GE Aerospace Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for GE Aerospace

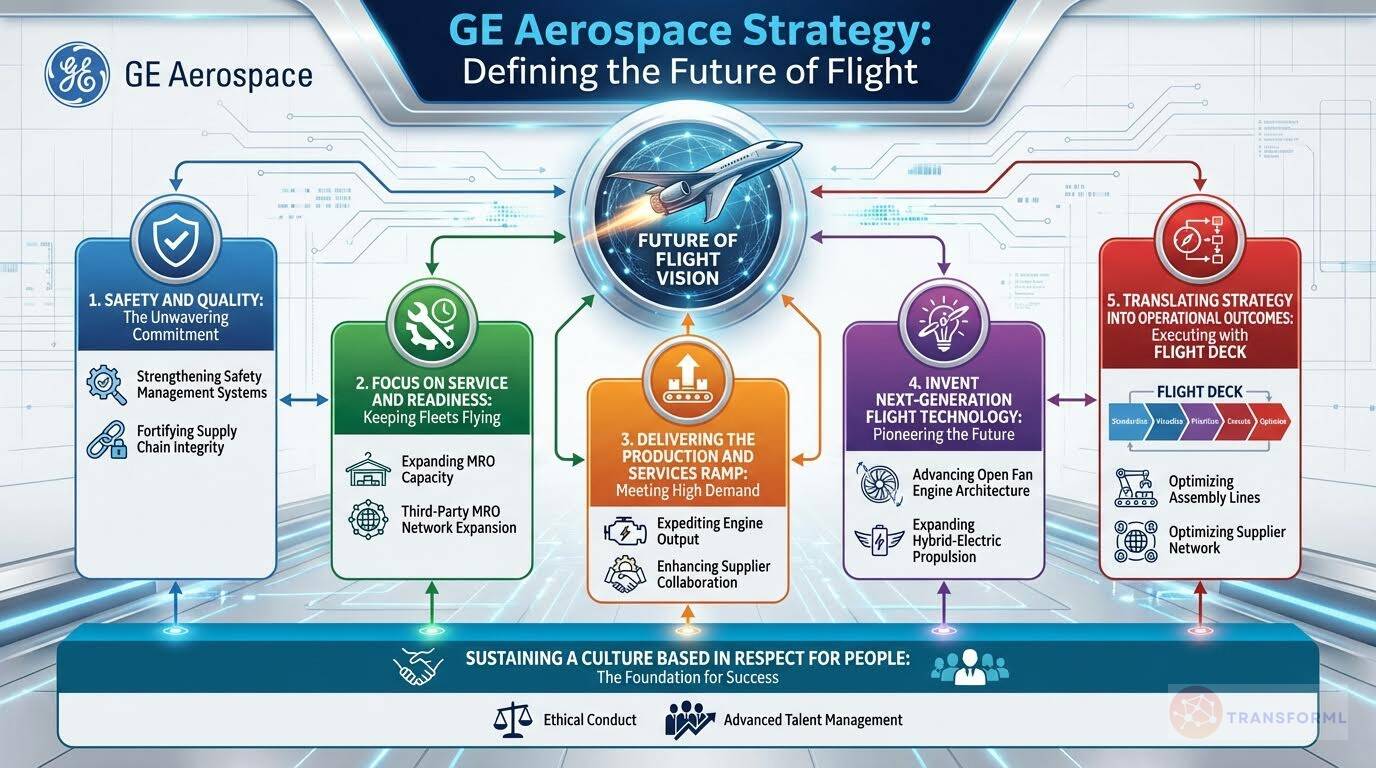

GE Aerospace, a global leader in propulsion, services, and systems, completed its spin-off as an independent public company in 2024. The company focuses on aftermarket services, which drive approximately 70% of its adjusted revenue, and invests heavily in research and development to invent the future of flight. GE Aerospace leverages its lean operating model, FLIGHT DECK, to prioritize safety, quality, delivery, and cost, aiming for sustainable performance and exceptional value for its customers.

Key Competitors for GE Aerospace

CFM International (joint venture with Safran)

Leader in narrowbody engines with the CFM56 and LEAP families, strong partnership with Airbus and Boeing, and extensive global support network.

Pratt & Whitney

Offers competing engine options for various aircraft platforms, strong presence in military engines, and innovative geared turbofan technology.

Rolls-Royce

Competes in commercial and defense engine markets, strong position in widebody engines, and extensive aftermarket services.

RTX (Raytheon Technologies)

Parent of Pratt & Whitney with diversified aerospace portfolio, significant R&D investment, and strong defense market presence.

Safran

French aerospace and defense company with strong engine and aircraft systems portfolio, and CFM joint venture partnership.

Honeywell Aerospace

Aircraft systems and engines manufacturer with strong position in business aviation, comprehensive avionics portfolio, and aftermarket services.

MTU Aero Engines

German engine manufacturer with strong engineering capabilities, partnerships with major engine makers, and specialized MRO services.

Lufthansa Technik

Major MRO provider with global network, comprehensive maintenance services, and strong airline customer relationships.

Insights from GE Aerospace's strategy and competitive advantages

What Stands Out in GE Aerospace strategy

GE Aerospace's strategy is uniquely distinguished by its relentless focus on monetizing a massive installed base through high-margin aftermarket services, a deeply embedded proprietary lean operating model, and a clear, forward-looking technology bet on next-generation commercial propulsion. This positions GE as an offensive, market-shaping player.

Dominance in Aftermarket Services: While competitors have service businesses, GE's identity and financial model are overwhelmingly built on it, with services accounting for ~70% of its revenue. This provides a stable, recurring revenue stream that insulates it from the volatility of new equipment sales. This contrasts with Boeing, which is focused on selling new airframes, and defense-focused competitors like Lockheed Martin, whose revenue is program-based. GE's strategic initiatives, such as 'Increase MRO Capacity Investment' and 'Strengthen LEAP Third-Party MRO Network', are designed to fortify this lucrative stronghold.

Proprietary Lean Operating Model (FLIGHT DECK): While all peers champion operational excellence (e.g., Lockheed's '1LMX', RTX's 'RLPM'), GE frames 'FLIGHT DECK' as a core competitive advantage and the central nervous system of the company. It is a named, proprietary system for translating strategy into outcomes, from the factory floor to supplier management. The initiative to 'Extend FLIGHT DECK to Supplier Network' demonstrates a level of strategic integration and control that goes beyond the internal-facing transformation programs of its rivals.

Leadership in Future Commercial Propulsion: GE's commitment to the 'CFM RISE' program, focusing on Open Fan architecture, represents a bold, potentially revolutionary leap in commercial engine technology. This move to define the future of sustainable flight is more aggressive than competitors' approaches. For example, while RTX is advancing its 'GTF Advantage' engine, it's an incremental improvement on an existing architecture, whereas GE's Open Fan is a fundamental shift aimed at securing technological leadership for decades.

What are the challenges facing GE Aerospace to achieve their strategy

GE Aerospace faces significant challenges primarily centered on external dependencies, particularly on the production health of its key airframer customers, and intense, direct competition in its core markets. Its success is not entirely within its own control.

High Dependency on Airframer Production Rates: GE's growth is directly tethered to the operational stability of its primary customers, Boeing and Airbus. The strategic pillar 'Deliver the Production and Services Ramp' is at high risk due to severe, well-documented production and quality issues at Boeing. Boeing's entire strategy is a testament to this crisis, with core goals like 'Strengthening Safety & Quality' and stabilizing a production rate that is far below demand. If Boeing cannot ramp up its 737 production, GE's ability to 'Expedite LEAP Engine Output' is severely constrained, creating a ceiling on a major revenue stream.

Intense Duopolistic Competition from RTX: In the engine market, GE faces a formidable and direct competitor in RTX (Pratt & Whitney). RTX is a diversified giant with a massive backlog ($218B vs GE's $170B), a significant R&D budget, and a competing product for nearly every GE engine. The engine market is effectively a duopoly where any technological or service stumble can lead to significant market share loss on the next major aircraft platform. RTX's focus on delivering its 'GTF Advantage' engine and expanding its own 'GTF Aftermarket Network' means GE is in a constant battle for supremacy on both new equipment and service revenue.

Competing in Defense Against Specialized Players: While GE has a defense portfolio, its strategic narrative and financial drivers are overwhelmingly commercial. It faces a challenge competing for large-scale defense programs against deeply entrenched specialists. Lockheed Martin's strategy is almost purely defense-focused, built around its '21st Century Security®' vision and flagship programs like the F-35. Similarly, RTX's Raytheon segment is a defense powerhouse. GE's defense initiatives, such as 'Develop Advanced Combat Technologies', are critical but must compete for mindshare and resources within a commercially-oriented company, and for contracts against rivals for whom defense is their primary mission.

What Positions GE Aerospace to win

Market Leadership

- GE Aerospace powers three out of every four commercial flights, demonstrating unmatched scale and scope across the world's most successful and innovative aircraft platforms.

Extensive Installed Base

- The company has an installed base of 70,000 commercial and defense engines, providing a strong foundation for aftermarket services revenue.

Strong Aftermarket Services

- Approximately 70% of GE Aerospace's adjusted revenue is driven by aftermarket services, providing a stable and recurring revenue stream.

Robust R&D Investment

- GE Aerospace invested approximately $2.7 billion in research and development, including customer and partner funding, driving breakthroughs in Open Fan engine architecture, hybrid electric propulsion, and hypersonics.

Lean Operating Model

- The company's proprietary lean operating model, FLIGHT DECK, focuses on safety, quality, delivery, and cost, driving operational and financial outcomes.

Strong Financial Performance

- GE Aerospace delivered a monumental year financially, marked by double-digit orders and adjusted revenue growth, operating profit up $1.7 billion, and free cash flow up $1.3 billion.

Safety Management System

- GE Aerospace's Safety Management System (SMS) is a robust framework that defines the criteria for the safety of flight and reinforces a culture of open reporting.

Global Reach

- The company serves customers in approximately 120 countries, with manufacturing and service operations carried out at numerous facilities worldwide.

What's the winning aspiration for GE Aerospace strategy

GE Aerospace aspires to lead the aerospace industry by defining the future of flight, ensuring safety and reliability, and delivering exceptional value to customers and shareholders. It aims to achieve this through continuous innovation, operational excellence, and a commitment to sustainability.

Company Vision Statement:

Company Vision Statement - to be the company that defines flight for today, tomorrow, and the future.

Where GE Aerospace Plays Strategically

GE Aerospace focuses on the commercial and defense aviation sectors, providing engines, services, and systems to airframers, airlines, and military customers globally. It targets both narrowbody and widebody aircraft platforms, as well as rotorcraft and unmanned applications.

Key Strategic Areas:

How GE Aerospace tries to Win Strategically

GE Aerospace wins by leveraging its extensive installed base, strong aftermarket services, and technological innovation. It differentiates itself through a relentless focus on safety, quality, delivery, and cost, as well as a commitment to sustainability.

Key Competitive Advantages:

Strategy Cascade for GE Aerospace

Below is a strategy cascade for GE Aerospace's strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Prioritize Safety and Quality

Maintain a relentless focus on safety, quality, delivery, and cost (SQDC), always in that order, across all operations.

Strengthen Safety Management System

Strengthen the Safety Management System (SMS) by incorporating advanced data analytics and predictive modeling to proactively identify and mitigate potential safety risks across all operations.

Expand Quality Management System Training

Implement comprehensive training programs for all employees on the Quality Management System (QMS) to ensure consistent adherence to quality standards and regulatory requirements in part production.

Fortify Aviation Supply Chain Integrity

Expand the Aviation Supply Chain Integrity Coalition's efforts by implementing blockchain technology to track and verify the authenticity of parts throughout the supply chain, preventing unauthorized parts from entering the aviation system.

Standardize MRO Data Digitization

Standardize the digitization of MRO records across all GE Aerospace MRO shops globally, ensuring consistent data quality and enabling AI-powered verification of key data fields to flag discrepancies in real time.

Focus on service and readiness

Focus on aftermarket services to keep customers' fleets in the air longer and ensure world-class safety and reliability.

Increase MRO Capacity Investment

Accelerate the multi-year $1 billion investment in internal MRO facilities to expand capacity and reduce turnaround times for both widebody and narrowbody fleets.

Strengthen LEAP Third-Party MRO Network

Expand the LEAP third-party MRO network by onboarding additional premier MROs and providing them with advanced training and technology to support the growing LEAP-powered aircraft fleet.

Accelerate Services Technology Deployment

Expedite the deployment of new inspection and repair processes developed at the Services Technology Acceleration Center in Ohio to MRO shops globally, improving service quality and efficiency.

Optimize Fleet Management Strategies

Develop and implement advanced fleet management strategies, leveraging data analytics and predictive maintenance, to optimize engine performance, extend time on wing, and reduce unscheduled maintenance events.

Deliver the Production and Services Ramp

Meet the tremendous demand cycle with equipment and services backlog strong at more than $170 billion, ensuring the highest quality standards and greater predictability.

Expedite LEAP Engine Output

Address supply chain constraints and manufacturing yield issues to significantly increase LEAP engine output and meet the growing demand for narrowbody aircraft engines.

Enhance Supplier Collaboration

Deepen collaboration with priority suppliers by deploying engineering and supply chain resources to identify and resolve labor shortfalls, manufacturing yield issues, and raw material shortages.

Improve MRO Turnaround Times

Implement FLIGHT DECK principles to reduce LEAP test cycle time and improve standard work at MRO facilities, reducing turnaround times for customers and increasing aftermarket capacity.

Manage Product Lifecycles Effectively

Implement comprehensive product lifecycle management strategies across all engine platforms to enable customer success today and in the future, ensuring timely service and support throughout the engine's operational life.

Invent Next-Generation Flight Technology

Invest in research and development to drive breakthroughs in Open Fan engine architecture, hybrid electric propulsion, hypersonics, small engines for unmanned applications, and next-generation adaptive cycle engines.

Advance CFM RISE Technology Development

Accelerate the CFM RISE technology development and demonstration program with Safran, focusing on Open Fan engine architecture and compact core technologies to improve fuel efficiency and reduce CO2 emissions.

Expand Hybrid Electric Propulsion Capabilities

Further develop and demonstrate hybrid electric propulsion systems, building on the successful demonstration of a one-megawatt system for the U.S. Army, to advance hybrid electric propulsion applications.

Develop Advanced Combat Technologies

Continue developing and delivering advanced technologies for the future of combat, including advanced materials, hypersonics, small engines for unmanned applications, and next-generation adaptive cycle engines through the Edison Works team.

Integrate Generative AI into Engineering

Expand the use of the company's first generative AI platform, Wingmate, across engineering and design processes to accelerate innovation and improve efficiency.

Translate Strategy into Operational Outcomes

Utilize FLIGHT DECK, the proprietary lean operating model, to better serve customers through a relentless focus on safety, quality, delivery, and cost.

Implement FLIGHT DECK Across Operations

Expand the implementation of FLIGHT DECK across all GE Aerospace facilities and processes, focusing on problem-solving to drive continuous improvement and eliminate waste in all areas of the business.

Reduce Injury and Incident Rates

Leverage FLIGHT DECK to implement targeted action plans focused on common injury causes and robust injury case management, aiming to significantly reduce the company's Injury & Incident (I&I) rate.

Optimize Assembly Processes

Apply FLIGHT DECK principles to transition assembly sites from a 'push' to a 'pull' strategy for key parts, aligning supply and demand to improve on-time delivery and reduce inventory.

Extend FLIGHT DECK to Supplier Network

Extend the FLIGHT DECK operating model to key suppliers, providing training and support to improve their processes and performance, ensuring a more reliable and efficient supply chain.

Sustain a Company culture based in Respect for People

Sustain a company culture based in Respect for People through leadership behaviors of humility, transparency and focus, with a commitment to unyielding integrity.

Reinforce Ethical Conduct Standards

Strengthen the culture of integrity by reinforcing The Spirit & The Letter, GE Aerospace's employee code of conduct, and providing regular training on ethical decision-making and compliance standards.

Enhance Employee Listening Strategy

Enhance the employee listening strategy by conducting regular enterprise-wide culture surveys and implementing feedback mechanisms to understand employee concerns and improve the work environment.

Advance Talent Management Practices

Advance talent management practices by conducting annual organization and talent reviews for each business to support a strong leadership pipeline and succession planning process.

Champion Fairness and Opportunity

Champion fairness and opportunity across the enterprise by fostering an environment centered on Respect for People, ensuring that every employee feels empowered and has the opportunity to contribute to improve our performance.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.