Berkshire Hathaway Inc. Strategy Analysis

AI-assisted analysis. Editor-reviewed by Ahmad Zaidi

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Berkshire Hathaway Inc.

Berkshire Hathaway's strategy in 2024 focused on leveraging its insurance operations, particularly GEICO, and reinvesting capital to build taxable income. The company continued its ambidextrous equity activity, balancing controlled businesses with minority stakes in large, profitable companies, and emphasized its preference for equities over cash-equivalent assets. A key strategic move included increasing investments in Japanese companies, reflecting a long-term commitment to international markets.

Key Competitors for Berkshire Hathaway Inc.

State Farm

Large agency sales force and brand recognition

Progressive

Advanced data analytics and pricing strategies

Allstate

Extensive distribution network and diverse product offerings

USAA

Strong customer loyalty and focus on military community

Sandvik

Wide assortment of products and extensive distribution networks

Kennametal, Inc.

Wide assortment of products and extensive distribution networks

Insights from Berkshire Hathaway Inc.'s strategy and competitive advantages

What Stands Out in Berkshire Hathaway Inc. strategy

Berkshire Hathaway's strategy is fundamentally distinctive from its insurance-focused competitors due to its structure as a holding company that prioritizes long-term, ambidextrous capital allocation over operational integration. While competitors like Chubb and Progressive focus on being the best insurance operators, Berkshire focuses on being the best capital allocator. This is evident in its strategic pillar to 'Deploy Capital Ambidextrously' across wholly-owned businesses and marketable equities, a scope far broader than Chubb's more focused 'Strategic Holdings' partnership with KKR or Progressive's operational reinvestments.

Furthermore, Berkshire's 'Promote Decentralized Operations' philosophy stands in stark contrast to its peers. For example, Chubb actively seeks to 'Integrate Life and Non-Life Offerings' to find synergies, and Progressive pushes for product bundling. Berkshire, conversely, empowers subsidiary managers with extreme autonomy, believing this fosters entrepreneurialism, a core part of its 'How to Win' strategy. This patient, decentralized, and capital-centric model, funded by the massive '$171 billion in float' from its insurance arms, defines its unique position in the market.

What are the challenges facing Berkshire Hathaway Inc. to achieve their strategy

Berkshire Hathaway's primary strategic challenge is a potential innovation and agility gap, particularly in technology and digital transformation, when compared to its more operationally focused competitors. While Berkshire's plan includes 'Strengthen Cybersecurity Defenses', it lacks a proactive, enterprise-wide digital strategy pillar. This contrasts sharply with Chubb, which has a core pillar to 'Lead in Digital Transformation' with specific programs like 'Ingest Customer Data Automatically' and 'Engineer Business Processes'.

Similarly, Progressive's entire model is built on technological superiority, with strengths in 'Effective Pricing and Underwriting' driven by telematics and advanced data analytics. Berkshire's decentralized model, while a strength, may inhibit the cross-pollination of these critical technological advancements, leaving it vulnerable to competitors who leverage data and AI to achieve greater efficiency and more accurate risk pricing.

A second challenge is its growth model; its sheer size and reliance on finding large, undervalued 'elephant' acquisitions can lead to periods of slower growth compared to the aggressive organic growth demonstrated by Progressive (21% growth in net premiums written) and Chubb (nearly 10% growth in P&C premiums). This reliance on market bargains, coupled with a largely defensive posture on emerging trends like climate change ('Adapt Underwriting Practices'), could cede ground to competitors like Chubb who are actively building new business lines around them ('Develop Climate Tech Insurance Solutions').

What Positions Berkshire Hathaway Inc. to win

Financial Strength

- Berkshire Hathaway maintains exceptionally high levels of capital strength in its insurance companies, with a combined statutory surplus of approximately $310 billion at December 31, 2024. This differentiates it from competitors and supports its AA+ rating by Standard & Poor's and A++ (superior) rating by A.M. Best.

Underwriting Expertise

- The company has a demonstrated ability to achieve underwriting profits over time, with a focus on rejecting inadequately priced risks. Its insurance business has generated $32 billion of after-tax profits from underwriting over the past two decades.

Investment Acumen

- Berkshire Hathaway's investment portfolios are managed by its Chief Executive Officer and two corporate investment managers, with a history of generating significant returns through a concentrated portfolio of publicly traded equity securities.

Decentralized Management

- The company's operating subsidiaries are managed on an unusually decentralized basis, fostering entrepreneurial spirit and accountability at the local level.

Long-Term Investment Horizon

- Berkshire Hathaway maintains a long-term investment horizon, often involving decades, which allows it to benefit from the compounding effects of successful business decisions.

Unique Insurance Model

- The company's property-casualty insurance business operates on a 'money-up-front, loss-payments-later' model, allowing it to invest large sums ('float') while generally delivering underwriting profits.

Commitment to Reinvestment

- Berkshire Hathaway's shareholders have consistently endorsed continuous reinvestment, enabling the company to build its taxable income and generate substantial cash income-tax payments to the U.S. Treasury.

Strong Leadership and Succession Planning

- With Greg Abel poised to succeed Warren Buffett as CEO, Berkshire Hathaway is ensuring a smooth transition of leadership and a continued commitment to the company's core values and principles.

What's the winning aspiration for Berkshire Hathaway Inc. strategy

Berkshire Hathaway aims to continue its long-term growth and value creation by strategically allocating capital to businesses with excellent economics and honest management, while also contributing significantly to the U.S. Treasury through income tax payments.

Company Vision Statement:

Company Vision Statement - Not explicitly stated in the document.

Where Berkshire Hathaway Inc. Plays Strategically

Berkshire Hathaway strategically focuses on sectors where it can leverage its financial strength and management expertise, primarily in the U.S. but with increasing investments in international markets. It competes across diverse industries, including insurance, freight rail transportation, energy, manufacturing, services, and retailing.

Key Strategic Areas:

How Berkshire Hathaway Inc. tries to Win Strategically

Berkshire Hathaway wins by leveraging its financial strength, underwriting expertise, decentralized management, and long-term investment horizon. It focuses on building sustainable competitive advantages and maintaining a culture of savings and reinvestment.

Key Competitive Advantages:

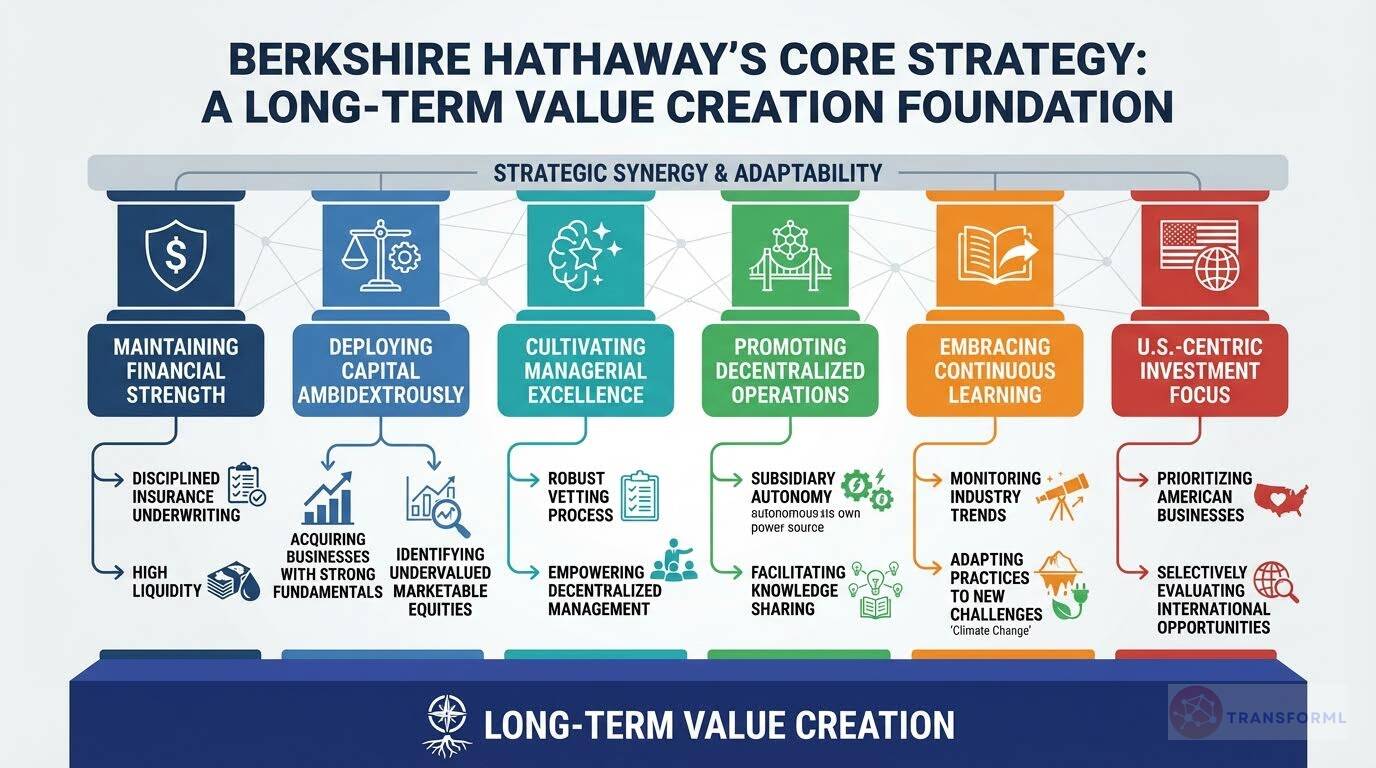

Strategy Cascade for Berkshire Hathaway Inc.

Below is a strategy cascade for Berkshire Hathaway Inc.'s strategy that has been formed through an outside-in analysis of publicly available data. Click on the arrows to expand each strategic pillar and see more details:

Maintain Financial Strength

Ensure Berkshire Hathaway's financial stability and resilience to withstand extreme losses and economic downturns.

Increase Insurance Underwriting Discipline

Improve the pricing and risk assessment processes within the insurance businesses to ensure adequate premiums are collected to cover potential losses, while unemotionally taking lumps when surprises develop.

Strengthen Cybersecurity Defenses

Enhance cybersecurity measures across all business units to protect against cyber-attacks and data breaches, safeguarding critical information and assets.

Diversify Investment Portfolio

Explore opportunities to diversify the investment portfolio to mitigate risks associated with concentrated holdings and market volatility.

Maintain High Liquidity Levels

Ensure sufficient cash reserves and liquid assets are available to meet obligations and capitalize on investment opportunities during economic downturns.

Deploy Capital Ambidextrously

Allocate capital effectively across both wholly-owned businesses and marketable equities, based on where the best returns can be achieved.

Identify Undervalued Marketable Equities

Actively search for and invest in undervalued marketable equities of outstanding businesses, taking advantage of occasional bargain prices.

Acquire Businesses with Strong Fundamentals

Pursue acquisitions of businesses with consistent earning power, good returns on equity, and able and honest management.

Reinvest in Existing Businesses

Prioritize reinvestment in existing wholly-owned businesses to foster growth and improve operational efficiencies.

Evaluate Capital Allocation Decisions

Establish a framework for rigorously evaluating past capital allocation decisions to identify mistakes and improve future investment strategies.

Cultivate Managerial Excellence and Fidelity

Recruit, retain, and empower high-quality managers with both ability and integrity to lead Berkshire's operating companies.

Implement Robust Manager Vetting Process

Develop a comprehensive process for vetting potential managers, focusing on both their abilities and their ethical standards.

Empower Decentralized Management

Provide managers with the autonomy and resources needed to effectively run their businesses, while maintaining oversight of capital allocation and strategic direction.

Offer Competitive Compensation and Incentives

Design compensation packages that align managers' interests with those of Berkshire Hathaway, rewarding long-term value creation and ethical behavior.

Promote Ethical Conduct and Compliance

Reinforce a culture of ethics and compliance with government laws and regulations, providing basic standards for ethical and legal behavior of employees.

Prioritize Internal Talent Development

Invest in training, learning, and career advancement opportunities for employees to foster a pipeline of qualified managers within Berkshire's operating companies.

Promote Decentralized Operations

Maintain a decentralized management philosophy, empowering operating subsidiaries to establish their own policies and practices.

Establish Clear Accountability Frameworks

Define clear roles, responsibilities, and performance metrics for each operating subsidiary to ensure accountability and alignment with overall company goals.

Facilitate Knowledge Sharing and Collaboration

Create platforms and forums for operating subsidiaries to share best practices, lessons learned, and innovative ideas across the Berkshire Hathaway ecosystem.

Streamline Centralized Support Functions

Optimize centralized support functions such as legal, finance, and IT to provide efficient and cost-effective services to operating subsidiaries without compromising their autonomy.

Monitor Subsidiary Performance and Risk

Implement a system for monitoring the financial performance, operational efficiency, and risk profiles of each operating subsidiary to identify potential issues and ensure compliance with company standards.

Embrace Continuous Learning and Adaptation

Foster a culture of lifelong learning and adapt to changing market conditions and technological advancements to maintain competitiveness.

Invest in Employee Training and Development

Provide employees with access to training programs, workshops, and educational resources to enhance their skills and knowledge in relevant areas.

Monitor Industry Trends and Disruptions

Establish a system for tracking emerging industry trends, technological advancements, and potential disruptions to inform strategic decision-making.

Promote Innovation and Experimentation

Encourage operating subsidiaries to experiment with new technologies, business models, and product offerings to drive innovation and growth.

Benchmark Performance Against Competitors

Regularly compare the performance of Berkshire's operating companies against industry benchmarks and competitors to identify areas for improvement.

Adapt Underwriting Practices to Climate Change

Update underwriting practices to reflect the major increase in damage from convective storms and the growing and increasingly unpredictable property damage arising from hurricanes, tornadoes and wildfires.

Maintain a U.S.-Centric Investment Focus

Prioritize investments in American equities and businesses, while selectively pursuing international opportunities that align with Berkshire's values and long-term strategy.

Prioritize American Equity Investments

Direct a substantial majority of investment capital towards American equities and businesses, leveraging Berkshire's expertise in the U.S. market.

Evaluate Select International Opportunities

Establish a framework for evaluating international investment opportunities that align with Berkshire's values, long-term strategy, and risk tolerance.

Maintain Currency Neutrality in International Investments

Implement strategies to mitigate currency risk associated with international investments, such as yen-denominated borrowings to offset Japanese equity holdings.

Support Boards of Directors in Key Investments

Actively support the boards of directors of key investments, both domestic and international, to ensure sound corporate governance and long-term value creation.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.