Mastercard Incorporated Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Mastercard Incorporated

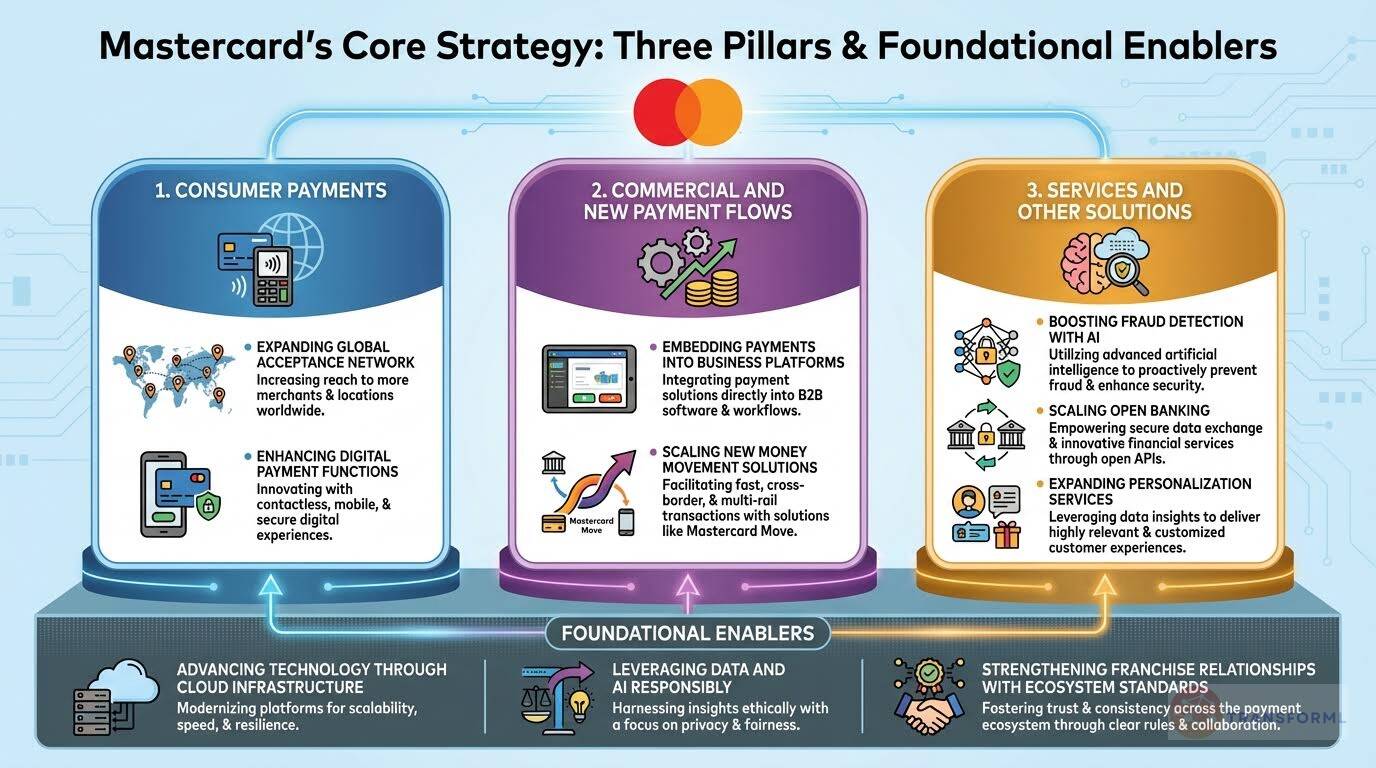

Mastercard is a technology company in the global payments industry that connects consumers, financial institutions, merchants, and other organizations worldwide by enabling electronic payments. The company's strategy centers on growing its core business, diversifying its customer base and geographic reach, and building new areas for the future through both organic and inorganic strategic initiatives. Mastercard focuses on consumer payments, commercial and new payment flows, and services and other solutions to drive value for its customers and the broader payments ecosystem.

Key Competitors for Mastercard Incorporated

Visa

Extensive global network and brand recognition

American Express

Strong brand loyalty and premium card offerings

JCB

Dominant market share in Japan and expanding global reach

China UnionPay

Dominant market share in China and government support

Discover

Integrated payments network and direct banking services

Insights from Mastercard Incorporated's strategy and competitive advantages

What Stands Out in Mastercard Incorporated strategy

Mastercard's strategy is distinctive in its balanced focus on being a core technology partner across multiple payment rails, its proactive integration of advanced services, and a pronounced emphasis on responsible data utilization. Pragmatic 'Multi-Rail' Technology Focus: While competitor Visa aggressively brands a 'Network of Networks' strategy, Mastercard articulates a more grounded technology-partner approach through its 'multi-rail capabilities'. This is evident in specific initiatives like 'Scale Mastercard Move Use Cases' for disbursements and remittances and 'Enhance Payment Rails' to support new services. This positions Mastercard not just as a network aggregator, but as a flexible technology provider that enables choice for its partners, contrasting with American Express's more vertically integrated, card-centric model.

Deep Integration of Security and AI Services: Mastercard uniquely elevates 'Services and Other Solutions' and 'Leverage Data and AI Responsibly' to the level of core strategic pillars. This is more than just an add-on; it's central to their value proposition. For example, the initiative to 'Incorporate threat intelligence capabilities from Recorded Future' into its core services and using generative AI to 'Boost Fraud Detection Rates' demonstrates an offensive and defensive strategy to embed value. While Visa also has a strong services suite ('Visa Protect'), Mastercard's strategic framing presents these capabilities as fundamental to its identity as a technology company.

Embedded B2B Payment Solutions: All three companies target commercial payments, but Mastercard's strategy details a highly integrated approach. Initiatives such as 'Embed Payments into B2B Platforms' and 'Drive Virtual Card Number Adoption' focus on embedding solutions directly into corporate workflows. This goes beyond simply offering a commercial card, as is a core part of American Express's B2B play, and appears more granularly focused on platform integration than Visa's broader 'New Flows' category.

What are the challenges facing Mastercard Incorporated to achieve their strategy

Mastercard faces significant challenges from competitors who are leveraging greater scale and different business models, making differentiation difficult in a crowded market.

Competition with a Larger, Near-Identical Competitor: Mastercard's primary challenge is competing against Visa, which pursues an almost identical strategy but with greater market scale. Visa reports higher revenue ($35.9B vs Mastercard's $28.2B) and payments volume ($13.2T vs Mastercard's 11% GDV growth). For nearly every strategic program at Mastercard, such as 'Enhance Digital Payment Functionality', Visa has a direct and well-established counterpart like 'Enhance Click to Pay Experience'. This intense overlap with a larger rival puts immense pressure on execution and innovation to maintain a competitive edge.

Visa's Aggressive Expansion into Core Banking Services: Visa's strategy appears more aggressive in vertically integrating along the value chain. Its acquisition of the Pismo platform ('Integrate Pismo Platform') to offer core banking and issuer-processing capabilities is a significant move that Mastercard has no stated public equivalent for. This allows Visa to offer a more comprehensive, 'stickier' solution to financial institution clients, potentially locking them into the Visa ecosystem and creating a significant competitive gap in value-added services.

Structural Disadvantage Against American Express's Integrated Model: As Mastercard seeks to move 'beyond the transaction' with data and personalization services ('Expand Personalization Services'), it directly competes with American Express's inherent structural advantage. American Express operates a largely 'closed-loop' system, giving it direct access to rich cardholder and merchant data. This enables Amex to 'Provide Data-Driven Marketing Insights' and build deep customer relationships as a core function of its model. Mastercard, operating in an 'open-loop' model, must build these data capabilities as a service layer, whereas for Amex, they are a natural byproduct of its business, posing a long-term challenge in the race for value-added services.

What Positions Mastercard Incorporated to win

Global Network

- Mastercard possesses a highly adaptable and world-class global payments network that can reach a variety of parties to enable payments anywhere.

Franchise Model

- Mastercard's franchise model establishes rules, standards, and financial risk-bearing mechanisms, including a settlement guarantee backed by a strong credit standing, that allow for interoperability among all participants.

Multi-Rail Capabilities

- Mastercard offers multiple payments capabilities based on its innovation and technology, enabling choice for consumers and businesses.

Brand Recognition

- Mastercard has globally recognized and trusted brands that instill confidence and reliability in its payment solutions.

Data and AI Expertise

- Mastercard leverages its data and AI assets, technology, platforms, and expertise to create products and services that incorporate its Data and Tech Responsibility Principles and reflect its Privacy by Design, Data by Design, and AI Governance processes.

Talent and Culture

- Mastercard has a world-class talent pool and a strong corporate culture guided by the Mastercard Way, with a focus on providing equal opportunities for all employees and 'doing well by doing good'.

Technology Leadership

- Mastercard's leading-edge technology advances the quality, speed, and diversity of its offerings and solutions, ensuring it remains at the forefront of the payments industry.

Government Engagement

- Mastercard's expanded on-soil presence in individual markets and heightened focus on working with governments enable it to serve a broad array of participants in global payments.

What's the winning aspiration for Mastercard Incorporated strategy

Mastercard aims to be the leading technology company driving global commerce by providing secure, simple, and accessible payment solutions that benefit all participants in the payments ecosystem. It seeks to empower consumers, businesses, and governments through innovative payment technologies and services, while maintaining a balanced ecosystem that fosters innovation and trust.

Company Vision Statement:

Company Vision Statement - We connect consumers, financial institutions, merchants, governments, digital partners, businesses and other organizations worldwide by enabling electronic payments and making those payment transactions secure, simple, smart and accessible.

Where Mastercard Incorporated Plays Strategically

Mastercard competes globally across various segments of the payments industry, focusing on consumer payments, commercial payments, and new payment flows. It targets financial institutions, merchants, governments, and digital partners, with a significant presence in North America and expanding operations in Asia and other regions.

Key Strategic Areas:

How Mastercard Incorporated tries to Win Strategically

Mastercard wins by leveraging its global network, franchise model, and multi-rail capabilities to provide secure, reliable, and innovative payment solutions. It differentiates itself through data-driven services, strong brand recognition, and a commitment to responsible data and AI practices.

Key Competitive Advantages:

Strategy Cascade for Mastercard Incorporated

Below is a strategy cascade for Mastercard Incorporated's strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Consumer Payments

Focus on enabling consumer payments, providing consumers with choice and flexibility to transact across multiple payment rails, while ensuring that all payments are safe, secure and seamless.

Expand Acceptance Network Globally

Increase the number of acceptance locations and digital access points worldwide to facilitate greater consumer payment volume, focusing on cash displacement and opening up closed-loop and domestic networks.

Enhance Digital Payment Functionality

Improve digital payment experiences by offering comprehensive digital functionality, such as Digital First, and streamlining online checkout to drive increased approval, spend, and activation rates.

Modernize Card Switch Infrastructure

Upgrade the card switch to meet evolving needs, enabling tokenization of credentials, identities, assets, and data, and facilitating secure exchange between counterparties.

Develop Consumer Bill Payment Solutions

Expand consumer bill payment solutions to provide a seamless and secure way for consumers and small businesses to pay their billers, offering flexibility and benefits to consumers, financial institutions, and billers.

Commercial and New Payment Flows

Focus on capturing opportunities in commercial payments and disbursements and remittances through Mastercard Move.

Accelerate Commercial Point-of-Sale Adoption

Expand the distribution of point-of-sale offerings across financial institutions, new geographies, new channels, and small businesses to accelerate the secular shift in commercial point-of-sale purchases.

Embed Payments into B2B Platforms

Integrate payments into widely used platforms and workflows to capture commercial invoiced payments, simplifying workflows, releasing working capital, and improving data reconciliation.

Scale Mastercard Move Use Cases

Expand money movement across the global network of financial institution partners by utilizing Mastercard Move to scale use cases across senders and receiving consumers, both domestic and cross-border.

Drive Virtual Card Number Adoption

Increase the adoption of Virtual Card Numbers (VCN) by integrating the VCN solution into third-party technology platforms and offering suppliers Mastercard Receivables Manager.

Services and Other Solutions

Drive value for customers and the broader payments ecosystem by offering security solutions, consumer acquisition and engagement, business and market insights, gateway, processing and open banking.

Integrate Threat Intelligence Capabilities

Incorporate threat intelligence capabilities from Recorded Future into identity, fraud prevention, real-time decisioning, and cybersecurity services to enhance security solutions.

Expand Personalization Services

Leverage AI to help businesses provide personalized digital experiences for their customers, delivering product recommendations, offers, and content across digital channels.

Enhance Transaction Processing Platforms

Extend processing capabilities in the payments value chain by providing customers with a complete processing solution and enabling quick deployment of payments portfolios across banking channels.

Scale Open Banking Solutions

Expand the open banking platform to enable data providers and third parties to reliably access, securely transmit, and confidently manage consumer and small business data to improve the customer experience.

Boost Fraud Detection Rates

Enhance fraud detection rates by leveraging generative AI techniques to produce additional data points to help assess the validity of a transaction.

Attract, Develop, and Retain Top Talent

Attract, develop and retain top talent, in alignment with strategic priorities, and foster a winning culture guided by the Mastercard Way.

Strengthen Talent Acquisition Initiatives

Continuously recruit talent by leveraging the strength of the brand and utilizing a variety of sources, channels, and initiatives to support growth across sectors, markets, and emerging industries.

Expand Employee Well-being Offerings

Prioritize and expand well-being offerings for employees, including access to mental, physical, and financial health resources, additional paid time off for dependent care, and support for family planning.

Customize Global Inclusion Strategies

Customize global inclusion strategies by region, ensuring that local leadership implements and executes strategies that reflect the viewpoints of appropriate stakeholders and consider cultural nuances.

Reinforce Ethical Business Practices

Maintain a culture of high ethical business practices and compliance standards, grounded in honesty, decency, trust, and personal accountability, driven by 'tone at the top' and reinforced with regular training.

Leverage Data and AI Responsibly

Create a range of products and services for customers using data and AI assets, technology, platforms and expertise, while following Data and Tech Responsibility Principles.

Enhance Data Governance Framework

Practice robust data and AI governance aimed at ensuring that we have the right controls and oversight over the use of our data and technology.

Implement Data Minimization Practices

Practice collecting and retaining only the personal information that is needed for a given product or service, and limiting the amount and type of personal information shared with third parties.

Advance Positive Social Impact

Utilize data sets and analytics capabilities to create innovative solutions to societal challenges, benefit society, and promote inclusive financial, social, climate, health, and education growth.

Address Fairness in Data and AI

Implement governance and processes to help test and mitigate for bias when we use advanced analytics, including Al and machine learning, to create fair and inclusive solutions.

Advance Technology and Innovation

Utilize technology to help grow the core business, diversify into new customers and geographies, and build new areas for the future, while also enhancing operational strength.

Standardize Customer Connectivity

Standardize and simplify how we connect with customers to provide them with the tools to manage and expand their Mastercard relationship.

Deploy Cloud-Native Infrastructure

Deploy our cloud-native technology infrastructure to adapt to evolving market conditions and further enhance speed, resiliency, and scalability.

Enhance Payment Rails

Enhance payment rails and expand them across payments and services, including providing seamless customer adoption across new services and solutions.

Improve Delivery Speed

Improve the speed in which we deliver for our customers through a combination of tools and customer-centric practices.

Strengthen Franchise Relationships

Manage an ecosystem of stakeholders who participate in the global payments network, creating and sustaining a comprehensive series of value exchanges across the ecosystem.

Define Ecosystem Roles and Responsibilities

Determine that each new customer meets the necessary prerequisites to use and contribute to our network by defining clear ecosystem roles and responsibilities for their operations.

Define Technical and Operational Standards

Define the technical, operational, and financial standards that all network participants are required to uphold.

Establish Consumer Protections

Establish central principles, including safeguarding consumer protections and integrity, so participants feel confident to transact on the network.

Set Performance Standards

Set performance standards to support ecosystem optimization and growth and use proactive monitoring designed to both ensure participant adherence to operating standards and protect the integrity of the ecosystem.

Operate Dispute Resolution Framework

Operate a framework to address disputes between our network participants.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.