Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Generative AI in Finance: How are Goldman Sachs and Morgan Stanley deploying AI for trading, risk, and efficiency?

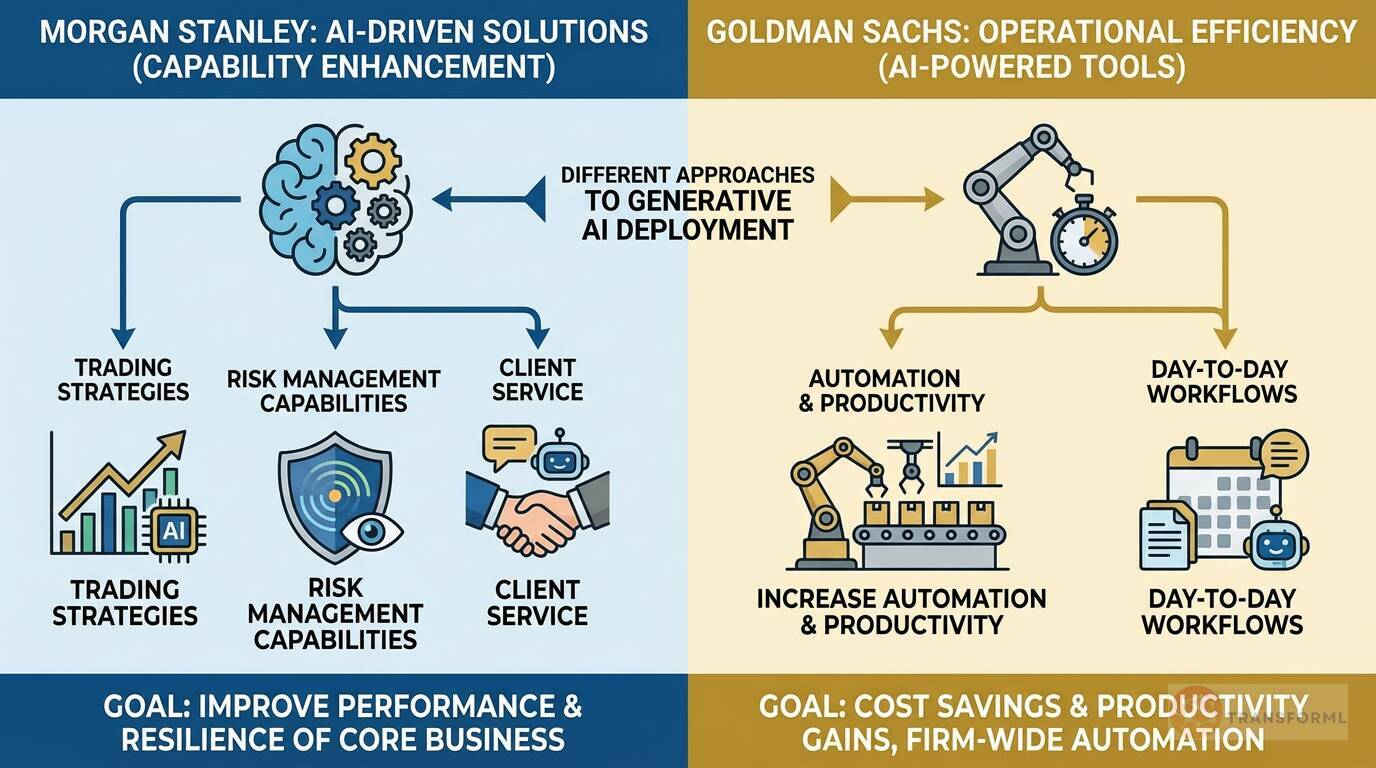

Both Morgan Stanley and Goldman Sachs identify technological innovation as critical, with a specific focus on Artificial Intelligence. Morgan Stanley's strategy is to "Embrace Technological Innovation" by making targeted investments in "AI-Driven Solutions." These initiatives are aimed at enhancing specific high-value areas such as trading strategies, client service, and, crucially, its "Risk Management Capabilities." The goal is to leverage AI to improve the performance and resilience of its core business lines.

Goldman Sachs frames its AI strategy more explicitly around operational efficiency. A central pillar of its plan is to "Run the Firm More Efficiently," and a key tactic is to "Increase Automation and Productivity" by increasing the "use of generative AI-powered tools in day-to-day workflows." While also used to enhance client experience, Goldman's communication highlights a firm-wide push to embed AI as a foundational tool for cost savings and productivity gains, suggesting a more immediate and operational focus compared to Morgan Stanley's capability-enhancement approach.

Review detailed strategy and competitive analysis of companies in Investment Banking

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.