Johnson & Johnson Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Johnson & Johnson

Johnson & Johnson is a leading healthcare company focused on pharmaceuticals and medical technology. In 2024, the company delivered robust operational sales growth and significant investments in research and development, including strategic acquisitions. The company is committed to its Credo and stakeholders, aiming to transform health for humanity.

Key Competitors for Johnson & Johnson

AbbVie

Strong presence in immunology and oncology

Novartis

Diverse portfolio and strong pipeline

Medtronic

Market leader in medical technology

Becton Dickinson

Strong presence in medical supplies and devices

Stryker

Focus on orthopedics and surgical equipment

Insights from Johnson & Johnson's strategy and competitive advantages

What Stands Out in Johnson & Johnson strategy

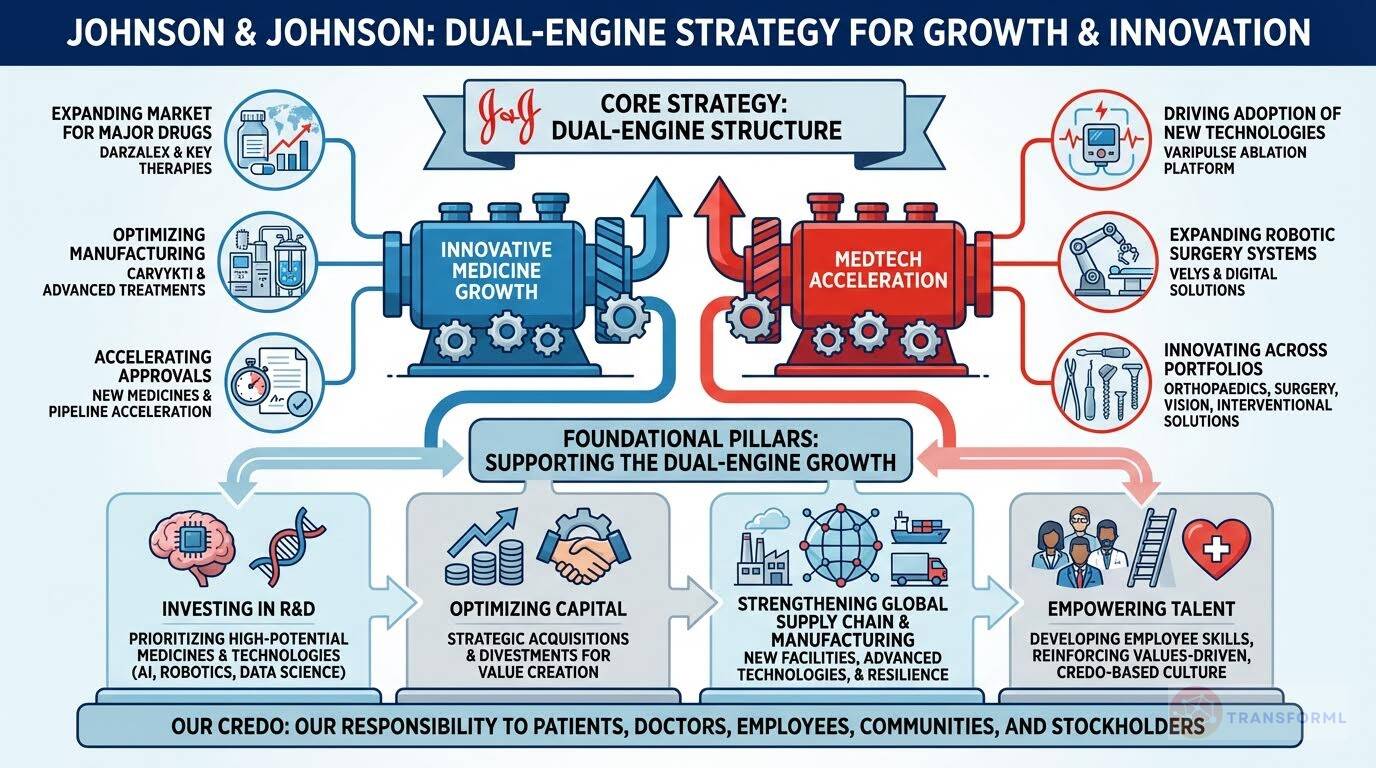

Johnson & Johnson's (J&J) strategy is uniquely distinguished by its dual-engine structure, combining a massive 'Innovative Medicine' (pharmaceuticals) division with a world-leading 'MedTech' (medical devices) business. This comprehensive healthcare model provides unparalleled diversification and resilience that competitors lack. For instance, while peers like Eli Lilly and Amgen are making highly concentrated bets on the explosive obesity market with drugs like Zepbound and MariTide, J&J drives growth across a vast portfolio, simultaneously launching MedTech platforms like the VARIPULSE pulsed field ablation system and growing pharmaceutical blockbusters like DARZALEX.

This breadth, exemplified by 26 products/platforms generating over $1 billion in annual sales, insulates J&J from the intense patent cliff pressures faced by more focused companies like AbbVie with its Humira replacement strategy. Furthermore, J&J's long-standing, explicitly stated 'Credo-Based Culture' serves as a strategic pillar, underpinning a brand reputation and trust that is a core competitive advantage, distinct from the more purely commercial or pipeline-focused strategies of its rivals.

What are the challenges facing Johnson & Johnson to achieve their strategy

The primary challenge for Johnson & Johnson's strategy stems from the immense scale and complexity that define its distinctiveness, leading to a slower, more incremental growth trajectory compared to more focused and agile competitors. J&J's 7% operational sales growth, while robust for its size, is dwarfed by the explosive 32% revenue surge at Eli Lilly, which is capitalizing on a dominant position in the transformative obesity market.

J&J's current strategic plan lacks a comparable, high-profile bet in a 'hot' market, ceding ground in a potentially generation-defining therapeutic area to rivals. Another significant challenge is the substantial drag from major legacy legal issues, most notably the talc litigation. The need for a dedicated strategic goal to 'Implement Talc Litigation Resolution Strategy' represents a significant diversion of capital, management focus, and reputational capital that competitors like Vertex or Gilead, who are concentrated on pipeline execution and market expansion, do not face on such a large scale.

What Positions Johnson & Johnson to win

Financial Strength

- Johnson & Johnson demonstrates robust financial performance with $88.8 billion in consolidated sales and strong free cash flow generation of approximately $20 billion in 2024. The company has a history of increasing dividends for 62 consecutive years, reflecting its financial stability and commitment to returning value to shareholders.

R&D Investment

- Johnson & Johnson has invested approximately $50 billion in research and development and inorganic innovation since January 2024, including the planned acquisition of Intra-Cellular Therapies. This significant investment underscores the company's commitment to driving future growth through innovation.

Product Portfolio

- Johnson & Johnson possesses an unrivaled portfolio and pipeline, with 26 products/platforms generating over $1 billion in annual sales. Key growth drivers include DARZALEX, ERLEADA, CARVYKTI, and TREMFYA in Innovative Medicine, and strong momentum in cardiovascular within MedTech.

Global Reach

- Johnson & Johnson operates in virtually all countries of the world, with a significant presence in both developed and emerging markets. This global footprint enables the company to access diverse patient populations and capture growth opportunities worldwide.

Manufacturing Capacity

- Johnson & Johnson is strengthening its manufacturing capacity in the United States and around the world, including a $2 billion advanced technology facility in North Carolina and extensions to Impella heart pump facilities in Massachusetts and Germany. This investment ensures the company can meet growing demand for its products.

MedTech Innovation

- Johnson & Johnson's MedTech segment launched 15 major products in 2024, including the VARIPULSE pulsed field ablation platform and the VELYS system for robot-assisted spine and partial-knee surgery. The company also progressed 18 clinical trial programs, including securing IDE approval of its Ottava robotic surgical system.

Employee Engagement

- Johnson & Johnson has a highly engaged workforce, with 93% of employees willing to go the extra mile to help the company meet its goals and improve patients' lives. This strong employee commitment fuels the company's ability to transform health for humanity.

Credo-Based Culture

- Johnson & Johnson is a purpose-driven company guided by Our Credo, which emphasizes its responsibilities to patients, consumers, customers, healthcare professionals, employees, communities, and shareholders. This credo-based culture fosters ethical behavior and a commitment to improving health for humanity.

What's the winning aspiration for Johnson & Johnson strategy

Johnson & Johnson aims to be healthcare's leading, most comprehensive innovation powerhouse, impacting the full spectrum of disease through best-in-class solutions for patients at every step of their journeys, fueled by a purpose-driven culture and a commitment to its Credo.

Company Vision Statement:

Company Vision Statement - Johnson & Johnson has an unrivaled portfolio and pipeline, with the financial muscle, global reach, and disease expertise to deliver the sustained pace of innovation and growth that is our hallmark.

Where Johnson & Johnson Plays Strategically

Johnson & Johnson strategically focuses on pharmaceuticals and medical technology, targeting a broad spectrum of diseases from cardiology to oncology, and mental health to vision. The company operates globally, distributing its products through various channels including retailers, wholesalers, hospitals, and healthcare professionals.

Key Strategic Areas:

How Johnson & Johnson tries to Win Strategically

Johnson & Johnson leverages its unrivaled portfolio and pipeline, financial strength, global reach, and disease expertise to deliver sustained innovation and growth. The company's competitive advantages include a strong brand reputation, a commitment to its Credo, and a highly engaged workforce.

Key Competitive Advantages:

Strategy Cascade for Johnson & Johnson

Below is a strategy cascade for Johnson & Johnson's strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Drive Innovative Medicine Growth

Focus on key growth drivers within the Innovative Medicine segment, such as DARZALEX, ERLEADA, CARVYKTI, and TREMFYA, while advancing the pipeline with regulatory submissions and approvals for new drugs and additional indications.

Expand DARZALEX Market Share

Increase the market share of DARZALEX through strategic pricing, expanded indications, and enhanced marketing efforts, focusing on frontline transplant-eligible and transplant-ineligible multiple myeloma patients.

Accelerate TREMFYA Adoption for Ulcerative Colitis

Drive faster adoption of TREMFYA for the treatment of ulcerative colitis by increasing awareness among gastroenterologists, securing favorable reimbursement, and demonstrating superior clinical outcomes compared to existing therapies.

Optimize CARVYKTI Manufacturing and Supply Chain

Improve the manufacturing process and strengthen the supply chain for CARVYKTI to increase production capacity, reduce costs, and ensure reliable delivery to patients in need of this CAR-T-cell therapy.

Expedite Regulatory Approvals for Key Pipeline Assets

Accelerate the regulatory approval process for key pipeline assets, such as nipocalimab for generalized myasthenia gravis and OPSUMIT for pediatric pulmonary arterial hypertension, by working closely with regulatory agencies and generating robust clinical data.

Accelerate MedTech Innovation and Sales

Focus on key areas within the MedTech segment, including cardiovascular, orthopaedics, surgery, and vision, while launching major products and progressing clinical trial programs.

Drive Adoption of VARIPULSE Pulsed Field Ablation Platform

Increase the adoption of the VARIPULSE pulsed field ablation platform in major markets by providing comprehensive training to electrophysiologists, demonstrating its clinical benefits, and securing favorable reimbursement.

Expand VELYS System Applications

Broaden the applications of the VELYS system for robot-assisted surgery by developing new modules for different surgical procedures and expanding its use in both spine and partial-knee surgery.

Advance Ottava Robotic Surgical System Clinical Trials

Progress clinical trials for the Ottava robotic surgical system in the U.S. and other key markets to demonstrate its safety and efficacy and secure regulatory approval for commercial launch.

Increase Market Penetration of ACUVUE OASYS 1-Day Contact Lenses

Drive increased market penetration of ACUVUE OASYS 1-Day family of products by expanding distribution channels, launching targeted marketing campaigns, and highlighting their benefits for contact lens wearers.

Invest in Research and Development

Sustain a high level of investment in research and development to drive innovation and create life-enhancing products, focusing on key therapeutic areas and strategic partnerships.

Prioritize Innovative Medicine R&D Investments

Focus Innovative Medicine R&D investments on the most promising medicines within Immunology, Infectious Diseases, Neuroscience, Oncology, Pulmonary Hypertension, and Cardiovascular and Metabolism with the greatest benefit to patients.

Expand MedTech R&D in Enabling Technologies

Increase MedTech R&D investment in enabling technologies such as robotics, digital surgery, and artificial intelligence to develop new and improved surgical tools and techniques.

Strengthen Strategic R&D Partnerships

Actively seek and cultivate strategic partnerships with leading academic institutions, biotechnology companies, and other organizations to access external innovation and accelerate the development of new products and technologies.

Enhance Data Science and AI Capabilities

Build internal expertise in data science, machine learning, and other forms of AI to improve drug discovery, clinical trial design, and patient care.

Attract, Develop, and Empower Talent

Focus on attracting and retaining top talent, developing employee skills, and fostering a culture of innovation, inclusion, and well-being, guided by Our Credo.

Enhance Employee Skill-Building Programs

Expand professional development programs and educational resources available to all employees, with a focus on skill-building courses on J&J Learn, to equip them with the right knowledge and skills for the changing healthcare landscape.

Promote Inclusive Leadership Development

Implement leadership development programs that promote inclusive leadership practices and create a diverse pipeline of talent to deliver on the Company's long-term strategies.

Expand Employee Health and Well-being Programs

Continuously expand health and well-being programs throughout the Company and across the globe, incorporating new thinking and technologies to keep its offerings best-in-class and to help employees achieve their personal health goals.

Strengthen Credo-Based Culture

Reinforce Our Credo and Code of Business Conduct through ongoing training, communication, and recognition programs to ensure that employees are guided by the Company's values in all their actions.

Optimize Capital Allocation

Prioritize strategic actions, including acquisitions, divestitures, and increased dividends, to deliver sustained, differentiated growth and return value to shareholders.

Execute Strategic Acquisitions to Enhance Portfolio

Pursue strategic acquisitions that complement the Company's existing portfolio and provide access to new technologies, markets, and therapeutic areas, ensuring that acquisitions meet financial and strategic criteria.

Divest Non-Core Assets to Improve Focus

Identify and divest non-core assets or businesses that do not align with the Company's long-term strategic priorities, using the proceeds to invest in higher-growth opportunities.

Increase Dividend Payout Ratio

Increase the dividend payout ratio over time, while maintaining a strong balance sheet and financial flexibility, to return more value to shareholders.

Implement Share Repurchase Program

Execute a share repurchase program to return excess cash to shareholders and offset dilution from equity-based compensation plans.

Navigate Regulatory and Legal Landscape

Proactively manage regulatory challenges, including drug pricing pressures and compliance requirements, and address legal proceedings, such as talc litigation, to minimize risks and protect the company's reputation.

Develop Proactive Regulatory Engagement Strategy

Establish a proactive regulatory engagement strategy to anticipate and address potential regulatory changes, including drug pricing pressures and compliance requirements, by building strong relationships with regulatory agencies and advocating for policies that support innovation and patient access.

Strengthen Data Privacy and Cybersecurity Compliance

Enhance data privacy and cybersecurity compliance programs to meet evolving regulatory requirements and protect sensitive data, including personal information and intellectual property, by implementing robust security measures and providing ongoing training to employees.

Implement Talc Litigation Resolution Strategy

Execute a comprehensive strategy to resolve the talc litigation, including pursuing settlements, defending cases in court, and exploring alternative resolution mechanisms, while minimizing the financial and reputational impact on the company.

Enhance Government Price Reporting Compliance

Strengthen government price reporting compliance programs to ensure accurate and timely reporting of drug prices and avoid penalties, by implementing robust internal controls and monitoring changes in government regulations.

Strengthen Global Supply Chain and Manufacturing

Enhance manufacturing capacity, ensure supply chain resilience, and comply with increasing regulatory requirements to maintain a reliable supply of high-quality products.

Expand Biologics Manufacturing Capacity

Expand production of our biologic portfolio and pipeline by investing in advanced technology facilities, such as the $2 billion facility in North Carolina, to meet growing demand and ensure a reliable supply of these critical medicines.

Diversify Key Raw Material Sourcing

Reduce reliance on single-source suppliers for key raw materials by diversifying the supply base and developing alternative sourcing strategies to mitigate the risk of supply chain disruptions.

Implement Advanced Manufacturing Technologies

Adopt advanced manufacturing technologies, such as automation and data analytics, to improve efficiency, reduce costs, and enhance the quality and reliability of manufacturing processes.

Enhance Supply Chain Risk Management

Strengthen supply chain risk management processes to identify and mitigate potential disruptions, including natural disasters, political instability, and supplier financial distress, by developing contingency plans and building redundancy into the supply chain.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.