Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

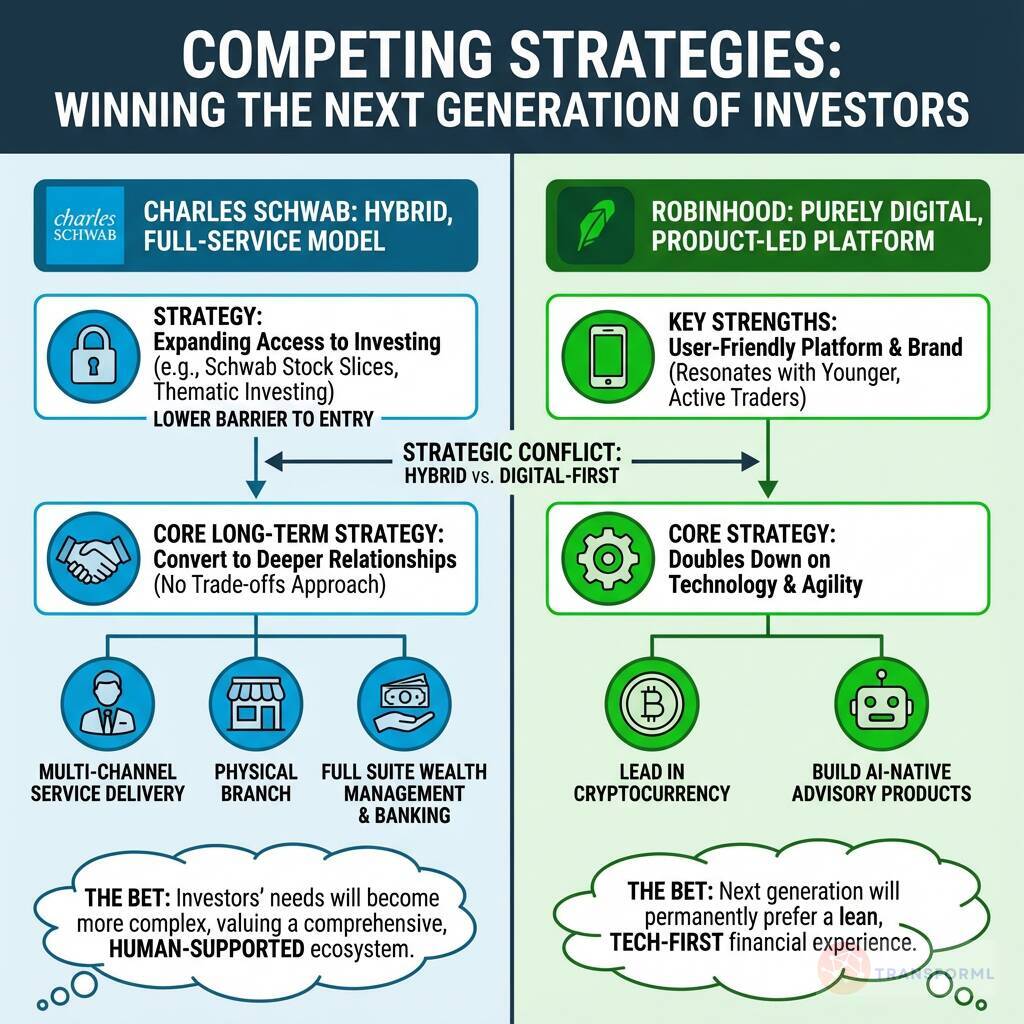

What are the competing strategies of Charles Schwab's full-service model versus Robinhood's digital-first platform to win the next generation of investors?

Charles Schwab is pursuing a hybrid strategy to attract and retain the next generation of investors. To compete with digital-first platforms, Schwab is "Expanding Access to Investing" with features like "Schwab Stock Slices" and thematic investing, which lower the barrier to entry. However, its core long-term strategy is to convert these new clients into deeper relationships. Schwab's "no trade-offs" approach combines this easy entry with a "multi-channel service delivery model" that includes human advisors, physical branches, and a full suite of wealth management and banking products. The bet is that as investors' needs become more complex, they will value the comprehensive, human-supported ecosystem that Schwab provides.

Robinhood's strategy is fundamentally different, focusing on winning and retaining the next generation within a purely digital, product-led ecosystem. Its key strengths are a "user-friendly platform" and a brand that resonates with younger, active traders. Instead of building a human-centric service model, Robinhood doubles down on technology and agility, with plans to "Lead in Cryptocurrency" and build "AI-Native Advisory Products." The core strategic conflict is clear: Robinhood is betting that the next generation will permanently prefer a lean, tech-first financial experience, while Schwab is betting they will eventually graduate to a more traditional, full-service relationship.

Review detailed strategy and competitive analysis of companies in Brokerage & Trading Platforms

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.