Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

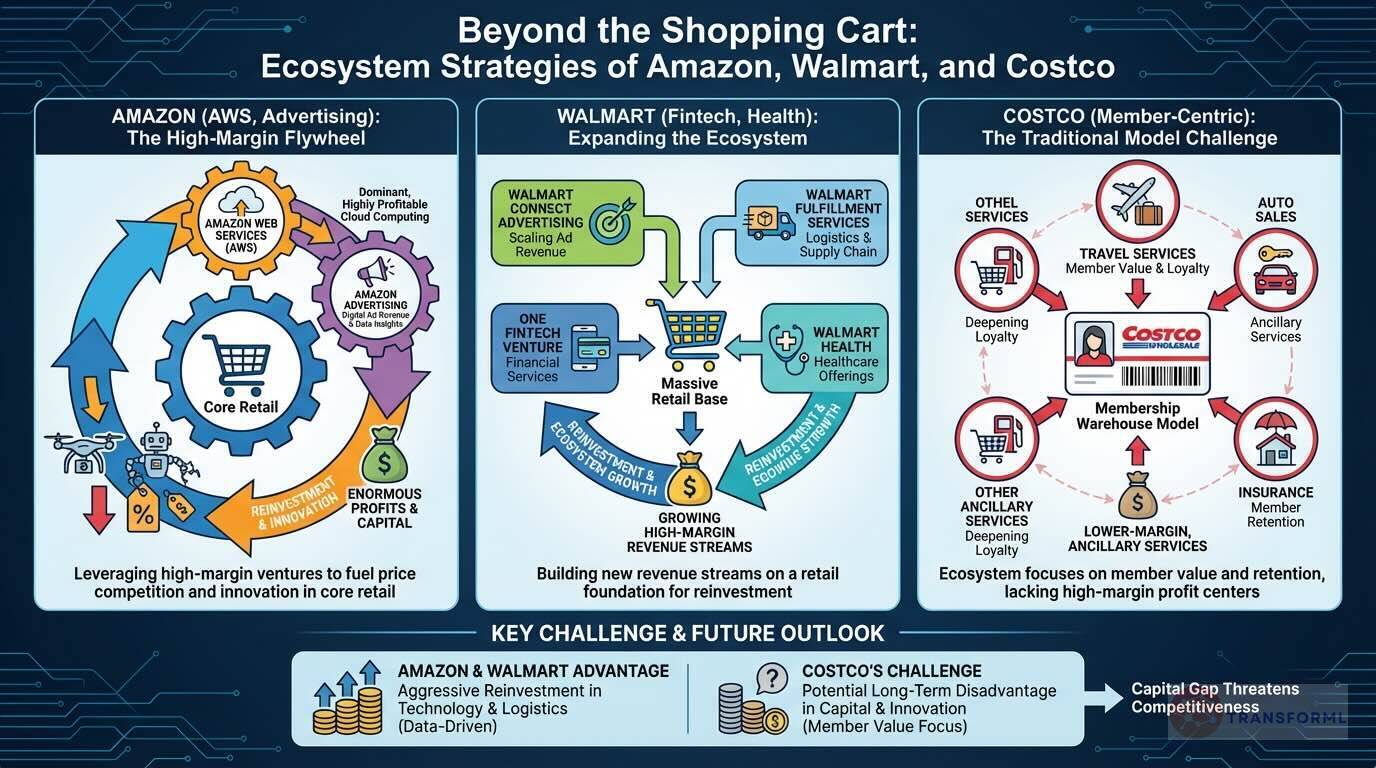

Beyond the Shopping Cart: How are Amazon (AWS, Advertising) and Walmart (Fintech, Health) building high-margin ecosystems, and can Costco's member-centric model compete?

Amazon and Walmart are aggressively building high-margin ecosystems that extend far beyond core retail, a strategy that presents a significant challenge to Costco's more traditional model. Amazon is the prime example, leveraging its "flywheel" to create dominant, highly profitable businesses like Amazon Web Services (AWS) and digital advertising. These ventures, born from supporting its retail operations, now generate enormous profits and capital that can be reinvested to fuel innovation and price competition in its core business. Walmart is following a similar playbook with its strategy to "Expand the Ecosystem." It is building new revenue streams on its massive retail base through initiatives like "Grow Walmart Connect Advertising Revenue," "Scale Walmart Fulfillment Services," and developing its "ONE Fintech Venture" and "Walmart Health" offerings.

Costco's approach is more conservative and strictly member-centric. Its ecosystem consists of ancillary services like travel, auto sales, and insurance, designed to "Optimize Member Value" and deepen loyalty rather than to create massive, independent profit centers. While these services are valuable for member retention, they lack the scale and profitability of Amazon's AWS or Walmart's emerging advertising and fintech businesses. This difference in strategy is identified in the data as a "key challenge" for Costco. The high-margin capital generated by its competitors allows for aggressive reinvestment in technology and logistics, putting Costco at a potential "long-term disadvantage in a technology- and data-driven retail landscape" where its focus remains on the core tenets of its successful membership warehouse model.

Review detailed strategy and competitive analysis of companies in Retail

Central Retail Corporation Public Company Limited

Industry: Technology

Analysis Year: 2024

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.