Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Wealth Management vs. Private Credit: How are Morgan Stanley and Goldman Sachs competing for the future of asset growth?

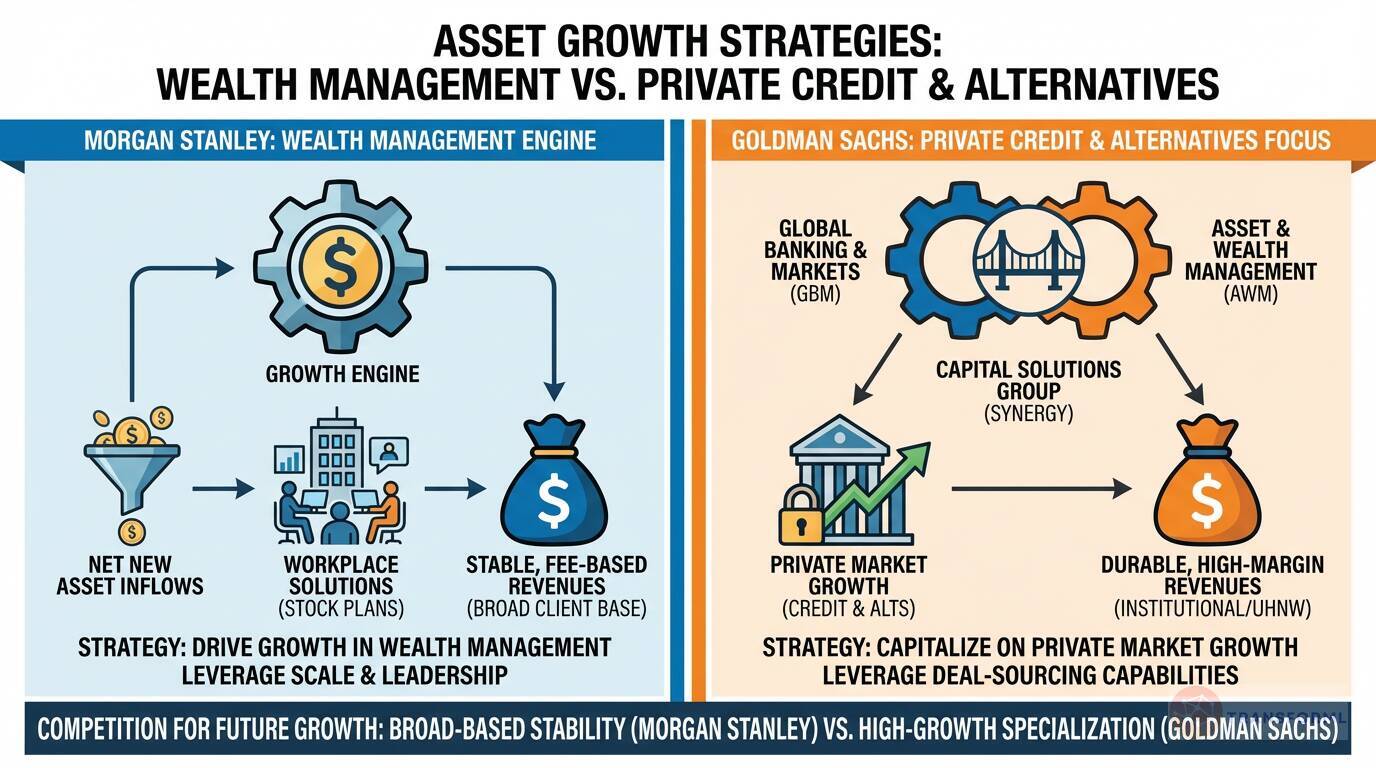

Morgan Stanley is driving its growth by leaning into its dominant Wealth Management franchise. The firm's strategy is centered on the top-level goal to "Drive Growth in Wealth Management" by attracting "Net New Asset Inflows" and expanding "Workplace Solutions" like stock plan administration. This approach leverages its established scale and leadership in the segment to generate stable, fee-based revenues from a broad base of individuals and corporate clients, making it the primary engine for the firm's growth.

Goldman Sachs, in contrast, is pursuing a more focused, high-growth strategy by aiming to "Capitalize on Private Market Growth." It has established a dedicated "Capital Solutions Group" designed to create powerful synergies between its Global Banking & Markets (GBM) and Asset & Wealth Management (AWM) divisions. This structure allows Goldman to leverage its deal-sourcing capabilities in investment banking to create unique private credit and alternative investment opportunities for its AWM clients, aiming to generate more durable, high-margin revenues from a more concentrated institutional and ultra-high-net-worth client base.

Review detailed strategy and competitive analysis of companies in Investment Banking

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.