Chevron Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Chevron

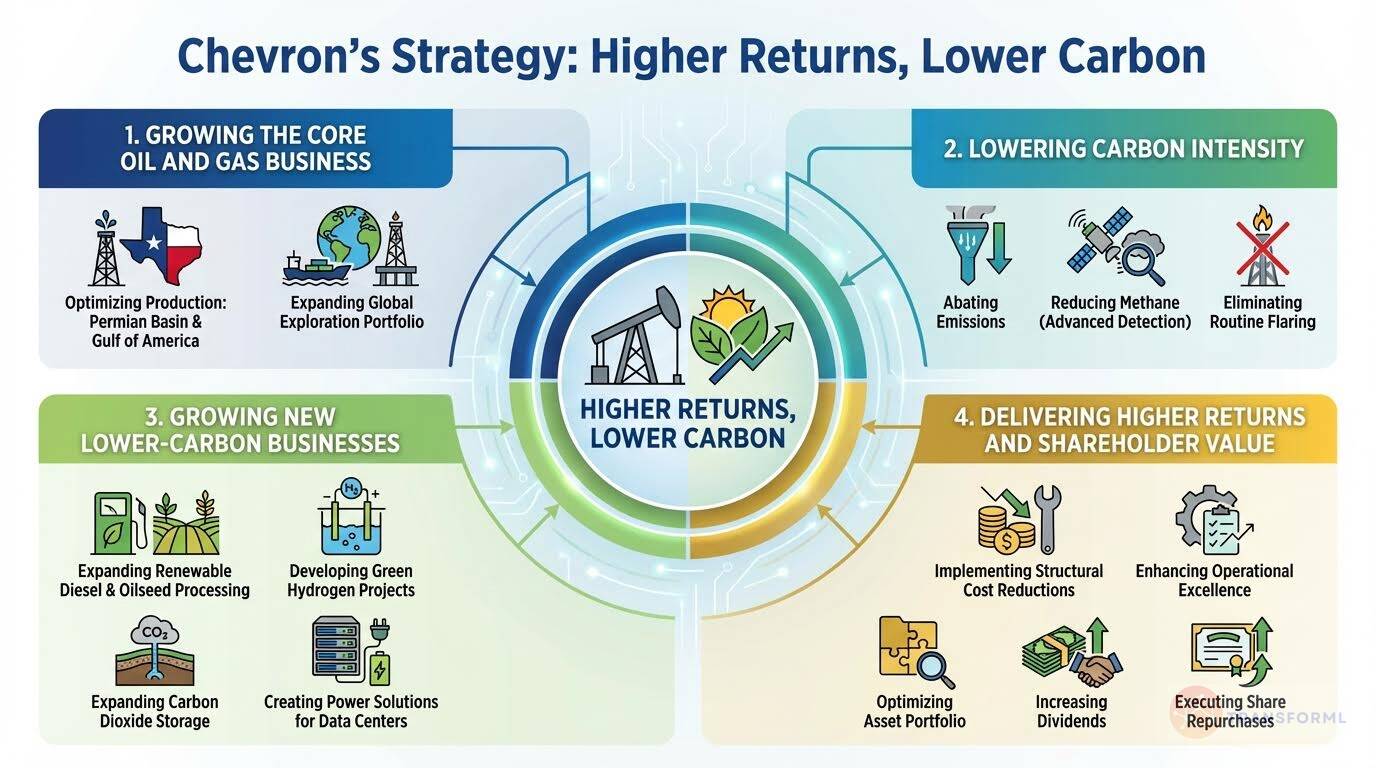

Chevron's strategy is focused on delivering affordable, reliable, and lower-carbon energy while generating superior long-term shareholder value. The company is pursuing disciplined growth in its core oil and gas business to meet rising global energy demand, while reducing the carbon intensity of its operations through technology, methane reduction, and emissions abatement. Chevron is also expanding into lower-carbon businesses such as renewable fuels, carbon capture and storage, hydrogen, and power solutions, while maintaining strong capital discipline, operational excellence, and a commitment to returning excess cash to stockholders through dividends and share repurchases.

Key Competitors for Chevron

ExxonMobil

Integrated operations and large-scale projects

Shell

Global presence and diverse energy portfolio

TotalEnergies

Focus on renewable energy and sustainability

BP

Investments in renewable energy and low-carbon technologies

Insights from Chevron's strategy and competitive advantages

What Stands Out in Chevron strategy

Chevron's strategy is distinctive for its pragmatic and balanced 'and' approach, simultaneously pursuing growth in its core oil and gas business while building a diverse portfolio of specific, tangible new energy ventures. This contrasts with the more focused strategies of its competitors.

For example, while ExxonMobil is making massive, concentrated bets on advantaged assets like Guyana and new ventures like lithium, and ConocoPhillips is laser-focused on shareholder returns as an E&P pure-play, Chevron is executing a dual-track strategy. A prime example of this distinctiveness is its initiative to 'Develop Scalable Power Solutions for Data Centers', a unique market play that leverages existing natural gas assets to tap into a high-growth tech sector, something not explicitly detailed by its peers.

Furthermore, its commitment to specific, named projects like the 'ACES Delta green hydrogen project' and the 'Geismar biorefinery expansion' demonstrates a tangible, project-based approach to the energy transition, rather than just a high-level ambition.

What are the challenges facing Chevron to achieve their strategy

The primary challenge for Chevron is the inherent risk of its balanced strategy being perceived as 'stuck in the middle,' potentially lacking the aggressive scale of ExxonMobil and the financial clarity of ConocoPhillips.

For instance, ExxonMobil's acquisition of Pioneer Natural Resources gives it a scale and resource depth in the Permian Basin that will be difficult for Chevron to match, potentially putting Chevron at a cost and production disadvantage in this key region. On the financial front, ConocoPhillips offers investors a crystal-clear value proposition with its commitment to 'return over 30% of cash from operations.'

While Chevron also has strong shareholder returns, its narrative is divided between funding this return and capitalizing a broad array of new energy projects. This breadth of investment (renewable diesel, hydrogen, CCS, etc.) could dilute capital and focus, challenging Chevron to achieve a market-leading position in any single new energy segment against competitors like ExxonMobil, which is building a formidable, integrated 'end-to-end carbon capture and storage system'.

What Positions Chevron to win

World-Class Asset Portfolio

- Chevron possesses a diverse portfolio of world-class assets, including low-carbon intensity oil and gas assets in the Gulf of America and significant production in the Permian Basin, positioning the company for profitable growth.

Technological and Engineering Innovation

- Chevron demonstrates a commitment to technological and engineering innovation, exemplified by the successful deployment of high-pressure technology in the Anchor project and waterflood operations at the St. Malo and Tahiti fields.

Financial Discipline

- Chevron maintains a strong balance sheet with a debt ratio of 13.9% and a net debt ratio of 10.4%, enabling the company to navigate volatility, consistently reward stockholders, and opportunistically capture value.

Commitment to Lower Carbon Solutions

- Chevron is actively investing in lower carbon solutions, including renewable fuels, carbon capture, and hydrogen, with projects like the Geismar biorefinery expansion and the ACES Delta green hydrogen project.

Strategic Partnerships

- Chevron leverages strategic partnerships, such as the joint venture with Bunge for renewable fuels and the collaboration with Microsoft and SLB for digital transformation, to enhance capabilities and scale solutions.

Strong Stockholder Returns

- Chevron has a consistent track record of increasing dividends, marking the 37th consecutive year of higher annual per-share dividend payout in 2024, and returning excess cash to stockholders through share repurchases.

Operational Excellence

- Chevron is focused on operational excellence, as demonstrated by the implementation of Conduct of Operations (COO) to maintain high standards of safety and reliability across its value chain.

Global Exploration Portfolio

- Chevron continues to expand its exploration portfolio by adding new positions in key regions such as Australia, Angola, Brazil, Namibia, and Uruguay.

What's the winning aspiration for Chevron strategy

Chevron aspires to lead the energy transition by safely delivering affordable, reliable, and ever-cleaner energy solutions, while maximizing shareholder value and minimizing environmental impact. It aims to grow its oil and gas business while simultaneously expanding into new, lower-carbon energy sectors.

Company Vision Statement:

Chevron Vision Statement - leverage our strengths to safely deliver lower carbon energy to a growing world.

Where Chevron Plays Strategically

Chevron strategically focuses on key geographic regions and business segments to maximize its competitive advantage and achieve its energy transition goals. It balances its traditional oil and gas operations with targeted investments in lower-carbon energy solutions.

Key Strategic Areas:

How Chevron tries to Win Strategically

Chevron aims to win by leveraging its operational excellence, technological innovation, and financial strength to deliver affordable, reliable, and lower-carbon energy solutions. It focuses on maximizing returns from its existing assets while strategically investing in new technologies and partnerships to drive long-term growth and sustainability.

Key Competitive Advantages:

Strategy Cascade for Chevron

Below is a strategy cascade for Chevron's strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Safely Deliver Lower Carbon Energy

Leverage Chevron's strengths to safely deliver lower carbon energy to a growing world.

Expand Lower Carbon Energies Portfolio

Increase investments in lower carbon energy sources, including renewable fuels, hydrogen, and carbon capture, to diversify Chevron's energy offerings.

Implement Advanced GHG Management Technologies

Deploy advanced technologies, including digital solutions and innovative technologies, to enhance operational efficiency, safety, and GHG management across Chevron's operations.

Develop Scalable Power Solutions for Data Centers

Create scalable power solutions for U.S. data centers using natural gas-fired turbines with the flexibility to integrate carbon capture and storage, renewables, or other lower carbon-intensity enhancements.

Progress ACES Delta Green Hydrogen Project

Advance the ACES Delta green hydrogen project in Utah to convert water into hydrogen using renewable energy and salt caverns for dispatchable energy storage for power generation.

Grow Oil and Gas Business

Expand Chevron's oil and gas business to meet growing global energy demand.

Optimize Permian Basin Production

Increase production in the Permian Basin to reach 1 million boe per day in 2025, leveraging efficient capital investment and technological advancements.

Expand Gulf of America Operations

Further develop Chevron's Gulf of America operations by safely deploying technology that can handle pressures up to 20,000 pounds per square inch to unlock resources previously difficult to access.

Optimize Tengiz Field Production

Increase total output to 1 million barrels of oil-equivalent per day at Tengizchevroil (TCO) by ramping up production at the Future Growth Project (FGP).

Expand Exploration Portfolio

Continue to expand Chevron's exploration portfolio by adding new positions in key regions such as Australia, Angola, Brazil, Equatorial Guinea, Namibia, and Uruguay.

Lower Carbon Intensity of Operations

Reduce the carbon footprint of Chevron's existing operations through various abatement projects and operational changes.

Abate Carbon Dioxide-Equivalent Emissions

Implement projects and operational changes designed to abate over 700,000 tonnes of carbon dioxide-equivalent annually from Chevron's operations.

Reduce Methane Emissions

Deploy advanced methane detection technologies, including ground sensors, airborne sensors, and satellites, to monitor and inform opportunities to reduce emissions.

Design New Facilities Without Routine Methane Emissions

Design, where possible, new upstream facilities without routine methane emissions, aligning with the ambition to remain top-quartile in methane emissions performance.

Eliminate Routine Flaring

Target zero routine flaring by 2030, aligning with the World Bank's 'Zero Routine Flaring by 2030' initiative.

Grow New Businesses in Lower Carbon Solutions

Expand into new business areas such as renewable fuels, carbon capture and offsets, hydrogen, and power generation for data centers.

Expand Renewable Diesel Production

Increase renewable diesel nameplate capacity at the Geismar, Louisiana, biorefinery from 7,000 to 22,000 barrels per day by starting up the expansion project in 2025.

Develop Oilseed Processing Plant

Construct an oilseed processing plant in Louisiana through the joint venture, Bunge Chevron Ag Renewables LLC.

Expand Carbon Dioxide Storage Portfolio

Increase carbon dioxide storage portfolio by adding 2.6 million acres offshore Western Australia and drilling test wells at Bayou Bend on the U.S. Gulf Coast.

Invest in Future Energy Technologies

Allocate capital through the $500 million Future Energy Fund III to venture investments in technology-based solutions that have the potential to enable affordable, reliable, and lower carbon energy.

Safely Deliver Higher Returns

Focus on safely delivering higher returns in any business environment.

Optimize Portfolio Through Asset Sales

Execute $10-15 billion of asset sales over the five-year period ending in 2028, focusing on assets that are not expected to provide sufficient long-term value.

Implement Structural Cost Reductions

Achieve $2-3 billion in structural cost reductions by the end of 2026 through optimizing the portfolio, leveraging technology, and changing how and where work is performed.

Enhance Operational Excellence

Instill disciplined behavior and actions through Conduct of Operations (COO) to maintain the highest standards of safety and reliability at every step in the value chain.

Upgrade Pasadena Refinery

Increase product flexibility and expand the processing capacity of lighter crude oil to 125,000 barrels per day by upgrading the Pasadena Refinery.

Return Excess Cash to Stockholders

Consistently reward stockholders through dividends and share repurchases.

Increase Quarterly Dividend

Increase the quarterly dividend by $0.08 per share, approximately five percent, to $1.71 per share payable in March 2025.

Execute Share Repurchase Program

Repurchase shares of common stock under the $75 billion share repurchase program authorized in January 2023.

Maintain Strong Credit Ratings

Maintain high-quality debt ratings to ensure access to capital markets and minimize borrowing costs.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.