Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

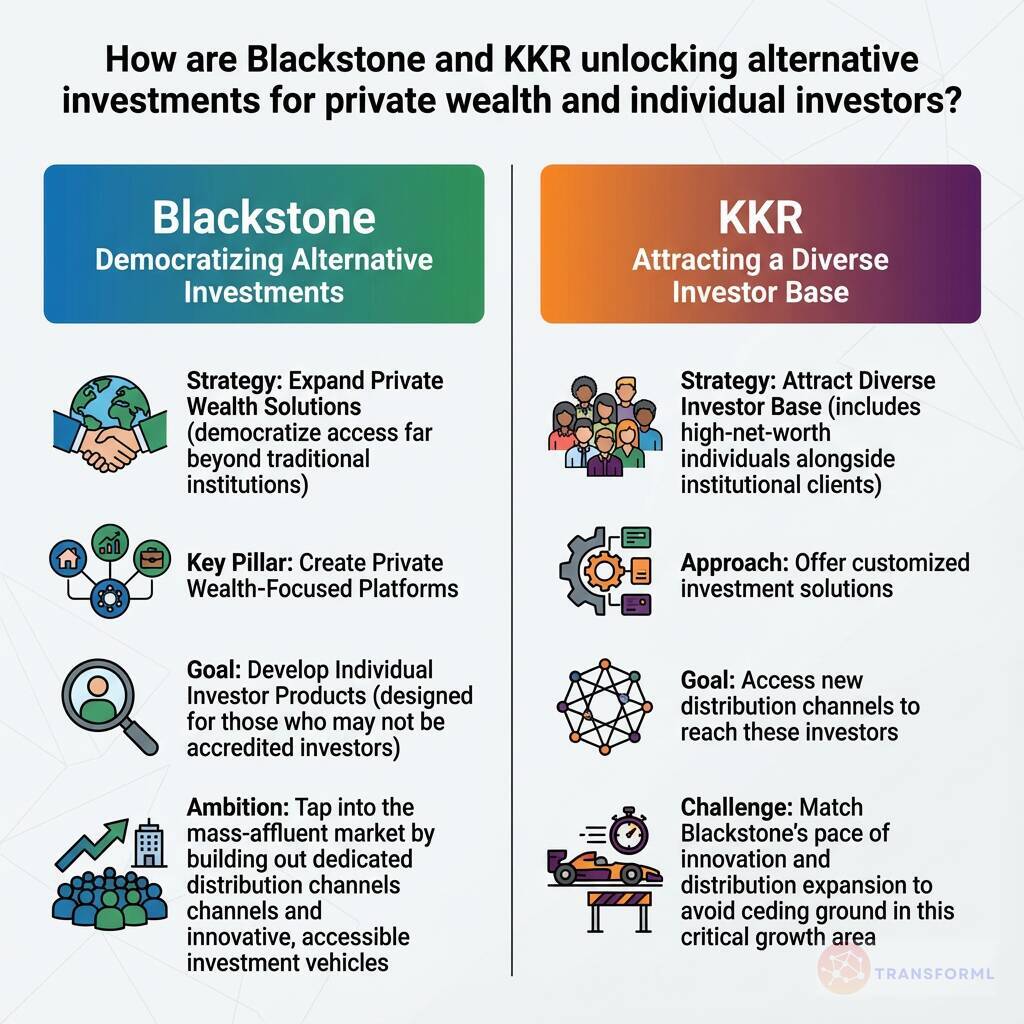

How are Blackstone and KKR unlocking alternative investments for private wealth and individual investors?

Blackstone is pursuing an aggressive and granular strategy to "Expand Private Wealth Solutions," aiming to democratize access to alternative investments far beyond traditional institutions. A key pillar of this strategy is the development of specific products and platforms tailored for this market, including goals to "Create Private Wealth-Focused Platforms" and, notably, to "Develop Individual Investor Products" designed for those who may not be accredited investors. This indicates a clear ambition to tap into the mass-affluent market by building out dedicated distribution channels and innovative, accessible investment vehicles that leverage Blackstone's massive scale and brand recognition.

KKR is also targeting this lucrative market, though its strategy is framed more broadly as a push to "Attract Diverse Investor Base," which includes high-net-worth individuals alongside institutional clients. KKR's approach involves offering "customized investment solutions" and accessing "new distribution channels" to reach these investors. While KKR is a formidable player, its stated strategy appears more focused on the traditional high-net-worth segment compared to Blackstone's more explicit and ambitious push into the mass market. The key challenge for KKR, as noted in its analysis, is to match Blackstone's pace of innovation and distribution expansion to avoid ceding ground in this critical growth area.

Review detailed strategy and competitive analysis of companies in Alternative-Asset Managers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.