Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

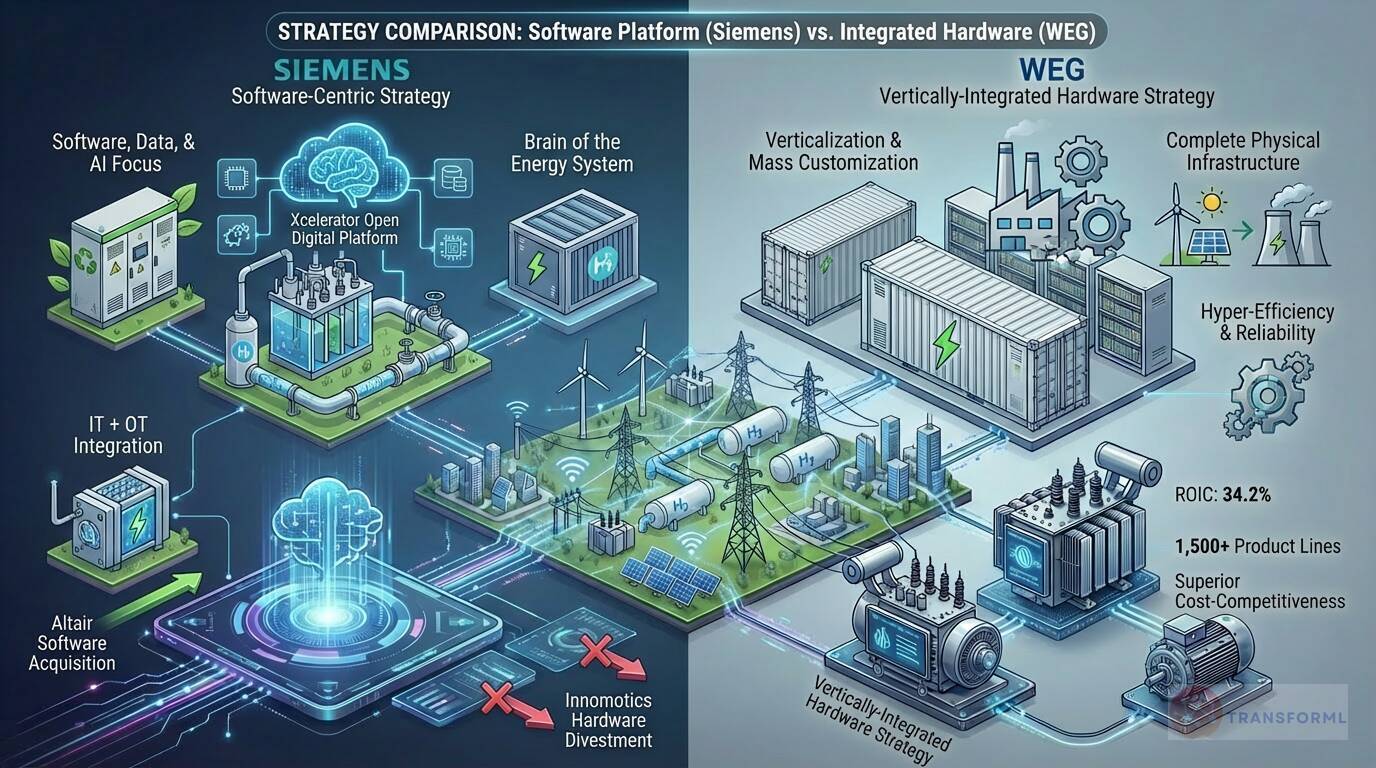

How do Siemens' software-platform (Xcelerator) and WEG's vertically-integrated hardware strategies compare in delivering end-to-end energy transition solutions?

Siemens' strategy to deliver end-to-end solutions is rooted in its transformation into a "ONE Tech Company" driven by software and digitalization. Its "How to Win" is based on the Siemens Xcelerator, an "open digital platform" that integrates the real world of operational technology (OT) with the digital world of information technology (IT). This platform approach allows Siemens to offer "one-stop solutions" that optimize the entire value chain for customers, from design and simulation to operation and maintenance. By focusing on software, data, and AI, Siemens is strategically positioning itself to be the "brain" that controls and optimizes complex energy systems. This is reinforced by its portfolio moves, such as acquiring software firm Altair for €9.3 billion while divesting the Innomotics hardware motor business.

WEG's end-to-end strategy is fundamentally different, built on a foundation of "Verticalization" and "mass customization" of hardware. WEG wins by controlling the entire manufacturing value chain, enabling it to produce a comprehensive portfolio of over 1,500 product lines—from motors and transformers to renewable energy generation equipment—with superior efficiency and cost-competitiveness. This operational prowess results in a remarkable 34.2% Return on Invested Capital (ROIC). WEG's "end-to-end" claim is about providing the complete physical infrastructure for the energy transition, "from generation... to consumption." The comparison is stark: Siemens is betting the future of the energy transition lies in a centralized software and data platform, while WEG is betting it lies in the efficient, vertically-integrated manufacturing of the mission-critical hardware that powers it.

Review detailed strategy and competitive analysis of companies in Power Grid Equipment

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.