Intuitive Surgical, Inc. Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Intuitive Surgical, Inc.

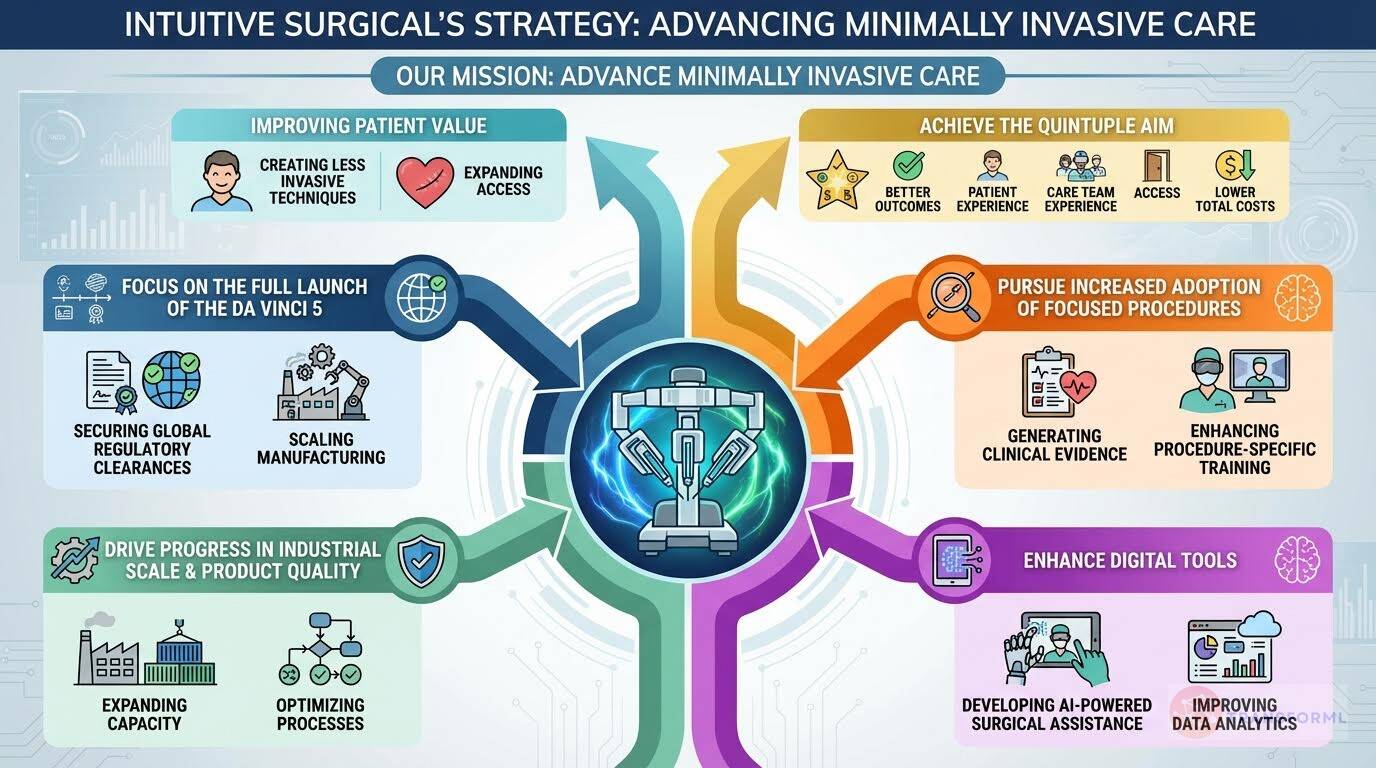

Intuitive Surgical is a medical device company focused on advancing minimally invasive care through its da Vinci surgical systems and Ion endoluminal system. The company's strategy centers around improving patient outcomes, enhancing patient and care team experiences, expanding access to care, and lowering the total cost of treatment. Intuitive Surgical's commitment to innovation and collaboration with healthcare professionals positions it to transform patient diagnosis, treatment, and recovery.

Key Competitors for Intuitive Surgical, Inc.

Johnson & Johnson

Extensive product portfolio and strong market presence in surgical instruments and medical devices

Medtronic plc

Broad range of medical technologies and established relationships with hospitals and healthcare providers

CMR Surgical Ltd.

Developing innovative robotic-assisted surgical systems with a focus on versatility and ease of use

Shanghai Microport Medbot (Group) Co., Ltd.

Emerging competitor in the Chinese market with government support and local market expertise

Insights from Intuitive Surgical, Inc.'s strategy and competitive advantages

What Stands Out in Intuitive Surgical, Inc. strategy

Intuitive Surgical's strategy is uniquely distinguished by its deep, focused, and integrated ecosystem model centered on robotic-assisted surgery. Unlike its highly diversified competitors, Intuitive's entire strategy revolves around a narrow set of core platforms (da Vinci, Ion), enabling a powerful recurring revenue stream that accounts for 84% of total revenues—a figure unparalleled by its peers.

This focus is evident in its strategic initiatives, which are almost exclusively aimed at enhancing and expanding its core offerings, such as the 'Focus on Full Launch of da Vinci 5'. This contrasts sharply with competitors like Abbott, which drives growth across disparate segments like diagnostics (FreeStyle Libre) and nutritionals, or Medtronic, which leverages a wide pipeline including pacemakers (Micra), TAVR systems (Evolut), and spine technology (AiBLE).

Furthermore, Intuitive's 'How to Win' is uniquely framed around the 'Quintuple Aim,' a customer-centric value proposition that directly aligns its goals with hospital objectives, creating a deeper, more partnership-oriented relationship than the broader, product-focused strategies of competitors.

What are the challenges facing Intuitive Surgical, Inc. to achieve their strategy

The primary strategic challenge for Intuitive Surgical is its profound reliance on a narrow product portfolio, which creates significant risk in an increasingly competitive market. This intense focus, while a current strength, is a potential vulnerability compared to the highly diversified models of its competitors.

For example, a setback with the da Vinci platform would be catastrophic for Intuitive, whereas a single product issue for Abbott, Medtronic, or Stryker would be cushioned by their vast portfolios spanning medical devices, diagnostics, nutritionals, and pharmaceuticals. Additionally, Intuitive faces a formidable challenge from the sheer scale and market access of these competitors, who are now aggressively entering the robotic surgery space.

Medtronic is advancing its AiBLE spine ecosystem, and Stryker is a leader in robotic-assisted orthopaedics with its Mako platform. These large incumbents can leverage their existing, deep hospital relationships and superior financial muscle (e.g., Abbott's ~$42B revenue vs Intuitive's ~$8.4B) to bundle products, invest more heavily in R&D and acquisitions, and erode Intuitive's market leadership, effectively shrinking the competitive moat that Intuitive has long enjoyed.

What Positions Intuitive Surgical, Inc. to win

Technological Leadership

- Intuitive Surgical maintains a leading position in the robotic-assisted surgery market through continuous innovation and development of advanced platforms like the da Vinci 5 and Ion endoluminal system.

Established Market Presence

- The company has a large installed base of over 10,600 systems globally, demonstrating strong market acceptance and customer loyalty.

Recurring Revenue Model

- A significant portion of Intuitive Surgical's revenue is recurring, driven by the sales of instruments, accessories, and service contracts, providing a stable and predictable income stream.

Comprehensive Training and Support

- Intuitive Surgical offers extensive training programs and support services to surgeons and healthcare teams, ensuring effective utilization of its systems and fostering long-term partnerships.

Strong Financial Performance

- The company demonstrates robust financial performance with consistent revenue growth, high gross margins, and a strong cash position.

Global Reach

- Intuitive Surgical has a well-established presence in key markets worldwide, including the U.S., Europe, and Asia, with a growing network of direct sales and distribution channels.

Commitment to Innovation

- The company invests heavily in research and development, with over 2,000 employees engaged in R&D activities, driving continuous improvements and new product introductions.

Digital Ecosystem

- Intuitive Surgical is expanding its digital capabilities, offering connected solutions and data-driven insights to optimize surgical workflows and improve hospital performance.

What's the winning aspiration for Intuitive Surgical, Inc. strategy

Intuitive Surgical aspires to transform healthcare by enabling physicians to provide better patient outcomes, enhance patient and care team experiences, expand access to high-quality minimally invasive care, and lower the total cost per patient episode. The company aims to achieve this by delivering innovative technology-enabled ecosystems that address unmet needs in advanced intervention and surgery.

Company Vision Statement:

Company Vision Statement - We envision a future of care that is less invasive and profoundly better, where diseases are identified early and treated quickly so patients can get back to what matters most.

Where Intuitive Surgical, Inc. Plays Strategically

Intuitive Surgical focuses on the global market for minimally invasive surgical procedures, targeting hospitals, surgeons, and integrated delivery networks. The company competes across five surgical specialties and is expanding into diagnostic procedures.

Key Strategic Areas:

How Intuitive Surgical, Inc. tries to Win Strategically

Intuitive Surgical wins by providing physicians and hospitals with smart, connected systems, robotic technologies, advanced imaging, and informatics that deliver superior patient value, physician value, and hospital value. The company's competitive advantages include technological leadership, a comprehensive ecosystem, and a strong brand reputation.

Key Competitive Advantages:

Strategy Cascade for Intuitive Surgical, Inc.

Below is a strategy cascade for Intuitive Surgical, Inc.'s strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Advance Minimally Invasive Care

Continue to improve healthcare with Intuitive's ecosystem and partners to transform patient diagnosis, treatment, and recovery.

Develop Advanced Imaging Modalities

Create new imaging technologies, such as augmented reality, to provide surgeons with enhanced visualization and guidance during minimally invasive procedures.

Expand Robotic-Assisted Bronchoscopy

Increase the installed base and utilization of the Ion endoluminal system for minimally invasive lung biopsies, enabling earlier diagnosis and treatment of lung cancer.

Enhance Surgical Precision and Dexterity

Develop new da Vinci instruments with improved wrist articulation, force feedback, and motion scaling to enable surgeons to perform more complex and delicate procedures.

Improve Post-operative Recovery

Invest in research and development to minimize post-operative complications, reduce patient pain, and shorten hospital stays through less invasive surgical techniques.

Focus on Full Launch of da Vinci 5

Prioritize the full launch of da Vinci 5 in the U.S. and its clearances in key markets globally, as well as follow-on features.

Secure Global Regulatory Clearances

Expedite regulatory submissions and approvals for da Vinci 5 in key international markets, including Japan and Europe, to expand its global availability.

Scale da Vinci 5 Manufacturing Capacity

Increase manufacturing output and optimize production processes to meet anticipated demand for da Vinci 5 systems and ensure timely delivery to customers.

Develop da Vinci 5 Follow-on Features

Accelerate the development and release of new hardware and software upgrades for da Vinci 5, including digital features supported by the platform's increased computing power.

Expand da Vinci 5 Training Programs

Create and implement comprehensive training programs for surgeons and OR staff on the da Vinci 5 platform, ensuring proficiency in its use and maximizing its clinical benefits.

Pursue Increased Adoption of Focused Procedures

Drive increased adoption of focused procedures through clinical and evidentiary pathways, training, commercial activities, and market access efforts.

Generate Clinical Evidence for Key Procedures

Conduct clinical studies and publish peer-reviewed articles demonstrating the clinical and economic benefits of da Vinci surgery for focused procedures, such as hernia repair and colorectal surgery.

Enhance Procedure-Specific Training Programs

Develop and implement specialized training programs for surgeons on focused procedures, incorporating best practices and advanced techniques to improve surgical outcomes.

Targeted Commercial Campaigns

Launch targeted marketing campaigns to promote the benefits of da Vinci surgery for focused procedures to patients, physicians, and hospitals.

Improve Market Access for Focused Procedures

Work with payers and healthcare systems to secure favorable reimbursement policies for da Vinci surgery for focused procedures, ensuring patient access to minimally invasive care.

Drive Progress in Industrial Scale and Product Quality

Continue to drive progress in building industrial scale, product quality, and manufacturing optimization.

Expand Manufacturing Capacity

Establish new manufacturing facilities and expand existing facilities to increase production capacity and meet growing demand for da Vinci systems and instruments.

Implement Advanced Quality Control Systems

Enhance quality control processes and implement advanced testing methodologies to ensure the highest levels of product quality and reliability.

Optimize Manufacturing Processes

Streamline manufacturing processes and implement lean manufacturing principles to improve efficiency, reduce costs, and enhance product availability.

Diversify Supply Chain

Identify and qualify alternative suppliers for critical components to reduce reliance on sole-sourced suppliers and mitigate supply chain risks.

Enhance Digital Tools

Apply focus to the availability of Intuitive's digital tools and their excellence.

Expand Digital Tool Integration

Integrate digital tools, such as My Intuitive and Intuitive Hub, into the da Vinci surgical system workflow to provide surgeons with real-time data and insights during procedures.

Improve Data Analytics Capabilities

Enhance data analytics capabilities to provide hospitals and surgeons with actionable insights into surgical performance, cost, and outcomes.

Develop AI-Powered Surgical Assistance

Invest in the development of AI-powered tools to assist surgeons with surgical planning, navigation, and decision-making during procedures.

Improve Telepresence Functionality

Enhance the functionality and accessibility of the Intuitive Telepresence platform to facilitate remote collaboration, training, and support for surgeons and OR staff.

Improve Patient Value

Provide physicians with procedure options that are both highly effective and less invasive than others and work to increase access to minimally invasive care.

Develop Less Invasive Surgical Techniques

Invest in research and development to create new surgical techniques and instruments that minimize tissue trauma, reduce pain, and shorten recovery times for patients.

Expand Access to Rural Communities

Partner with hospitals and healthcare systems in rural and underserved communities to increase access to da Vinci surgery and other minimally invasive procedures.

Address Health Equity Disparities

Implement programs to address health equity disparities and ensure that all patients, regardless of socioeconomic status or geographic location, have access to high-quality minimally invasive care.

Promote Patient Education and Empowerment

Develop educational materials and resources to empower patients to make informed decisions about their surgical options and advocate for minimally invasive care.

Achieve the Quintuple Aim

Align goals to those of customers, often called the Quintuple Aim: enabling physicians and hospitals to improve outcomes for their patients, improve their patient's experience, improve the care team's experience, address barriers to expanding access to high quality minimally invasive care, and lower the total cost to treat per patient episode.

Reduce Surgical Site Infections

Implement programs and protocols to minimize surgical site infections and other complications, improving patient outcomes and reducing healthcare costs.

Improve Care Team Ergonomics

Design and implement ergonomic improvements to the da Vinci surgical system and OR workflow to reduce fatigue and improve the well-being of surgeons and OR staff.

Reduce Clinical Variation

Develop and implement standardized surgical protocols and training programs to reduce clinical variation and improve the consistency of surgical outcomes.

Optimize OR Efficiencies

Implement solutions to improve OR efficiencies, such as reducing turnover times and optimizing instrument utilization, to lower the total cost of care and improve access to surgery.

Expand Access to Equitable Quality Care

Partner with hospitals and healthcare systems to expand access to high-quality minimally invasive care for underserved populations, addressing barriers to care and promoting health equity.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.