Applied Materials, Inc. Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Applied Materials, Inc.

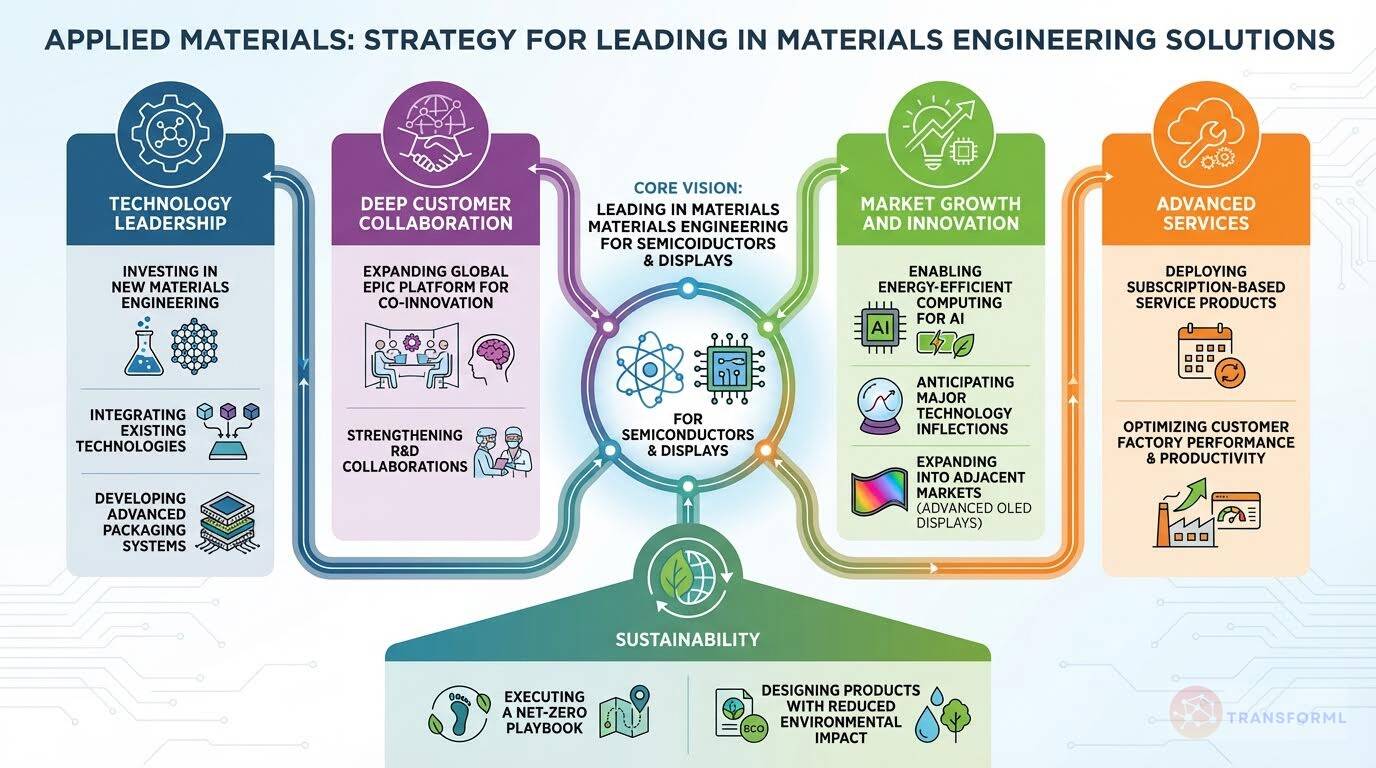

Applied Materials' strategy is centered on strengthening its leadership in materials engineering solutions for the semiconductor and advanced display industries by delivering a unique, connected portfolio of technologies that span unit process equipment, integrated systems, and advanced services. The company is focused on accelerating key technology inflections in AI, advanced packaging, and energy-efficient computing through heavy investment in R&D, earlier and deeper collaboration with customers via its global EPIC platform, and expansion into adjacent markets. Applied Materials is also scaling its high-margin services and subscription offerings to support customers' fab productivity and lifecycle performance, while advancing sustainability initiatives such as its Net Zero 2040 roadmap. Together, these priorities position Applied Materials to grow its addressable market, enable next-generation semiconductor innovation, and remain a critical partner to leading chipmakers worldwide.

Key Competitors for Applied Materials, Inc.

Lam Research

Strong in etch and deposition technologies

Tokyo Electron (TEL)

Broad portfolio, strong customer relationships in Japan

ASML

Dominant in lithography equipment

KLA Corporation

Leader in process control and yield management

Insights from Applied Materials, Inc.'s strategy and competitive advantages

What Stands Out in Applied Materials, Inc. strategy

Applied Materials' core strategic distinctiveness lies in its unparalleled breadth and integration of its technology portfolio. Unlike its more specialized competitors, AMAT's strategy is to be a one-stop-shop for 'materials engineering solutions', offering a 'comprehensive and connected portfolio' from unit process equipment to 'co-optimized, integrated solutions'. This allows them to tackle complex device challenges, such as heterogeneous integration, in a holistic way that competitors cannot.

For example, while Lam Research focuses deeply on being a leader in etch and deposition and KLA dominates the process control niche, AMAT's strategy aims to integrate these and other steps to improve power, performance, and yield across the entire manufacturing flow. This is tangibly supported by their 'global EPIC platform', a specific, large-scale initiative designed for 'earlier and broader collaborations' with customers to co-develop these integrated solutions, a more formalized approach than competitors' general collaboration goals.

Finally, its sheer scale (revenue of $27.1B vs Lam's $14.9B and KLA's $9.8B) and explicit focus on growing its addressable market into adjacent areas like Display with its 'MAX OLED™ solution' further differentiate it from its more narrowly focused peers.

What are the challenges facing Applied Materials, Inc. to achieve their strategy

The primary challenge for Applied Materials stems directly from its breadth: competing against best-in-class specialists in critical segments. The company faces intense pressure from highly focused rivals who are leaders in their respective domains.

For instance, Lam Research has 'clear leadership in the etch and deposition technologies' and is aggressively targeting key 'technology inflections like gate-all-around' and 'backside power delivery'. Similarly, KLA Corporation is the undisputed leader in process control, leveraging 'physics-based AI algorithm innovations' to extend its technological moat. AMAT must defend its position across all these fronts simultaneously, which risks spreading its R&D resources thinner than its rivals.

This is reflected in its financial metrics; while strong, AMAT's gross margin of 47.5% is significantly lower than KLA's 60%, highlighting the profitability challenge of managing a diverse portfolio compared to KLA's high-margin niche. Furthermore, competitors are advancing in specific strategic capabilities; Lam Research's 'Semiverse™ Solutions' presents a very articulated 'digital twin' strategy for virtual collaboration, which appears more advanced than AMAT's described initiatives, potentially creating a gap in next-generation customer engagement models.

What Positions Applied Materials, Inc. to win

Technology Leadership

- Applied Materials possesses a comprehensive and connected portfolio of materials engineering technologies, spanning unit process equipment to co-optimized and integrated solutions. This allows the company to deliver differentiated solutions that improve the power, performance, yield, and costs of semiconductor devices.

Market Position

- The company holds established market positions in technically-differentiated LCD and OLED manufacturing solutions. It has a strong presence in key markets such as foundry, logic, DRAM, and flash memory.

Customer Collaboration

- Applied Materials is focused on driving earlier and broader collaborations with customers and partners through its global EPIC platform. This platform is designed to accelerate cycles of learning, increase mutual success rates, and improve investment efficiencies.

Service Business Growth

- The company is experiencing double-digit growth in its parts and service business, supported by advanced service products and a high percentage of revenues from subscriptions in the form of long-term agreements. This provides a recurring revenue stream and strengthens customer relationships.

Financial Performance

- Applied Materials has demonstrated strong financial performance, with record revenue and earnings per share in fiscal 2024. The company has also distributed significant capital to shareholders through share repurchases and increased dividends.

Innovation Focus

- The company is committed to continued development of new materials engineering solutions, including products and platforms that enable expansion into new and adjacent markets. It invests significantly in research, development, and engineering to deliver innovative technologies ahead of strong demand.

Global Reach

- Applied Materials has a strong global presence, with operations in numerous countries and a diverse workforce spanning 24 countries. This allows the company to effectively serve its customers and adapt to changing market conditions.

Commitment to Sustainability

- Applied Materials is focused on reducing the environmental impact of its operations and those of its customers and suppliers. The company's 'Net Zero 2040 Playbook' outlines a collaborative approach to reducing carbon emissions.

What's the winning aspiration for Applied Materials, Inc. strategy

Applied Materials aims to lead the semiconductor industry by enabling advancements in energy-efficient computing and AI, driving innovation through materials engineering, and delivering differentiated solutions that help customers win the race for AI leadership.

Company Vision Statement:

Company Vision Statement - Applied Materials is the leader in the materials engineering solutions used to produce virtually every semiconductor and advanced display in the world.

Where Applied Materials, Inc. Plays Strategically

Applied Materials strategically focuses on the semiconductor and display industries, targeting key markets like foundry, logic, memory, and advanced packaging. The company is expanding its presence in emerging areas such as AI and energy-efficient computing, while maintaining a strong global footprint with a significant presence in Asia.

Key Strategic Areas:

How Applied Materials, Inc. tries to Win Strategically

Applied Materials leverages its unique and connected portfolio of technologies, collaborative approach, and advanced service products to deliver differentiated solutions and accelerate innovation for its customers. The company's expertise in materials engineering and focus on customer collaboration enable it to outperform the industry and win in the long term.

Key Competitive Advantages:

Strategy Cascade for Applied Materials, Inc.

Below is a strategy cascade for Applied Materials, Inc.'s strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Build a unique and connected portfolio

Develop and maintain a portfolio of highly enabling technologies, including unit process equipment and co-optimized, integrated solutions.

Invest in Materials Engineering Solutions

Increase investment in research and development of new materials engineering solutions, including products and platforms that enable expansion into new and adjacent markets.

Integrate Existing Technologies

Combine, co-optimize, and integrate existing technologies across the portfolio to develop highly differentiated solutions for customers.

Develop Advanced Packaging Systems

Advance heterogeneous integration capabilities to allow customers to connect multiple chips together, enabling them to advance the technology roadmap beyond a single chip.

Expand Technology Portfolio

Pursue acquisitions of companies, technologies, or products in existing, related, or new markets to complement existing technology capabilities and reduce time to market.

Drive earlier and broader collaborations

Foster earlier and broader collaborations with customers and partners to accelerate the introduction of next-generation technology.

Expand EPIC Platform Globally

Build out the global EPIC platform to accelerate cycles of learning, increase mutual success rates, and improve investment efficiencies.

Strengthen R&D Collaboration

Strengthen research and development collaboration with customers and partners to accelerate innovation and commercialization of groundbreaking new technologies.

Establish Early-Stage Technology Selection

Deliver new products and technologies before the emergence of strong demand, allowing customers to incorporate these products into their manufacturing plans during early-stage technology selection.

Deploy advanced service products

Utilize advanced service products to help customers accelerate R&D, technology transfer, and optimize factory operations.

Optimize Customer Factory Performance

Provide solutions to optimize plant performance and productivity, leveraging transactional and subscription service products, spares, and factory automation software.

Expand Subscription-Based Service Agreements

Shift the AGS service and spares business to a subscription agreement model, improving customer factory performance and optimizing operating costs.

Enhance System Performance

Offer products and services to improve system performance, lower overall cost of ownership, and increase yields and productivity of customers' fab operations.

Enable Energy-Efficient Computing

Focus on enabling more energy-efficient computing through semiconductor technology advancements.

Improve Computing Performance-per-Watt

Help leading AI companies achieve a 10,000 times improvement in computing performance-per-watt over the next 15 years.

Advance Device Architecture Inflections

Focus on enabling device architecture inflections in logic, memory, and advanced packaging through materials science and materials engineering.

Deliver Energy-Efficient Compute Performance

Deliver substantial improvements in energy-efficient compute performance to help companies win the race for AI leadership.

Reduce Environmental Impact

Reduce the environmental impact of Applied Materials' operations and those of its customers and suppliers.

Execute Net Zero 2040 Playbook

Execute Applied's Net Zero 2040 Playbook, outlining a collaborative approach to reducing the company's and the semiconductor industry's carbon emissions.

Develop Sustainable Products

Design products with reduced energy consumption and improved environmental impact.

Adhere to Ethical Labor Practices

Commit to ethical labor practices, responsible minerals sourcing, Responsible Business Alliance and SEMI guidelines, and the Applied Materials Standards of Business Conduct as defined in our Environmental, Social and Governance (ESG) commitment.

Grow Addressable Market

Grow Applied Materials' addressable market through technology transitions and innovation.

Enable OLED IT Inflection

Enable Display customers for the coming OLED IT inflection with innovations like the MAX OLED™ solution, which is designed to bring the superior OLED displays found in high-end smartphones to tablets, PCs and eventually TVs.

Expand into Adjacent Markets

Develop new materials engineering capabilities, including products and platforms that enable expansion into new and adjacent markets.

Anticipate Technology Inflections

Successfully anticipate technology inflections, and ensure products continuously evolve to satisfy customers' requirements to compete effectively in the marketplace.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.