Lam Research Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Lam Research

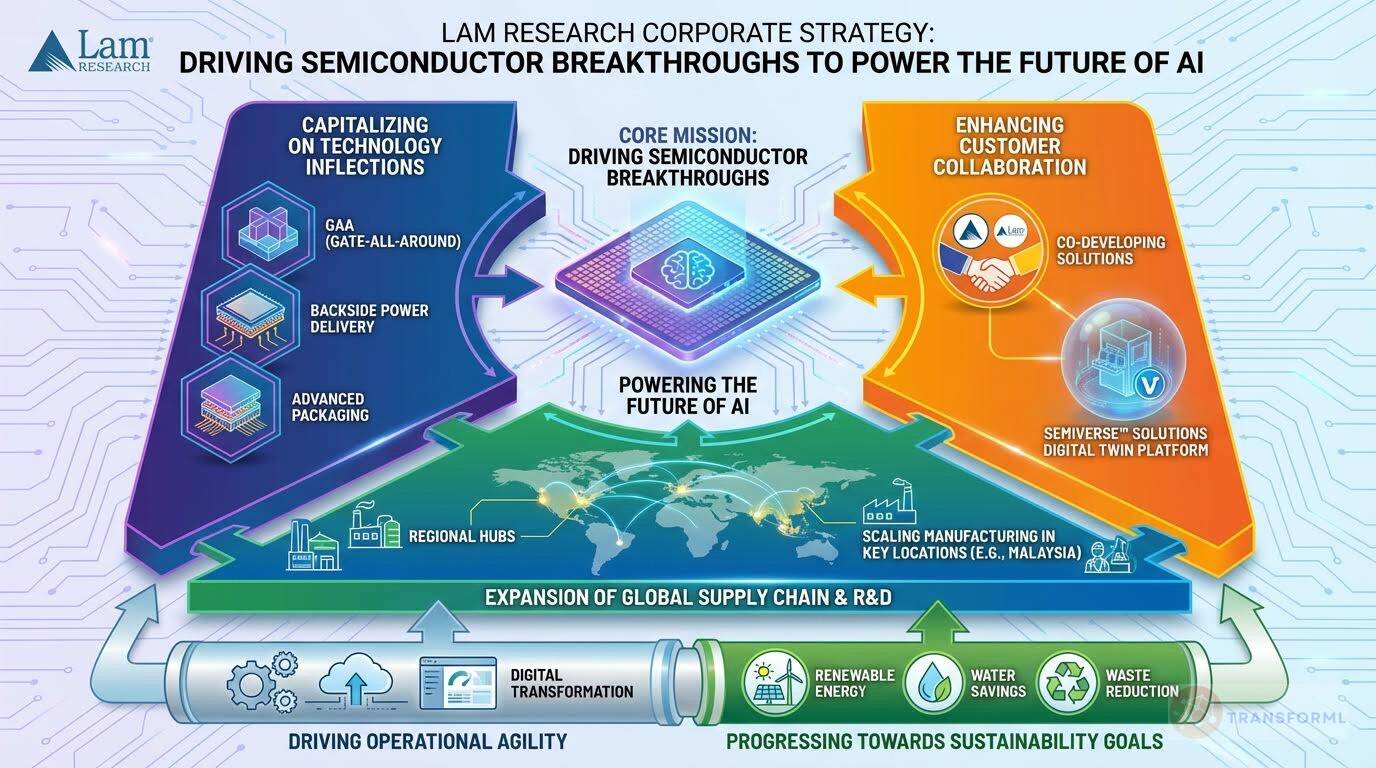

Lam Research demonstrated strong performance in fiscal year 2024, delivering revenue of nearly $15 billion and diluted earnings per share of $29.00 amidst a cyclical decline in the non-volatile memory sector. The company is strategically investing in R&D and expanding its global supply chain to capitalize on opportunities created by technology inflections like gate-all-around, backside power delivery, and advanced packaging, positioning itself for long-term growth in the semiconductor industry.

Key Competitors for Lam Research

Applied Materials

Broad product portfolio and strong customer relationships

Tokyo Electron

Advanced technology and strong presence in Japan

ASML

Dominance in lithography equipment

KLA Corporation

Expertise in process control and inspection

Insights from Lam Research's strategy and competitive advantages

What Stands Out in Lam Research strategy

Lam Research's strategy is uniquely distinguished by its deep and targeted specialization in the enabling technologies for vertical scaling, particularly etch and deposition. While competitor Applied Materials casts a wider net with a broad 'materials engineering' portfolio, Lam's 'How to Win' is explicitly focused on dominating the critical process steps required for next-generation 3D architectures like Gate-All-Around (GAA) and 3D NAND.

This is exemplified by strategic pillars like 'Capitalize on Technology Inflections' and specific projects to 'Accelerate Gate-All-Around Solutions'. Furthermore, Lam's aggressive investment in its 'Semiverse™ Solutions' provides a distinct digital-twin-based collaboration platform, which appears more central to its strategy than the more general digital transformation initiatives mentioned by its peers.

This focus on virtual R&D and collaboration, coupled with a tangible and record-setting manufacturing ramp-up in Malaysia, showcases a highly focused approach to winning in the most technically challenging and high-growth segments of the industry.

What are the challenges facing Lam Research to achieve their strategy

A key challenge for Lam Research is its relative scale and portfolio concentration compared to its primary competitor, Applied Materials. With revenue of approximately $15 billion, Lam is significantly smaller than Applied Materials' $27 billion, which allows Applied to outspend Lam on R&D in absolute terms ($3.2B vs $1.9B) and leverage a more comprehensive product portfolio to offer integrated solutions.

This creates a risk of being out-muscled in competitive bids where customers prefer a single, broader supplier. Another challenge arises from the lack of a dominant, standalone business in a critical adjacent market like process control, a segment where KLA Corporation is the undisputed leader.

While Lam integrates process control into its solutions, it doesn't possess the indispensable, high-margin service and equipment business that KLA has built around yield management. This makes Lam more vulnerable to the cyclicality of its core equipment markets, as noted by the impact of the 'cyclical decline in the non-volatile memory sector', whereas KLA's and Applied's more diversified revenue streams may offer greater stability.

What Positions Lam Research to win

Financial Performance

- Lam Research achieved solid financial results in fiscal year 2024, including revenue of nearly $15 billion and diluted earnings per share of $29.00. The company also achieved the highest gross margin percentage since the merging of Lam with Novellus in 2013.

R&D Investment

- Lam Research is increasing its research and development (R&D) investments, including over 10% spending growth in fiscal year 2024 compared to fiscal year 2023, to capitalize on opportunities and grow its market share.

Global Supply Chain Expansion

- Lam Research has strategically expanded its global supply chain and located R&D centers and manufacturing capacity in closer proximity to its customers. The company is driving faster, more productive collaboration with its customers through R&D and engineering labs in the United States, India, Korea, and Taiwan.

Manufacturing Capacity

- Lam Research is scaling manufacturing at its new Malaysia facility, where it ended the fiscal year by shipping its 5,000th chamber, the fastest manufacturing ramp in its history.

Digital Transformation

- Lam Research is collaborating virtually using its Semiverse™ Solutions, including digital twin capabilities that rapidly accelerate product design and testing in simulated production environments. The company has also invested in digital transformation of the entire organization to drive greater operational agility and efficiency.

Sustainability

- Lam Research continues to progress toward its 2025 sustainability goals regarding water and energy savings, as well as its goal of using 100% renewable electricity by 2030. In 2023, the company was once again named to the Dow Jones Sustainability Index for North America, and was also listed among the World's Most Ethical Companies by Ethisphere.

Technology Leadership

- Lam Research has clear leadership in the etch and deposition technologies that enabled the industry's adoption of 3D NAND. As more vertical scaling comes to logic and DRAM devices, the company is driving innovation further to deliver critical solutions.

Market Position

- Lam Research is the industry leader to tackle compute, memory, and storage challenges to unleash the transformative power of AI. The company is a critical enabler of the device innovation that will be required to make this exciting future a reality.

What's the winning aspiration for Lam Research strategy

Lam Research aspires to be the leading provider of wafer fabrication equipment and services, enabling semiconductor breakthroughs that drive the advancement of artificial intelligence and other high-growth technologies. The company aims to achieve this by leveraging its expertise in etch, deposition, and clean markets, expanding its global presence, and investing in sustainable operations.

Company Vision Statement:

Company Vision Statement - Engineering the world's most advanced chips.

Where Lam Research Plays Strategically

Lam Research focuses on the semiconductor industry, specifically targeting memory, foundry, and integrated device manufacturers. The company has a strong presence in North America, Asia, and Europe, with a growing emphasis on expanding its global supply chain and R&D centers in closer proximity to its customers.

Key Strategic Areas:

How Lam Research tries to Win Strategically

Lam Research wins by integrating hardware, process, materials, software, and process control to enable results on the wafer. The company differentiates itself through its focus on R&D, leveraging cycles of learning from its broad installed base, collaborating with semi-ecosystem partners, and delivering multi-product solutions.

Key Competitive Advantages:

Strategy Cascade for Lam Research

Below is a strategy cascade for Lam Research's strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Drive Semiconductor Breakthroughs

Focus on developing technologies that enable advancements in semiconductor manufacturing, particularly for AI applications.

Develop Advanced Etch Technologies

Create new etch technologies to meet the increasingly complex device scaling requirements for advanced CPUs, GPUs, and memory.

Enhance Deposition Process Capabilities

Improve deposition technologies to enable vertical scaling in logic and DRAM devices, focusing on gate-all-around and backside power delivery.

Advance Clean Technology Solutions

Develop innovative clean technologies to support the increasing complexity of semiconductor manufacturing, including advanced packaging.

Integrate Hardware, Process, and Software

Focus on integrating hardware, process, materials, software, and process control to enable breakthroughs on the wafer.

Capitalize on Technology Inflections

Focus on etch- and deposition-intensive technology inflections like gate-all-around, backside power delivery, advanced packaging, and dry extreme ultraviolet photoresist processing.

Accelerate Gate-All-Around Solutions

Prioritize the development and deployment of etch and deposition solutions for gate-all-around transistor architectures.

Commercialize Backside Power Delivery Technologies

Invest in R&D to create and commercialize solutions for backside power delivery networks in advanced logic devices.

Expand Advanced Packaging Portfolio

Develop and offer a comprehensive portfolio of etch and deposition equipment for advanced packaging applications, including HBM.

Pioneer Dry EUV Photoresist Processing

Lead the development of dry etch solutions for extreme ultraviolet (EUV) photoresist processing.

Expand Global Supply Chain and R&D

Strategically expand the global supply chain and locate R&D centers and manufacturing capacity closer to customers.

Establish Regional R&D Hubs

Create new R&D centers in key customer locations to facilitate faster collaboration and innovation.

Optimize Global Supply Chain Footprint

Expand and diversify the global supply chain to mitigate risks and improve responsiveness to customer needs.

Scale Manufacturing in Malaysia

Continue scaling manufacturing operations at the Malaysia facility to meet growing demand.

Enhance Customer Collaboration

Drive faster, more productive collaboration with customers through R&D and engineering labs and Semiverse™ Solutions.

Deploy Semiverse™ Digital Twins

Expand the use of Semiverse™ Solutions, including digital twin capabilities, to accelerate product design and testing in simulated production environments.

Co-Develop Solutions with Key Customers

Establish joint development programs with key customers to address their specific manufacturing challenges and roadmaps.

Improve Customer Proximity

Increase the number of R&D and engineering labs in close proximity to key customers to foster collaboration.

Progress Towards Sustainability Goals

Integrate 'Act with purpose for a better world' in all aspects of the business and progress toward 2025 sustainability goals.

Increase Renewable Energy Usage

Implement initiatives to achieve 100% renewable electricity usage by 2030.

Reduce Water Consumption

Implement water-saving technologies and practices to achieve 80 million gallons of water savings in water-stressed regions by 2025.

Minimize Hazardous Waste

Implement programs to achieve zero waste to landfill for hazardous waste.

Reduce Scope 1 and 2 GHG Emissions

Reduce absolute Scope 1 and 2 (market-based) GHG emissions 25% by 2025 and 60.6% by 2030 from a 2019 baseline.

Drive Operational Agility and Efficiency

Invest in digital transformation of the entire organization to drive greater operational agility and efficiency.

Implement Digital Solutions

Deploy digital solutions across the organization to streamline processes and improve decision-making.

Enhance Data Analytics Capabilities

Improve data analytics capabilities to gain insights into operational performance and identify areas for improvement.

Automate Key Processes

Automate key processes to reduce manual effort and improve efficiency.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.