Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

How do The Home Depot's supply chain automation and Lowe's' flexible fulfillment models represent different bets on the future of home improvement delivery?

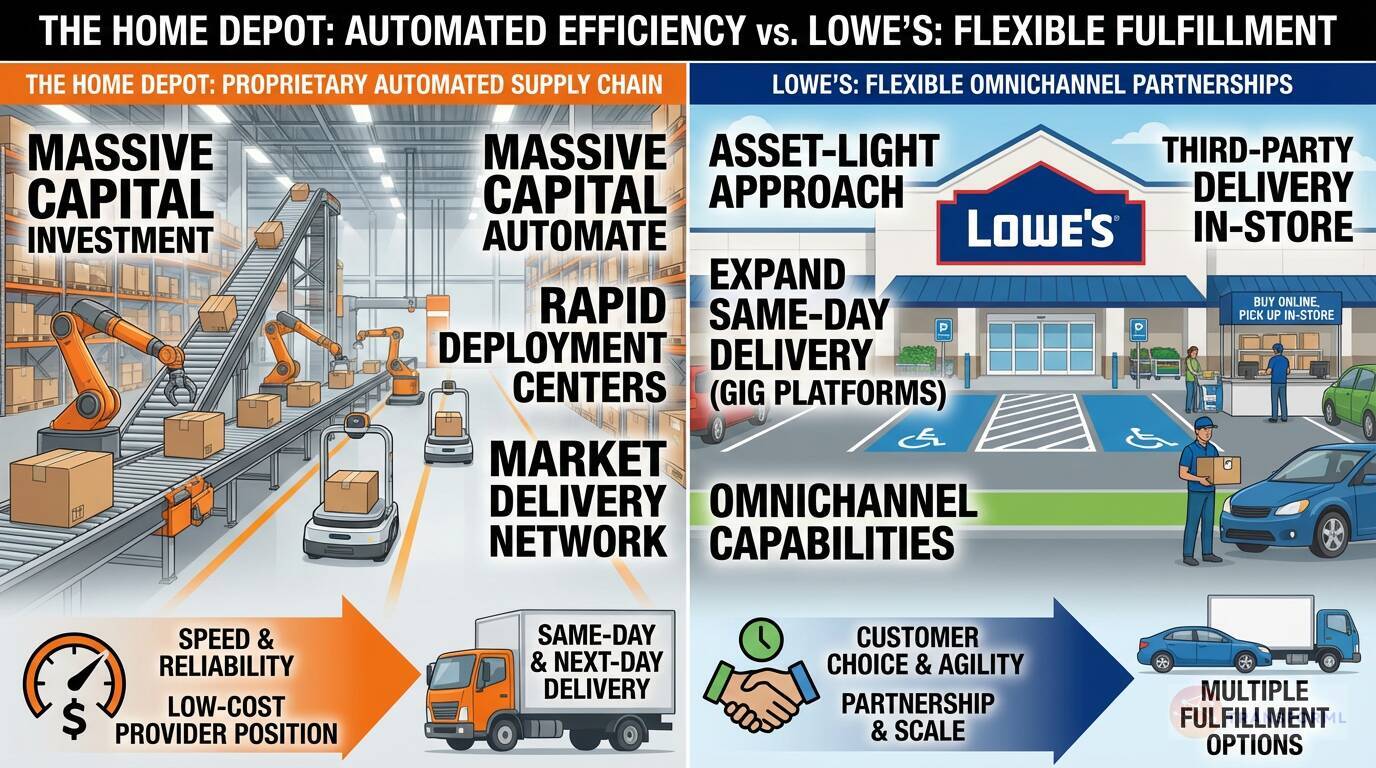

The Home Depot is betting on achieving overwhelming efficiency and speed through massive capital investment in a proprietary, automated supply chain. Its goal to "Extend Our Low-Cost Provider Position" is supported by initiatives to "Automate Rapid Deployment Centers" and transition "100% of Our Appliance Deliveries to Our Market Delivery Network." This strategy aims to build a nearly unbeatable competitive advantage by controlling the entire logistics process, driving down costs, and setting a new market standard for delivery speed and reliability.

Lowe's, on the other hand, is betting on flexibility and partnership to meet evolving customer expectations. Its supply chain strategy enables "Omnichannel Capabilities" by focusing on a variety of fulfillment options, including buy online, pick up in-store and curbside pickup. A key differentiator is its plan to "Expand Same-Day Delivery Options" by leveraging multiple gig platforms. This more asset-light approach prioritizes customer choice and agility, using partnerships to scale delivery capabilities quickly without the heavy capital investment of building a fully owned and automated network from the ground up.

Review detailed strategy and competitive analysis of companies in Home-Improvement Retailers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.