Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

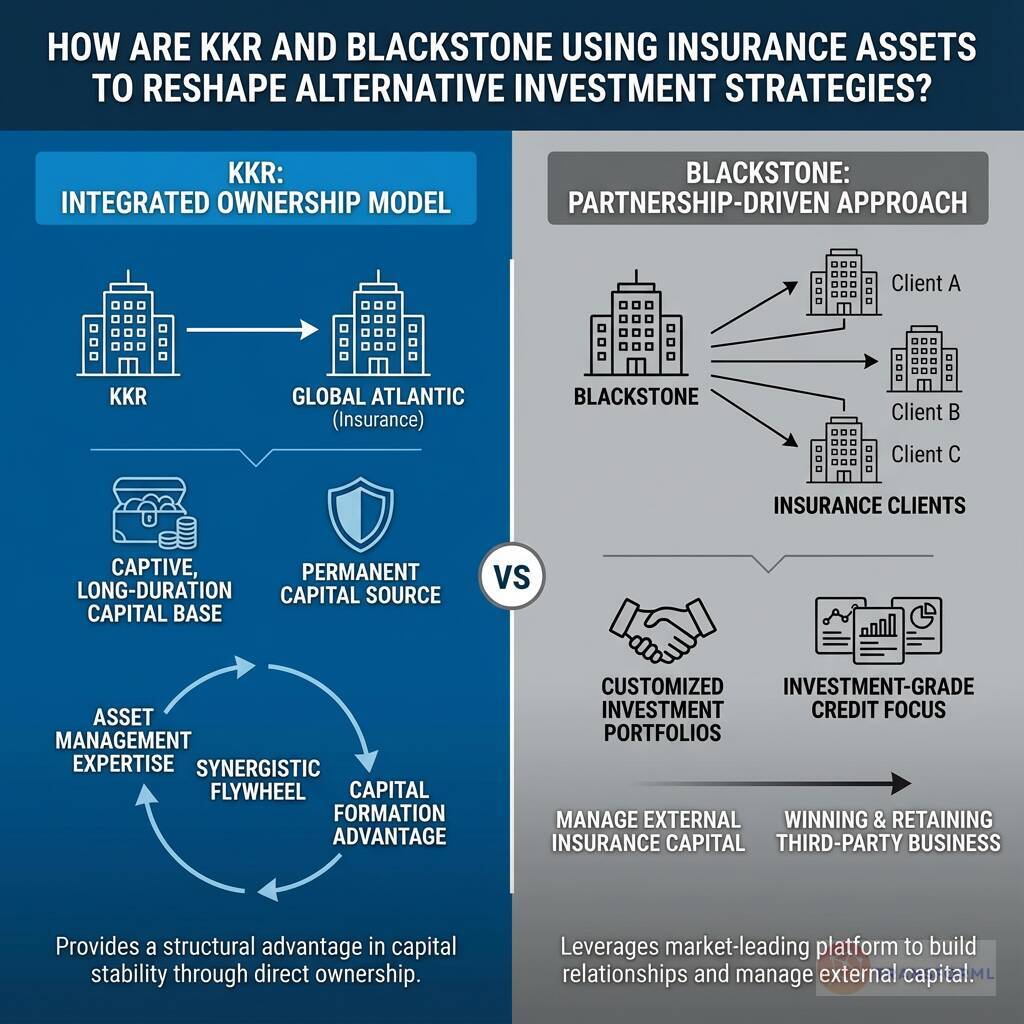

How are KKR and Blackstone using insurance assets to reshape alternative investment strategies?

KKR has built a unique and powerful model by fully integrating an insurance company into its core business. Its ownership of Global Atlantic, a "Leading Retirement and Life Insurance Company," is described as its "most significant strategic distinction." This provides KKR with a substantial and stable source of permanent capital, creating a synergistic flywheel. The insurance business supplies a captive, long-duration capital base to the asset management division, which in turn provides investment expertise to manage the insurer's assets. This integrated ownership model gives KKR a more robust and proprietary competitive advantage in capital formation compared to competitors who rely on partnerships.

In contrast, Blackstone employs a partnership-driven approach to tap into insurance assets. Its strategy is to "Cultivate Insurance Investment Partnerships," where it offers customized and diversified investment portfolios—primarily in investment-grade credit—to major insurance company clients. While Blackstone's scale makes it a premier partner for insurers, this model relies on winning and retaining third-party business rather than having a guaranteed, captive source of capital. The fundamental difference lies in ownership versus alliance; KKR's direct ownership provides a structural advantage in capital stability, while Blackstone leverages its market-leading platform to build relationships and manage external insurance capital.

Review detailed strategy and competitive analysis of companies in Alternative-Asset Managers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.