Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

What are the thematic investment strategies of Blackstone and KKR in Private Credit, Real Assets, and Life Sciences?

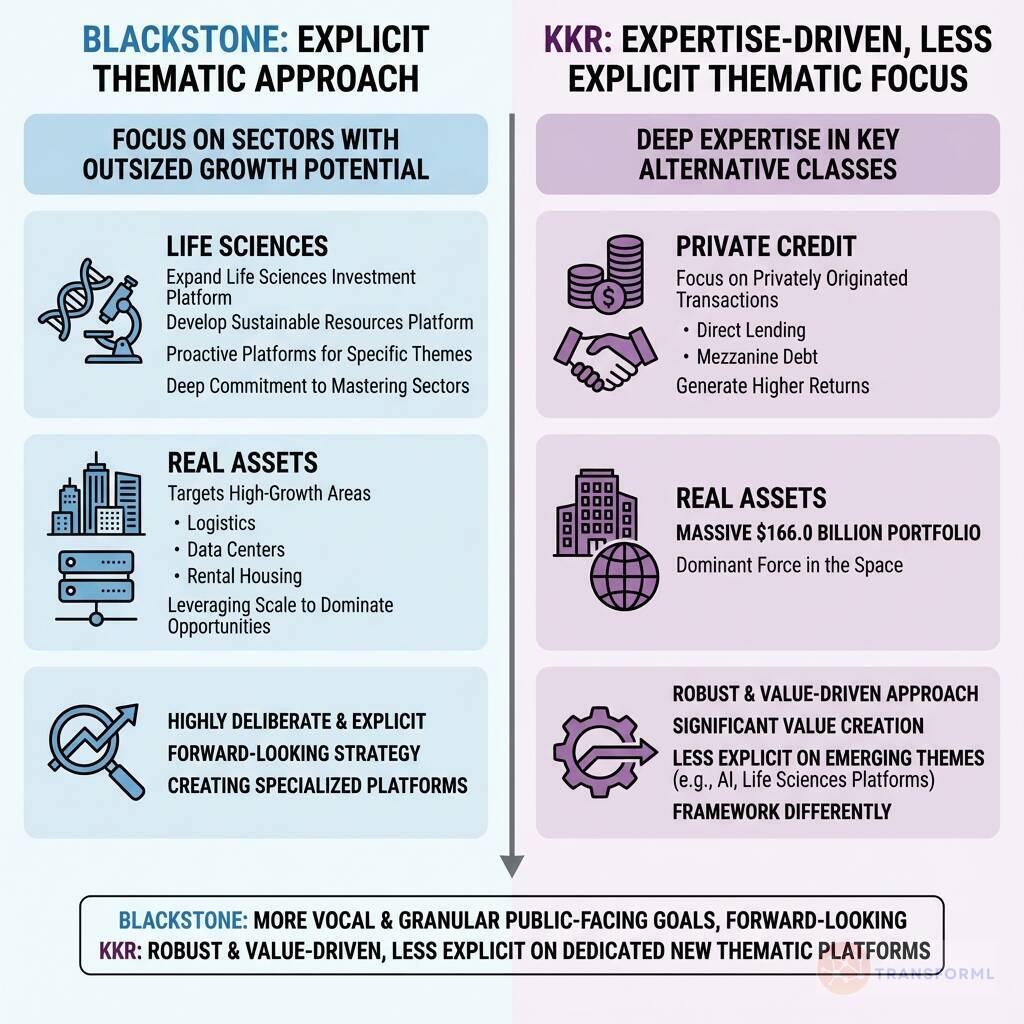

Blackstone employs a highly deliberate and explicit "Thematic Investment Approach" that focuses on sectors with outsized growth potential. The firm proactively builds dedicated platforms for these themes, with stated goals to "Expand Life Sciences Investment Platform" and "Develop Sustainable Resources Platform." This forward-looking strategy also applies to its real asset investments, where it targets high-growth areas like logistics, data centers, and rental housing. By creating specialized platforms, Blackstone signals a deep commitment to mastering these specific sectors, leveraging its scale to dominate investment opportunities within them.

KKR's strategy also demonstrates deep expertise in key alternative classes, though it is framed differently. In Private Credit, KKR has a primary objective to "Focus on Privately Originated Transactions," such as direct lending and mezzanine debt, to generate higher returns. The firm manages a massive Real Assets portfolio of $166.0 billion, making it a dominant force in the space. However, based on the available data, KKR's strategy is less explicit about building dedicated platforms for emerging themes like Life Sciences or AI integration compared to Blackstone. While KKR's approach is robust and drives significant value, Blackstone's strategy is more vocal and granular in its public-facing goals around specific, forward-looking investment themes.

Review detailed strategy and competitive analysis of companies in Alternative-Asset Managers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.