Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

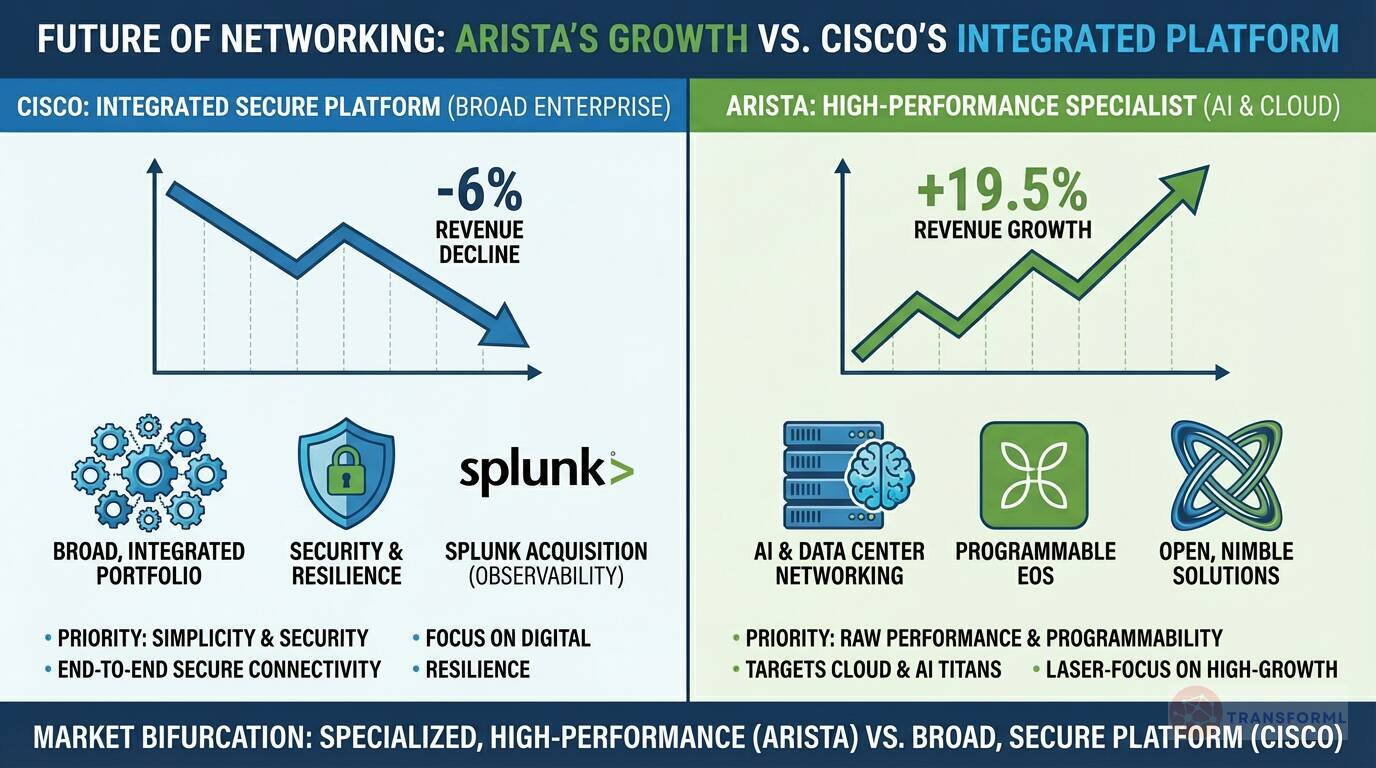

Why is Arista growing at 19.5% while Cisco's revenue declined, and what does it mean for the future of networking?

The stark difference in financial performance—Arista's 19.5% revenue growth versus Cisco's 6% decline—is a direct result of their differing strategies and market focus. Arista's success is fueled by its "laser-focus on high-growth segments like AI and data center networking," as noted in Cisco's own challenges. By targeting "Cloud and AI Titans" with a simple, programmable operating system (EOS), Arista has captured the fastest-growing part of the market. Its smaller size and focused portfolio allow it to be more nimble and responsive to the needs of these highly sophisticated customers. Cisco, as a massive incumbent with a $53.8B revenue base, faces the challenge of pivoting its vast and complex portfolio, making it harder to match the growth rate of a specialized competitor.

This divergence signals a bifurcation in the networking market. One future path is defined by Arista's success: specialized, open, and software-driven solutions will dominate in cutting-edge, high-performance environments like AI and cloud computing, where programmability and raw performance are paramount. The other path is the one Cisco is pursuing: providing broad, integrated platforms that deliver security and "digital resilience" to the wider enterprise market. Cisco's strategy of becoming an end-to-end secure connectivity provider, fortified by Splunk, appeals to the millions of customers who prioritize simplicity and security over ultimate performance. The future of networking is not a single outcome, but a market with distinct segments for both the high-performance specialist and the integrated platform provider.

Review detailed strategy and competitive analysis of companies in Enterprise Networking Hardware

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.