Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

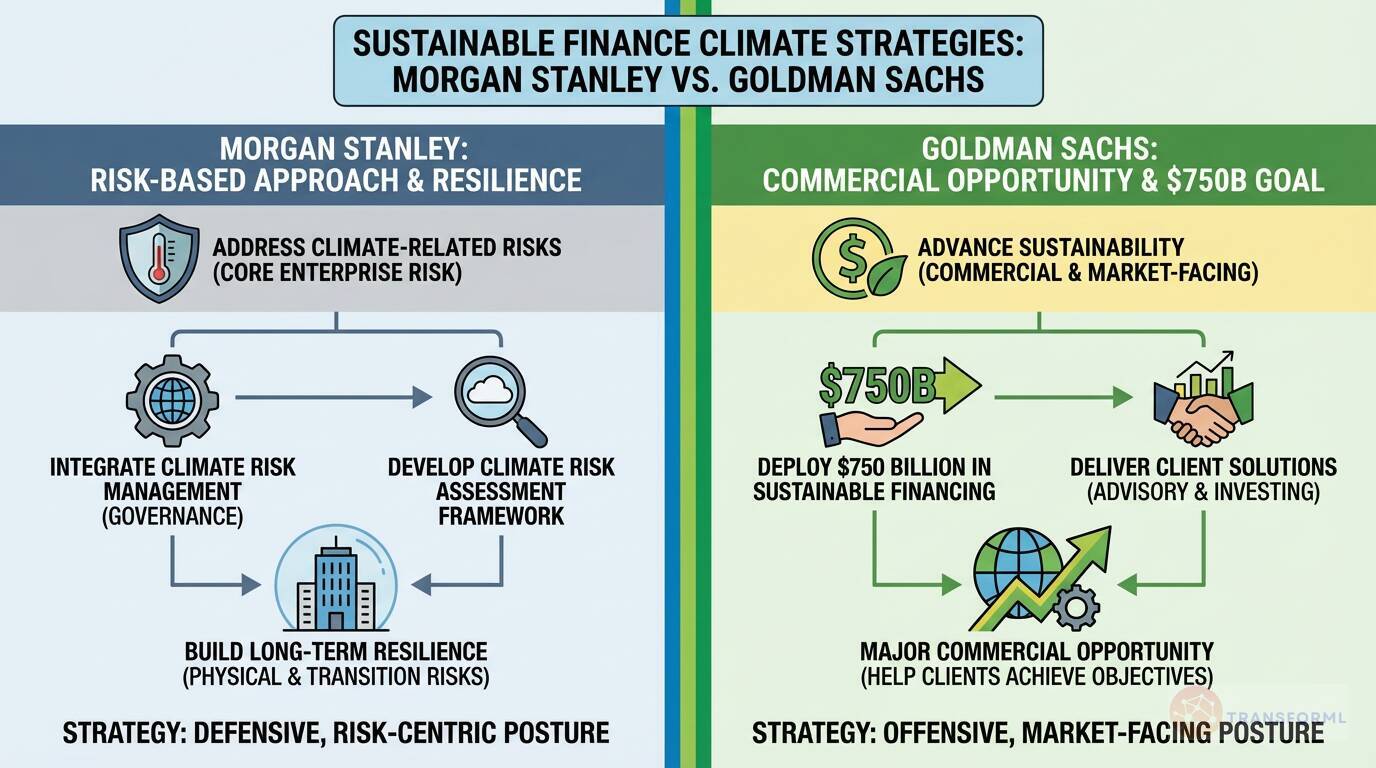

Sustainable Finance: How do Morgan Stanley's risk-based approach and Goldman Sachs's $750B financing goal shape their climate strategies?

Morgan Stanley's climate strategy is fundamentally shaped by a risk-management perspective. Its top-level strategic goal is to "Address Climate-Related Risks," which it supports through initiatives like "Integrate Climate Risk Management" into its governance structures and "Develop [a] Climate Risk Assessment Framework." This approach treats climate change as a core enterprise risk to be measured, monitored, and mitigated, positioning the firm to build long-term resilience against physical and transition risks.

Goldman Sachs, on the other hand, approaches sustainability with a more commercial and market-facing strategy. Its primary goal is to "Advance Sustainability" by delivering solutions for its clients, underscored by its headline-grabbing commitment to "Deploy $750 Billion in Sustainable Financing, Investing and Advisory Activity" by 2030. While also managing its own risk, Goldman's strategy is distinctly offensive, positioning sustainability as a major commercial opportunity and a key service offering to help clients achieve their own climate objectives, contrasting with Morgan Stanley's more defensive, risk-centric posture.

Review detailed strategy and competitive analysis of companies in Investment Banking

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.