Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

What are the key differences in how The Home Depot and Lowe's are using digital tools and loyalty programs to capture the modern home improvement shopper?

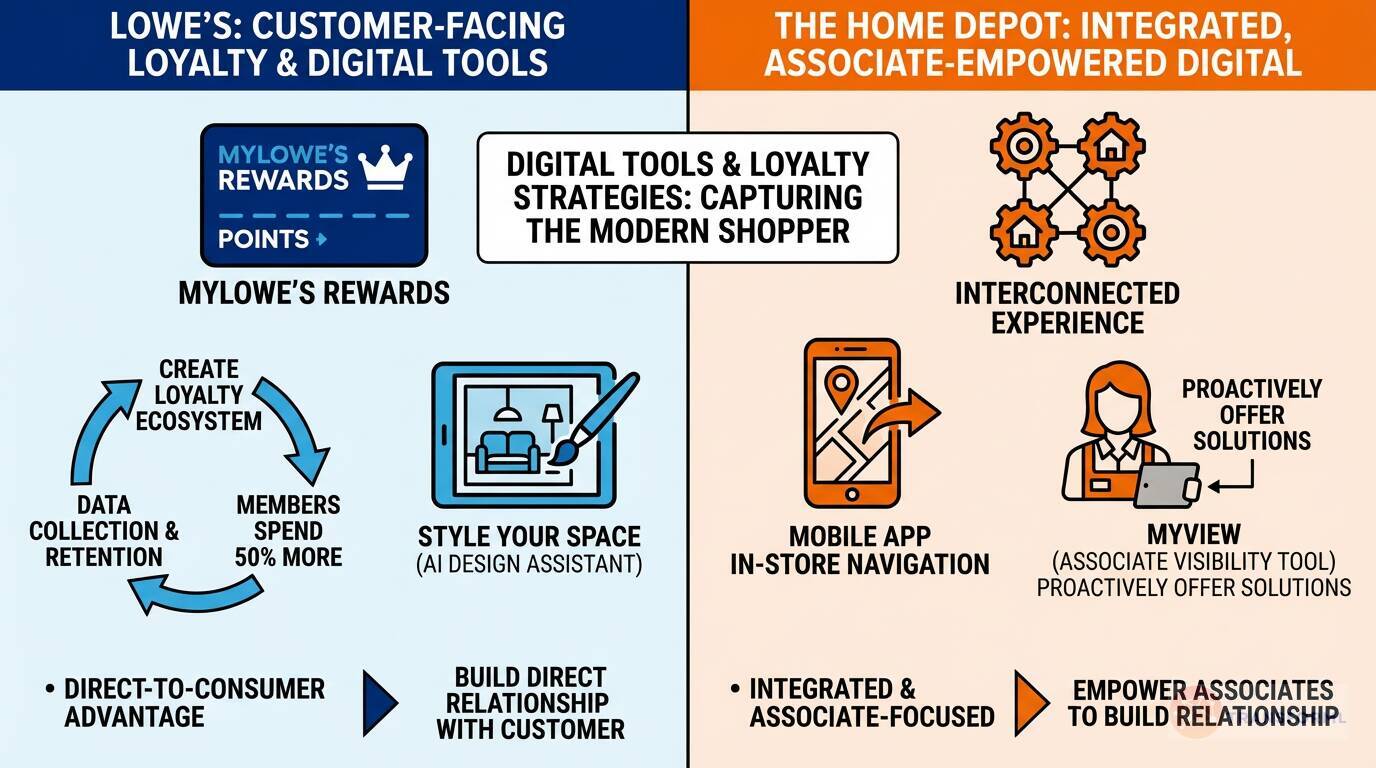

Lowe's has made a formal, customer-facing loyalty program a central pillar of its strategy, aiming to "Create a Loyalty Ecosystem." Its MyLowe's Rewards program, designed for both Pro and DIY customers, is a powerful tool for data collection and retention, with the company noting that members spend nearly 50% more than non-members. Lowe's is also deploying innovative, consumer-facing digital tools like the "Style Your Space" generative AI design assistant to directly engage shoppers and inspire projects, positioning technology as a direct-to-consumer advantage.

The Home Depot's approach is more integrated and associate-focused. It lacks a prominently featured, broad-based loyalty program like Lowe's. Instead, it embeds digital capabilities into the broader "Interconnected Experience." For instance, it focuses on practical tools like enhancing the mobile app's in-store navigation. Crucially, it empowers its staff with tools like "MyView," which gives associates better visibility into customer projects to proactively offer solutions. This represents a key difference: Lowe's uses digital and loyalty to build a direct relationship with the customer, while Home Depot uses digital to empower its associates to build that relationship.

Review detailed strategy and competitive analysis of companies in Home-Improvement Retailers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.