The Home Depot, Inc. Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for The Home Depot, Inc.

The Home Depot, Inc. is the world's largest home improvement retailer. In fiscal 2024, the company focused on delivering the best customer experience, developing differentiated capabilities, and extending its low-cost provider position, while also growing market share and delivering exceptional shareholder value. The company made strategic investments in interconnected shopping experiences, Pro capabilities, and new store builds.

Key Competitors for The Home Depot, Inc.

Lowe's

Extensive network of stores and a strong brand presence.

Menards

Strong presence in the Midwest with a focus on value and a wide product selection.

Amazon

Dominant online presence, vast product selection, and efficient delivery network.

Local Hardware Stores

Personalized customer service and community ties.

Specialty Retailers

Deep expertise in specific product categories (e.g., flooring, paint).

Insights from The Home Depot, Inc.'s strategy and competitive advantages

What Stands Out in The Home Depot, Inc. strategy

The Home Depot's strategy is fundamentally distinctive in its aggressive pursuit of scale and market consolidation. This is most evident in its strategic acquisition of SRS Distribution, a move that significantly expands its total addressable market in the Pro segment beyond what competitors are doing organically.

For example, while Lowe's aims to 'Drive Pro Penetration' through enhanced assortments and service levels, Home Depot is acquiring an entire specialty trade distribution network to capture complex project purchases. Furthermore, its commitment to physical growth, with a stated goal of opening 80 new stores, contrasts with Lowe's focus on optimizing existing space ('Increase Space Productivity').

This demonstrates a powerful, forward-investing posture. Finally, Home Depot frames its supply chain not just as a function but as a core competitive weapon, with ambitious goals like automating deployment centers and managing 100% of appliance deliveries through its own network, a level of specified operational ambition that surpasses Lowe's stated plans.

What are the challenges facing The Home Depot, Inc. to achieve their strategy

A key challenge for The Home Depot is the risk of being outmaneuvered by Lowe's on specific customer-facing innovations and service models. While Home Depot focuses on a broad 'Interconnected Experience,' Lowe's is launching targeted, potentially more appealing initiatives like the 'Style Your Space' generative AI design assistant, which could capture the imagination of the DIY customer.

Another significant challenge is Lowe's highly developed 'Loyalty Ecosystem.' Lowe's explicitly details its MyLowe's Rewards program as a strategic pillar, citing impressive results (members spend ~50% more), whereas Home Depot's strategy lacks a similarly prominent and detailed loyalty initiative. This could put Home Depot at a disadvantage in customer retention and data collection.

Additionally, Lowe's' focus on creating a 'Simplified Installation Solution' with a dedicated 'Central Selling Team' presents a more structured and potentially superior service experience than Home Depot's less-highlighted offering, posing a threat to capturing total project spend. Lastly, the sheer scale of the SRS acquisition, while a strength, introduces immense integration complexity and execution risk that is not present in Lowe's more organic strategy.

What Positions The Home Depot, Inc. to win

Market Leadership

- The Home Depot maintains its position as the world's largest home improvement retailer based on net sales, demonstrating its strong market presence and brand recognition.

Interconnected Shopping Experience

- The company has made significant investments in creating a seamless shopping experience across physical stores and digital platforms, enhancing customer satisfaction and driving sales.

Pro Customer Focus

- The Home Depot is dedicated to growing its market share with professional customers through a differentiated set of capabilities, including the acquisition of SRS Distribution and the development of a Pro ecosystem.

Supply Chain Optimization

- The company continues to invest in its supply chain network to achieve the fastest, most efficient, and most reliable delivery capabilities in home improvement, ensuring product availability and speed of delivery for customers.

Financial Performance

- The Home Depot demonstrates strong financial performance with substantial revenue, gross profit, and cash flow from operations, enabling continued investment in strategic initiatives and shareholder returns.

Capital Allocation Discipline

- The company follows a disciplined approach to capital allocation, prioritizing reinvestment in the business, paying dividends, and returning excess cash to shareholders through share repurchases.

Associate Engagement and Culture

- The Home Depot fosters a strong culture and values-centric business, focusing on associate engagement, talent development, and creating a compelling associate experience.

Sustainability and Community Engagement

- The company is committed to sustainability and human capital management, focusing on its people, operating sustainably, and strengthening communities through various initiatives and partnerships.

What's the winning aspiration for The Home Depot, Inc. strategy

The Home Depot aspires to lead the home improvement market by providing an unmatched interconnected customer experience, expanding its Pro customer base, and optimizing its store footprint and supply chain, ultimately delivering exceptional value to shareholders.

Company Vision Statement:

Company Vision Statement - We intend to provide the best customer experience in home improvement and develop differentiated capabilities for our customers; we intend to extend our position as the low-cost provider in home improvement; and we intend to be the most efficient investor of capital in home improvement.

Where The Home Depot, Inc. Plays Strategically

The Home Depot strategically focuses on serving both DIY consumers and professional customers across the United States, Canada, and Mexico. It leverages its physical store network and e-commerce platforms to provide a wide assortment of home improvement products and services, while also expanding its presence in the Pro market through acquisitions like SRS.

Key Strategic Areas:

How The Home Depot, Inc. tries to Win Strategically

The Home Depot aims to win by delivering a best-in-class interconnected shopping experience, developing differentiated capabilities for its Pro customers, and maintaining its position as the low-cost provider in home improvement. It leverages its merchandising organization, supply chain network, and associate expertise to provide superior value and service to its customers.

Key Competitive Advantages:

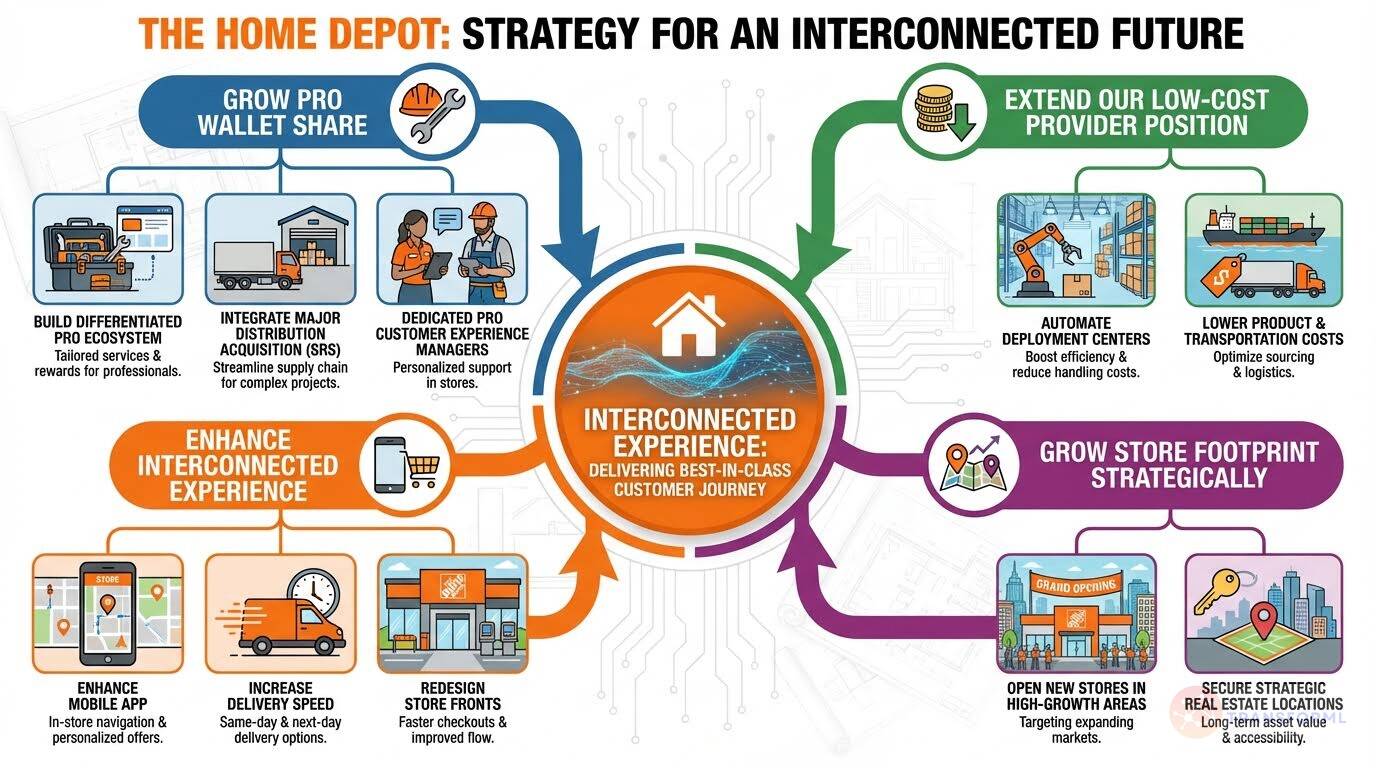

Strategy Cascade for The Home Depot, Inc.

Below is a strategy cascade for The Home Depot, Inc.'s strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Deliver a Best in Class Interconnected Experience

Provide customers with a seamless shopping experience across physical and digital channels, focusing on speed of delivery and customer satisfaction.

Enhance Mobile App Navigation

Improve the in-store navigation features of the mobile app to guide customers to product locations and relevant information, enhancing their shopping experience.

Increase the Speed of Delivery

Invest in supply chain network improvements, including increased inventory of high-velocity products in direct fulfillment centers, to reduce lead times and offer same-day and next-day delivery options.

Transform the Front End of Our Stores

Redesign the front end of stores to expedite the checkout process, allowing customers to enter and exit more quickly, and improve overall customer flow.

Transition 100% of Our Appliance Deliveries to Our Market Delivery Network

Increase the capacity and reach of market delivery operations to manage all appliance delivery volume and expand last-mile delivery capabilities.

Grow Pro Wallet Share Through A Differentiated Set of Capabilities

Increase sales to professional customers by offering differentiated capabilities, including in-store support, a robust sales organization, and a digital platform tailored to their needs.

Improve On-Shelf Availability

Leverage Sidekick and Computer Vision technologies to improve on-shelf availability of products that Pros know and trust, ensuring they can quickly find and purchase necessary items.

Introduce a Pro Customer Experience Manager to Our Store Leadership Teams

Introduce Pro Customer Experience Managers to store leadership teams to drive connectivity with in-store Pro and outside sales teams, delivering a more seamless experience and exceptional service.

Provide Associates with Enhanced Tools

Provide associates with enhanced tools, such as the MyView tool, to give them better visibility to customer activity and prompt them to reach out to customers about projects, product offerings, and perks.

Further Develop Our Pro Ecosystem

Expand foundational capabilities in key markets, including a broader product assortment, digital assets, a sales force, and differentiated fulfillment options, to effectively serve Pros working on larger, more complex projects.

Integrate SRS Distribution Synergies

Leverage the SRS acquisition to better serve the complex project purchase occasion, while also increasing Home Depot's total addressable market by adding a leading specialty trade distributor across multiple verticals.

Extend Our Low-Cost Provider Position

Maintain and improve cost efficiency throughout the business to offer competitive pricing and value to customers.

Lower Product and Transportation Costs

Drive productivity throughout the business by actively seeking opportunities to lower product and transportation costs, improving overall cost efficiency.

Reduce Our Fixed Cost Structure

Execute plans to reduce the fixed cost structure of the business, improving overall profitability and competitiveness.

Automate Rapid Deployment Centers

Invest in further automating and mechanizing the rapid deployment center network to drive greater efficiency and faster movement of product.

Grow Store Footprint Strategically

Increase sales by opening new stores in areas with significant population growth or where it makes sense to relieve pressure on existing high-volume stores.

Invest in New Stores in Geographic Areas That Have Experienced Significant Population Growth

Conduct market research and analysis to identify geographic areas that have experienced significant population growth and present opportunities for new store openings.

Relieve Pressure on Existing High-Volume Stores

Assess existing high-volume stores and strategically build new stores in nearby areas to relieve pressure and improve the customer experience.

Secure Strategic Real Estate Locations

Proactively identify and secure available locations with appropriate characteristics for new stores and branches to ensure continued effective customer service.

Accelerate New Store Opening Timeline

Streamline the new store opening process to accelerate the timeline for opening the planned 80 new stores over the next five years.

Deliver Exceptional Shareholder Value

Generate value for shareholders through disciplined capital allocation, including reinvesting in the business, paying dividends, and repurchasing shares.

Reinvest in Our Business

Allocate capital to reinvest in the business to drive growth faster than the market, focusing on strategic initiatives and differentiated capabilities.

Pay a Quarterly Dividend

Continue paying a quarterly dividend to shareholders, providing a consistent return on investment.

Return Excess Cash to Our Shareholders Through Share Repurchases

Continuously evaluate opportunities to return excess cash to shareholders through share repurchases, while considering strategic priorities and market conditions.

Optimize Capital Expenditure Allocation

Allocate capital expenditures to support business goals, advance strategic objectives, and build an interconnected customer experience.

Focus on Our People

Cultivate a compelling associate experience by investing in competitive wages and benefits, providing training and development opportunities, and fostering a strong culture of safety and respect.

Make Wage Investments

Continuously make wage investments to ensure compensation packages reflect evolving market conditions and remain competitive within the industry.

Offer Relevant Content Through Multiple Platforms

Offer robust development opportunities through the Home Depot University (HDU) program, providing relevant content through multiple platforms and empowering associates to learn new skills.

Create an Engaging Workplace

Create an engaging workplace by continuously listening to and acting on associate feedback, using pulse check surveys and the annual Voice of the Associate survey to gauge engagement levels.

Maintain a Culture That Welcomes Everyone

Maintain a culture that welcomes everyone, providing equal opportunity for all associates and fostering an environment where they feel valued and respected.

Maintain a Safe Shopping and Working Environment

Reinforce a strong culture of safety by empowering associates to make decisions that prioritize the safety of everyone and investing in tools, equipment, and technology to reduce risks.

Operate Sustainably

Reduce the environmental impact of operations and products through responsible sourcing, climate risk mitigation, and environmental impact reduction initiatives.

Ensure That Suppliers Adhere to Our High Standards of Social and Environmental Responsibility

Ensure suppliers adhere to high standards of social and environmental responsibility through a global responsible sourcing program, including factory audits and compliance visits.

Reduce the Impact That Our Operations and Products Have on the Environment

Implement initiatives to reduce the impact of operations on the environment, focusing on store construction, maintenance, and operations, as well as supply chain and packaging initiatives.

Bring New and Innovative Products to Our Customers That Help Simplify Their Projects

Offer products and services that help customers reduce their environmental impacts, from job-lot quantities of specialized products to DIY customers seeking products to reduce their environmental impacts.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.