Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

How are JPMorgan Chase, Capital One, and Bank of America using AI and Data to redefine the customer experience and the future of banking?

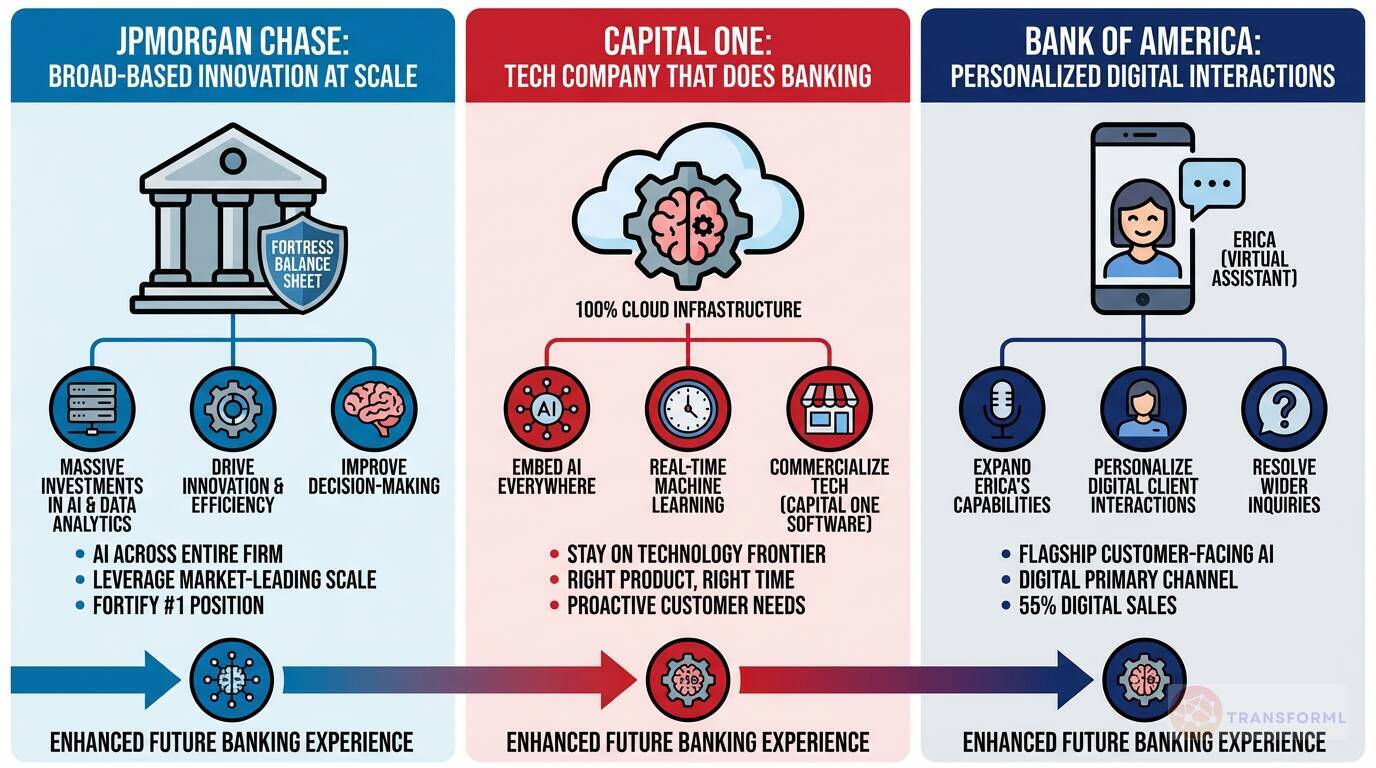

These banking giants are pursuing distinct strategies with AI and data, reflecting their core identities. Capital One positions itself as a "technology company that does banking," embedding AI and a 100% cloud infrastructure at its core. Its goal is to "Stay on the Frontier of Technology, Data, and AI" by embedding AI into every customer channel to proactively address needs and even commercializing its proprietary tech through Capital One Software. In contrast, JPMorgan Chase leverages its market-leading scale and "Fortress Balance Sheet" to fund massive, broad-based investments in AI and data analytics to "drive innovation and efficiency" across the entire firm. Bank of America has focused its efforts on a flagship, customer-facing AI tool, with a key objective to "Expand Erica's Capabilities," its popular virtual financial assistant, to resolve a wider range of inquiries and "personalize digital client interactions."

The practical applications of these strategies highlight their different endgames. Capital One's data-driven aspiration is to deliver "the right product at the right price to the right customer at the right time," using real-time machine learning in products like Capital One Travel and Shopping. Bank of America is focused on making its digital channels, powered by Erica, the primary point of interaction, with 55% of its consumer sales now originating digitally. JPMorgan Chase is implementing AI solutions more broadly to "improve efficiency, reduce costs, and enhance decision-making," a strategy that uses AI to fortify its number-one position across multiple business lines rather than centering its brand identity around a single technology or tool.

Review detailed strategy and competitive analysis of companies in Financial Services

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.