Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

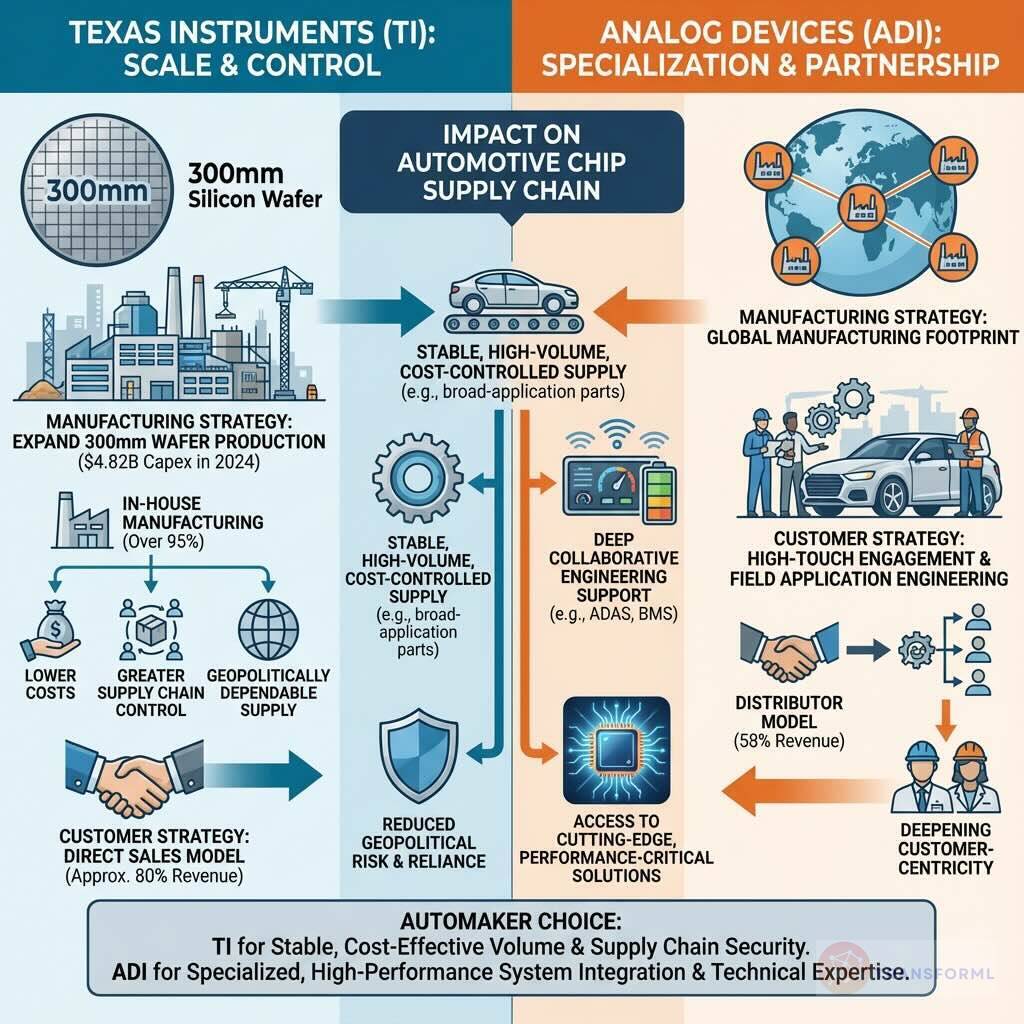

Analog Devices vs. Texas Instruments: How do their different manufacturing and customer strategies impact the automotive chip supply chain?

The distinct manufacturing strategies of Analog Devices and Texas Instruments create different value propositions for the automotive chip supply chain. Texas Instruments is executing a massive capital expenditure plan ($4.82 billion in 2024) to "Expand 300mm Wafer Production" and bring over 95% of its manufacturing in-house. This strategy is designed to provide "lower costs, greater control of the supply chain, and geopolitically dependable supply." For automotive manufacturers facing long production cycles and seeking cost efficiency, TI's approach promises a stable, high-volume, and cost-controlled source of essential components. This reduces reliance on third-party foundries and mitigates some geopolitical risks.

In contrast, Analog Devices' approach is centered on a "Global Manufacturing Footprint" and a high-touch customer engagement model. While TI is moving to a direct sales model that accounts for approximately 80% of its revenue, ADI relies on distributors for 58% of its revenue and emphasizes "Deepening customer-centricity" through initiatives like "Enhance Field Application Engineering." For the automotive supply chain, this means that while TI offers scale and direct procurement, ADI provides deep, collaborative engineering support essential for integrating its high-performance, specialized chips into complex systems like advanced driver-assistance systems (ADAS) and battery management systems (BMS). Automakers may choose TI for supply chain security and cost on broad-application parts, while partnering with ADI for its deep technical expertise on cutting-edge, performance-critical solutions.

Review detailed strategy and competitive analysis of companies in Analog & Mixed-Signal ICs

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.