AT&T Inc. Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for AT&T Inc.

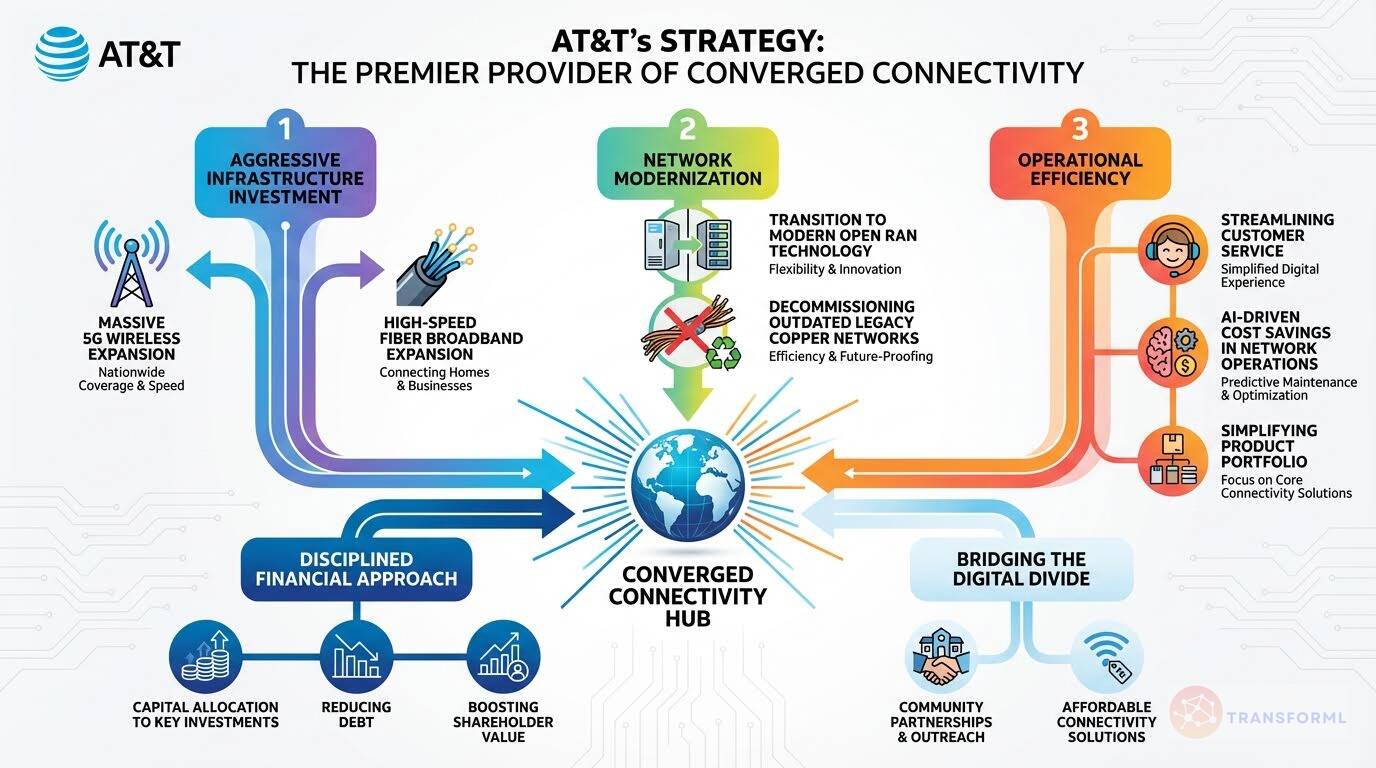

AT&T Inc.'s strategy is centered on strengthening its position as America's leading connectivity provider by scaling owned 5G wireless and fiber broadband networks to meet accelerating demand for high-performance, reliable connectivity. The company is investing heavily in nationwide 5G and fiber expansion, modernizing its network through initiatives such as Open RAN and legacy copper retirement, and driving operational efficiency through simplification and AI-enabled cost savings. AT&T is pairing disciplined capital allocation and net-debt reduction with long-term infrastructure investment to support sustainable free cash flow, shareholder returns, and leadership in converged connectivity, with a long-term goal of reaching more than 50 million fiber locations by 2029.

Key Competitors for AT&T Inc.

Verizon

Extensive wireless network coverage and brand recognition

T-Mobile US, Inc.

Aggressive pricing strategies and rapid 5G deployment

Comcast

Large cable infrastructure and bundled service offerings

América Móvil

Dominant market share in Mexico

Insights from AT&T Inc.'s strategy and competitive advantages

What Stands Out in AT&T Inc. strategy

AT&T's strategy is uniquely defined by its commitment to a fully-owned, dual-infrastructure model of converged connectivity, combining its massive wireless and fiber networks. Unlike competitors who often prioritize one infrastructure or rely on partnerships (e.g., Comcast's MVNO on Verizon's network), AT&T's core 'How to Win' is built on owning and deeply integrating both pillars.

This is exemplified by its aggressive goal to expand its fiber network to over 50 million locations by 2029, creating a direct-to-customer asset that both T-Mobile and Verizon are trying to match primarily through Fixed Wireless Access (FWA). Furthermore, AT&T's large-scale, public commitment to 'Lead the USA in Commercial Scale Open RAN Deployment' is a significant technological differentiator, representing a forward-looking bet on network architecture to lower costs and increase flexibility, a move more pronounced than competitors' more generalized mentions of network modernization.

Finally, its exclusive FirstNet contract for public safety provides a substantial, high-value customer base and a powerful network reliability credential that no competitor can replicate.

What are the challenges facing AT&T Inc. to achieve their strategy

AT&T faces the significant challenge of being caught in a competitive pincer movement. On one side, T-Mobile aggressively dominates on growth metrics and value perception, leveraging its 'Un-carrier' brand and attractive bundles ('Hulu On Us') to win market share. On the other, Verizon maintains a strong brand reputation for premium network quality.

This leaves AT&T's brand positioning in a challenging middle ground. A second major challenge is its legacy burden; the strategic initiative to 'Exit Legacy Copper Network Operations' highlights a costly and complex operational drag that competitors like T-Mobile (primarily wireless) and Comcast (cable-based) do not face to the same extent.

While AT&T bets heavily on its multi-billion dollar fiber expansion, it faces a direct and potent threat from cable providers like Comcast, whose 'Accelerate DOCSIS 4.0 Deployment' initiative aims to deliver competitive multi-gigabit speeds over its existing infrastructure, potentially mitigating the unique advantage of fiber and challenging the return on AT&T's massive capital investment.

What Positions AT&T Inc. to win

Network Leadership

- AT&T possesses the nation's largest wireless and fiber networks, positioning it to efficiently meet customer needs and capture organic growth opportunities.

Customer Growth in Key Areas

- The company added 1.7 million high-value postpaid phone customers in 2024, demonstrating its ability to attract and retain valuable subscribers.

Financial Discipline

- AT&T reduced its net debt by nearly $9 billion in 2024, showcasing its commitment to financial stability and efficient capital allocation.

Technological Innovation

- AT&T is modernizing its wireless network with open radio access network (Open RAN) deployment, enhancing its 5G implementation and positioning it to capitalize on future wireless technologies.

FirstNet Leadership

- AT&T's wireless network is the heart of FirstNet, keeping first responders and the public safety community connected when it matters most, with 6.7 million connections across nearly 30,000 public safety agencies and organizations.

Fiber Expansion

- AT&T has added 1 million or more AT&T Fiber customers for the 7th consecutive year, closing 2024 with 9.3 million in total and nearly 29 million consumer and business locations passed with fiber.

Customer Satisfaction

- AT&T Fiber is rated as America's fastest internet with the most reliable speeds, and #1 in customer satisfaction.

Stockholder Returns

- AT&T delivered total shareholder returns of 44% in 2024, outpacing the S&P and industry peers.

What's the winning aspiration for AT&T Inc. strategy

AT&T aims to be America's best connectivity provider through its superior 5G and fiber networks, delivering seamless and high-performance connectivity to customers while driving sustainable growth and shareholder value.

Company Vision Statement:

Company Vision Statement - To connect people to greater possibilities.

Where AT&T Inc. Plays Strategically

AT&T focuses on the U.S. market, providing wireless and wireline telecom and broadband services to consumers and businesses. It is expanding its fiber network to new geographies and exploring fixed wireless and satellite connectivity options to reach remote areas.

Key Strategic Areas:

How AT&T Inc. tries to Win Strategically

AT&T leverages its superior 5G and fiber networks, converged connectivity solutions, and focus on customer experience to win in the market. It aims to provide seamless wireless and broadband connectivity, offering innovative services and plans that bundle product offerings.

Key Competitive Advantages:

Strategy Cascade for AT&T Inc.

Below is a strategy cascade for AT&T Inc.'s strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Cement AT&T's leadership as the premier provider of converged connectivity services

Cement AT&T's leadership as the premier provider of converged connectivity services by offering seamless wireless and broadband connectivity.

Bundle Wireless and Fiber Services

Create attractive bundled offers combining 5G wireless and fiber broadband to increase customer adoption and retention, focusing on seamless integration and simplified billing.

Expand Integrated Gateway Availability

Increase the availability and adoption of the AT&T Integrated Gateway device, providing internet backup for businesses to prevent disruptions and enhance converged connectivity solutions.

Enhance Customer Experience Across Platforms

Improve the customer experience by providing a seamless and consistent experience across all AT&T services and platforms, including online, in-store, and customer service interactions.

Accelerate Converged Products and Solutions

Invest in research and development to create new and innovative converged products and solutions that leverage the strengths of both wireless and wireline technologies.

Reach more than 50 million total locations by the end of 2029

Continue aggressive investment in and deployment of 5G and fiber infrastructure to meet growing data demands and expand coverage.

Expand AT&T Fiber High-Speed Internet to New Geographies

Increase the pace of fiber deployment to reach more than 50 million total locations by the end of 2029, focusing on high-growth areas and strategic partnerships.

Reach More Than 314 Million People in the U.S. with 5G Network

Continue to invest in expanding 5G network capacity and coverage, including deploying mid-band spectrum and modernizing the wireless network.

Best Utilize a Wireless Network with Sufficient Spectrum and Capacity

Redeploy existing spectrum and acquire additional spectrum licenses to support higher mobile data usage and improve network performance.

Lead the U.S. in Commercial Scale Open RAN Deployment

Expand the deployment of Open RAN technology throughout the wireless network to foster lower network costs, improved operational efficiencies, and continued investment in broadband.

Focus on Effective and Efficient Operations

Focus on effective and efficient operations to accelerate cost savings, deliver adjusted EBITDA and Free Cash Flow (FCF) growth, and support sustainable and organic growth.

Streamline and Modernize Distribution and Customer Service

Implement business transformation initiatives to streamline and modernize distribution and customer service, remove redundancies, and simplify processes and support functions.

Drive Al-Driven Efficiencies in Network Design and Operations

Leverage AI-driven efficiencies in network design and operations to reduce costs and improve network performance.

Focus on Owned and Operated Connectivity Services Powered by 5G and Fiber

Simplify the product portfolio by focusing on core connectivity services and sunsetting legacy technologies and services.

Adapt the Compensation Model to Provide Fair and Inclusive Pay Practices

Right-size the workforce and improve employee productivity through training, development, and fair and inclusive pay practices.

Our deliberate capital allocation strategy supported significant investment in 5G and fiber

Employ a deliberate capital allocation strategy to support significant investment in 5G and fiber while reducing net debt and improving shareholder returns.

Support Investment in 5G and Fiber

Allocate capital primarily to strategic infrastructure investments in 5G and fiber networks to drive long-term growth and competitive advantage.

Achieve Target of Net Debt-To-Adjusted EBITDA in the 2.5x Range in the First Half of 2025

Continue to reduce net debt to achieve the target of net debt-to-adjusted EBITDA in the 2.5x range in the first half of 2025.

Return $40 Billion+ to Shareholders Through Dividends and Share Repurchases During 2025-2027

Execute a plan to return $40 billion+ to shareholders through dividends and share repurchases during 2025-2027.

Monetize Non-Core Assets

Identify and monetize non-core assets to generate additional capital for strategic investments and debt reduction.

Modernize Network Infrastructure

Transition to modern communications infrastructure, including Open RAN deployment, and decommission high-cost legacy technologies.

Exit Legacy Copper Network Operations

Actively work to exit legacy copper network operations by migrating customers to fiber and wireless alternatives and decommissioning inefficient copper infrastructure.

Scale the Open RAN Environment Throughout Our Wireless Network

Scale the Open RAN environment throughout the wireless network in coordination with multiple suppliers to capitalize on next-generation wireless technology and spectrum.

Manage the Migration of Wireline Customers to Services Using Fiber Infrastructure

Continue to convert to a software-based network, managing the migration of wireline customers to services using fiber infrastructure and software-defined network (SDN) technologies.

Manage Secure and Reliable Networks

Strengthen network security measures to protect against cyberattacks and ensure the reliability and resilience of the network.

Encourage Investment, Innovation, Growth, and Global Competitiveness

Promote sound, rational public policy and regulation that encourage investment, innovation, growth, and global competitiveness in the telecommunications industry.

Modernize Policy Frameworks for the Digital Age

Advocate for regulatory reforms that reflect current and emerging technologies, retire less secure technologies, and establish market-based mechanisms to sustain private investment.

Increase Allocation of Spectrum

Support policies that increase the allocation of spectrum to sustain the affordability and expand the performance of U.S. wireless networks.

Reform the Universal Service Fund

Advocate for reform of the Universal Service Fund to streamline federal subsidy programs and broaden funding support for internet access.

Work with Policymakers at All Levels to Accomplish Bold Reforms

Actively engage with policymakers at all levels to accomplish bold reforms necessary to support a new era of sustained economic growth and innovation.

Help Connect Every American to the Internet

Connect every American to the internet through initiatives like Connected Learning Centers and a $5 billion commitment to help 25 million people get and stay connected.

Open at Least 100 CLCs by 2027

Increase the number of Connected Learning Centers to at least 100 by 2027, providing access to technology and educational resources in underserved communities.

Help 25 Million People Get and Stay Connected

Develop and support digital literacy programs to help 25 million people get and stay connected, focusing on skills training and access to affordable internet services.

Offer Affordable Connectivity Solutions

Provide affordable broadband and wireless connectivity solutions to low-income households and underserved communities.

Partner with Community Organizations

Collaborate with community organizations and government agencies to expand access to internet and technology resources in underserved areas.

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.