Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

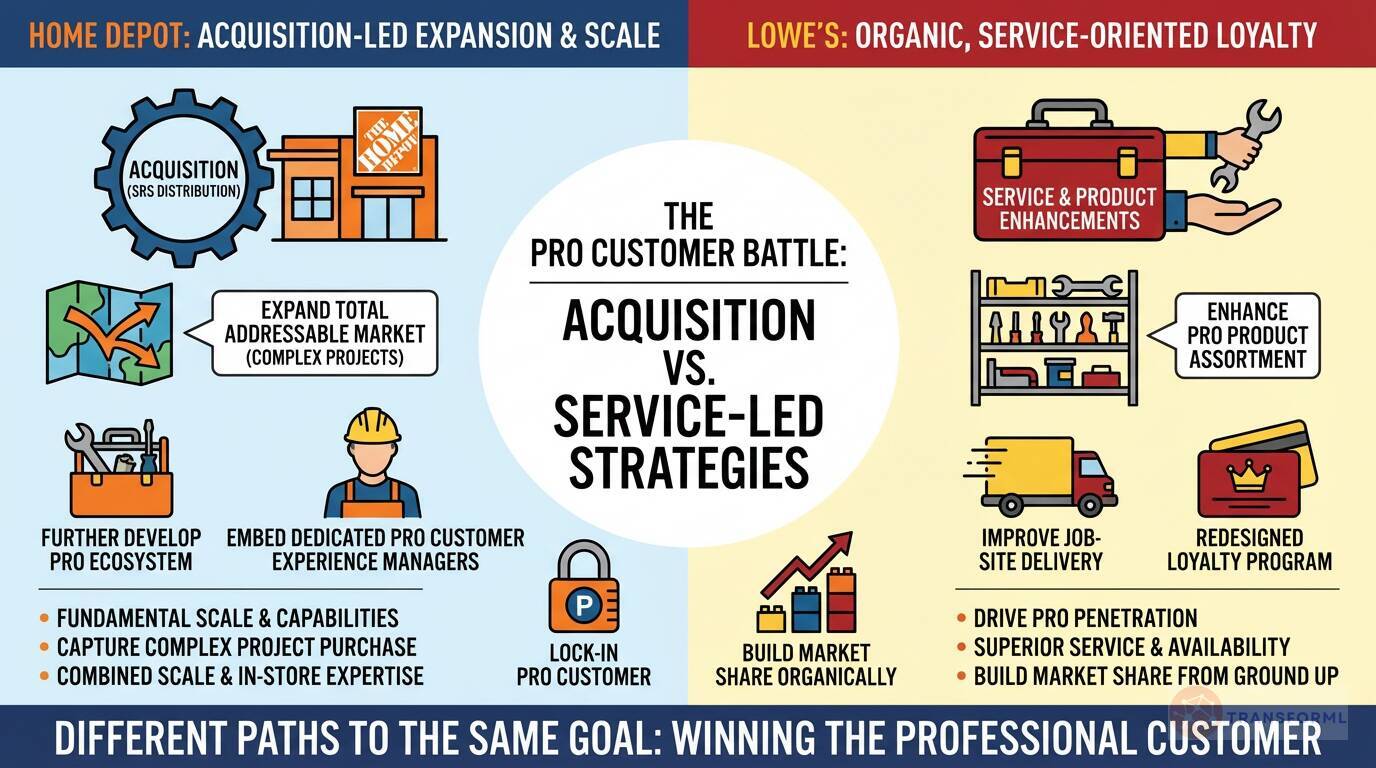

How are The Home Depot and Lowe's battling for the professional (Pro) customer through acquisitions versus service-led strategies?

The Home Depot is pursuing an aggressive, acquisition-led strategy to dominate the professional market by fundamentally expanding its scale and capabilities. The centerpiece of this approach is the integration of SRS Distribution, a major specialty trade distributor. This move is designed to capture the complex project purchase occasion, significantly increasing Home Depot's total addressable market. This is complemented by organic efforts to "Further Develop Our Pro Ecosystem" and embed dedicated Pro Customer Experience Managers into store leadership, creating a powerful combination of acquired scale and in-store expertise to lock in the Pro customer.

In contrast, Lowe's is taking a more organic, service-oriented approach to "Drive Pro Penetration." Rather than acquiring new business lines, Lowe's is focused on improving the experience for Pros within its existing model. Key initiatives include enhancing its Pro product assortment, improving job-site delivery, and adding dedicated service levels within its stores. This strategy bets on winning Pro loyalty through superior service, better product availability, and a redesigned loyalty program, aiming to build market share from the ground up rather than buying it in large blocks.

Review detailed strategy and competitive analysis of companies in Home-Improvement Retailers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.