Morgan Stanley Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Morgan Stanley

Morgan Stanley is a global financial services firm operating through Institutional Securities, Wealth Management, and Investment Management. In 2024, the firm achieved strong financial results, including increased net revenues and net income, driven by higher client activity and improved market conditions. The firm focuses on advising, originating, trading, managing, and distributing capital for governments, institutions, and individuals.

Key Competitors for Morgan Stanley

Goldman Sachs

Strong investment banking franchise and global reach

JPMorgan Chase

Large balance sheet and diversified financial services

Bank of America

Extensive retail banking network and wealth management capabilities

Citigroup

Global presence and comprehensive financial solutions

BlackRock

Leading asset management platform and ETF offerings

Insights from Morgan Stanley's strategy and competitive advantages

What Stands Out in Morgan Stanley strategy

Firstly, Morgan Stanley's strategy is uniquely distinguished by the pronounced centrality of its Wealth Management (WM) division and a deeply integrated, risk-centric approach to sustainability. Unlike its competitors, where wealth management is one part of a broader portfolio, MS positions WM as a primary engine for stable, fee-based growth, exemplified by its top-level strategic goal to 'Drive Growth in Wealth Management' through initiatives like expanding workplace solutions and increasing net new asset inflows.

This contrasts with Goldman Sachs, whose AWM growth appears more focused on alternatives and institutional penetration, and JPMorgan Chase, whose wealth business is integrated into a vast universal banking model. Secondly, MS distinctly frames sustainability as a core enterprise risk. Its strategic pillar 'Address Climate-Related Risks' and the initiative to 'Integrate Climate Risk Management' into its governance framework show a mature, defensive posture, which is a subtle but significant difference from Goldman Sachs' more commercially-focused '$750 Billion in Sustainable Financing' target and JPMorgan's community-oriented goals like 'Finance Affordable Housing'.

What are the challenges facing Morgan Stanley to achieve their strategy

Morgan Stanley faces two primary strategic challenges: competing with the immense scale of universal banks and fending off aggressive, focused competition in its core markets. Firstly, compared to JPMorgan Chase, MS operates at a significant scale disadvantage. JPM's '$177.6 billion' revenue, 'Fortress Balance Sheet,' and vast retail banking network provide a low-cost funding base and massive cross-selling opportunities that MS's more focused model cannot match, making it more sensitive to market volatility.

Secondly, Goldman Sachs poses a direct and aggressive threat. GS's explicit strategy to 'Run the Firm More Efficiently' has already resulted in a superior efficiency ratio (63.1% vs MS's 71%). Furthermore, GS's formation of a dedicated 'Capital Solutions Group' to dominate the private credit market is a highly focused offensive move that directly targets a lucrative area for MS. While Morgan Stanley's strategy is solid, it lacks a similar headline-grabbing, transformative initiative, appearing more incremental compared to JPM's integration of First Republic Bank or GS's aggressive new ventures.

What Positions Morgan Stanley to win

Strong Financial Performance

- Morgan Stanley demonstrates robust financial health with significant increases in net revenues and net income, reflecting effective business strategies and favorable market conditions. The firm's ROE of 14.0% and ROTCE of 18.8% are indicative of its profitability and efficient use of equity.

Diversified Business Model

- The firm operates across three main business segments—Institutional Securities, Wealth Management, and Investment Management—providing a wide array of products and services to a diverse client base, which reduces reliance on any single business area.

Robust Capital Position

- Morgan Stanley maintains a strong capital base, as evidenced by its Standardized Common Equity Tier 1 capital ratio of 15.9% and its ability to accrete $5.6 billion of Common Equity Tier 1 capital while returning capital to shareholders. This strong capital position provides financial flexibility and resilience.

Effective Expense Management

- The firm's expense efficiency ratio of 71% demonstrates its commitment to managing costs effectively, contributing to improved profitability. This is achieved through disciplined expense management and leveraging higher revenues.

Wealth Management Leadership

- Morgan Stanley's Wealth Management business continues to be a strong performer, delivering substantial net revenues and fee-based asset flows. The business added significant net new assets, indicating its ability to attract and retain clients.

Global Reach and Brand Recognition

- The firm has a well-established global presence, with offices in numerous countries, enabling it to serve a wide range of clients and participate in diverse markets. Its strong brand recognition enhances its ability to attract and retain clients and employees.

Commitment to Talent Development

- Morgan Stanley invests in its employees through talent development programs, leadership training, and initiatives that promote diversity and inclusion. This commitment helps attract and retain qualified employees, contributing to the firm's long-term success.

Strong Risk Management Framework

- The firm has a comprehensive Enterprise Risk Management framework to identify, measure, monitor, escalate, mitigate, and control the principal risks involved in its business activities. This framework helps protect the firm's capital base and franchise.

What's the winning aspiration for Morgan Stanley strategy

Morgan Stanley aims to be a leading global financial services firm that delivers exceptional value to its diverse client base by providing integrated financial solutions and expertise, while maintaining a strong capital base and a robust risk management framework.

Company Vision Statement:

Company Vision Statement - We are a global financial services firm that, through our subsidiaries and affiliates, advises, and originates, trades, manages and distributes capital for governments, institutions and individuals.

Where Morgan Stanley Plays Strategically

Morgan Stanley strategically focuses on serving corporations, governments, financial institutions, and high-net-worth individuals across global markets. The firm competes in investment banking, sales and trading, wealth management, and investment management, primarily in the Americas, EMEA, and Asia.

Key Strategic Areas:

How Morgan Stanley tries to Win Strategically

Morgan Stanley leverages its reputation, client experience, and the quality of its long-term investment performance to compete effectively. The firm focuses on innovation, execution, and relative pricing to maintain its competitive position.

Key Competitive Advantages:

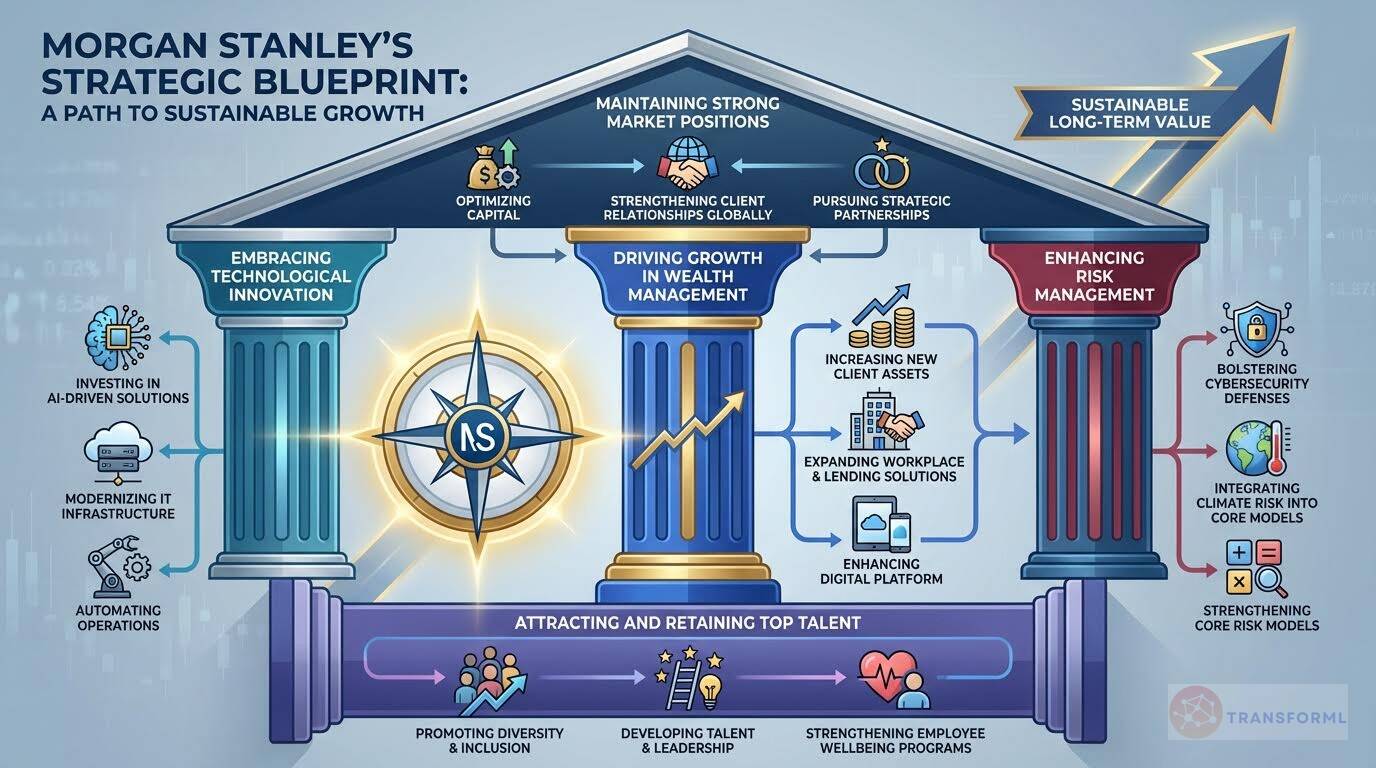

Strategy Cascade for Morgan Stanley

Below is a strategy cascade for Morgan Stanley's strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Maintain Strong Market Positions

Sustain and enhance leading positions in Institutional Securities, Wealth Management, and Investment Management through effective resource allocation and strategic initiatives.

Optimize Capital Allocation Across Segments

Review and adjust capital allocation to Institutional Securities, Wealth Management, and Investment Management based on market opportunities, risk-adjusted returns, and regulatory requirements.

Expand Product Offerings in High-Growth Areas

Develop and introduce innovative products and services in areas with high growth potential, such as sustainable investing, digital assets, and alternative investments.

Strengthen Client Relationships Globally

Enhance client experience and deepen relationships with corporations, governments, financial institutions, and individuals across all geographic regions.

Pursue Strategic Acquisitions and Partnerships

Identify and execute strategic acquisitions, joint ventures, partnerships, and minority stakes to expand market reach, enhance capabilities, and access new technologies.

Attract and Retain Top Talent

Prioritize talent acquisition, development, and retention through competitive compensation, benefits, and a diverse and inclusive workplace culture.

Enhance Compensation and Benefits Programs

Review and enhance compensation and benefits programs to ensure competitiveness and alignment with employee expectations, including salaries, bonuses, retirement savings plans, and wellbeing programs.

Promote Diversity and Inclusion Initiatives

Invest in efforts to recruit, advance, and retain a talented and diverse workforce through professional development, wellness programs, and an inclusive workplace culture.

Expand Talent Development Programs

Develop and expand talent development programs to provide employees with resources for career growth, management skills, and leadership development.

Strengthen Employee Wellbeing Programs

Enhance programs that support the physical, mental, and financial wellbeing of employees and their families, including healthcare, mental health resources, and financial planning assistance.

Navigate the Regulatory Environment

Proactively monitor and adapt to the evolving regulatory landscape in the U.S. and globally, ensuring compliance and mitigating legal and regulatory risks.

Strengthen Regulatory Compliance Programs

Enhance compliance programs to address new and evolving regulations, including capital, leverage, funding, liquidity, consumer protection, and recovery and resolution requirements.

Enhance Financial Crimes Prevention

Strengthen the Financial Crimes program to detect and deter money laundering, terrorist financing, and other illicit activities, ensuring compliance with AML, economic sanctions, and anti-corruption laws.

Engage with Regulatory Agencies

Maintain open communication and collaboration with regulatory agencies in the U.S. and globally to address regulatory concerns and ensure compliance.

Monitor and Adapt to Regulatory Changes

Establish a dedicated team to monitor and analyze regulatory changes, assess their impact on the business, and implement necessary adjustments to policies and procedures.

Enhance Risk Management Capabilities

Continuously improve risk management strategies, models, and processes to effectively mitigate market, credit, operational, and other risks.

Improve Market Risk Modeling

Enhance market risk models to better capture market fluctuations, volatility, and illiquid market conditions, including stress testing and scenario analysis.

Strengthen Credit Risk Assessment

Improve credit risk assessment processes, including valuations and reserves for losses on credit exposures, to accurately measure and manage credit quality.

Bolster Cybersecurity Defenses

Enhance cybersecurity defenses to protect against cyberattacks, information breaches, and technology failures, ensuring the confidentiality, integrity, and availability of data.

Refine Liquidity Risk Management

Enhance liquidity risk management framework to ensure access to adequate funding across a wide range of market conditions and time horizons.

Integrate Climate Risk Management

Develop and implement processes to embed climate risk considerations into risk management practices and governance structures, addressing physical and transition risks.

Drive Growth in Wealth Management

Expand the Wealth Management business segment through net new asset flows, fee-based asset growth, and effective competition across different channels.

Increase Net New Asset Inflows

Implement strategies to attract new clients and increase asset inflows into Wealth Management accounts, focusing on advisory services, financial planning, and workplace solutions.

Grow Fee-Based Assets

Promote the adoption of fee-based advisory services to increase fee-based assets, enhancing recurring revenue and aligning incentives with client success.

Enhance Digital Direct Platform

Improve the functionality and user experience of the digital direct platform to attract and retain self-directed investors, offering competitive pricing and a wide range of investment options.

Expand Workplace Solutions

Grow the workplace solutions business, including stock plan administration and retirement plan services, to capture a larger share of the employee benefits market.

Optimize Lending Product Offerings

Expand and refine lending product offerings, including securities-based lending, residential mortgage loans, and structured loans, to meet the diverse needs of Wealth Management clients.

Embrace Technological Innovation

Implement and leverage technological advancements, including emerging technologies, to enhance products, services, and operational efficiency.

Invest in AI-Driven Solutions

Develop and implement AI-driven solutions to enhance trading strategies, risk management, client service, and operational efficiency.

Modernize IT Infrastructure

Modernize the firm's IT infrastructure to improve scalability, security, and resilience, supporting the adoption of new technologies and enhancing operational efficiency.

Enhance Digital Client Platforms

Improve the functionality and user experience of digital client platforms, including mobile applications and self-directed brokerage platforms, to attract and retain clients.

Automate Operational Processes

Automate operational processes to reduce manual effort, improve accuracy, and enhance efficiency, including trade processing, regulatory reporting, and client onboarding.

Address Climate-Related Risks

Integrate climate risk considerations into risk management practices and governance structures to mitigate physical and transition risks and achieve climate-related targets.

Develop Climate Risk Assessment Framework

Create a comprehensive framework for assessing and managing climate-related risks, including physical risks, transition risks, and reputational risks.

Incorporate Climate Data into Models

Integrate climate-related data and metrics into risk models to better assess the impact of climate change on credit risk, market risk, and operational risk.

Establish Sustainable Financing Targets

Set targets for sustainable financing and investments, promoting the transition to a low-carbon economy and supporting clients in their sustainability efforts.

Enhance Climate Risk Disclosure

Improve disclosure of climate-related risks and opportunities, aligning with regulatory requirements and stakeholder expectations.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.