Exxon Mobil Corporation Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Exxon Mobil Corporation

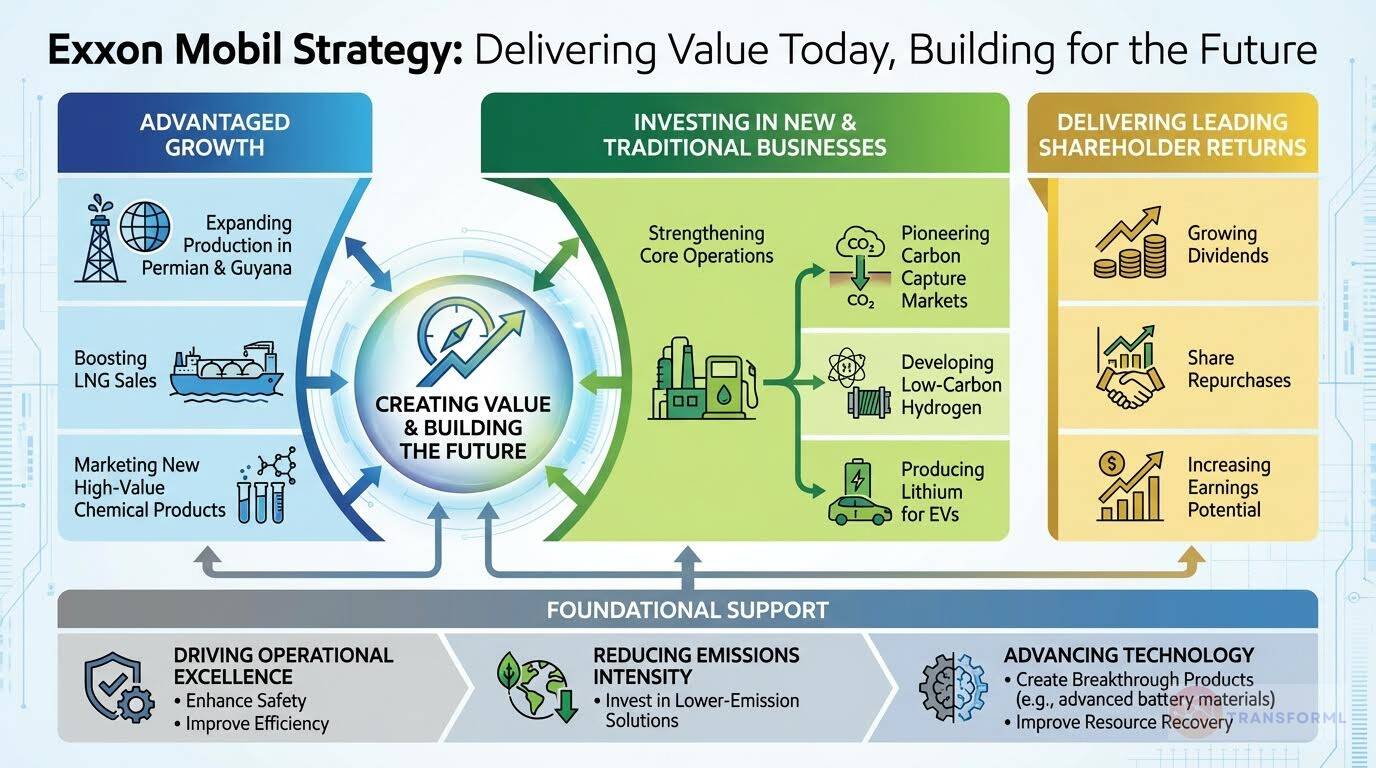

Exxon Mobil Corporation’s strategy is focused on delivering advantaged growth and leading shareholder returns by expanding production from high-quality, low-cost assets such as the Permian Basin, Guyana, and LNG, while strengthening operational excellence and capital discipline. The company is investing heavily in technology, scale, and integration to improve efficiency, reduce costs, and enhance resource recovery across its upstream, product solutions, and chemical businesses. ExxonMobil is also advancing its long-term energy transition strategy by scaling low-carbon solutions, including carbon capture and storage, low-carbon hydrogen, advanced recycling, and lithium, while reducing emissions intensity and meeting growing global energy demand through reliable, affordable energy.

Key Competitors for Exxon Mobil Corporation

BP

Strong presence in renewable energy and commitment to reducing carbon emissions.

Chevron

Large-scale operations and a focus on cost efficiency.

Shell

Diversified portfolio and investments in renewable energy technologies.

TotalEnergies

Integrated operations and a focus on sustainable energy solutions.

Insights from Exxon Mobil Corporation's strategy and competitive advantages

What Stands Out in Exxon Mobil Corporation strategy

ExxonMobil's strategy is distinctively characterized by its aggressive leveraging of an integrated model to pioneer technology-led ventures in adjacent, high-growth markets, and its unparalleled bet on Carbon Capture and Storage (CCS) as its primary low-carbon solution. Integrated Technology-Led Diversification: Unlike ConocoPhillips, which operates as a pure-play E&P company focused on returns from its core business, ExxonMobil utilizes its vast chemical and materials science expertise to build entirely new business lines. A prime example is the development of 'advanced carbon materials' for batteries and the strategic entry into the lithium market. This is a significant differentiator from Chevron, which is focused on more traditional energy transition pathways like renewable fuels and hydrogen. Exxon's ambition is not just to optimize its core but to create new, high-margin markets from its technological base.

Unmatched Scale in Advantaged Assets: While all competitors focus on key basins like the Permian, ExxonMobil's strategy, particularly after the Pioneer acquisition, outlines a growth ambition at a scale that aims to dominate. Its target of 2.3 million barrels per day from the Permian by 2030, combined with 1.7 million from Guyana, represents a more aggressive production growth profile than Chevron's stated goals. This demonstrates a clear strategy to win through overwhelming scale and cost efficiency in the most profitable regions.

CCS and Blue Hydrogen Centricity: ExxonMobil's low-carbon strategy is uniquely centered on building a world-scale, end-to-end CCS business and a large-scale low-carbon (blue) hydrogen plant in Baytown. This is a fundamentally different approach than that of its competitors. For instance, Chevron's low-carbon investments are more diversified, with a notable focus on renewable diesel and green hydrogen (ACES Delta project). ConocoPhillips's approach is far more conservative, focused on reducing its own operational emissions and 'evaluating' low-carbon opportunities rather than building new service-oriented business lines around them. Exxon is positioning itself to be the premier service provider for industrial decarbonization via CCS.

What are the challenges facing Exxon Mobil Corporation to achieve their strategy

ExxonMobil's primary challenges lie in the high execution risk of its pioneering ventures and the potential for its low-carbon strategy to be misaligned with a faster-paced energy transition, while facing intense competition in its core operations. High Execution Risk in New Markets: The strategic push into nascent markets like lithium production and commercial-scale CCS as a service carries substantial risk. These are areas where ExxonMobil lacks the deep-rooted operational history and established market dynamics it enjoys in oil and gas. The challenge is to translate its R&D and pilot projects into profitable, world-scale businesses. Competitors like Chevron are focusing on areas like renewable fuels, which are more adjacent to their existing refining and logistics capabilities, potentially offering a less risky path to lower-carbon revenue.

Perception and Pace of Energy Transition: ExxonMobil's heavy reliance on CCS and blue hydrogen, while technologically ambitious, makes its strategy highly dependent on the future value of carbon abatement rather than direct renewable energy generation. This contrasts with Chevron's tangible investments in renewable fuels and the broader strategy of European peers (mentioned as competitors) who are investing more heavily in wind and solar. This focus could expose ExxonMobil to regulatory and investor pressure if the political and economic landscape shifts more rapidly towards renewable generation, making its path appear slower or less comprehensive than that of its rivals.

Intensified Competition in Core Basins: Despite its scale, ExxonMobil faces formidable competition in its most critical growth area, the Permian Basin. It is competing directly against Chevron, a highly efficient operator, and the newly enlarged ConocoPhillips (post-Marathon Oil acquisition), a company whose entire value proposition is built on disciplined, low-cost shale production. The challenge for ExxonMobil is to not only integrate the massive Pioneer acquisition seamlessly but also to consistently outperform these focused, technically adept competitors on cost, efficiency, and technological deployment to justify its premium-scale strategy.

What Positions Exxon Mobil Corporation to win

Financial Performance

- ExxonMobil demonstrates strong financial performance with $34 billion in earnings and $55 billion in cash flow from operations in 2024. The company has consistently outperformed its peers, increasing cash flow at a higher rate and delivering significant shareholder distributions.

Operational Efficiency

- ExxonMobil has achieved over $12 billion in structural cost savings compared to 2019, demonstrating its commitment to operational efficiency and cost management. This includes optimizing expenses, improving production yields, and successfully integrating acquisitions.

Advantaged Assets

- ExxonMobil possesses a portfolio of advantaged assets, including the Permian Basin, Guyana, and LNG projects, which offer high returns and low cost of supply. The company's highest-ever production from these assets has driven record sales of high-value products.

Technological Innovation

- ExxonMobil is committed to technological innovation, with a wide array of research programs and over 8 thousand active patents worldwide. The company is developing new products, such as Proxxima™ resin systems and advanced carbon materials, with high-growth, high-margin applications.

Low Carbon Solutions

- ExxonMobil is uniquely positioned with a world-scale, end-to-end CCS system and is developing markets for carbon capture and storage and low-carbon hydrogen. The company has contracted more CO2 for transport and storage than any other company in the world.

Upstream Portfolio

- ExxonMobil has built the best Upstream portfolio in the industry, with record production from advantaged assets in the Permian Basin and Guyana. The company has added 2 billion oil-equivalent barrels to its estimated resource in the Permian Basin through better capital efficiency and higher resource recoveries.

Product Solutions Business

- ExxonMobil's Product Solutions business produces a diverse range of products, with 70% of its manufacturing facilities serving all three Product Solutions businesses. The company is the world's largest polyethylene producer and has a refining circuit that is double the scale of other integrated oil companies.

Talent Development

- ExxonMobil has a long-term orientation towards talent development, recruiting exceptional candidates and providing individually planned experiences and training. This results in strong retention and an average length of service of about 30 years for career employees.

What's the winning aspiration for Exxon Mobil Corporation strategy

ExxonMobil aims to create world-scale solutions to some of society's biggest challenges, now and decades into the future, by leveraging its unique advantages in technology, scale, integration, execution excellence, and people to meet the world's evolving energy needs and create substantial shareholder value.

Company Vision Statement:

Competitive advantages deliver leading value today and profitable growth far into the future - TEXT

Where Exxon Mobil Corporation Plays Strategically

ExxonMobil strategically focuses on key geographic regions and business segments to maximize its competitive advantages. It concentrates on areas with high-return opportunities and growing demand, while also expanding into new markets with innovative products and low-carbon solutions.

Key Strategic Areas:

How Exxon Mobil Corporation tries to Win Strategically

ExxonMobil leverages its competitive advantages in technology, scale, integration, and operational excellence to deliver superior value to customers and shareholders. The company focuses on innovation, cost efficiency, and strategic investments to maintain its industry leadership and achieve profitable growth.

Key Competitive Advantages:

Strategy Cascade for Exxon Mobil Corporation

Below is a strategy cascade for Exxon Mobil Corporation's strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Delivering advantaged growth

Focus on growing production and sales from advantaged assets, projects, and high-value products, including Permian Basin, Guyana, LNG, and performance products.

Expand Permian Basin Production

Increase oil and gas production in the Permian Basin to 2.3 million barrels per day by 2030, integrating Pioneer assets and applying advanced technologies.

Develop Guyana Deepwater Resources

Increase oil production in Guyana to 1.7 million barrels per day by the end of the decade, utilizing floating production storage and offloading vessels.

Increase LNG Sales Volume

Expand LNG sales to more than 40 million metric tons per year by 2030, focusing on projects on the U.S. Gulf Coast and in Qatar.

Grow High-Value Product Sales

Develop and market new high-value products, including Proxxima™ resin systems and advanced carbon materials, targeting a $100 billion market by 2030.

Investing in unmatched opportunities in traditional and new businesses

Prioritize investments in traditional oil and gas businesses while expanding into new, high-growth areas like carbon capture and storage, low-carbon hydrogen, and lithium.

Capture Pioneer Synergies

Achieve annual synergies from the Pioneer merger surpassing $3 billion, focusing on capital efficiency and higher resource recoveries.

Expand Advanced Recycling Capacity

Increase advanced recycling capacity to 500 million pounds by expanding the Baytown facility.

Develop Low-Carbon Hydrogen Plant

Move forward with the low-carbon hydrogen plant project in Baytown, Texas, aiming to produce up to 1 billion cubic feet per day.

Secure CO2 Storage Leases

Continue to secure CO2 storage leases, focusing on the U.S. Gulf Coast, to support carbon capture and storage operations.

Establish Lithium Supply Agreements

Establish agreements to supply lithium carbonate to support EV manufacturing, utilizing new technology with fewer environmental impacts.

Delivering leading shareholder returns

Focus on increasing dividends, executing share repurchases, and growing earnings and cash flow potential to provide superior returns to shareholders.

Increase Annual Dividend Per Share

Continue to increase the annual dividend per share, building on 42 consecutive years of growth.

Execute Share Repurchase Program

Continue the share repurchase program with a $20 billion repurchase pace per year through 2026, assuming reasonable market conditions.

Grow Earnings Potential

Implement firm plans to grow earnings potential by $20 billion by 2030.

Grow Cash Flow Potential

Implement firm plans to grow cash flow potential by $30 billion by 2030.

Drive Operational Excellence

Improve operational efficiency, safety, and reliability across all business segments to reduce costs and maximize production.

Maintain Industry-Leading Safety Performance

Continue industry leadership in safety performance, focusing on preventing workplace incidents and ensuring employee well-being.

Achieve Structural Cost Savings

Realize and maintain structural cost savings of $12 billion versus 2019, focusing on operational efficiencies and workforce optimization.

Integrate Technology For Efficiency

Integrate technology across operations to improve production yields, optimize reservoir performance, and enhance capital efficiency.

Optimize Asset Portfolio

Regularly reappraise the asset portfolio to identify opportunities for divestment and ensure assets contribute to strategic objectives.

Reduce Emissions Intensity

Lower greenhouse gas emissions intensity from operations and products through technology deployment and investments in lower-emission solutions.

Reduce Methane Emissions Intensity

Continue to reduce methane emissions intensity from operated assets, targeting a >60% reduction since 2016.

Reduce Upstream GHG Emissions Intensity

Reduce Upstream greenhouse gas emissions intensity by 40-50% by 2030.

Invest In Lower-Emission Solutions

Pursue up to $30 billion in lower-emission investments from 2025 through 2030, focusing on carbon capture and storage and low-carbon hydrogen.

Advance Carbon Capture And Storage

Build and expand the world's only large-scale end-to-end carbon capture and storage system.

Advance Technology and Innovation

Develop and deploy proprietary technologies to enhance resource recovery, improve efficiency, create new products, and enable lower-emission solutions.

Apply Lightweight Proppant Technology

Expand the use of patented lightweight proppant in the Permian Basin to achieve up to 15% higher recovery potential.

Develop Proxxima™ Resin Systems

Further develop and commercialize Proxxima™ resin systems for applications in construction, automotive, and energy industries.

Advance Carbon Materials Technology

Advance carbon materials technology to produce feedstock for higher performance graphite, resulting in batteries with improved capacity, charging time, and life.

Improve Hydraulic Fracturing Efficiency

Continuously improve the efficiency of hydraulic fracturing technology to enhance resource recovery and reduce environmental impact.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.