Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Honeywell's corporate split vs. Eaton's portfolio focus: Which strategy will win in the future of industrial automation?

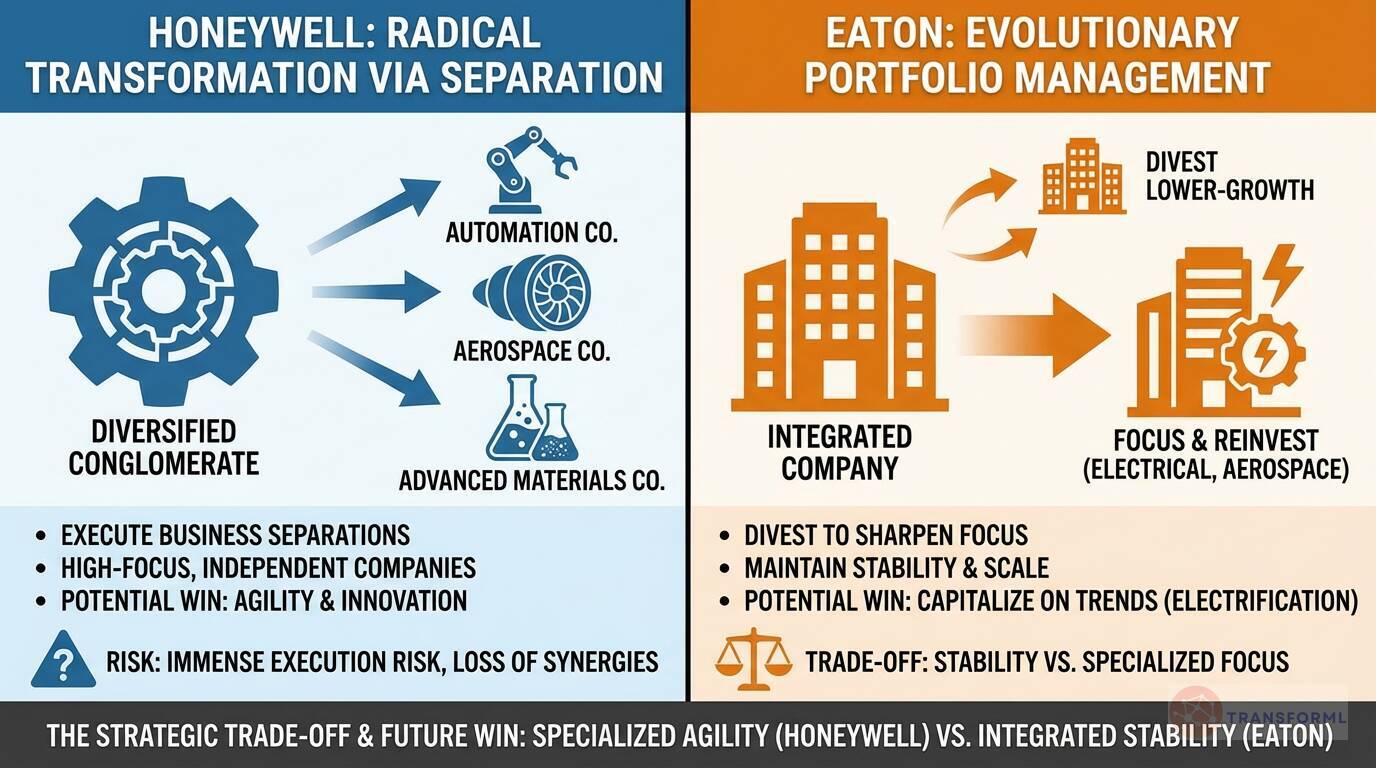

Honeywell is betting on a radical strategy of transformation through separation. Its plan to "Execute Business Separations" and spin off its Automation, Aerospace, and Advanced Materials businesses into three independent, publicly traded companies is a fundamental overhaul of its corporate identity. The strategic logic is that these new, highly focused entities will be more agile, innovative, and better equipped to lead their respective industries than a large, diversified conglomerate. The potential "win" for Honeywell is creating nimble market leaders who can outmaneuver slower competitors. However, this path is fraught with what the data calls "immense execution risk," including internal disruption and a potential loss of cross-business synergies.

In stark contrast, Eaton is pursuing an evolutionary strategy of "Strategic Portfolio Management." Instead of a complete split, Eaton is divesting lower-growth businesses to sharpen its focus and reinvest in its core Electrical and Aerospace segments. This approach allows Eaton to maintain the stability and scale of a large, integrated company while still concentrating on high-growth areas like electrification and digitalization. The potential "win" for Eaton is its ability to capitalize on market trends without the massive organizational distraction of a corporate separation. The ultimate winner will be determined by a classic strategic trade-off: whether the specialized focus and agility of Honeywell's future spun-off companies can outperform the stability, scale, and retained synergies of Eaton's integrated model.

Review detailed strategy and competitive analysis of companies in Industrial Automation & Controls

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.