Boston Scientific Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Boston Scientific

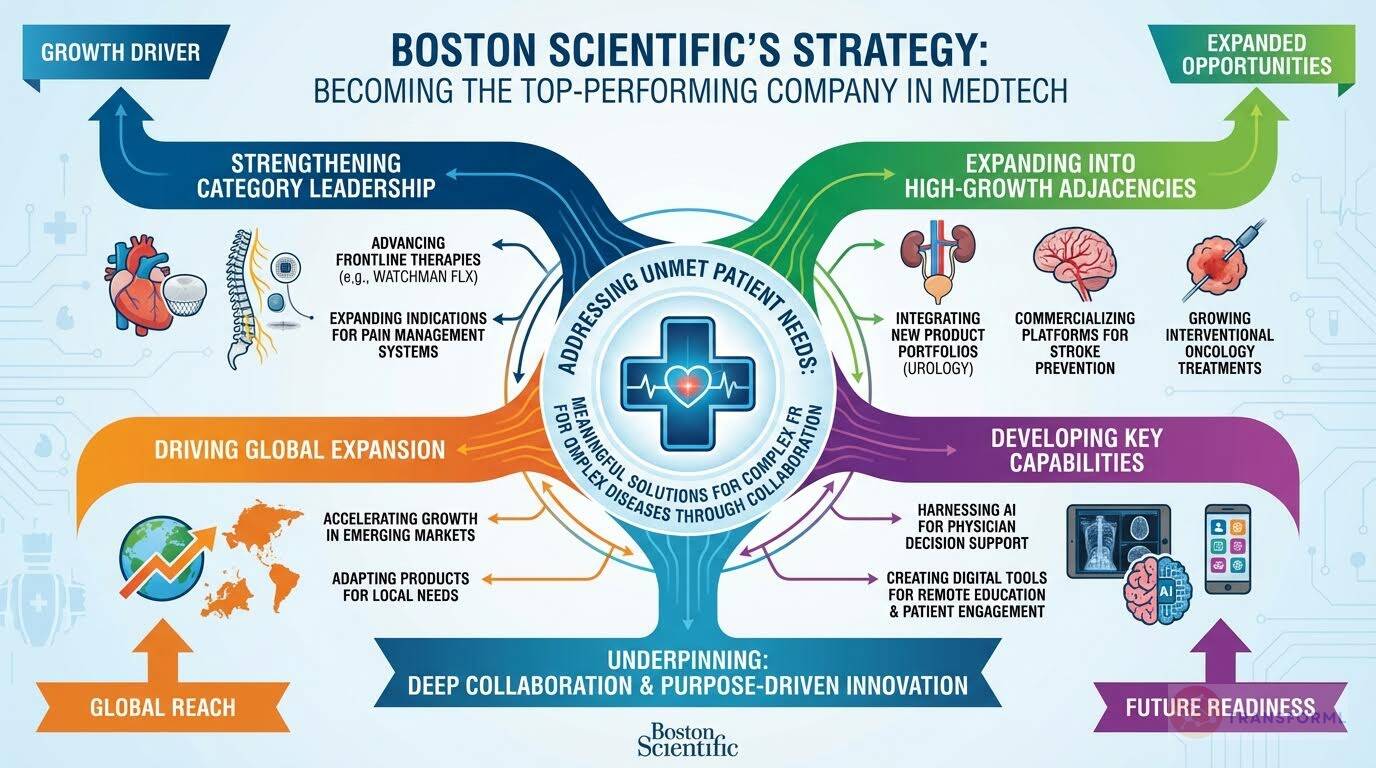

Boston Scientific's strategy is focused on achieving category leadership across core medical specialties, expanding into high-growth adjacencies, and accelerating global expansion to drive sustainable, above-market growth. The company is strengthening its competitive position through targeted acquisitions, differentiated product innovation, and expanded clinical evidence, while scaling its presence in emerging markets and priority geographies. Boston Scientific is also investing in research and development, digital and AI-enabled capabilities, supply chain resilience, and operational excellence to improve outcomes for patients and providers and position itself as the highest-performing large-cap company in medtech.

Key Competitors for Boston Scientific

Medtronic

Extensive product portfolio and global presence.

Abbott

Strong position in cardiovascular devices and diagnostics.

Johnson & Johnson

Broad healthcare portfolio and strong brand recognition.

Stryker

Leading player in surgical equipment and implants.

Insights from Boston Scientific's strategy and competitive advantages

What Stands Out in Boston Scientific strategy

Boston Scientific's strategy is distinctively characterized by its aggressive and highly specific acquisition-led approach to achieving 'Category Leadership' in targeted high-growth markets. While competitors also engage in M&A, Boston Scientific's strategic cascade is explicitly built around the integration and commercialization of recent, high-profile acquisitions.

For example, specific projects like 'Integrate Axonics Product Portfolio' and 'Commercialize Silk Road Medical Platform' are central to their plan to expand into adjacent markets like sacral neuromodulation and stroke prevention. This contrasts with the broader, more organically focused growth strategies of competitors like Abbott, which emphasizes its diversified model across diagnostics and nutritionals, and Medtronic, which focuses on leveraging its vast internal pipeline.

Furthermore, Boston Scientific's winning aspiration to be the 'highest-performing large cap company in medtech' is more overtly financial and performance-driven compared to the more patient-centric or broad-impact visions of competitors like Intuitive Surgical ('Advance Minimally Invasive Care') or Abbott ('helping people live fuller lives'). This sharp focus on acquiring and dominating specific, profitable niches is Boston Scientific's key strategic signature.

What are the challenges facing Boston Scientific to achieve their strategy

Boston Scientific faces significant challenges related to scale, platform dominance, and the intensity of technological competition. First, it is considerably smaller in revenue ($16.7B) than diversified giants like Abbott ($41.9B) and Medtronic ($32.4B), who can leverage their scale for greater R&D investment, supply chain efficiencies, and broader market access.

Second, unlike Intuitive Surgical, Boston Scientific lacks a single, dominant, ecosystem-defining platform like the da Vinci surgical system. Intuitive's strategy is built around deepening this ecosystem with its 'Quintuple Aim' and integrated digital tools, creating high switching costs and a powerful recurring revenue model that is difficult for a portfolio-based competitor to replicate.

Third, while Boston Scientific aims to 'Harness AI for Actionable Insights', competitors appear to have more mature and integrated AI strategies. Medtronic, for instance, details initiatives like 'AI-powered "driver assist" technology for surgical robots' and an open platform for its GI Genius module, suggesting a more advanced digital offensive. Finally, Boston Scientific's core growth areas, such as Pulsed Field Ablation (PFA) with its FARAPULSE system, are highly contested battlegrounds, with formidable competitors like Medtronic launching their own 'PulseSelect PFA System' and Abbott possessing a strong, established position in cardiovascular devices.

What Positions Boston Scientific to win

Revenue Growth

- Boston Scientific achieved a 17.6% increase in net sales, reaching $16.7 billion, driven by strong commercial execution and strategic acquisitions.

Profitability

- The company's adjusted operating margin was 27%, indicating efficient cost management and profitable operations.

Cash Flow Generation

- Boston Scientific generated $2.65 billion in free cash flow, demonstrating its ability to convert earnings into cash.

Global Expansion

- The company experienced double-digit operational growth in all regions, including a 19.6% increase in Emerging Markets.

Product Innovation

- Boston Scientific launched approximately 100 products and made groundbreaking advancements in cardiology, including the FARAPULSE™ PFA System.

Strategic Acquisitions

- The acquisitions of Axonics, Silk Road Medical, and Cortex added differentiated devices and expanded the company's portfolio in high-growth markets.

Category Leadership

- Boston Scientific is a leader in left atrial appendage closure (LAAC) devices and has disrupted the AF ablation market with its entry into pulsed field ablation (PFA).

R&D Investment

- Boston Scientific invested $1.6 billion in R&D, demonstrating its commitment to developing innovative technologies and expanding into adjacent markets.

What's the winning aspiration for Boston Scientific strategy

Boston Scientific aims to be the highest-performing large cap company in medtech by establishing itself as the go-to company in the medical specialties it serves, driven by category leadership, innovation, and global expansion.

Company Vision Statement:

Company Vision Statement - To transform lives through innovative medical solutions that improve the health of patients around the world.

Where Boston Scientific Plays Strategically

Boston Scientific competes in complex cardiovascular, respiratory, digestive, oncological, neurological and urological diseases and conditions. The company focuses on deepening its presence in these areas, expanding into high-growth markets, and entering adjacencies that complement its existing offerings.

Key Strategic Areas:

How Boston Scientific tries to Win Strategically

Boston Scientific wins by offering differentiated clinical and economic outcomes, creating innovative technologies, and applying these technologies cost-effectively. The company also focuses on building strong relationships with physicians and key hospital service line administrators.

Key Competitive Advantages:

Strategy Cascade for Boston Scientific

Below is a strategy cascade for Boston Scientific's strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Strengthen Category Leadership

Deepen focus in existing medical specialty areas to become the go-to company.

Advance WATCHMAN Device as Frontline Therapy

Expand the clinical evidence and commercial reach of the WATCHMAN FLX device to establish it as a frontline therapy for a broader number of patients with AF at risk of stroke.

Expand Indications for WaveWriter SCS Systems

Pursue additional clinical trials and regulatory approvals to expand the indications for WaveWriter Spinal Cord Stimulator Systems to treat a wider range of chronic pain conditions.

Optimize Supply Chain Effectiveness

Continuously improve supply chain effectiveness, strengthen manufacturing processes, and increase operational efficiencies to support category leadership and new product launches.

Enhance Quality Systems

Continually enhance quality systems and provide quality products to maintain regulatory compliance and customer trust.

Expand into High-Growth Adjacencies

Grow by entering adjacent markets that complement existing offerings.

Integrate Axonics Product Portfolio

Successfully integrate the Axonics product portfolio of sacral neuromodulation devices into the existing urology portfolio to expand into the treatment of urinary and bowel dysfunction.

Commercialize Silk Road Medical Platform

Expand the commercial reach of the Silk Road Medical platform for stroke prevention and the treatment of carotid artery disease through transcarotid artery revascularization (TCAR).

Develop Intracardiac Echocardiography Product

Advance the development of an intracardiac echocardiography product through the acquisition of SoundCath, Inc. to simplify visualization during ablation and other cardiac procedures.

Expand Interventional Oncology Treatments

Integrate the Intera Oncology, Inc. hepatic artery infusion pump and chemotherapy drug to expand treatments for liver cancer.

Drive Global Expansion

Increase net sales and market share by expanding global presence, including in Emerging Markets.

Accelerate Emerging Markets Growth

Increase investments in China and other Emerging Markets countries to drive net sales growth and expand market share.

Leverage International Relationships

Leverage relationships with leading physicians and their clinical research programs to increase net sales and market share in international markets.

Adapt Products for Local Markets

Expand collaborations to include research and development teams in emerging market countries to focus on both global and local market requirements.

Optimize Global Infrastructure

Leverage existing infrastructure in markets where commercially appropriate and use third-party distributors in markets where it is not economical or strategic to establish a direct presence.

Fund the Journey to Fuel Growth

Allocate capital effectively to support growth initiatives and strategic imperatives.

Transform Research and Development

Transform how research and development is conducted by identifying best practices, driving efficiencies, and optimizing the cost structure.

Maintain Supplier Resiliency Program

Continue the ongoing supplier resiliency program to identify and mitigate risk and take measures to mitigate the impact of challenges within the global supply chain.

Optimize Energy and Resource Usage

Optimize energy and resource usage to reduce greenhouse gas emissions and waste.

Maintain Investment Grade Ratings

Maintain investment grade credit ratings at the three ratings agencies to ensure access to capital markets and favorable borrowing terms.

Develop Key Capabilities

Enhance organizational capabilities, including digital and AI, to compete more effectively.

Harness AI for Actionable Insights

Expand the use of AI and digital technologies to improve diagnostics and provide decision support for physicians.

Develop Digital Sales Force Productivity

Continue to develop digital tools and technologies that enable the company to compete more effectively and increase digitally-enabled sales force productivity.

Provide Remote Physician Education

Continue to develop digital tools and technologies that enable the company to deliver first class remote physician education.

Drive Deeper Patient Engagement

Continue to develop digital tools and technologies that enable the company to drive deeper patient engagement.

Addressing Unmet Needs to Improve Patient Care

Collaborate with customers to identify clinical challenges and devise meaningful solutions.

Devise Meaningful Solutions for Coronary Artery Disease

Expand the use of the AGENT™ Drug-Coated Balloon (DCB) to reopen blocked vessels and transfer a therapeutic drug to the vessel wall to help prevent reoccurrence.

Promote High-Quality Care Supported by Reimbursement

Perform analytics and research to support commercial coverage and reimbursements for Boston Scientific products and procedures.

Collaborate with Customers to Identify Clinical Challenges

Continue to collaborate with customers to identify clinical challenges in need of solutions across the specialties served.

Support Healthcare Worker Education and Development

Provide grants that support education and development for healthcare workers and support chronic disease screenings in vulnerable communities worldwide.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.