PepsiCo Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for PepsiCo

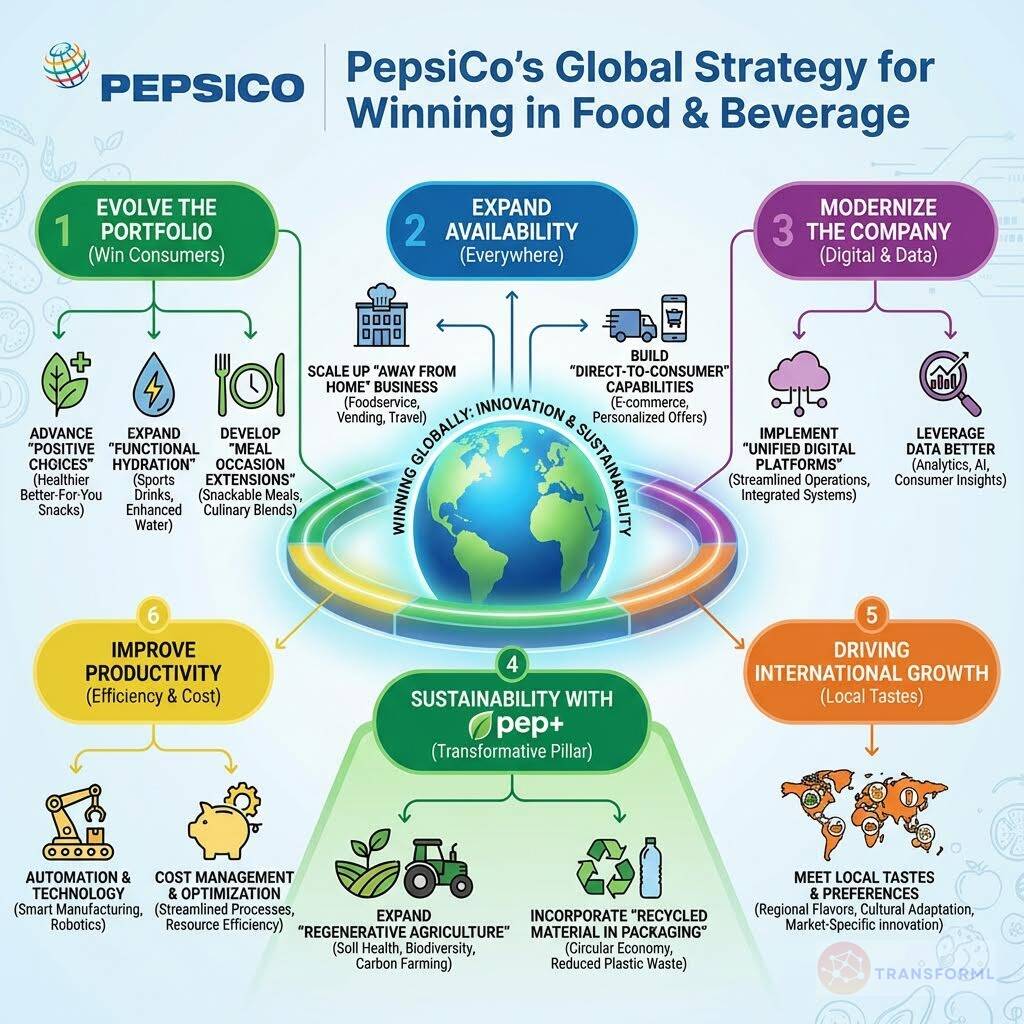

PepsiCo's strategy for 2024 revolves around resilience and growth, focusing on key pillars such as evolving its portfolio, expanding availability, modernizing the company, and becoming more sustainable through its pep+ initiative. Despite facing headwinds, the company delivered organic revenue growth and earnings per share growth, driven by its international business and strategic investments.

Key Competitors for PepsiCo

The Coca-Cola Company

Significant carbonated soft drink (CSD) market share, particularly outside the United States

Mondelēz International, Inc.

Global presence in the snack food industry

Nestlé S.A.

Diversified portfolio of food and beverage products

Keurig Dr Pepper Inc.

Strong presence in the beverage market, particularly in the United States

Insights from PepsiCo's strategy and competitive advantages

What Stands Out in PepsiCo strategy

PepsiCo's primary distinctiveness lies in its synergistic and broad 'Food & Beverage' portfolio, which no single competitor in this set can match. This strategy allows PepsiCo to 'win the consumer' across the entire day, from snacks to drinks. A key example is the initiative to 'Develop Meal Occasion Extensions,' such as Lay's potato omelets, a cross-category innovation that competitors like the beverage-only Coca-Cola or the non-food focused P&G cannot replicate.

Furthermore, PepsiCo's 'pep+ (PepsiCo Positive)' initiative stands out as a deeply integrated and branded sustainability strategy that goes beyond operational metrics. While competitors like P&G and Coca-Cola have strong sustainability goals, pep+ is positioned as a central pillar transforming the entire value chain—from 'Expand Regenerative Agriculture Practices' to 'Elevate Positive Choices Through Recipe Improvement,' making it a core part of its consumer-facing value proposition.

What are the challenges facing PepsiCo to achieve their strategy

A significant challenge for PepsiCo is the inherent complexity of managing its vast and evolving portfolio compared to the focused strategies of its competitors. While PepsiCo aims to 'Evolve our portfolio,' competitors like P&G are driving a laser-focused strategy of 'Irresistible Superiority' to dominate specific categories, and Coca-Cola is geared towards flawless 'Commercial Execution' at the shelf level. This breadth risks diluting PepsiCo's focus and resources.

For example, P&G's goal to 'Enhance Product Performance Benchmarking' for category leadership contrasts with PepsiCo's more complex task of balancing innovation in diverse areas like functional hydration and multicultural snacks. Another challenge is the threat from more radical innovation. While PepsiCo focuses on 'Modernize the company,' P&G actively pursues 'Constructive Disruption,' and Philip Morris International's entire strategy is a business model transformation. PepsiCo's more evolutionary approach to D2C and digital platforms may be outpaced by competitors who are forced to, or choose to, fundamentally reinvent their business models and routes to market.

What Positions PepsiCo to win

Brand Portfolio

- PepsiCo possesses a diverse and complementary portfolio of well-recognized brands, including Lay's, Doritos, Pepsi-Cola, and Gatorade, which cater to a wide range of consumer preferences.

Global Reach

- The company has an extensive global presence, serving customers and consumers in over 200 countries and territories, providing diversification and growth opportunities.

Resilient Business Model

- PepsiCo's business model demonstrates resilience, with the ability to navigate economic headwinds and deliver profitable growth through product and geographic diversification.

Strong International Performance

- The international business has been a significant growth driver, contributing a substantial portion of net revenue and demonstrating strong compound annual growth in core operating profit.

Commitment to Sustainability

- PepsiCo's pep+ (PepsiCo Positive) strategy focuses on sustainability, including regenerative agriculture, water stewardship, and packaging improvements, enhancing the company's reputation and long-term value.

Productivity Initiatives

- The company's multi-year productivity programs drive cost savings and efficiencies through automation, digital platforms, and standardized processes, supporting reinvestment in growth initiatives.

Adaptability and Innovation

- PepsiCo demonstrates adaptability by evolving its portfolio to meet changing consumer preferences, including healthier options and personalized products, and expanding into high-growth channels and markets.

Strong Financial Performance

- PepsiCo exhibits strong financial performance, including consistent dividend payments, share repurchases, and a focus on delivering long-term value to shareholders.

What's the winning aspiration for PepsiCo strategy

PepsiCo aims to be the leading global beverage and convenient food company by offering a diverse portfolio of products that meet consumer needs throughout the day, while also creating sustainable growth and value for its stakeholders through its pep+ strategy.

Company Vision Statement:

Company Vision Statement - Our aspiration is to offer consumers a broad portfolio of products that meets their needs throughout the day.

Where PepsiCo Plays Strategically

PepsiCo competes in the global beverage and convenient foods market, with a focus on both developed and emerging markets. The company is expanding its presence in high-growth channels and markets, including away-from-home, direct-to-consumer, and business-to-business platforms.

Key Strategic Areas:

How PepsiCo tries to Win Strategically

PepsiCo wins by evolving its portfolio to meet consumer needs, expanding its availability to reach consumers everywhere, modernizing the company to fuel growth, and becoming more sustainable and resilient with pep+ (PepsiCo Positive). The company leverages its beloved brands, talented team, and advantaged capabilities to capture additional opportunities for growth.

Key Competitive Advantages:

Strategy Cascade for PepsiCo

Below is a strategy cascade for PepsiCo's strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Evolve our portfolio to always win the consumer

Offer a broad portfolio of products that meet consumer needs throughout the day by accelerating portfolio innovation, focusing on positive choices, functionality, portion control, and personalization.

Advance Positive Choices Innovation

Increase the development and launch of no-sugar beverages and products with diverse ingredients like whole grains and pulses across the PepsiCo portfolio.

Expand Functional Hydration Offerings

Invest in and expand the portfolio of functional hydration products, such as Gatorade Hydration Booster and Propel powders, to meet consumer demand for better hydration solutions.

Develop Meal Occasion Extensions

Extend large brands into meal occasions around the world, such as Lay's potato omelets in Europe and Doritos Loaded at colleges in the U.S.

Refresh Iconic Offerings with Healthier Options

Reformulate existing products, such as Lay's Classic, to reduce sodium and incorporate more natural ingredients, like the Simply line relaunch.

Advance Multicultural Portfolio Focus

Expand the presence of multicultural brands like Sabritas and Siete Foods in the U.S. market to cater to diverse consumer tastes.

Expand our availability to reach consumers everywhere

Increase brand presence in high-growth channels and markets, including Away From Home, new markets, direct-to-consumer, and business-to-business platforms.

Scale Away From Home Food and Beverage Presence

Increase investment in the Away From Home business in both foods and beverages, focusing on strategic partnerships and innovative solutions for restaurants, businesses, schools, and stadiums.

Develop Tostitos-Centric Meal Solutions

Expand the Tosticentros model in Mexico to enable consumers to create meals centered around Tostitos, leveraging street food trucks and local partnerships.

Build Direct-to-Consumer Platform Capabilities

Invest in and expand PepsiCo's direct-to-consumer and business-to-business platforms to reach consumers directly and build stronger relationships.

Penetrate High-Growth International Markets

Prioritize expansion into new international markets with high growth potential, tailoring product offerings and distribution strategies to local consumer preferences.

Modernize the company to fuel growth

Elevate and accelerate multi-year, corporate-wide transformation and productivity programs by modernizing with digital platforms, simplifying IT systems, and standardizing ways of working.

Implement Unified Digital Platforms

Accelerate the implementation of digital platforms across all business units to streamline operations, improve data analytics, and enhance decision-making.

Harmonize Global IT Systems

Simplify and harmonize IT systems across the company to reduce duplication, improve efficiency, and enable better knowledge sharing.

Standardize Global Ways of Working

Standardize ways of working across different regions and business units to improve agility, speed to market, and execution at the store level.

Expand Global Capability Centers Network

Further develop and expand the network of global capability centers to centralize information, leverage global scale, and avoid duplication of effort.

Better Leverage Data for Competitive Advantage

Improve the company's ability to leverage data to make it more competitive in the marketplace by improving agility, speed to market, and precise execution at the store level, while also lowering costs.

Become more sustainable and resilient with pep+ (PepsiCo Positive)

Transform PepsiCo from end-to-end to create sustainable growth and value by transforming the supply chain, evolving the portfolio, and ensuring the right capabilities are in place.

Expand Regenerative Agriculture Practices

Increase the adoption of regenerative agriculture practices across PepsiCo's supply chain to improve soil health, reduce environmental impact, and enhance the resilience of farming communities.

Incorporate Recycled Material in Packaging

Scale and improve the efficiency of incorporating recycled plastic (rPET) into packaging across brands and geographies to reduce reliance on virgin plastics.

Improve Water-Use Efficiency

Implement programs to improve operational and agricultural water-use efficiency in high water-risk areas and watersheds, building on the success of exceeding existing targets.

Elevate Positive Choices Through Recipe Improvement

Continuously improve recipes to reduce sodium, saturated fat, and added sugar, while incorporating more diverse ingredients to enhance the nutritional profile of PepsiCo products.

Promote Sustainable Farming Practices

Advance sustainable farming practices by suppliers and expand the initiative globally to improve the sustainability and resources of PepsiCo's agricultural supply chain.

Drive International Business Growth

Continue to build presence outside North America, focusing on meeting local tastes, offering more value and convenience, and elevating productivity to fund investments in growth.

Meet Local Tastes

Increase investment in research and development to create products that cater to the specific tastes and preferences of consumers in international markets.

Offer Consumers More Value and Convenience

Develop and implement strategies to offer more value and convenience to consumers in international markets, such as smaller pack sizes, affordable pricing, and convenient distribution channels.

Elevate Productivity in International Operations

Implement productivity initiatives across international operations to reduce costs and free up resources for investments in growth.

Expand Distribution Networks in Emerging Markets

Invest in and expand distribution networks in emerging markets to increase product availability and reach a wider range of consumers.

Strengthen Local Partnerships

Forge strategic partnerships with local businesses and organizations to enhance market access, build brand awareness, and navigate local regulations.

Improve Productivity and Efficiency

Continuously reduce costs and improve efficiencies through digitalization, shared business services, and organizational restructuring.

Increase Automation in Plants and Warehouses

Increase automation in manufacturing plants to reduce labor costs, improve production efficiency, and enhance product quality.

Improve Optimization Across Transportation and Fleet Networks

Implement advanced technologies and strategies to optimize transportation and fleet networks, reducing fuel consumption, delivery times, and overall logistics costs.

Empower Frontline Decision-Making

Provide frontline employees with the tools and training necessary to make informed decisions, improving responsiveness and efficiency at the operational level.

Implement Shared Business Service Organizational Models

Consolidate and streamline shared business services, such as finance, human resources, and IT, to reduce duplication and improve efficiency.

Focus on Cost Management and Waste Elimination

Implement programs to identify and eliminate waste across all areas of PepsiCo's operations, from manufacturing to distribution, reducing costs and improving sustainability.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.