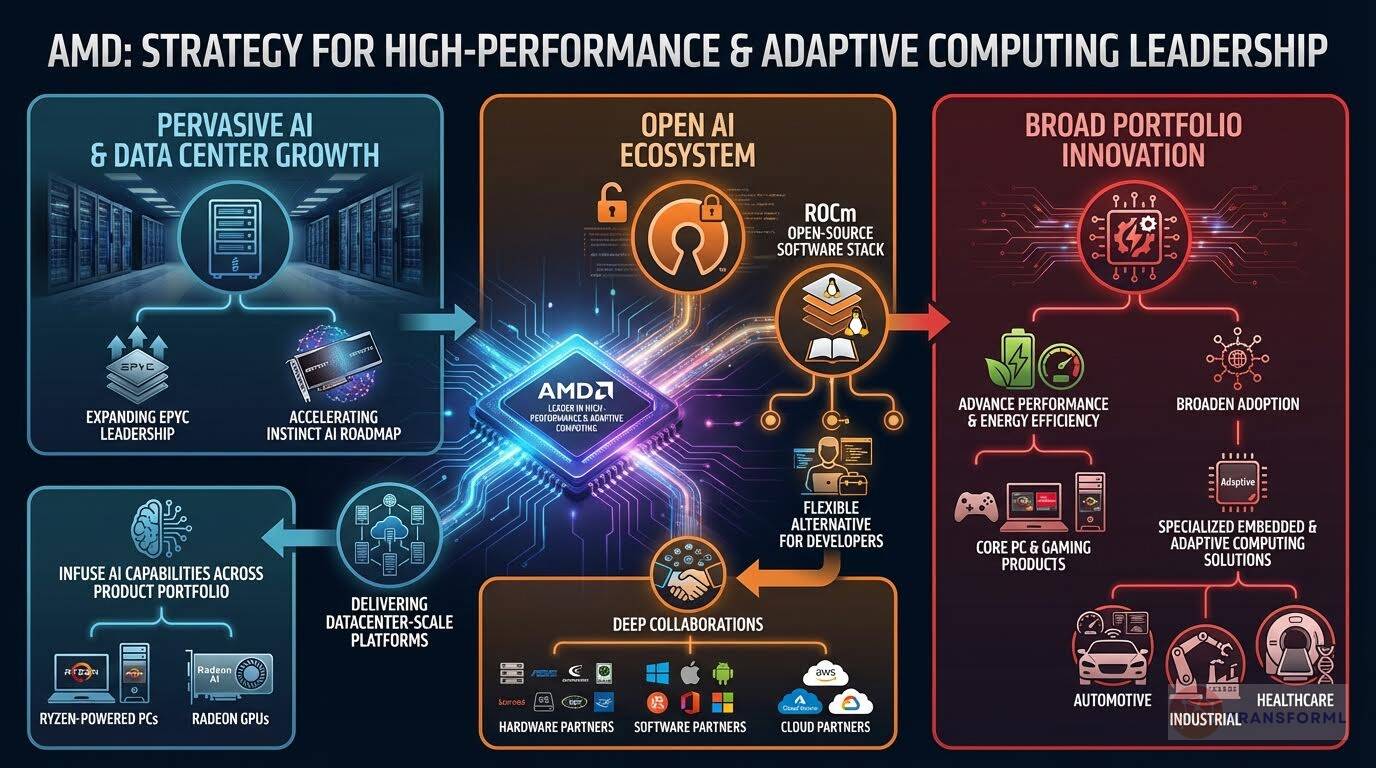

Advanced Micro Devices (AMD)'s strategy is focused on accelerating leadership in high-performance computing and artificial intelligence by scaling its data center business, expanding its AI accelerator roadmap, and delivering energy-efficient CPUs, GPUs, and adaptive computing platforms. The company is prioritizing rapid growth in data centers through EPYC processors and Instinct accelerators, building open, full-stack AI software ecosystems with ROCm, and deepening partnerships across cloud, enterprise, and AI developers to drive adoption at scale. At the same time, AMD is strengthening its client, gaming, and embedded portfolios by integrating AI capabilities across products, improving performance-per-watt, and leveraging adaptive computing to serve industrial, automotive, and edge use cases. This strategy positions AMD as a leading open and scalable alternative in AI and high-performance computing markets while supporting long-term growth through innovation, ecosystem expansion, and diversified end markets.

Key Competitors for Advanced Micro Devices, Inc.

Intel Corporation

Dominant market share in microprocessors, strong relationships with OEMs

NVIDIA Corporation

Dominant market share in GPUs, strong software ecosystem

Taiwan Semiconductor Manufacturing Company Limited (TSMC)

Leading-edge manufacturing process technology

Insights from Advanced Micro Devices, Inc.'s strategy and competitive advantages

What Stands Out in Advanced Micro Devices, Inc. strategy

AMD's strategy is uniquely distinguished by its commitment to an open ecosystem approach as a direct counter-strategy to its primary competitor's closed platform, and its broad portfolio of high-performance compute engines (CPU, GPU, Adaptive). While competitors focus on dominating specific areas, AMD positions itself as the versatile high-performance alternative across multiple critical domains.

The 'Open' Alternative to AI Dominance: AMD's most significant distinction is its strategic pillar to "Build open, full-stack AI software ecosystem" centered around ROCm. This is a direct challenge to NVIDIA's dominant, proprietary CUDA platform. By fostering an open-source community and aiming for compatibility with frameworks like PyTorch, JAX, and Hugging Face, AMD is positioning itself as the flexible, non-proprietary choice for developers and enterprises wary of vendor lock-in. This contrasts sharply with NVIDIA's strategy to "Expand the Global AI Ecosystem" by reinforcing its own CUDA platform and rolling out proprietary tools like NVIDIA Inference Microservices (NIM).

Versatile High-Performance Portfolio: AMD is uniquely positioned with leadership or strong challenger products across CPUs (EPYC, Ryzen), GPUs (Instinct, Radeon), and adaptive computing (FPGAs via the Xilinx acquisition). This breadth allows AMD to offer integrated, heterogeneous computing solutions (e.g., EPYC CPUs paired with Instinct GPUs) for the data center. This contrasts with NVIDIA, which is GPU-dominant (though building out its Grace CPU), and Qualcomm, which is primarily focused on mobile-first SoCs and connectivity. AMD's goal to "Enable leadership AI capabilities across entire product portfolio" leverages this unique combination of assets.

Targeted Adaptive and Embedded Solutions: The integration of Xilinx's technology gives AMD a distinct advantage in the embedded and adaptive computing markets. Initiatives like "Develop Kria System on Modules" for industrial applications and creating "AI Engines for Versal Adaptive SoCs" provide AMD with a specialized 'how-to-win' in markets like automotive, industrial, and healthcare that is differentiated from the GPU-centric approach of NVIDIA or the connectivity-focused strategy of Qualcomm.

What are the challenges facing Advanced Micro Devices, Inc. to achieve their strategy

AMD faces substantial challenges stemming from competing against a deeply entrenched and financially superior rival in the AI space, the strategic risk of its broad market focus, and the immense difficulty of shifting an entire software ecosystem.

Battling a Fortified Ecosystem (NVIDIA's CUDA Moat): AMD's greatest challenge is overcoming the massive incumbency advantage of NVIDIA's CUDA platform. NVIDIA's strength is not just hardware, but its "Full-Stack Platform" and a "CUDA Ecosystem" it claims has 5 million developers. AMD's ROCm is playing catch-up. While its open strategy is distinctive, it faces the immense hurdle of achieving feature parity, performance, and developer mindshare against a platform that has been the industry standard for over a decade. NVIDIA is already advancing to deploying "NIM Inference Microservices," showcasing a level of ecosystem maturity that AMD is still aspiring to build.

Immense Financial and R&D Disparity: AMD is fighting an economic battle at a significant disadvantage. NVIDIA reported revenue of $60.9B with a 72.7% gross margin, dwarfing AMD's $25.8B revenue and 49% margin. This vast difference in profitability provides NVIDIA with enormous capital to reinvest in R&D, acquisitions, and market-building activities at a scale that is exceptionally difficult for AMD to match, creating a challenging competitive cycle.

Resource Allocation Across a Broad Front: AMD competes in the data center, client, gaming, and embedded markets. While this diversification is a strength, it also presents a challenge. The company's financial report shows declining revenue in its Gaming (-58%) and Embedded (-33%) segments, suggesting that resources may be stretched thin. This contrasts with NVIDIA's laser focus on the hyper-growth accelerated computing and AI markets, and Broadcom's strategy of achieving leadership in specific niches, often through large-scale acquisitions like VMware. AMD must successfully execute across all its chosen fronts to avoid being outmaneuvered by more focused competitors.

What Positions Advanced Micro Devices, Inc. to win

Data Center Growth

- AMD has demonstrated significant growth in the data center market, with revenue increasing by 94% year-over-year. This growth is driven by the adoption of AMD EPYC CPUs and Instinct GPUs in hyperscale data centers and enterprise environments.

Client Segment Performance

- The client segment has shown strong performance, with revenue increasing by 52% year-over-year. This growth is attributed to the success of AMD Ryzen mobile and desktop processors, which offer competitive performance and features.

AI Capabilities

- AMD is focused on developing AI capabilities across its product portfolio, including CPUs, GPUs, and adaptive computing solutions. The company's AI strategy involves delivering high-performance hardware and software solutions, expanding partnerships, and enabling open software ecosystems.

Product Innovation

- AMD has a strong track record of product innovation, with the launch of new products such as the 5th Gen AMD EPYC processors, AMD Instinct MI325X GPUs, and Ryzen AI 300 Series processors. These products offer competitive performance and features, enabling AMD to gain market share and drive revenue growth.

Strategic Acquisitions

- AMD has made strategic acquisitions to expand its capabilities and product offerings. The acquisition of Silo AI Oy expands AMD's capability to accelerate development and deployment of AI models on AMD hardware. The pending acquisition of ZT Systems will strengthen AMD's systems and customer enablement capabilities and accelerate the deployment of AMD AI solutions at scale.

Open Ecosystem Approach

- AMD is committed to building an open software ecosystem for AI, with the goal of establishing ROCm as the industry's leading open software stack. This approach provides developers with greater flexibility and accelerates innovation.

Financial Performance

- AMD has delivered strong financial results, with revenue increasing by 14% year-over-year and gross margin improving to 49%. The company has also generated significant cash flow from operations, which is used to fund investments in research and development, acquisitions, and stock repurchases.

Brand Recognition

- AMD has increased its brand value 24% year-over-year, ranking as the fifth fastest-growing brand since 2020 among the world's 500 most valuable brands, according to Brand Finance.

What's the winning aspiration for Advanced Micro Devices, Inc. strategy

AMD aims to be the leading provider of high-performance and adaptive computing solutions, enabling the next wave of revolutionary solutions across various industries and improving the daily lives of billions through pervasive AI capabilities and seamless end-to-end solutions.

Company Vision Statement:

High performance and adaptive computing is transforming our lives. - TEXT

Where Advanced Micro Devices, Inc. Plays Strategically

AMD competes in the data center, client computing, gaming, and embedded markets, focusing on high-performance computing and adaptive solutions. The company targets hyperscale data centers, OEMs, ODMs, and a broad range of embedded applications, with a significant international presence.

Key Strategic Areas:

How Advanced Micro Devices, Inc. tries to Win Strategically

AMD wins by delivering differentiated solutions through high-performance and energy-efficient processors, adaptive computing technology, and a strong focus on open ecosystems. The company leverages its intellectual property, design expertise, and partnerships to provide value to customers.

Key Competitive Advantages:

Strategy Cascade for Advanced Micro Devices, Inc.

Below is a strategy cascade for Advanced Micro Devices, Inc.'s strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Extend industry-leading data center, PC and gaming product portfolios

Expand the performance and energy efficiency advantages of AMD EPYC, Ryzen and Radeon processors across data center, PC and gaming product portfolios.

Develop Next-Generation EPYC Processors

Create new AMD EPYC processors with enhanced performance and energy efficiency for data center workloads, building on the 'Zen 5' core architecture.

Enhance Ryzen Mobile Performance

Improve the performance and battery life of AMD Ryzen mobile processors for notebooks, focusing on AI capabilities and differentiated experiences.

Advance Radeon Graphics Performance

Deliver next-generation Radeon GPUs with significantly enhanced ray tracing performance and new AI capabilities for the gaming market.

Optimize Power Consumption Across Product Lines

Reduce power consumption in all new CPU and GPU designs to improve energy efficiency and lower the total cost of ownership for customers.

Execute multi-year roadmap of AMD Instinct accelerators

Offer turnkey, datacenter-scale platforms that deliver industry-leading performance-per-watt for a broad range of AI workloads, executing the multi-year roadmap of AMD Instinct accelerators.

Accelerate MI Series GPU Development

Expedite the development and release of new AMD Instinct MI series GPUs, ensuring an annual cadence of leadership AI accelerator solutions.

Develop Datacenter Scale AI Platforms

Create complete, datacenter-scale platforms that integrate AMD Instinct accelerators with EPYC processors and networking solutions for AI workloads.

Improve Performance Per Watt

Optimize the performance-per-watt of AMD Instinct accelerators to achieve industry-leading energy efficiency for AI training and inference.

Integrate UALink and UEC Standards

Incorporate Ultra Accelerator Link (UALink) and Ultra Ethernet Consortium (UEC) open industry standards for AI networking into AMD's datacenter solutions.

Broaden adoption of embedded and adaptive computing solutions

Expand the adoption of AMD's embedded and adaptive computing solutions that power unique features and capabilities for customers across a wide range of industries.

Develop Application-Specific Embedded Solutions

Create new embedded solutions tailored to specific applications in key markets such as automotive, industrial, and healthcare.

Expand Adaptive Computing Platform Designs

Increase customer adoption of AMD's adaptive computing platforms by securing new embedded CPU designs and expanding the portfolio with differentiated solutions.

Integrate AI Processing in Embedded Portfolio

Incorporate dedicated AI processing capabilities into AMD's embedded portfolio to enable AI application acceleration on a single chip.

Develop Kria System on Modules

Create new Kria System on Modules (SOMs) to provide high determinism and low latency for powering electric drives and motor controllers.

Enable leadership AI capabilities across entire product portfolio

Ensure all of AMD's CPU, GPU and adaptive computing products excel at both AI and traditional computing, enabling leadership AI capabilities across the entire product portfolio.

Integrate NPUs into Ryzen Processors

Integrate Neural Processing Units (NPUs) into Ryzen processors to accelerate AI workloads on client devices.

Optimize GPU Performance for AI

Enhance the performance of AMD Radeon GPUs for AI/ML based workloads, enabling immersive visualization and AI processing.

Develop AI Engines for Versal SoCs

Create AI Engines for Versal Adaptive SoCs to achieve dramatic system-level performance improvements for AI applications.

Optimize EPYC Processors for AI Workloads

Optimize AMD EPYC processors to efficiently process, interact with, and generate insights from massive real-world datasets for AI systems.

Build open, full-stack AI software ecosystem

Strengthen ROCm with the speed and scale of the open-source community, building an open, full-stack AI software ecosystem.

Enhance ROCm Software Stack

Develop and improve the AMD ROCm open software stack, adding new features and optimizing popular libraries for AI training and inference.

Expand Open-Source Community Support

Increase resources supporting the open-source community to enable faster development, testing, and release of software enhancements for AMD Instinct accelerators.

Integrate Leading AI Frameworks

Ensure seamless integration of AMD hardware with leading AI frameworks like PyTorch and JAX, and emerging compilers like OpenAI Triton.

Optimize Hugging Face Models

Optimize AMD hardware to seamlessly run more than 1 million models on Hugging Face.

Drive Data Center Growth

Accelerate growth in the Data Center segment by delivering leadership performance and capabilities for a wide range of data center workloads.

Increase EPYC Processor Market Share

Expand the adoption of AMD EPYC processors across cloud, enterprise, and supercomputing customers to achieve record server processor market share.

Scale Data Center AI Business

Rapidly scale AMD's data center AI business by deploying AMD Instinct accelerators in large-scale production environments.

Expand Cloud Instance Availability

Increase the number of AMD-powered public cloud instances available from major cloud providers.

Increase Enterprise EPYC Adoption

Expand the footprint of AMD EPYC processors with Forbes 2000 companies to power their mission-critical workloads.

Expand the deep and collaborative partnerships

Expand the deep and collaborative partnerships across the ecosystem to accelerate deployments of AMD based Al solutions at scale.

Collaborate with Hardware and Software Leaders

Foster close collaboration with hardware and software leaders across the industry to drive innovation and adoption of AMD's AI solutions.

Engage with Cloud Providers and AI Innovators

Engage with leading cloud providers and AI innovators to adopt AMD Instinct accelerators at scale for their AI workloads.

Participate in Industry Consortia

Actively participate in industry consortia like UALink and UEC to define open industry standards for AI networking.

Enable Hugging Face Integration

Work with Hugging Face to ensure that more than 1 million models run seamlessly on AMD hardware.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.