Honeywell International Inc. Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Honeywell International Inc.

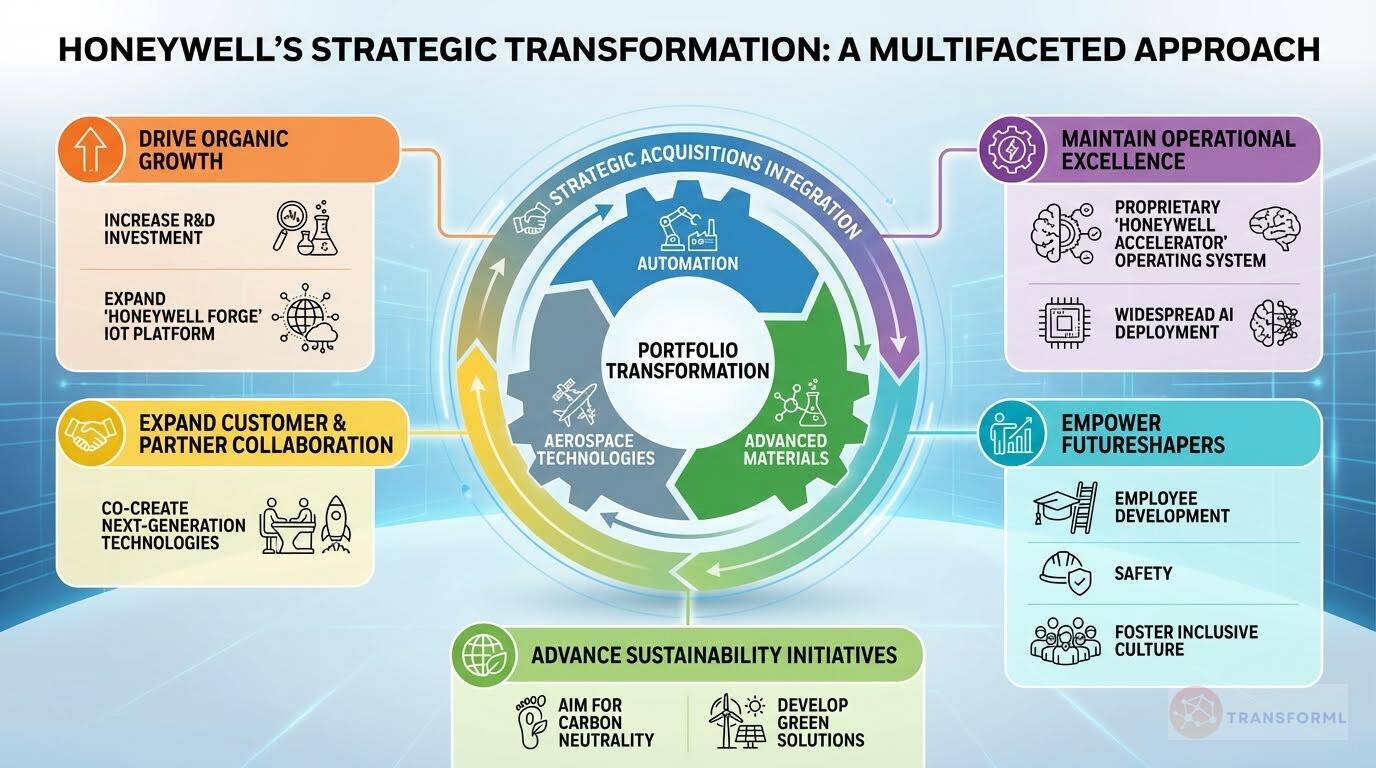

Honeywell International Inc. is undergoing a significant portfolio transformation to focus on automation, the future of aviation, and energy transition. The company is separating into three industry-leading, publicly traded companies, including Automation, Aerospace Technologies, and Advanced Materials. Honeywell is also emphasizing organic growth through increased R&D spending and strategic partnerships, while maintaining a commitment to operational excellence and sustainability.

Key Competitors for Honeywell International Inc.

RTX Corporation

Strong presence in aerospace and defense

Siemens

Extensive portfolio in building automation and industrial solutions

Emerson Electric

Leading provider of process automation technologies

Johnson Controls

Major player in building automation and energy management

Schneider Electric

Global presence in energy management and automation solutions

Insights from Honeywell International Inc.'s strategy and competitive advantages

What Stands Out in Honeywell International Inc. strategy

Honeywell's strategy is uniquely defined by its radical and aggressive portfolio transformation. While competitors like Eaton also engage in portfolio management, Honeywell's plan to separate into three independent, publicly traded companies (Automation, Aerospace Technologies, and Advanced Materials) is a fundamental restructuring of its entire corporate identity. This move is far more profound than Eaton's strategy of divesting lower-growth businesses to strengthen its core Electrical and Aerospace segments.

For example, Honeywell's strategic programs like 'Execute Business Separations' and 'Complete Advanced Materials Spin-off' signify a complete overhaul, aimed at creating highly focused, industry-leading entities. Another distinctive feature is the central role of its branded proprietary systems, the 'Honeywell Accelerator' operating system for operational excellence and the 'Honeywell Forge' IoT platform for organic growth. While Eaton also pursues operational excellence and digitalization, Honeywell positions these named systems as core, integrated competitive advantages.

What are the challenges facing Honeywell International Inc. to achieve their strategy

The primary challenge for Honeywell is the immense execution risk associated with its massive corporate separation. The complexity of splitting into three companies can lead to significant internal disruption, potential loss of cross-business synergies, and a prolonged period of management distraction from core market competition. In contrast, Eaton's more incremental portfolio adjustments allow it to maintain a stable structure and focus intently on capitalizing on market trends.

For instance, while Honeywell is executing complex initiatives like 'Finalize Separation Plans' and 'Establish Standalone Operations,' Eaton is pursuing more direct growth initiatives like 'Expand High-Growth Market Presence' in data centers and utilities. Furthermore, Eaton demonstrates a more granular and aggressive strategic focus on high-growth electrification markets. Eaton's strategy to 'strengthen participation across the entire electrical power value chain' and its explicit targeting of data center, utility, and eMobility markets may present a significant competitive challenge to Honeywell's more broadly defined 'energy transition' and 'automation' businesses, potentially allowing Eaton to capture market share in these key growth segments more rapidly.

What Positions Honeywell International Inc. to win

Portfolio Transformation

- Honeywell is proactively reshaping its business portfolio to capitalize on high-growth sectors, including automation, the future of aviation, and energy transition, through strategic acquisitions and divestitures.

Strong Financial Performance

- The company demonstrates solid financial results, including increased sales, a robust backlog, and strong operating cash flow, indicating effective management and market positioning.

Innovation and R&D

- Honeywell is committed to innovation, as evidenced by increased R&D expenditures and the launch of groundbreaking products, contributing significantly to organic growth and revenue from new products.

Strategic Partnerships

- The company actively fosters collaboration with key customers and partners, leveraging a technology trifecta of AI, Cloud, and 5G to drive innovation and expand autonomous operations.

Operational Excellence

- Honeywell maintains a strong focus on operational excellence, utilizing the Six Sigma methodology and the Accelerator operating system to drive continuous improvement and streamlined processes.

Sustainability Commitments

- Honeywell is dedicated to environmental responsibility, reflected in its commitment to carbon neutrality by 2035 and its development of sustainability-oriented solutions for customers.

Global Reach

- The company has a significant international presence, with manufacturing, sales, service, and R&D activities spanning numerous countries, enabling it to serve a diverse customer base worldwide.

Strong Brand Recognition

- Honeywell benefits from a well-established brand and a reputation for delivering high-quality products and services, enhancing its competitive position in the market.

What's the winning aspiration for Honeywell International Inc. strategy

Honeywell's winning aspiration is to be a leader in automation, the future of aviation, and energy transition, leveraging its technology and global presence to solve complex challenges and improve lives worldwide. This is achieved through portfolio optimization, innovation, and strategic partnerships.

Company Vision Statement:

Company Vision Statement - Our products and solutions enable a safer, more comfortable, and more productive world, enhancing the quality of life of people around the globe.

Where Honeywell International Inc. Plays Strategically

Honeywell competes globally across a diverse range of industries, focusing on key sectors such as aerospace, industrial automation, building automation, and energy. The company targets both original equipment manufacturers (OEMs) and aftermarket customers, leveraging its global presence to serve markets worldwide.

Key Strategic Areas:

How Honeywell International Inc. tries to Win Strategically

Honeywell wins by leveraging its technology, innovation, and operational excellence to deliver superior value to customers. The company's competitive advantages include its strong brand, extensive installed base, and ability to integrate physical products with software solutions.

Key Competitive Advantages:

Strategy Cascade for Honeywell International Inc.

Below is a strategy cascade for Honeywell International Inc.'s strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Optimize Portfolio

Actively manage the business portfolio through strategic acquisitions and divestitures to align with compelling megatrends and deliver superior growth.

Complete Advanced Materials Spin-off

Finalize all necessary steps to successfully spin off the Advanced Materials business into an independent, publicly traded company by the end of 2025 or early 2026.

Execute Automation and Aerospace Separation

Complete the separation of the Automation and Aerospace Technologies businesses into independent, publicly traded companies by the second half of 2026.

Divest Personal Protective Equipment Business

Finalize the sale of the personal protective equipment business for $1.3 billion in the first half of 2025.

Integrate Recent Acquisitions

Successfully integrate Carrier Access Solutions, Civitanavi, CAES, and Air Products' liquified natural gas business to achieve synergies and accelerate growth.

Drive Organic Growth

Prioritize organic growth through increased R&D investment, talent upgrades, process improvements, and high-impact innovations.

Increase Research and Development Investment

Continue to increase research and development expenditures to fuel innovation and new product development.

Enhance New Product Vitality

Increase the overall percentage of sales from new products (NPI vitality) by launching groundbreaking products and technologies.

Expand Honeywell Forge Adoption

Drive adoption of Honeywell Forge, the leading Internet of Things platform for industrials, to capitalize on massive data sets and deliver innovative solutions.

Upgrade Talent Pool

Upgrade talent across the organization to support growth initiatives and strategic priorities.

Maintain Operational Excellence

Ensure operational excellence through continuous improvement, streamlined processes, and effective problem-solving using the Six Sigma methodology and the Accelerator operating system.

Expand Lean Six Sigma Training

Provide Futureshapers with opportunities to engage with Lean Six Sigma mentors and training opportunities within the Accelerator operating system.

Enhance Accelerator System Capabilities

Strengthen the integration of AI and other capabilities into Honeywell's digital backbone to help operate smarter and faster.

Deploy AI Across Functions

Facilitate the deployment of AI in areas such as product development, customer services, sales, legal, and HR to drive growth and innovation.

Expand Customer and Partner Collaboration

Increase collaboration with customers and partners to drive innovation and bring certainty and speed to new products, particularly in the areas of AI, Cloud, and 5G.

Advance Next-Generation Aviation Technology

Co-innovate with Bombardier to advance next-generation aviation technology and generate revenue potential through aftermarket offerings and new technologies.

Develop Innovative Products with Technology Partners

Collaborate with Google Cloud, NXP Semiconductors, and Qualcomm to bring innovative new products, solutions, and services to customers.

Bridge Physical and Digital Worlds

Support customers in bridging the physical and digital worlds to expand autonomous operations and accelerate the move to industrial autonomy at scale.

Execute Business Separations

Successfully execute the planned separations of Automation and Aerospace Technologies and the spin-off of the Advanced Materials business into independent, publicly traded companies.

Finalize Separation Plans

Develop and finalize detailed separation plans for the Automation and Aerospace Technologies businesses, including financial structures, leadership teams, and operational strategies.

Secure Regulatory Approvals

Obtain all necessary regulatory approvals for the separation of Automation and Aerospace Technologies and the spin-off of the Advanced Materials business.

Ensure Tax-Free Status

Ensure that the separation of Automation and Aerospace Technologies and the spin-off of the Advanced Materials business are tax-free to Honeywell shareowners.

Establish Standalone Operations

Establish independent operational infrastructure and systems for the separated Automation and Aerospace Technologies businesses and the spun-off Advanced Materials business.

Advance Sustainability Initiatives

Achieve carbon neutrality in operations and facilities by 2035 and mitigate 2.0 billion metric tons of CO₂e between 2023 and 2030 through Honeywell technologies.

Implement Energy Efficiency Projects

Implement sustainability projects at facilities, including energy management and control systems, LED lighting, and renewable energy sources.

Reduce Greenhouse Gas Emissions

Reduce Scope 1 and 2 GHG emissions by 50% from a 2018 baseline in the U.S. and achieve carbon neutrality in operations and facilities by 2035.

Develop Sustainable Technologies

Lead the marketplace in sustainable technology development and help customers meet their sustainability goals through innovative solutions.

Manage Air Emissions and Wastewater

Manage air emissions and wastewater effluent in accordance with regulatory requirements and the HSEPS Management System.

Empower Futureshapers

Support and develop Honeywell's employees ('Futureshapers') through professional development, continuous learning, skills-building opportunities, and a focus on workplace safety and inclusion.

Expand Professional Development Opportunities

Grow the professional development, continuous learning, and skills-building opportunities available at Honeywell.

Grow Futureshapers Academy

Increase the number of interns participating in the Honeywell Futureshapers Academy to shape the next generation of leaders.

Enhance Workplace Safety

Enhance the focus on workplace safety to support Futureshapers and create a safe operating environment.

Promote Inclusion and Diversity

Foster an inclusive environment where all employees feel valued and respected, and can innovate to solve the world's most challenging problems.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.