Texas Instruments Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Texas Instruments

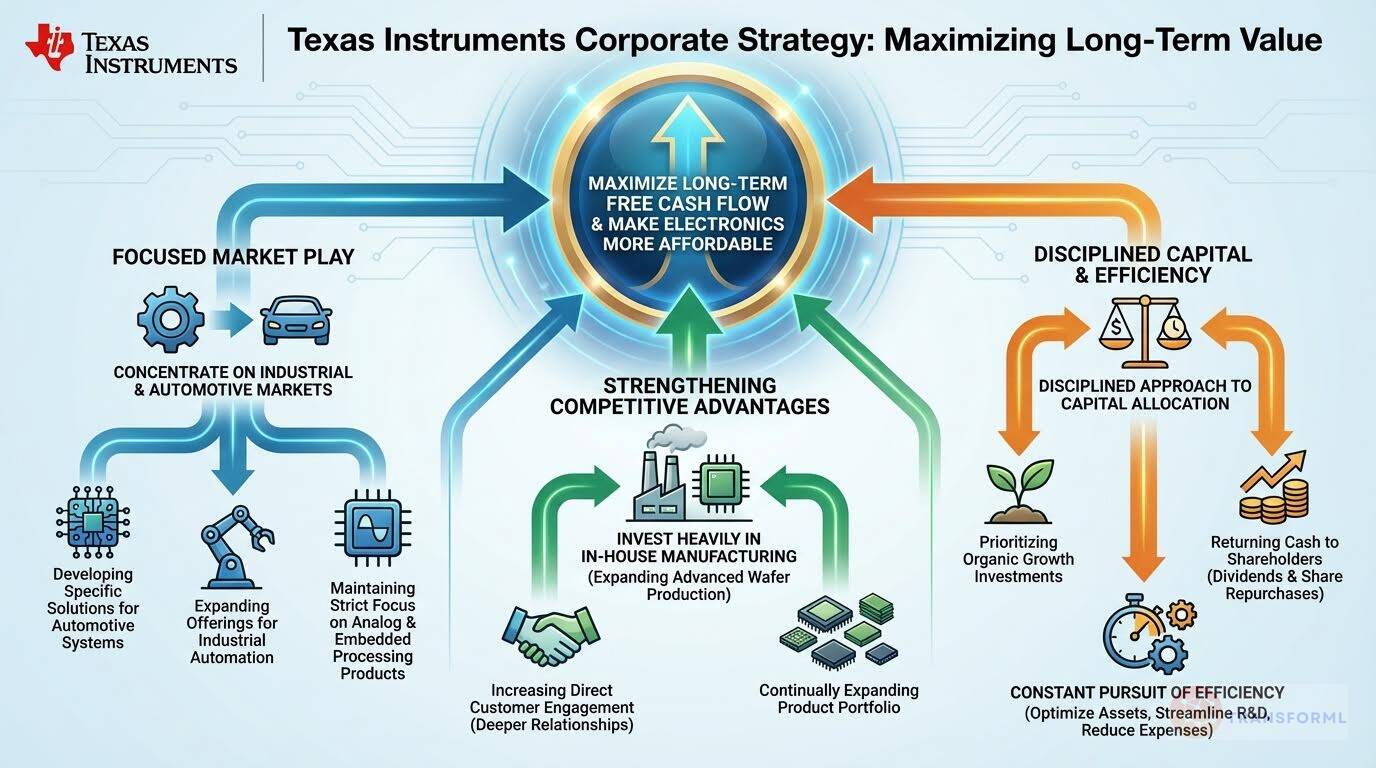

Texas Instruments (TI) is a global semiconductor company focused on analog and embedded processing products. The company's strategy centers on maximizing long-term free cash flow per share by investing in competitive advantages, disciplined capital allocation, and operational efficiency. In 2024, TI continued to strengthen its strategic position by expanding manufacturing capacity and building closer customer relationships, despite a weaker overall semiconductor market.

Key Competitors for Texas Instruments

Analog Devices, Inc.

Specialized in high-performance analog and mixed-signal processing

Intel Corporation

Dominant in CPU market, expanding into embedded systems

NXP Semiconductors N.V.

Strong in automotive and industrial applications

Qualcomm Incorporated

Leading in mobile technologies and wireless connectivity

STMicroelectronics N.V.

Broad portfolio across multiple markets, including automotive and industrial

Insights from Texas Instruments's strategy and competitive advantages

What Stands Out in Texas Instruments strategy

Texas Instruments' strategy is uniquely defined by two core, intertwined principles: a fanatical focus on maximizing long-term free cash flow per share and a massive, contrarian bet on in-house manufacturing. While competitors state broader technology-focused aspirations, TI's winning aspiration is explicitly financial, which dictates a disciplined capital allocation model aimed at shareholder returns.

A focused financial objective directly fuels its most distinctive operational strategy: a multi-year, high-capital expenditure plan to own and operate its 300mm wafer fabrication facilities which stands in stark contrast to fabless competitors like QUALCOMM and Broadcom and is a much deeper vertical integration push than that of Analog Devices. By aiming for over 95% internal sourcing, TI is strategically positioning for lower long-term costs, greater supply chain control, and geopolitical resilience. For example, TI's $4.82 billion in capital expenditures in 2024 is a direct execution of this strategy, a scale of investment in internal manufacturing not seen in its direct competitors' reports.

Furthermore, its aggressive shift to a direct sales model, with ~80% of revenue now direct, differentiates it from peers like Analog Devices, which relies on distributors for 58% of its revenue, allowing TI to build stickier customer relationships and gain deeper design insights.

What are the challenges facing Texas Instruments to achieve their strategy

Texas Instruments' focused strategy presents significant challenges when compared to its more diversified and agile competitors. The primary challenge is the immense risk associated with its capital-intensive manufacturing build-out which are heavy investments in fixed assets that could become a liability if market demand shifts or if a technological leap renders its fabs less efficient, a risk that fabless competitors like QUALCOMM and Broadcom completely avoid.

Secondly, TI's deep concentration in the industrial and automotive markets (~70% of revenue) places it in direct, head-to-head competition with Analog Devices, which has a nearly identical market focus and a competing reputation for high-performance solutions. The intense rivalry in its core segments could erode margins as both companies are targeting the same secular growth trends in automotive and factory automation, creating a zero-sum competition for key design wins.

Finally, while TI is doubling down on its core, competitors are aggressively diversifying into adjacent high-growth areas. QUALCOMM is leveraging its wireless IP to achieve massive growth in automotive (55% revenue increase), and Broadcom has fundamentally transformed its business with the acquisition of VMware, moving heavily into infrastructure software. This lack of diversification makes TI more vulnerable to downturns in its chosen markets, as evidenced by its 10.7% revenue decrease in a year where diversified competitors like Broadcom and QUALCOMM posted significant growth.

What Positions Texas Instruments to win

Manufacturing and Technology

- Texas Instruments possesses a strong foundation in manufacturing and technology, providing lower costs, greater control of its supply chain, and geopolitically dependable capacity. The company is nearly 70% through a six-year elevated CapEx cycle that will uniquely position it to deliver dependable, low-cost 300mm capacity at scale to meet customer demand.

Broad Product Portfolio

- Texas Instruments has a broad portfolio of analog and embedded processing products, offering more opportunity per customer and more value for its investments. The company has more than 80,000 products that are integral to almost every type of electronic equipment.

Market Channel Reach

- Texas Instruments has a strong reach of market channels, giving access to more customers and more of their design projects, leading to the opportunity to sell more of its products into each design and giving better insight and knowledge of customer needs. In 2024, about 80% of its revenue was direct, which includes TI.com.

Diversity and Longevity

- Texas Instruments has diversity and longevity of its products, markets, and customer positions, providing less single-point dependency and longer returns on its investments. The company has high exposure to the industrial and automotive markets, which represented about 70% of revenue.

Financial Strength

- Texas Instruments has a strong balance sheet and a commitment to return all free cash flow to its owners over time. The company increased the dividend 5% in 2024.

Customer Relationships

- Texas Instruments has been investing in new capabilities to build closer direct customer relationships. Closer direct relationships with its customers help to strengthen its reach of market channel advantage and give access to more customers and more of their design projects, leading to opportunities to sell more of its products into each design.

Innovation and R&D

- Texas Instruments has a long history of innovation and continues to invest in research and development to improve existing technology and products, develop new products to meet changing customer demands, and improve its production processes. The company introduces hundreds of new products each year.

Human Capital Management

- Texas Instruments has a promote-from-within culture and offers training and development programs that provide the opportunity to quickly gain experience in different areas. In 2024, the company's turnover rate was 9.1%.

What's the winning aspiration for Texas Instruments strategy

Texas Instruments aims to create a better world by making electronics more affordable through semiconductors, focusing on long-term growth of free cash flow per share and acting as responsible corporate citizens.

Company Vision Statement:

Company Vision Statement - For decades, Texas Instruments has operated with a passion to create a better world by making electronics more affordable through semiconductors.

Where Texas Instruments Plays Strategically

Texas Instruments strategically focuses on the analog and embedded processing markets, with a particular emphasis on the industrial and automotive sectors. The company sells its products to over 100,000 customers worldwide, with a significant portion of revenue derived from customers outside the United States.

Key Strategic Areas:

How Texas Instruments tries to Win Strategically

Texas Instruments leverages its four sustainable competitive advantages to win: a strong foundation of manufacturing and technology, a broad portfolio of analog and embedded processing products, the reach of its market channels, and diversity and longevity of its positions. The company invests to strengthen these advantages, be disciplined in capital allocation, and stay diligent in its pursuit of efficiencies.

Key Competitive Advantages:

Strategy Cascade for Texas Instruments

Below is a strategy cascade for Texas Instruments's strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Related industry articles:

Maximize Long-Term Free Cash Flow

Focus on maximizing long-term free cash flow per share growth as the ultimate measure to generate value for owners.

Drive Revenue Growth in Core Markets

Increase revenue in the industrial and automotive markets, which are expected to grow faster than the overall semiconductor market, by focusing on secular content growth.

Optimize Product Portfolio for High-Margin Products

Shift the product mix towards higher-priced products to improve gross margins and increase free cash flow.

Increase Direct Customer Engagement

Expand direct sales channels and build closer relationships with customers to gain better insight into their design projects and increase sales of TI products.

Expand 300mm Wafer Production

Continue ramping up production in 300mm wafer fabrication facilities to reduce manufacturing costs and increase free cash flow per share.

Strengthen Competitive Advantages

Invest in and leverage the four sustainable competitive advantages: manufacturing and technology, a broad portfolio of analog and embedded processing products, reach of market channels, and diverse and long-lived positions.

Accelerate Internal Wafer Sourcing

Increase internal sourcing of wafers, aiming for more than 95% internal sourcing with more than 80% on 300mm by 2030, to gain greater control of the supply chain and reduce costs.

Expand Analog and Embedded Product Portfolio

Increase investments in research and development to introduce hundreds of new analog and embedded processing products each year, addressing an increasing number of semiconductor opportunities.

Enhance Customer Support Capabilities

Invest in new and improved capabilities to directly support customers, including order fulfillment services, inventory programs, business processes, logistics, and website and e-commerce capabilities.

Maintain Inventory for Customer Service

Build ahead of demand for broad-based products with low risk of obsolescence to maintain high levels of customer service and dependable lead times.

Disciplined Allocation of Capital

Practice discipline in allocating capital to the best opportunities, including R&D projects, new capabilities, manufacturing capacity, acquisitions, and returning cash to owners.

Prioritize Organic Growth Investments

Allocate the largest portion of capital to drive organic growth, including investments in R&D, sales and marketing, capital expenditures, and working capital for inventory.

Increase Share Repurchases Accretively

Make share repurchases with the goal of the accretive capture of future free cash flow for long-term investors.

Maintain Dividend Growth

Continue to increase the dividend to appeal to a broad set of investors and demonstrate commitment to returning cash to owners.

Target Strategic Acquisitions

Allocate capital to acquisitions that meet financial and strategic objectives, supporting inorganic growth.

Stay Diligent in Our Pursuit of Efficiencies

Focus on efficiency, striving for more output for every dollar spent, and continuously improving all areas of the company.

Optimize Manufacturing Asset Utilization

Improve manufacturing asset utilization to reduce fixed costs per unit and increase free cash flow margins.

Streamline Research and Development

Focus research and development investments in the most impactful areas to maximize the growth of long-term free cash flow per share.

Reduce SG&A Expenses

Implement continuous improvement initiatives to reduce selling, general, and administrative expenses as a percentage of revenue.

Focus on Analog and Embedded Processing

Maintain a business model focused on analog and embedded processing products.

Divest Non-Core Business Units

Evaluate and divest operating segments that do not meet the quantitative thresholds for individually reportable segments and cannot be aggregated with other operating segments.

Increase Analog Product Sales

Increase sales of analog products, which generated about 78% of revenue in 2024, by focusing on power and signal chain product lines.

Expand Embedded Processing Product Offerings

Expand embedded processing product offerings, which generated about 16% of revenue in 2024, by focusing on microcontrollers, processors, wireless connectivity, and radar products.

Target Industrial and Automotive Markets

Place additional strategic emphasis on designing and selling products into the industrial and automotive markets.

Develop Automotive-Specific Solutions

Increase R&D investment in automotive-specific solutions, including infotainment & cluster, advanced driver assistance systems (ADAS), hybrid, electric & powertrain systems, body electronics & lighting, and passive safety.

Expand Industrial Automation Offerings

Expand product offerings for industrial automation, aerospace & defense, medical & healthcare, energy infrastructure, building automation, and other industrial equipment.

Strengthen Automotive Customer Relationships

Build closer relationships with automotive customers to gain better insight into their design projects and increase sales of TI products.

Increase Industrial Market Share

Implement targeted sales and marketing campaigns to increase market share in the industrial sector.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.