Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

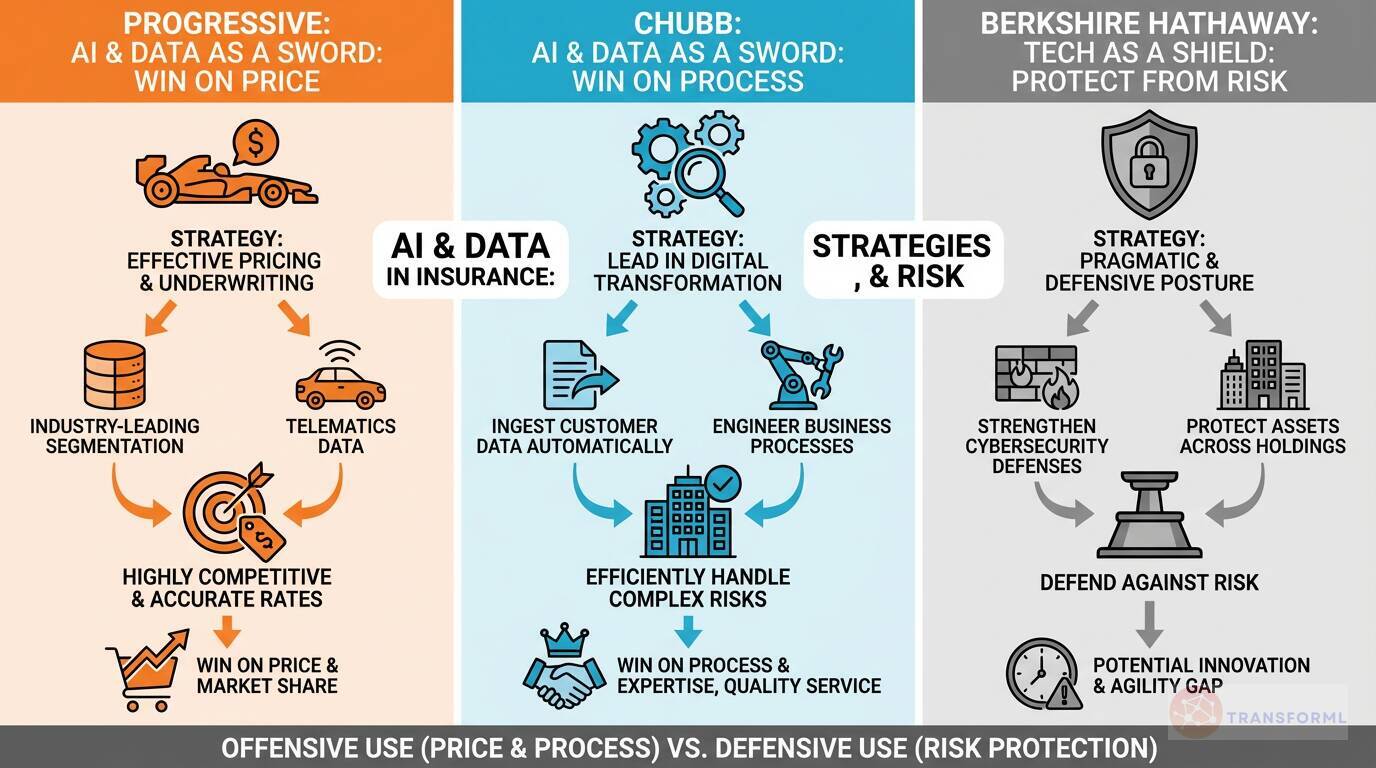

AI and Data in Insurance: How are Progressive, Chubb, and Berkshire Hathaway using technology to win on price, process, and risk?

Progressive and Chubb are leveraging technology as offensive tools to create distinct advantages. Progressive uses data and AI to win on price and market share. Its strength in "Effective Pricing and Underwriting" is built on "industry-leading segmentation" and telematics data, allowing it to offer highly competitive and accurate rates to the mass market. Chubb, conversely, uses technology to win on process and expertise. Its pillar to "Lead in Digital Transformation" focuses on internal efficiencies, with goals like "Ingest Customer Data Automatically" and hiring engineers to "Engineer Business Processes." This empowers their expert underwriters to efficiently handle complex, high-value commercial risks, reinforcing its reputation for quality service rather than competing on price alone.

Berkshire Hathaway takes a more pragmatic and defensive posture toward technology. Its most explicit technology-related goal is to "Strengthen Cybersecurity Defenses" across its vast and varied holdings. While it aims to "Embrace Continuous Learning and Adaptation," its decentralized model means tech adoption is often handled at the subsidiary level rather than through a centrally driven, enterprise-wide digital strategy. As noted in its key challenges, this can create a potential "innovation and agility gap" compared to its more focused competitors. While Progressive and Chubb use AI as a sword to capture market share and improve efficiency, Berkshire's current strategy uses technology primarily as a shield to protect its assets from risk.

Review detailed strategy and competitive analysis of companies in Insurance Carriers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.