Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

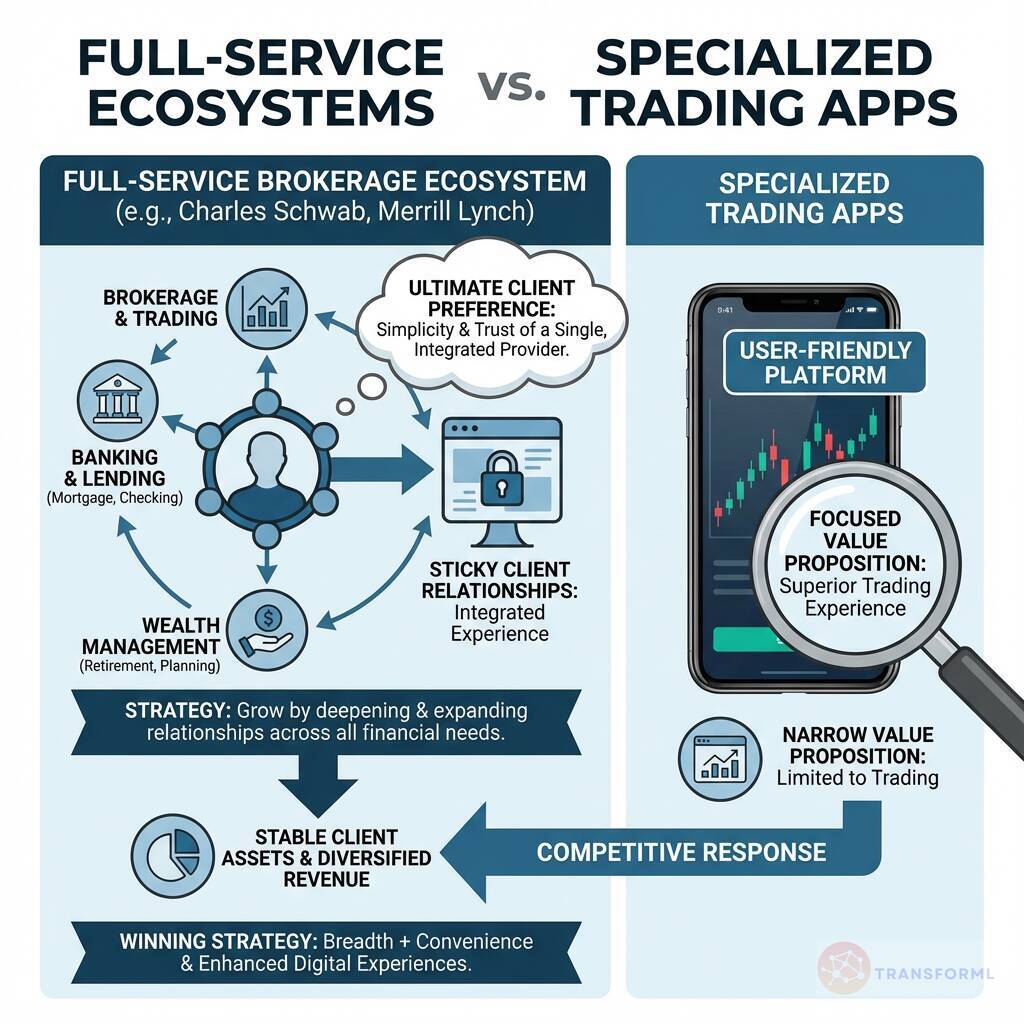

How are full-service brokerages like Charles Schwab and Merrill Lynch building integrated ecosystems to compete with the specialized trading experience of modern apps?

Full-service brokerages like Charles Schwab are building integrated ecosystems to create "sticky" client relationships that a specialized trading app cannot replicate. Schwab's "Operating Structure," which combines brokerage, banking, and wealth management, is central to this strategy. The goal is to "Grow by deepening and expanding relationships" by serving a wider array of client needs beyond simple trading. By actively investing in "Wealth Management Capabilities" and "Lending Product Offerings," Schwab encourages clients to consolidate their financial lives, from their mortgage and checking account to their retirement portfolio. This creates a powerful moat, enhances the stability of client assets, and generates more reliable, diversified revenue streams.

This ecosystem approach is a direct competitive response to the focused, often superior, trading experience offered by modern apps. While a specialized app may win on a single feature like a "user-friendly platform," its value proposition is narrow. Full-service firms like Schwab and competitor Merrill Lynch—noted for its "full suite of banking and investment solutions"—compete on breadth and convenience. They are not ceding the digital experience, as Schwab continues to "Enhance Digital Experiences," but are pairing it with a holistic product shelf. Their winning strategy is based on the premise that most clients will ultimately prefer the simplicity and trust of having all their financial needs met by a single, integrated provider.

Review detailed strategy and competitive analysis of companies in Brokerage & Trading Platforms

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.