Lowe's Companies, Inc. Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Lowe's Companies, Inc.

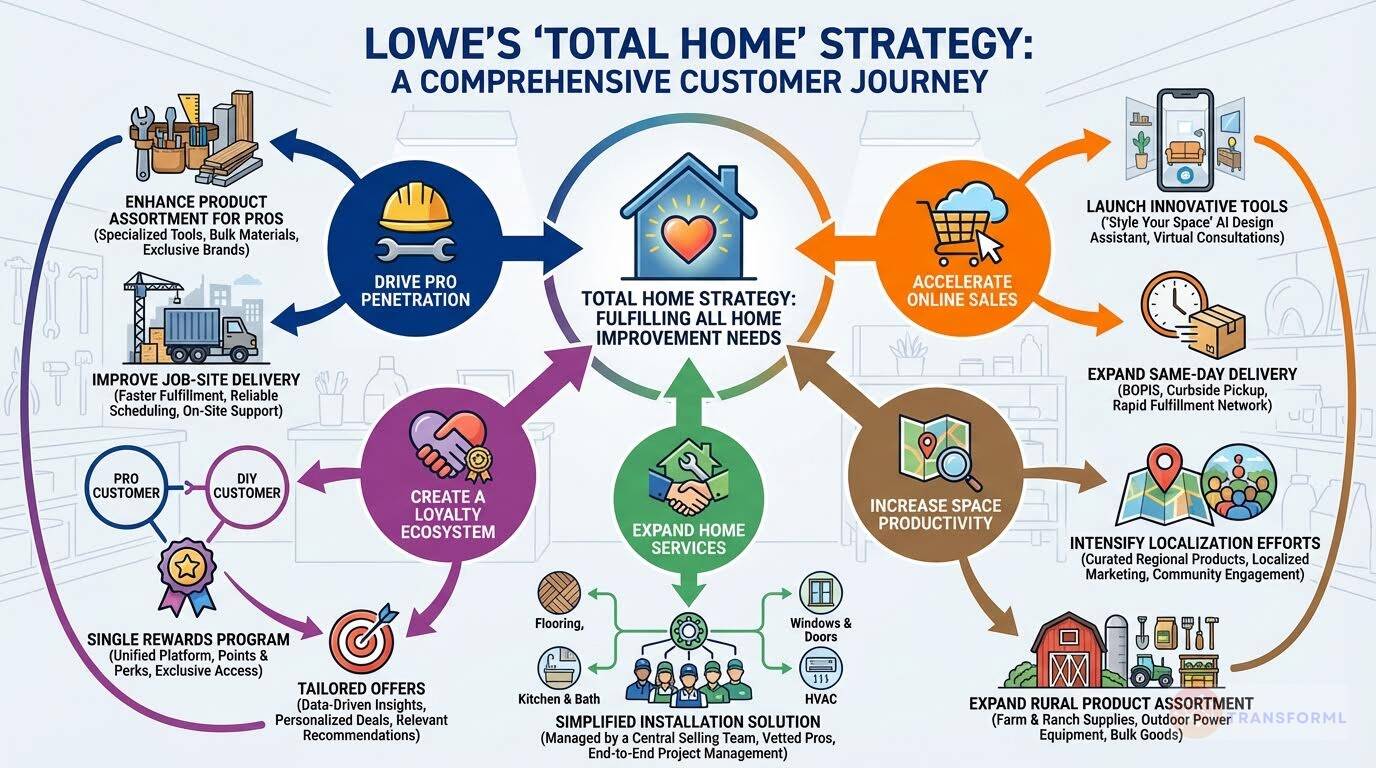

Lowe's Companies, Inc. is a home improvement retailer focused on helping customers with their home improvement needs. The company's Total Home strategy focuses on serving the Pro customer, accelerating online business, expanding installation services, creating a loyalty ecosystem, and increasing space productivity. Despite macroeconomic challenges in 2024, Lowe's made strides in enhancing customer and associate experiences and is positioning itself for future recovery in the home improvement industry.

Key Competitors for Lowe's Companies, Inc.

The Home Depot

Largest home improvement retailer with extensive supply chain network, strong brand recognition, and comprehensive product assortment.

Amazon

Dominant online presence with vast product selection, fast delivery options, and strong customer loyalty through Prime membership.

Walmart

Large customer base with competitive pricing, extensive store network, and growing home improvement category.

Menards

Regional home improvement chain with strong Midwest presence, competitive pricing, and comprehensive product selection.

Ace Hardware

Hardware store cooperative with local ownership model, strong customer service, and extensive network of independent stores.

True Value

Hardware store cooperative with independent retailer network, strong local market presence, and comprehensive product offerings.

Tractor Supply Co.

Rural lifestyle retailer with strong focus on rural markets, agricultural and pet supplies, and loyal customer base.

Wayfair

Online furniture and home goods retailer with extensive product selection, strong e-commerce platform, and competitive pricing.

Insights from Lowe's Companies, Inc.'s strategy and competitive advantages

What Stands Out in Lowe's Companies, Inc. strategy

Lowe's strategy demonstrates a pronounced focus on creating a unified and simplified customer journey, particularly through its loyalty program and services model. While competitor The Home Depot also focuses on the customer experience, Lowe's approach appears more centralized and explicitly targeted at broad-based engagement.

A key distinctive element is the strategic pillar 'Create a Loyalty Ecosystem', which aims to build out a single rewards infrastructure ('MyLowe's Rewards') for both Pro and DIY customers. This contrasts with Home Depot's more siloed approach to Pro engagement. Furthermore, Lowe's 'Expand Home Services' pillar, with initiatives like creating a 'Central Selling Team' and 'High Value Simplified Installation Solution', points to a unique strategy of abstracting complexity away from the customer for installation projects, a potential differentiator in a traditionally fragmented service experience.

Finally, the emphasis on 'Intensify Localization Efforts' and expanding the 'Rural Assortment' under its 'Increase Space Productivity' pillar suggests a more granular, community-focused merchandising strategy than Home Depot's broader plan to 'Grow Store Footprint Strategically'.

What are the challenges facing Lowe's Companies, Inc. to achieve their strategy

Lowe's faces significant challenges in scale, market momentum, and strategic depth, particularly in the critical Pro customer segment. The most pressing challenge is competing against The Home Depot's aggressive and acquisitive Pro strategy. While Lowe's aims to 'Drive Pro Penetration' through organic initiatives like enhancing product assortments and service levels, Home Depot is actively building a 'Pro Ecosystem' and has made a transformative move to 'Integrate SRS Distribution Synergies'.

This acquisition vastly expands Home Depot's addressable market and capabilities for complex projects, creating a competitive moat that Lowe's organic strategy may struggle to overcome. Financially, Lowe's is on the back foot, with a reported revenue decrease of 3.1% ($83.7B) compared to Home Depot's 4.5% growth ($159.5B). This significant size and growth disparity gives Home Depot superior leverage, capital for investment, and a stronger foundation for its stated goal to 'Extend Our Low-Cost Provider Position', potentially squeezing Lowe's margins.

Lastly, while both companies are investing in their supply chains, Home Depot's explicit goal to 'Automate Rapid Deployment Centers' and 'Increase the Speed of Delivery' signals an operational intensity that could set a new market standard, challenging Lowe's to keep pace on fulfillment speed and efficiency.

What Positions Lowe's Companies, Inc. to win

Strong Brand Recognition

- Lowe's is a well-established brand with a strong reputation in the home improvement market, attracting a large customer base.

Extensive Store Network

- The company operates over 1,700 stores in the United States, providing convenient access for customers across the country.

Omnichannel Capabilities

- Lowe's offers a seamless shopping experience through its physical stores, online platform, and mobile app, catering to diverse customer preferences.

Focus on Pro Customers

- Lowe's has made significant investments in its Pro offerings, resulting in increased Pro sales and market share gains.

Commitment to Sustainability

- The company is dedicated to reducing its environmental footprint through various initiatives, including energy efficiency, renewable energy, and waste management.

Strong Financial Performance

- Lowe's has demonstrated strong operating performance, with a healthy operating margin and free cash flow generation.

Loyalty Program

- The MyLowe's Rewards program has attracted over 30 million members, who spend nearly 50% more than non-members.

Skilled Trades Investment

- Lowe's is committed to developing the next generation of skilled trade experts through various programs and initiatives.

What's the winning aspiration for Lowe's Companies, Inc. strategy

Lowe's winning aspiration is to be the leading home improvement retailer by providing exceptional customer experiences, fostering a great place to work for associates, and improving communities, ultimately creating long-term, sustainable value for shareholders.

Company Vision Statement:

Company Vision Statement - Solving problems and fulfilling dreams for the home.

Where Lowe's Companies, Inc. Plays Strategically

Lowe's focuses on serving both Pro and DIY customers in the United States through a network of physical stores and a growing online presence. The company aims to meet customer demand through omnichannel capabilities and flexible fulfillment options.

Key Strategic Areas:

How Lowe's Companies, Inc. tries to Win Strategically

Lowe's aims to win by providing an excellent customer experience, a great place to work for associates, and improving communities. The company leverages its Total Home strategy, omnichannel capabilities, and investments in technology and supply chain to differentiate itself from competitors.

Key Competitive Advantages:

Strategy Cascade for Lowe's Companies, Inc.

Below is a strategy cascade for Lowe's Companies, Inc.'s strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Drive Pro Penetration

Increase sales and market share among professional customers.

Enhance Pro Product Assortment

Expand the range of products specifically tailored to the needs of professional customers, including high-volume and specialized items.

Improve Job-Site Delivery

Optimize the logistics and delivery network to provide faster and more reliable delivery of products to job sites.

Roll Out New Pro Extended Aisle

Increase the availability of Pro products through a wider selection, both in-store and online.

Add Dedicated Service Levels In Our Stores

Create a specialized service model for Pro customers, including dedicated service representatives and personalized support.

Launch Redesigned Loyalty Program

Improve the redesigned loyalty program to better incentivize Pro customers and increase their engagement with Lowe's.

Accelerate Online Sales

Increase revenue and market share through online channels.

Use Project Design Tools

Develop and improve online tools that help customers design and plan their home improvement projects.

Use Our Online Product Marketplace

Increase the range of products available online through the online product marketplace.

Enhance User Online Experience

Enhance the user experience on Lowes.com and the Lowe's app to make it easier for customers to find and purchase products.

Launch Style Your Space

Increase awareness and usage of the Style Your Space generative AI design assistant.

Expand Same-Day Delivery Options

Increase the availability of same-day delivery through multiple gig platforms and the Lowe's app.

Expand Home Services

Grow the business by offering a wider range of installation and related services.

Create High Value Simplified Installation Solution

Streamline the process of selling and administering installation projects to make it easier for customers to purchase and schedule services.

Provided By Our Network Of Independent Installers

Expand the network of independent contractors providing installation services to increase capacity and coverage.

Outsourced To Our Third-Party Model That Sells, Furnishes, And Installs Both Smaller Refresh Projects And More Complex Projects

Improve the outsourced installation model to ensure high-quality service and customer satisfaction.

Simplify The Process Through A Team Of Remote Associates That We Call Our Central Selling Team

Expand the central selling team to handle building quotes, answering questions, and providing personalized support.

Implementing Technology That Allows Our Customers To Finalize Their Installation Contract And Checkout On Lowes.Com Or Mobile Application

Implement technology that allows customers to finalize their installation contract and checkout online.

Create a Loyalty Ecosystem

Develop a comprehensive loyalty program to increase customer retention and spending.

Build Out Our MyLowe's Rewards Infrastructure For Both Pro And Do-It-Yourself (DIY) Customers

Develop and enhance the MyLowe's Rewards program to offer more personalized rewards and benefits to both Pro and DIY customers.

Tailoring Offers That Better Serve Their Home Improvement Needs And Incentivize Them To Shop At Lowe's Again And Again

Tailor offers and promotions to individual customer preferences and purchase history to increase engagement and spending.

Seamless Experience Across Channels

Ensure a seamless loyalty program experience across all channels, including in-store, online, and mobile.

Give Our Customers More Reasons To Choose Lowe's, With Rewards Toward Their Next Purchase And Member-Only Perks

Offer compelling incentives to encourage customers to enroll in the MyLowe's Rewards program.

Analyze Loyalty Program Data

Utilize data from the loyalty program to gain insights into customer behavior and preferences, and to optimize marketing and merchandising strategies.

Increase Space Productivity

Optimize store layouts and product assortments to maximize sales per square foot.

Optimize Our Assortments

Analyze sales data and customer preferences to optimize product assortments in each store.

Tailoring Them To The Local Markets

Customize product assortments to meet the specific needs and preferences of customers in each local market.

Balancing Our Value-Oriented Private Brands With Our National Brands

Optimize the mix of value-oriented private brands and national power brands to maximize sales and profitability.

Intensify Localization Efforts

Increase the focus on localizing product assortments and marketing efforts to better serve local communities.

Expand Our Rural Assortment

Increase the range of products available in rural stores to better meet the needs of rural customers.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.