Robinhood Markets, Inc. Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Robinhood Markets, Inc.

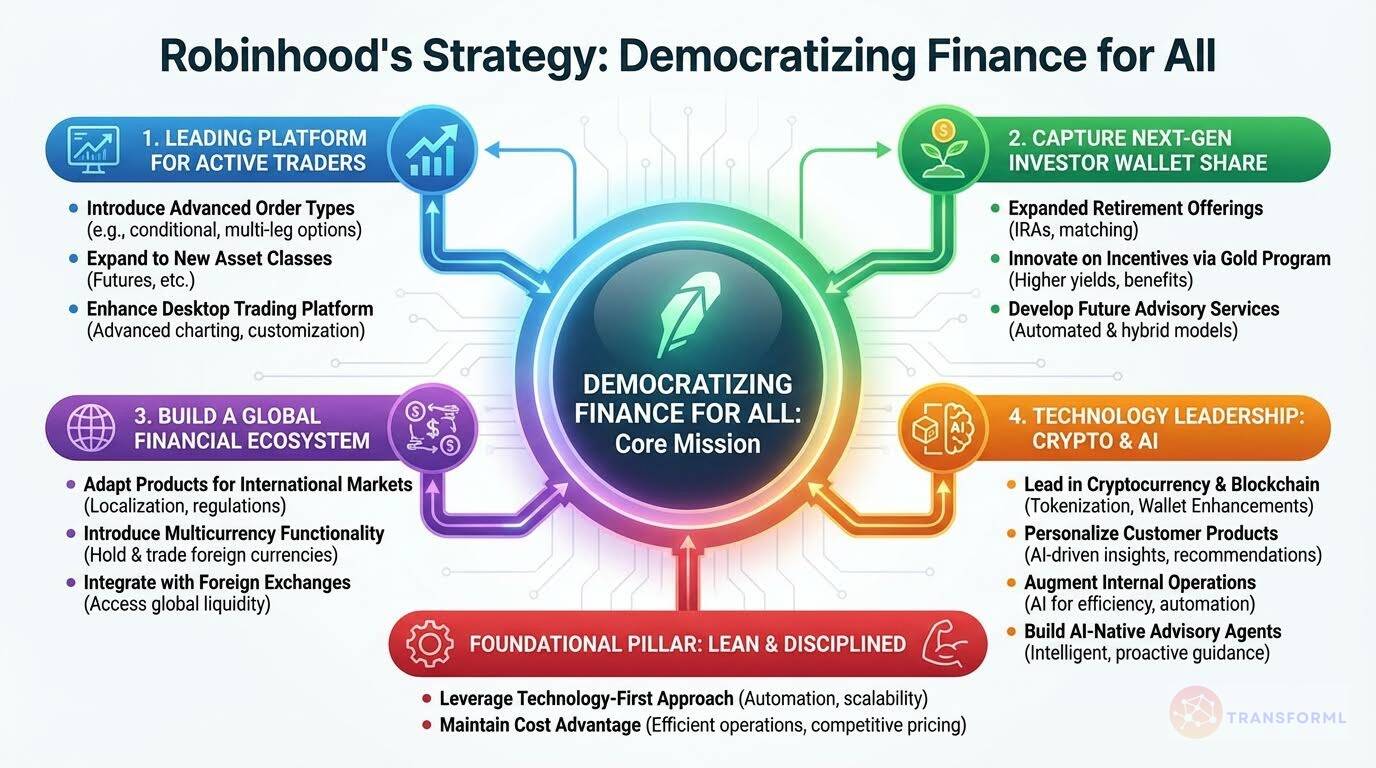

Robinhood's 2024 strategy focuses on expanding its platform to become the leading retail trading and investment ecosystem. Key initiatives include attracting active traders, increasing wallet share among the next generation of investors, and building a global financial ecosystem through product innovation and strategic acquisitions.

Key Competitors for Robinhood Markets, Inc.

Charles Schwab

Largest retail brokerage with comprehensive financial services, strong brand trust, extensive research tools, and full-service wealth management capabilities.

Fidelity Investments

Major brokerage and investment management firm with extensive research, retirement planning tools, and strong customer service reputation.

TD Ameritrade

Established online brokerage with advanced trading platforms, comprehensive educational resources, and strong options trading capabilities.

E*TRADE

Online brokerage with advanced trading tools, options trading expertise, and comprehensive investment research and analysis.

Interactive Brokers

Global brokerage with advanced trading platforms, low-cost structure, and extensive international market access.

SoFi

Financial technology company with banking, lending, and investment services, strong millennial focus, and comprehensive financial ecosystem.

Webull

Commission-free trading platform with advanced charting tools, real-time market data, and strong mobile trading experience.

Coinbase

Leading cryptocurrency exchange with extensive crypto offerings, institutional services, and strong regulatory compliance.

Insights from Robinhood Markets, Inc.'s strategy and competitive advantages

What Stands Out in Robinhood Markets, Inc. strategy

Robinhood's strategy is uniquely distinguished by its aggressive pursuit of the technological frontier and its laser focus on a specific high-growth demographic. Unlike The Charles Schwab Corporation, which focuses on enhancing its existing, broad-service model through digital efficiency, Robinhood aims to redefine the user experience with disruptive technology.

A prime example is its strategic pillar to 'Lead in Cryptocurrency and Blockchain Technology,' with projects like launching products that drive 'tokenization,' and its ambition to build 'complex AI agents' and 'AI-native advisory products.' This contrasts sharply with Schwab's more incremental innovation, which centers on 'enhancing digital experiences' and 'automating back-office processes.'

Furthermore, Robinhood's 'Where to Play' is explicitly targeted at 'active traders and the next generation of investors,' allowing for highly tailored products like 'Robinhood Legend' and 'Futures Trading.' Schwab, by comparison, caters to a much broader audience, including retail investors, independent RIAs, and workplace participants, which necessitates a more generalized approach.

What are the challenges facing Robinhood Markets, Inc. to achieve their strategy

Robinhood's primary challenge lies in competing with the comprehensive, trust-based ecosystem of incumbents like The Charles Schwab Corporation, particularly as Robinhood's customers mature. Schwab's strategy is built on a 'no trade-offs' value proposition, combining scale with a full suite of services including established wealth management, lending, and advisory services, which it is actively expanding.

Robinhood is only just beginning to address this with future plans for 'multigenerational advisory.' A significant challenge will be to retain its 'next generation' clients as their financial needs grow more complex and they seek the trusted, all-encompassing services that Schwab already provides.

Another challenge is Robinhood's reliance on more volatile, transaction-based revenue streams from active trading and nascent asset classes like crypto. Schwab's model is significantly more diversified and stable, with substantial revenue from asset management fees, banking, and advisory services. While Robinhood's focus on 'active traders' is a differentiator, it also exposes the company to greater market cyclicality than Schwab's broader, more service-oriented client base.

What Positions Robinhood Markets, Inc. to win

Creative Product Design

- Robinhood emphasizes user-centric design to create intuitive and engaging experiences, exemplified by the Robinhood app and Robinhood Legend. This approach aims to build long-term customer relationships and simplify access to financial markets.

Category-Defining Brand

- Robinhood has established itself as a recognizable brand in retail investing, committed to expanding its reach globally. Its people-centric approach and engaging customer experience have made investing more accessible and socially relevant.

Financial Services at Internet Scale

- Robinhood's platform is designed to provide relevant and accessible information to customers, fostering trust and long-term relationships. The platform's ability to deliver seamless, customized updates engenders trust and creates enduring long-term relationships.

Vertically Integrated Platform

- Robinhood's vertically integrated platform, supported by proprietary technology and cloud-based infrastructure, allows for faster development times, better customer experiences, and greater flexibility. The company holds licenses as an introducing broker-dealer, clearing broker-dealer, money-transmitter, and futures commission merchant.

Operating Efficiency

- Robinhood's operating efficiency and disciplined approach to managing fixed costs, combined with its technology-first approach to product development and customer service, create a cost advantage. This allows the company to competitively price its offerings while profitably serving its customers.

24 Hour Market

- Robinhood was the first U.S. broker to offer around-the-clock trading of individual stocks and ETFs, 5 days a week. This allows customers to better manage their risk and take advantage of opportunities, no matter what time of day they arise.

Joint Investing Accounts

- Robinhood's joint investing accounts allow customers to seamlessly manage investments with their partner while keeping their shared assets in one place. The joint account provides shared access for account holders that allows them to combine funds and increase their investment power as they work towards their financial goals.

Futures Trading

- Robinhood's futures trading allows customers to trade stock indexes, energy, currency, metals, and crypto at the speed of a tap with our sleek new trading ladder, while gaining access to potential tax benefits and one of the lowest commissions rates among leading competitors. In addition, our futures trading has no pattern day trading rules.

What's the winning aspiration for Robinhood Markets, Inc. strategy

Robinhood aims to be the leading financial services platform by democratizing finance for all, empowering a new generation of investors, and building a global financial ecosystem that provides access to innovative products and services.

Company Vision Statement:

Our mission is to democratize finance for all.

Where Robinhood Markets, Inc. Plays Strategically

Robinhood is focused on serving retail investors, particularly active traders and the next generation of investors, primarily in the United States and expanding internationally. The company offers a range of financial products and services across various asset classes, including equities, options, cryptocurrencies, and futures.

Key Strategic Areas:

How Robinhood Markets, Inc. tries to Win Strategically

Robinhood aims to win by offering a user-friendly, vertically integrated platform with innovative products, competitive pricing, and a strong brand. The company leverages technology and operating efficiency to deliver exceptional value to customers.

Key Competitive Advantages:

Strategy Cascade for Robinhood Markets, Inc.

Below is a strategy cascade for Robinhood Markets, Inc.'s strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Establish Number One Platform for Active Traders

Become the leading platform for active traders by focusing on innovation, speed, and expanding asset classes.

Introduce Advanced Order Types

Offer a wider range of sophisticated order types, such as conditional orders and iceberg orders, to cater to the needs of active traders and enhance their trading strategies.

Make Robinhood Legend the most state-of-the art desktop platform for trading

Prioritize the development and release of new capabilities and features on Robinhood Legend, focusing on low latency, advanced charting, and customization options to create a best-in-class trading experience.

Expand Asset Class Offerings

Accelerate the introduction of new asset classes, such as futures, options on futures, and event contracts, to provide active traders with a broader range of investment opportunities.

Improve Order Execution Quality

Optimize the order routing system to ensure best execution for active traders, focusing on price improvement and speed of execution.

Become Number One in Wallet Share for the Next Generation

Attain the largest share of the next generation's wallet by addressing their core financial needs, innovating on incentives, and streamlining onboarding and deposit processes.

Focus on multigenerational advisory in our future product roadmap

Create and launch wealth management and advisory products, with a focus on multigenerational advisory, to cater to the evolving financial needs of the next generation as they grow their wealth.

Continue Expanding the coverage of Robinhood Gold

Innovate on incentives within Robinhood Gold to provide greater value to customers as their assets grow, expanding its coverage to include more products and services.

Reduce Withdrawals and Increase Deposits

Simplify and expedite the process for customers to onboard, deposit funds, and transfer assets into Robinhood, reducing withdrawals and increasing deposits.

Expand Robinhood Retirement Offerings

Introduce new features and incentives within Robinhood Retirement accounts, such as higher matching contributions and personalized investment advice, to encourage long-term savings and attract the next generation.

Building the Number One Global Financial Ecosystem

Create a leading global financial ecosystem by extending existing products internationally, prioritizing cross-platform functionality, and introducing market-specific features.

Extend and Adapt Products that we have already built for U.S. consumers

Extend and adapt successful U.S. products, such as options trading and Robinhood Gold, to international markets, tailoring them to local regulatory requirements and customer preferences.

Prioritize Functionality that Creates Value for our Customers across our Platforms Globally

Prioritize the development of multicurrency accounts to create value for customers across platforms globally, enabling seamless transactions in different currencies.

Integrate with Foreign Exchanges like the London Stock Exchange

Establish integrations with foreign exchanges, such as the London Stock Exchange, to provide customers with access to a wider range of investment opportunities.

Introduce Market-Specific Functionality

Develop and launch market-specific functionality, such as individual saving accounts and self-invested personal pensions, in the U.K. to cater to local customer needs.

Lead in Cryptocurrency and Blockchain Technology

Position Robinhood as a leader in the cryptocurrency and blockchain space by launching new products and features that drive tokenization.

Continue Launching New Products and Features that Drive Tokenization in the Future

Create and launch new products and features that drive tokenization, enabling efficiency gains by moving traditional financial assets onto the blockchain.

Expand Cryptocurrency Offerings

Increase the number of cryptocurrencies available for trading on the platform, while ensuring compliance with regulatory requirements and conducting thorough risk assessments.

Enhance Robinhood Wallet Functionality

Develop and improve the Robinhood Wallet to provide customers with greater control over their digital assets, including support for additional blockchain networks and decentralized applications.

Establish Partnerships with Web3 Developers

Collaborate with developers to integrate Robinhood Connect into decentralized applications, enabling customers to fund Web3 wallets seamlessly.

Artificial Intelligence

Invest in and adopt AI technologies to augment internal operations, enhance customer-facing products, and develop sophisticated autonomous financial agents.

Augmenting Internal Operations

Implement AI-powered chatbots and virtual assistants to improve the efficiency and responsiveness of customer support, reducing wait times and resolving common issues.

Enhancing Customer-Facing Products

Incorporate AI algorithms to personalize the user experience, including tailoring newsfeeds, investment recommendations, and educational content to individual customer preferences and risk profiles.

Building Complex AI Agents and Expect to Introduce Significantly More in the Coming Year, Including our First AI-Native Advisory Products

Create and launch AI-native advisory products that provide customers with personalized financial advice and automated portfolio management services.

Improve Fraud Detection with AI

Enhance fraud detection systems using machine learning and AI to identify and prevent fraudulent activities on the platform, protecting customer assets and data.

Lean and Disciplined

Maintain a disciplined approach to managing fixed costs and leverage a technology-first approach to product development and customer service to create a cost advantage.

Pursue Operational Excellence

Continuously evaluate and optimize cloud infrastructure usage to reduce costs while maintaining performance and scalability.

Pursue Operational Excellence

Implement automation technologies to streamline internal processes, such as compliance and risk management, reducing manual effort and improving efficiency.

Do More with Less

Consolidate and centralize operational functions to eliminate redundancies and improve efficiency, reducing fixed costs.

Pursue Operational Excellence

Proactively negotiate favorable contracts with vendors and service providers to reduce costs and improve unit economics.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.