Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

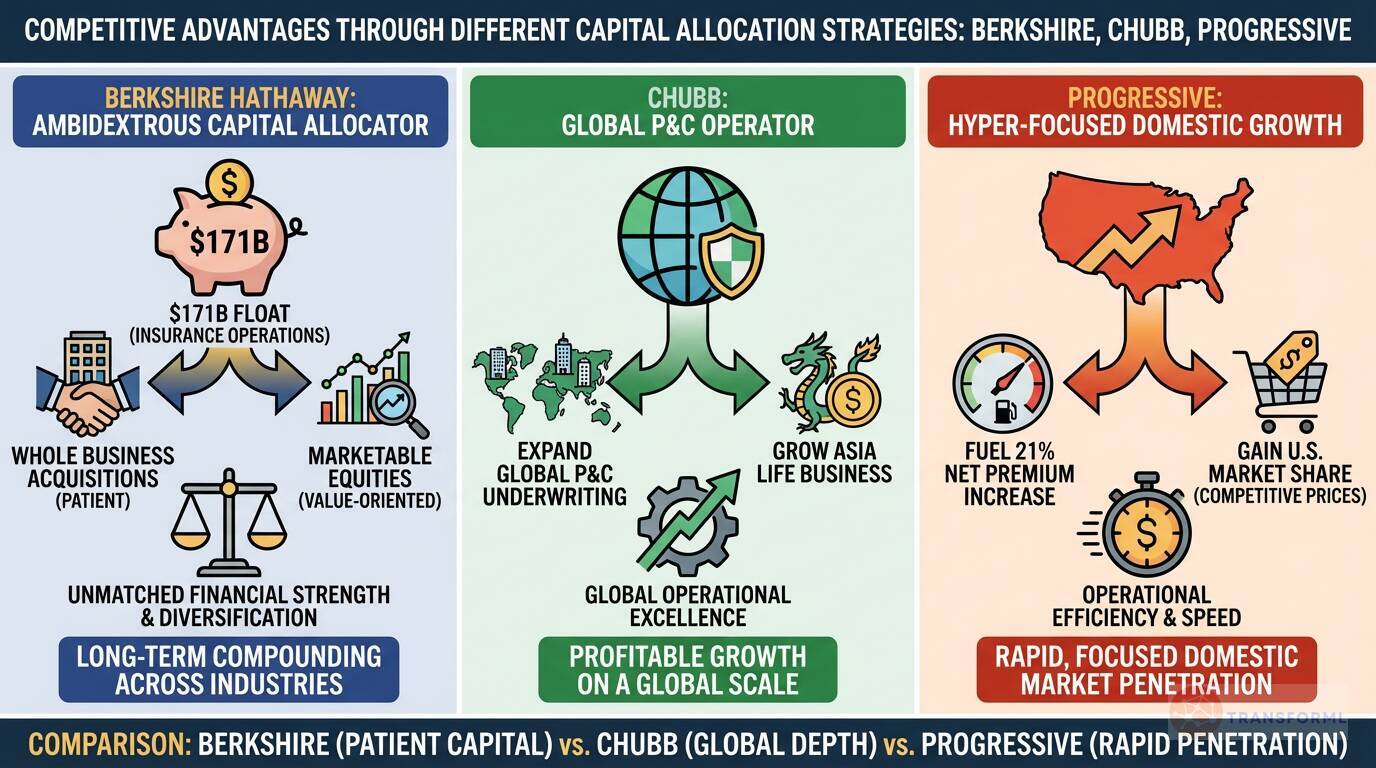

Berkshire Hathaway vs. Chubb vs. Progressive: How do their different capital allocation strategies create distinct competitive advantages?

Berkshire Hathaway's capital allocation strategy is its most profound competitive advantage, distinguishing it as a capital allocator first and an insurer second. The company's core goal is to "Deploy Capital Ambidextrously" by using its enormous "$171 billion in float from insurance operations" to invest across a wide spectrum of industries. This includes acquiring whole businesses with strong fundamentals or identifying undervalued marketable equities. This conglomerate model provides unmatched financial strength and diversification, allowing Berkshire to be patient, counter-cyclical, and less dependent on the performance of any single industry, including insurance. Its advantage lies in its long-term, value-oriented approach to compounding capital, which transcends the typical insurance business cycle.

In contrast, Chubb and Progressive employ more focused, operations-centric capital allocation strategies. Chubb acts as a premier global insurance operator, reinvesting its capital to "Expand Global P&C Underwriting" and "Grow Asia Life Business." It seeks to enhance returns by growing its insurance franchises and making specific investment choices, like increasing its allocation to private assets. Its competitive advantage is operational excellence and profitable growth on a global scale. Progressive's strategy is one of hyper-focused domestic growth, reinvesting capital to fuel a 21% increase in net premiums. It prioritizes gaining market share in the U.S. by "Offering competitive prices" driven by operational efficiency. Chubb's advantage is global operational depth, while Progressive's is rapid, focused domestic market penetration.

Review detailed strategy and competitive analysis of companies in Insurance Carriers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.