What strategies are companies in Insurance Carriers using to win

Explore Insurance Carriers company strategies

Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

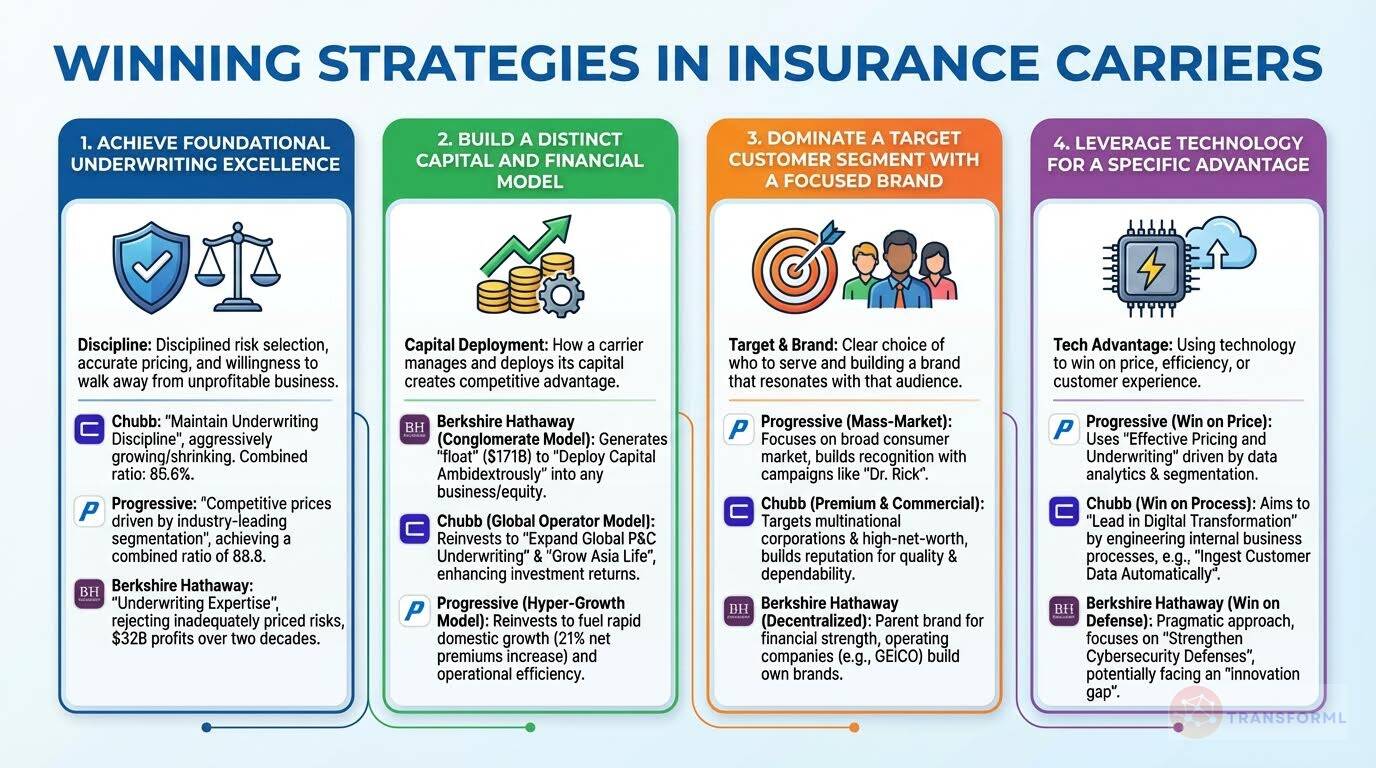

In Insurance Carriers, the following strategies are implemented by companies to win:

1. Achieve Foundational Underwriting Excellence

This is a non-negotiable core strategy. It involves disciplined risk selection, accurate pricing, and a willingness to walk away from unprofitable business.

Example: Chubb: Aims to "Maintain Underwriting Discipline" by "aggressively" growing when returns are adequate and "ruthlessly" shrinking when they are not. This has led to a P&C combined ratio of 86.6%.

Example: Progressive: Focuses on "Offering competitive prices driven by industry-leading segmentation" and systematically deploying underwriting efforts to ensure profitability, achieving a combined ratio of 88.8.

Example: Berkshire Hathaway: Relies on its "Underwriting Expertise" by rejecting inadequately priced risks, which has generated $32 billion in after-tax underwriting profits over the past two decades.

2. Build a Distinct Capital and Financial Model

How a carrier manages and deploys its capital creates a significant competitive advantage. The companies show three different successful models.

Example: The Conglomerate Model (Berkshire Hathaway): Uses its vast insurance operations to generate "float" ($171 billion) that it can "Deploy Capital Ambidextrously" into any attractive business or equity, making it a master capital allocator, not just an insurer.

Example: The Global Operator Model (Chubb): Focuses on being a premier insurance operator. It reinvests capital to "Expand Global P&C Underwriting" and "Grow Asia Life Business," while also enhancing investment returns through strategies like increasing its allocation to private assets.

Example: The Hyper-Growth Model (Progressive): Reinvests capital to fuel rapid domestic growth (21% increase in net premiums written) and operational efficiency, aiming to capture market share through competitive pricing.

3. Dominate a Target Customer Segment with a Focused Brand

Winning requires a clear choice of who to serve and building a brand that resonates with that audience.

Example: Mass-Market Brand (Progressive): Focuses on the broad consumer market with a vision to become the "#1 destination for insurance." It builds brand recognition through memorable campaigns like "Dr. Rick" and "Superstore."

Example: Premium & Commercial Brand (Chubb): Targets multinational corporations and high-net-worth individuals by building a "reputation for quality of service and dependability." A key goal is to "Penetrate Large Corporate Market" by cross-selling to its existing Fortune 1000 clients.

Example: Decentralized Brand (Berkshire Hathaway): While the parent company brand stands for financial strength, it allows its operating companies, like GEICO, to build their own brands to compete directly with players like Progressive in the consumer auto market.

4. Leverage Technology for a Specific Advantage

Technology can be used to win on price, efficiency, or customer experience.

Example: Win on Price (Progressive): Uses technology as a core part of its "How to Win" strategy. Its strength in "Effective Pricing and Underwriting" is driven by industry-leading data analytics and segmentation to offer competitive rates.

Example: Win on Process (Chubb): Aims to "Lead in Digital Transformation" by engineering its internal business processes. Goals like "Ingest Customer Data Automatically" and hiring engineers to work with underwriters are designed to make their experts more efficient and effective.

Example: Win on Defense (Berkshire Hathaway): Takes a more pragmatic and defensive stance, with goals like "Strengthen Cybersecurity Defenses." As noted in its key challenges, its decentralized model may create an "innovation and agility gap" compared to the more proactive tech strategies of its competitors.

Read More

Review detailed strategy and competitive analysis of companies in Insurance Carriers

Source and Disclaimer: This analysis is based on publicly available industry reports, market data, and company filings. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.