Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

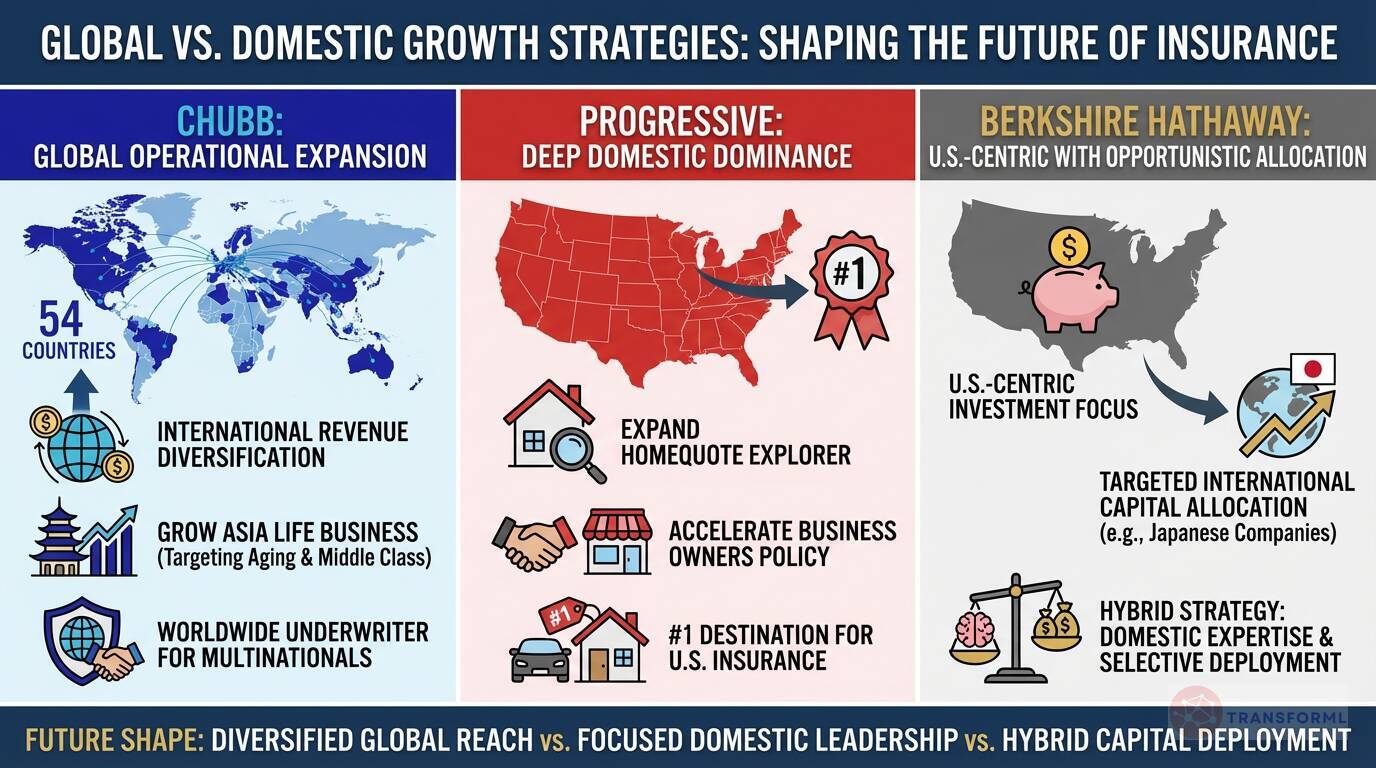

Global vs. Domestic Growth: How are Chubb's, Progressive's, and Berkshire Hathaway's expansion strategies shaping the future of insurance?

Chubb and Progressive represent two divergent paths for growth: global operational expansion versus deep domestic dominance. Chubb is committed to a "Global Expansion" strategy, operating in 54 countries and territories. Its goals are explicitly international, such as the plan to "Grow Asia Life Business" by targeting both aging, wealthy populations in North Asia and the rising middle class in Southeast Asia. This strategy diversifies its revenue and risk, positioning it to capitalize on growth in emerging markets and solidify its status as a leading worldwide underwriter for multinational corporations.

Berkshire Hathaway and Progressive are more U.S.-centric, but in different ways. Progressive is almost entirely focused on the U.S. market, with a winning aspiration to become the "#1 destination for insurance" domestically. Its initiatives to expand "HomeQuote Explorer" and accelerate its "Business Owners Policy" are designed to deepen its penetration of the American market. Berkshire Hathaway, while primarily operating in the U.S. with a goal to "Maintain a U.S.-Centric Investment Focus," takes a more opportunistic approach to international markets. Its recent increased investment in Japanese companies is not an operational expansion like Chubb's, but a targeted capital allocation decision. This hybrid strategy allows it to benefit from domestic expertise while selectively deploying capital to the most attractive international opportunities without the complexity of building a global operational footprint.

Review detailed strategy and competitive analysis of companies in Insurance Carriers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.