Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

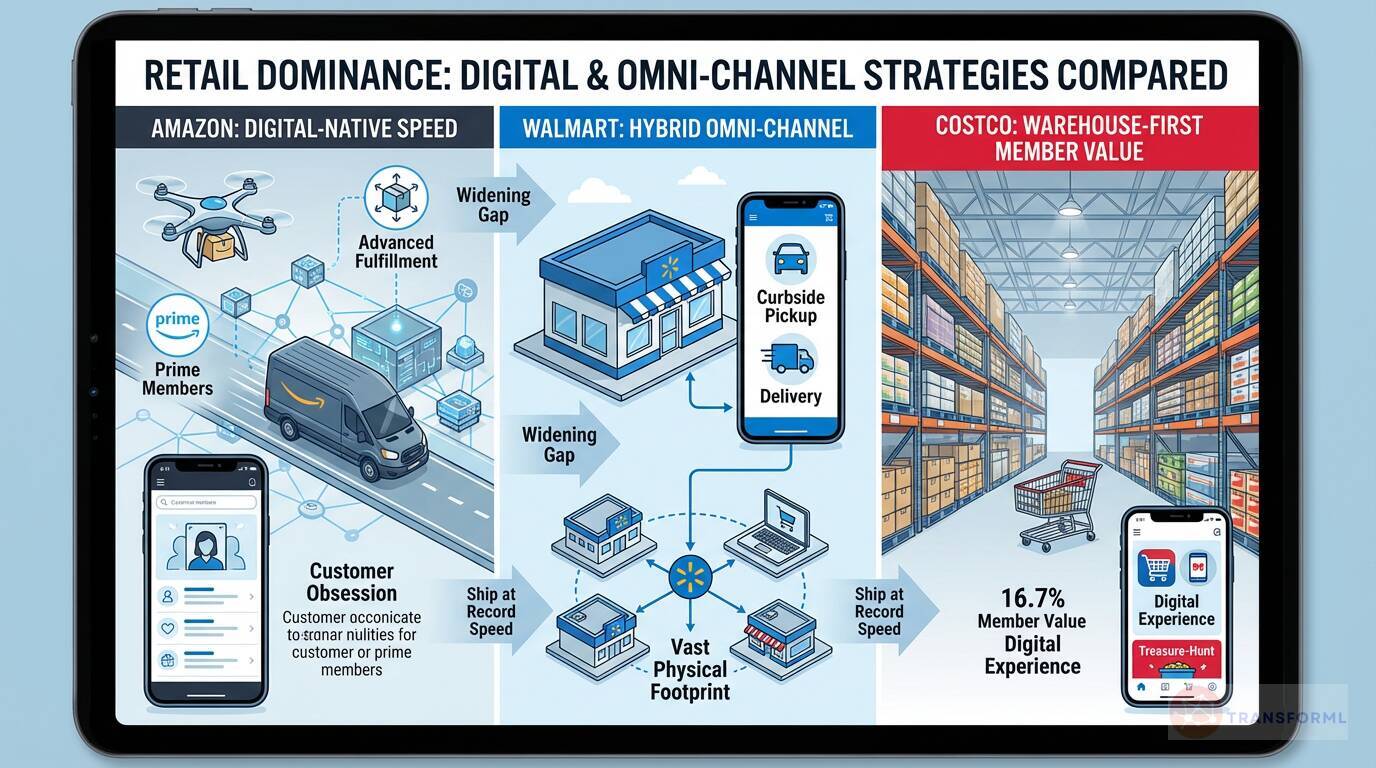

How do the digital and omni-channel strategies of Costco, Walmart, and Amazon differ in the race for retail dominance?

Amazon, Walmart, and Costco employ fundamentally different digital and omni-channel strategies that reflect their core business models. Amazon, as a digital-native company, leads with a strategy of "Customer Obsession" driven by unparalleled online convenience. Its entire infrastructure, from its "Advanced Logistics and Fulfillment Network" to its goal to "Ship at Record Speed to Prime Members," is designed to remove friction from the e-commerce experience. Walmart, in contrast, has built a formidable "Hybrid Omni-Channel Model" that leverages its vast physical footprint of over 10,500 stores as a strategic advantage. Its primary goal is to "Drive Omni-Channel Growth" by seamlessly integrating its stores and e-commerce through services like curbside pickup and delivery, directly challenging Amazon's speed with a unique blend of digital and physical accessibility.

Costco's strategy is warehouse-first, with digital playing a supporting role. Its primary focus is on the in-store "treasure-hunt" experience and delivering member value, not on winning the race for digital convenience. While Costco is working to "Cultivate and Improve Member Digital Experience," e-commerce still represents a small fraction of its sales (approximately 7%). This creates what the data identifies as a "key challenge" and a "widening gap" compared to its rivals. While Amazon perfects pure-play e-commerce and Walmart masters the integrated omni-channel experience, Costco's digital efforts are geared toward enhancing the value for its existing loyal members rather than fundamentally transforming its business model.

Review detailed strategy and competitive analysis of companies in Retail

Central Retail Corporation Public Company Limited

Industry: Technology

Analysis Year: 2024

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.