Wells Fargo Strategy Analysis

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Strategy overview for Wells Fargo

Wells Fargo had a year of considerable progress in 2024, producing stronger financial results than the prior year and executing well on its strategic priorities. The company increased earnings, earnings per share, and return on tangible common equity, while also improving customer service and making significant progress on risk and control work. Wells Fargo maintained a strong balance sheet, returning $25 billion of capital to shareholders.

Key Competitors for Wells Fargo

JPMorgan Chase

Broad range of financial services, strong capital base

Bank of America

Extensive retail network, diverse product offerings

Citigroup

Global presence, strong investment banking capabilities

U.S. Bancorp

Strong regional presence, focus on relationship banking

Insights from Wells Fargo's strategy and competitive advantages

What Stands Out in Wells Fargo strategy

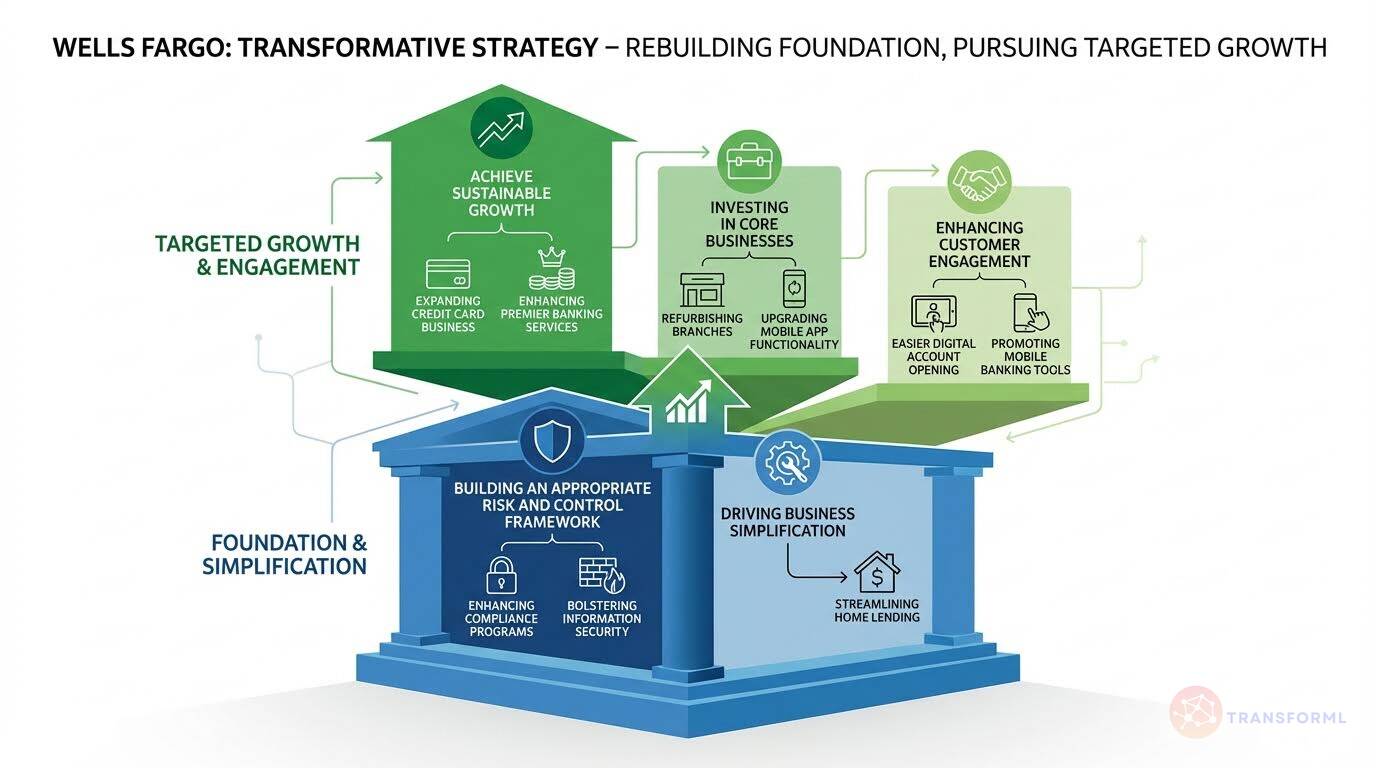

Wells Fargo's strategy is uniquely defined by its intense and explicit focus on remediation and rebuilding trust, positioning it as a turnaround story. Unlike competitors who focus on offensive growth from a stable base, Wells Fargo's primary strategic pillar is to 'Build Appropriate Risk and Control Framework,' a direct response to past regulatory issues.

This defensive posture is a core differentiator. For example, while JPMorgan Chase emphasizes its 'Fortress Balance Sheet' as a tool for strength and expansion, Wells Fargo's focus on risk is about addressing consent orders and fixing foundational issues. Similarly, its 'Drive Business Simplification' pillar, which includes specific projects like 'Reduce Third-Party Mortgage Servicing,' is about retracting from problematic areas, contrasting with Bank of America's 'Operational Excellence' which focuses on optimizing an already high-performing operation through initiatives like employee-sourced efficiency ideas.

What are the challenges facing Wells Fargo to achieve their strategy

Wells Fargo's primary challenge is that its strategy is fundamentally reactive and playing catch-up, particularly in technology and defining a unique growth engine. While competitors are aggressively innovating, Wells Fargo's tech goals, such as 'Enhance Mobile App Functionality,' are table stakes.

This lags significantly behind Capital One's vision to be a 'technology and information-based company' and Bank of America's established digital leadership with its AI assistant, Erica. Furthermore, Wells Fargo's strategy lacks a clear, differentiated growth engine for the future. While it aims to 'Invest in Core Businesses,' it does not articulate a visionary path to market leadership.

This contrasts sharply with Capital One's transformative acquisition of Discover to create a new payments platform, Citigroup's strategic pivot to its unique global institutional network, and JPMorgan Chase's offensive expansion of its global banking presence and affluent client services. Wells Fargo is focused on fixing its foundation while competitors are building new additions to their already solid structures.

What Positions Wells Fargo to win

Financial Performance

- Wells Fargo demonstrated solid financial performance in 2024, generating $19.7 billion in net income and $5.37 per diluted share. The company also achieved a 13.4% return on tangible common equity.

Fee-Based Revenue Growth

- Wells Fargo experienced a 15% increase in fee-based revenue, driven by growth in investment banking fees (62%), investment advisory fees (13%), trading revenues (10%), and deposit-related fees (7%).

Expense Management

- Wells Fargo reduced expenses by 2% from the previous year, achieving over $12 billion in gross expense savings over the past four years. This disciplined approach enabled the company to invest in technology and expand its businesses while reducing total expenses.

Capital Return to Shareholders

- Wells Fargo returned $25 billion to shareholders in 2024, including a 64% increase in common stock repurchases and an increase in the quarterly common stock dividend from $0.35 to $0.40 per share.

Strong Credit Discipline

- Wells Fargo maintained its strong credit discipline in 2024, with credit performance in line with expectations. The company took modest credit-tightening actions and saw good growth in credit card balances.

Deposit Growth

- Wells Fargo saw strong deposit growth in most of its businesses, including CIB (18%), Wealth and Investment Management (16%), and Commercial Banking (13%). This enabled the company to reduce higher-cost treasury deposits.

Risk and Control Improvements

- Wells Fargo has made significant progress in building a risk and control framework appropriate for a bank of its size and complexity. The company has added approximately 10,000 people across numerous risk- and control-related groups and spent approximately $2.5 billion more in 2024 than in 2018 in those areas.

Business Transformation

- Wells Fargo has reset the company's priorities, refreshed management, and changed how it manages the company over the past five years. The company has also made significant investments in its five core businesses and is seeing results.

What's the winning aspiration for Wells Fargo strategy

Wells Fargo aims to be the most respected and consistently growing financial institution in the country, delivering high risk-adjusted returns across economic cycles. The company seeks to achieve this by leveraging its strong financial services franchise, prioritizing risk management, and investing in core businesses to drive sustainable growth and returns.

Company Vision Statement:

Company Vision Statement - Our belief remains that we have one of the most enviable financial services franchises in the world, and we are working to be one of the most well-respected, consistently growing financial institutions in the country with high risk-adjusted returns over multiple economic cycles.

Where Wells Fargo Plays Strategically

Wells Fargo strategically focuses on the U.S. financial services market, leveraging its top-three position in most of its businesses. The company targets a broad range of clients, from consumers and small businesses to large corporate and institutional clients, with a diversified set of banking, investment, and mortgage products and services.

Key Strategic Areas:

How Wells Fargo tries to Win Strategically

Wells Fargo intends to win by focusing on building deeper and broader client relationships, leveraging its competitive advantages, and exercising strong risk management. The company aims to achieve industry-leading, sustainable growth and returns by providing value to its clients and communities.

Key Competitive Advantages:

Strategy Cascade for Wells Fargo

Below is a strategy cascade for Wells Fargo's strategy that has been formed through an outside-in analysis of publicly available data. Scroll down below the graphic to click on the arrows to expand each strategic pillar and see more details:

Build Appropriate Risk and Control Framework

Establish and maintain a risk and control framework that is appropriate for a bank of Wells Fargo's size and complexity.

Enhance Compliance Risk Management Program

Continue to improve the execution, risk management, and oversight of compliance activities across all business lines, addressing consent orders and regulatory expectations.

Strengthen Anti-Money Laundering Practices

Enhance anti-money laundering and sanctions risk management practices to meet regulatory requirements and prevent financial crimes.

Improve Model Risk Management

Enhance the governance, validation, and monitoring of model risk across the company to ensure decisions are based on reliable model outputs.

Bolster Information Security and Cyber Resilience

Strengthen practices, policies, and procedures to protect information systems, networks, and data from evolving information security threats, including cyberattacks.

Achieve Industry-Leading Sustainable Growth and Returns

Focus on producing industry-leading, sustainable growth and returns to become the most enviable bank in the country.

Grow Valuable Primary Checking Accounts

Increase the number of valuable primary checking accounts to drive growth and customer engagement in the CSBB segment.

Expand Credit Card Business

Increase investments in the cards franchise to achieve receivables growth, increased spend, and improved credit results.

Target Investment Banking Capabilities

Focus investment banking capabilities toward Commercial Banking clients to increase market share and support M&A activity.

Enhance Premier Banking Services

Continue to enhance Wells Fargo Premier to better serve affluent clients, focusing on increasing the number of Premier bankers and branch-based financial advisors in top locations.

Increase Fee-Based Revenue

Grow fee-based revenue to reduce sensitivity to interest rate fluctuations and net interest income.

Increase Treasury Management Fees

Drive higher treasury management fees on commercial accounts by increasing transaction service volumes and repricing.

Grow Investment Advisory Fees

Increase investment advisory and other asset-based fees by leveraging higher market valuations and attracting new clients.

Expand Investment Banking Activity

Increase investment banking fees by pursuing more debt and equity underwriting deals and advisory services.

Drive Business Simplification

Simplify the business strategy to improve service to clients and customers and improve the earnings profile.

Streamline Home Lending Operations

Continue to simplify the Home Lending franchise to compete effectively, serve the core client base well, and produce adequate returns across different economic cycles.

Reduce Third-Party Mortgage Servicing

Reduce the amount of third-party mortgage loans serviced to improve efficiency and profitability in Home Lending.

Improve Efficiency in Home Lending

Continue to focus on efficiencies in Home Lending to raise the level of profitability and returns.

Invest in Core Businesses

Make significant investments in the five core businesses (Consumer Lending, Corporate and Investment Banking, Consumer, Small and Business Banking, Wealth and Investment Management, and Commercial Banking) to drive growth and improve returns.

Expand Analytical Capabilities in Auto Lending

Build out analytical capabilities in Auto Lending to lend more broadly across the credit spectrum and increase returns in the business.

Invest in Talent and Technology in CIB

Continue to invest in talent and technology in CIB to support objectives and increase revenue and share in key sectors.

Refurbish Branch Locations

Accelerate efforts to refurbish branch locations to improve customer experience and engagement in the CSBB segment.

Enhance Mobile App Functionality

Continue to make enhancements to the mobile app to make it easier for customers to open accounts and manage their finances.

Promote Talent and Technology in CIB

Grow the Corporate and Investment Banking (CIB) business by promoting and hiring the best talent who share our values, and we will pursue high-quality business while exercising strong risk management.

Recruit Senior Hires in CIB

Continue to add senior hires to key coverage and product groups within Banking and Markets to increase revenue and market share.

Expand FX Business

Grow the foreign exchange (FX) business by increasing the institutional client base and volumes.

Increase Investment Banking Deal Leadership

Increase CIB's leadership of marquee deals to contribute to growth in investment banking revenue.

Enhance Customer Engagement in CSBB

Take actions that have just begun to generate growth and increase customer engagement in the Consumer, Small and Business Banking (CSBB) segment.

Improve Digital Account Opening

Make it significantly easier for customers to open accounts digitally to increase digital account openings.

Increase Mobile Active Customers

Grow mobile active customers to increase customer engagement in the CSBB segment.

Promote Zelle Usage

Encourage customers to use Zelle to increase transaction volume and customer engagement.

Read more about industry strategies

Source and Disclaimer: This analysis is based on analysis of Annual reports for 2024. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.