Analog Devices, Inc. Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Analog Devices, Inc.

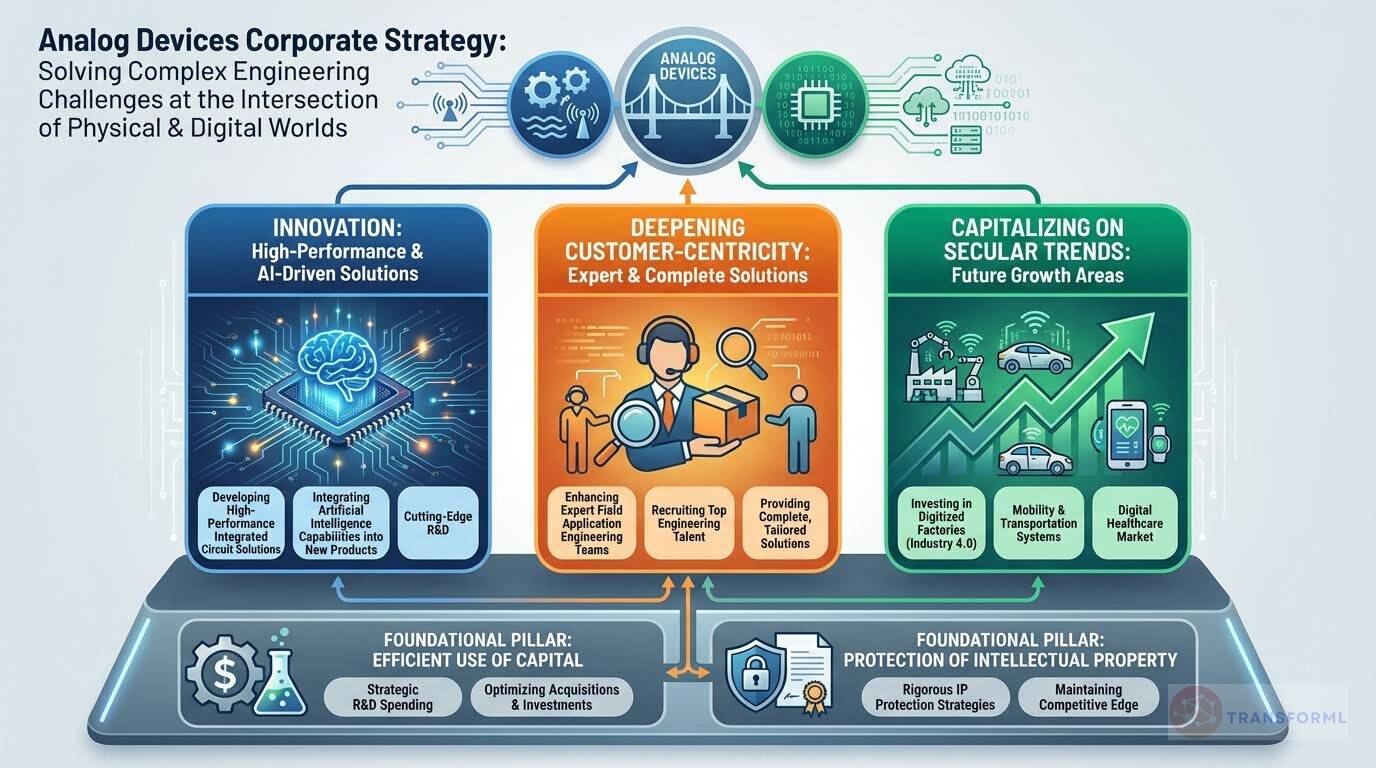

Analog Devices, Inc.'s strategy is focused on solving customers' most complex engineering challenges by delivering high-performance analog, mixed-signal, and digital signal processing solutions at the Intelligent Edge. The company is deepening customer-centricity through strong application engineering support and domain expertise, while making disciplined investments in research and development, strategic acquisitions, and capital efficiency. Analog Devices is positioning itself to capitalize on long-term secular growth trends—including industrial automation, mobility, digital healthcare, energy management, and connectivity—while protecting its intellectual property, managing global supply chain and geopolitical risks, and maintaining strong ESG standards to drive sustainable long-term value creation.

Key Competitors for Analog Devices, Inc.

Texas Instruments

Broad product portfolio and strong customer relationships

STMicroelectronics

Expertise in power management and automotive applications

Infineon Technologies

Leading provider of power semiconductors and security solutions

NXP Semiconductors

Strong position in automotive and industrial markets

Insights from Analog Devices, Inc.'s strategy and competitive advantages

What Stands Out in Analog Devices, Inc. strategy

ADI distinguishes itself through a high-touch, solution-centric model focused on solving the most complex engineering challenges at the 'Intelligent Edge', which is in contrast to Texas Instruments' (TI) strategy, as it's heavily oriented towards manufacturing scale and cost leadership. ADI's approach is evident in its emphasis on 'deep domain expertise' and significant investment in customer-facing technical talent. For example, a key strategic program for ADI is to 'Enhance Field Application Engineering', deploying expert engineers to help customers integrate ADI's high-performance products, in addition to a customer-centric innovation model is further supported by a higher R&D intensity (16% of revenue) and a reliance on strategic acquisitions to acquire cutting-edge technology and talent, as highlighted by their goal to 'Optimize Acquisition Integration'.

While TI also innovates, its primary 'How to Win' is through 'Manufacturing and Technology' leadership, specifically by expanding its own 300mm wafer production to lower costs, giving it a scale and cost advantage that ADI does not prioritize to the same degree.

What are the challenges facing Analog Devices, Inc. to achieve their strategy

ADI faces two significant challenges when compared to Texas Instruments. First, is the intense cost and margin pressure stemming from TI's formidable manufacturing strategy. TI is executing a massive capital expenditure plan to 'Expand 300mm Wafer Production' and 'Accelerate Internal Wafer Sourcing', aiming for a structural cost advantage which is reflected in TI's operating profit margin of 34.9%, which is substantially higher than ADI's 17.3%. This cost disparity could allow TI to compete aggressively on price, challenging ADI's position, particularly in less specialized product areas.

The second major challenge is TI's aggressive move to own the customer relationship directly. TI's strategy to 'Increase Direct Customer Engagement' has resulted in approximately 80% of its revenue coming through direct channels like TI.com. This contrasts sharply with ADI, which relies on distributors for 58% of its revenue. TI's direct model not only builds a strong moat around its customer base but also provides valuable data and insights, potentially leaving ADI at a strategic disadvantage in understanding market trends and locking in customers for the long term.

What Positions Analog Devices, Inc. to win

Comprehensive Product Portfolio

- Analog Devices offers a broad and diverse portfolio of integrated circuits, software, and subsystems, enabling it to serve a wide range of applications and customer needs.

Deep Domain Expertise

- The company possesses extensive knowledge and experience in high-performance analog, mixed-signal, and digital signal processing technologies, allowing it to develop innovative solutions for complex engineering challenges.

Advanced Manufacturing Capabilities

- Analog Devices has advanced manufacturing facilities and processes, including proprietary technologies, which enable it to produce high-performance and reliable products.

Customer-Centric Approach

- The company prioritizes close customer relationships, influencing all aspects of its business from product development to manufacturing, and strives to be a destination for top engineering talent to deepen these relationships.

Strong Financial Performance

- Analog Devices has historically demonstrated strong revenue generation, profitability, and cash flow, enabling it to invest in research and development, acquisitions, and shareholder returns.

Commitment to Innovation

- The company is dedicated to continuous innovation, driven by a diverse array of engineering talent, and actively incorporates AI capabilities into its technologies, business operations, products, and services.

Strategic Acquisitions

- Analog Devices has a track record of successful acquisitions that complement its existing product offerings, diversify its portfolio, expand its market coverage, and enhance its technological capabilities.

Global Manufacturing Footprint

- The company operates manufacturing facilities in multiple locations worldwide, enhancing its global resiliency and diversifying its manufacturing footprint.

What's the winning aspiration for Analog Devices, Inc. strategy

Analog Devices aims to be the leading provider of high-performance analog, mixed-signal, and digital signal processing solutions, enabling advancements in digitized factories, mobility, digital healthcare, climate change mitigation, and human connectivity.

Company Vision Statement:

Company Vision Statement - Analog Devices is a global semiconductor leader dedicated to solving our customers' most complex engineering challenges.

Where Analog Devices, Inc. Plays Strategically

Analog Devices strategically focuses on the B2B markets driving data growth at the Intelligent Edge, including Industrial, Automotive, and Communications, while also addressing Consumer applications. The company sells its products globally through a mix of direct sales, distributors, and representatives, with a significant portion of revenue derived from international markets.

Key Strategic Areas:

How Analog Devices, Inc. tries to Win Strategically

Analog Devices leverages its technical innovation, product performance, reliability, and strong customer service to differentiate itself in the competitive semiconductor market. The company emphasizes product performance and reliability, supported by a commitment to strong customer service and technical support.

Key Competitive Advantages:

Strategy Cascade for Analog Devices, Inc.

Below is a strategy cascade for Analog Devices, Inc.'s strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Solving our customers' most complex engineering challenges

Focus on delivering innovations that connect technology to human breakthroughs and play a critical role at the intersection of the physical and digital worlds.

Develop High-Performance IC Solutions

Create innovative integrated circuit (IC) solutions that address a wide range of real-world signal processing applications, focusing on high-performance analog, mixed-signal, and digital signal processing technologies.

Enhance Data Converter Technology

Continuously innovate data converter products to improve sampling rates, accuracy, noise levels, power efficiency, and package size, catering to diverse applications across industrial, automotive, consumer, and communications electronics.

Integrate AI Capabilities into Products

Incorporate artificial intelligence (AI) capabilities into the development of technologies, business operations, products, and services to enhance performance and provide innovative solutions.

Expand Sensor and Actuator Portfolio

Develop and offer a wider range of sensor and actuator products, including MEMS-based devices, to provide comprehensive solutions for sensing acceleration, rotation, temperature, magnetic fields, and other real-world phenomena.

Efficient use of capital

Prioritize R&D investments, realize targeted shareholder value creation from acquisitions, and deliver strong shareholder returns.

Increase Strategic R&D Spending

Allocate capital towards research and development (R&D) initiatives that focus on cutting-edge innovations and solving difficult problems across a broad array of applications.

Optimize Acquisition Integration

Improve the integration processes for acquired businesses and technologies to realize targeted shareholder value creation and synergies.

Maintain Strong Cash Flow Generation

Focus on generating significant cash flow through the development of cutting-edge innovations and the ability to solve difficult problems across a broad array of applications.

Execute Strategic Stock Repurchase

Repurchase shares of common stock in the open market or through negotiated transactions, depending on financial position, results of operations, outlook, liquidity, and other relevant factors.

Deepening customer-centricity

Focus on building close customer relationships, leveraging engineering talent, and providing complete and innovative solutions.

Enhance Field Application Engineering

Expand and strengthen the field application engineering team to provide customers with expert assistance in incorporating Analog Devices' products into their systems.

Develop Web-Based Design Tools

Create and improve web-based tools that ease product selection and aid in the design process for customers, enhancing their experience and enabling them to develop complete and innovative solutions.

Recruit Top Engineering Talent

Attract and retain highly-skilled engineers by offering challenging work in an environment that enables them to learn, grow, and reach their full potential.

Expand Customer Training Programs

Develop and implement extensive training programs, including technical seminars and webinars, to educate customers on the features and benefits of Analog Devices' products.

Capitalizing on secular trends

Position the business to capitalize on important secular growth trends to drive advancements in digitized factories, mobility and digital healthcare, combat climate change and reliably connect humans and the world.

Invest in Digitized Factory Solutions

Increase investments in research and development (R&D) and strategic partnerships to develop solutions for industrial automation, condition-based monitoring, and factory control.

Expand Mobility Product Offerings

Develop and market high-performance signal processing solutions for sophisticated transportation systems, including infotainment, electrification, and autonomous applications.

Penetrate Digital Healthcare Market

Collaborate with customers and partners to develop innovative solutions for increased access to better and more affordable care, preventative healthcare, and chronic condition management.

Develop Energy Management Solutions

Create and offer both standard and application-specific products for improved energy efficiency, conservation, reliability, and clean energy, including electric vehicle charging infrastructure, renewable energy, and power transmission systems.

Protect Proprietary Intellectual Property Rights

Establish and maintain proprietary rights in technology and products through patents, copyrights, trademarks, and trade secrets.

Increase Patent Application Filings

Implement a program to proactively identify and file patent applications for significant inventions in the United States and selected foreign countries.

Strengthen Trade Secret Protection

Enhance nondisclosure policies and confidentiality agreements to maintain trade secrets and confidential information.

Monitor Unauthorized Product Distribution

Implement measures to monitor and prevent the diversion of products from authorized distribution channels and sales on the gray market.

Enforce Intellectual Property Rights

Pursue litigation and other legal actions to enforce patents, copyrights, trademarks, and trade secrets against infringing products and unauthorized parties.

Manage Global Political and Economic Uncertainty

Navigate political, legal, and economic changes, crises, or instability that may impact markets in which the company does business.

Diversify Supply Chain Geographically

Reduce reliance on single-source suppliers and expand the geographic distribution of manufacturing facilities and suppliers to mitigate risks associated with regional instability.

Monitor Geopolitical Risks

Establish a dedicated team or function to monitor global political and economic developments, assess potential impacts on the business, and develop contingency plans.

Comply with Export Regulations

Ensure compliance with customs and export regulations, including the Export Administration Regulations and the International Traffic and Arms Regulations, to avoid penalties and restrictions.

Assess Currency Conversion Risks

Implement strategies to mitigate currency conversion risks and exchange rate fluctuations, including hedging and other financial instruments.

Maintain Strong Environment, Social and Governance (ESG) Standards

Adhere to applicable environment, health and safety (EHS) regulatory and industry standards across all facilities, and to encourage pollution prevention, reduce water and energy consumption, manage waste streams to divert from landfills and strive towards continual improvement.

Certify EHS Management Systems

Maintain certifications to ISO 14001:2015 for environmental management and ISO 45001:2018 for occupational health and safety across all manufacturing facilities.

Reduce Water and Energy Consumption

Implement programs to reduce water and energy consumption across all facilities, including investments in energy-efficient equipment and water conservation technologies.

Divert Waste from Landfills

Manage waste streams to divert from landfills and strive towards continual improvement in waste management practices.

Enhance Employee Engagement

Drive continuous improvements across diversity and inclusion through employee engagement and sustainability efforts.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.