Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

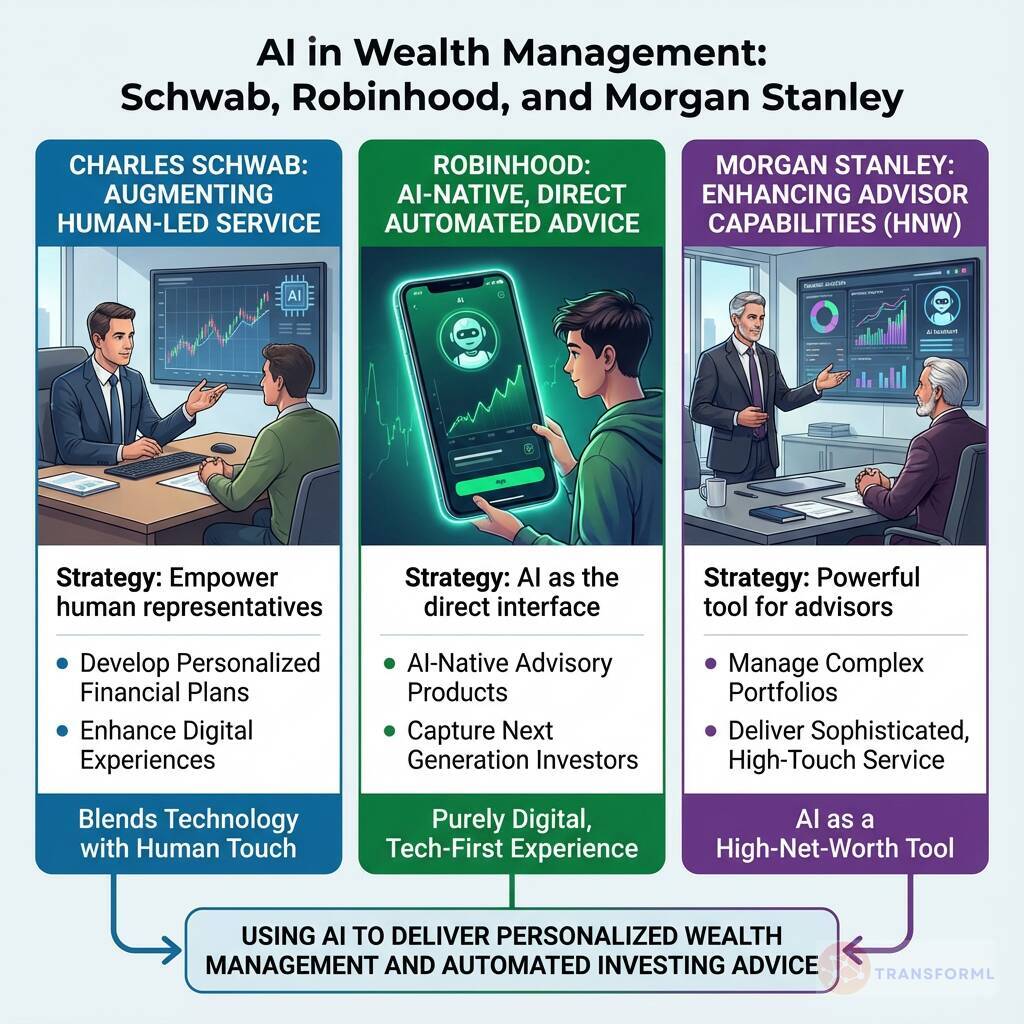

How are Charles Schwab, Robinhood, and Morgan Stanley using AI to deliver personalized wealth management and automated investing advice?

Charles Schwab is integrating AI primarily to augment its human-led, client-centric service model. The company's strategy focuses on using technology to empower its representatives to "Develop Personalized Financial Plans" and to "Enhance Digital Experiences" for clients. This approach blends technology with the human touch, using AI and automation to streamline back-office processes, improve efficiency, and provide better self-service tools. Rather than replacing advisors, Schwab's strategy suggests using AI to make its human-delivered advice more scalable, accessible, and insightful, aligning with its core principle of seeing the world "Through Clients' Eyes."

In contrast, digital-native competitors are pursuing a more aggressive, tech-first AI strategy. Robinhood, for instance, is noted for its plan to develop "AI-Native Advisory Products," aiming to use AI as the direct interface for automated advice and capture the "next generation" of investors who prefer a purely digital experience. Meanwhile, traditional wealth managers like Morgan Stanley, known for serving high-net-worth clients, likely use AI in a manner more similar to Schwab—as a powerful tool to enhance the capabilities of their human advisors, helping them manage complex portfolios and deliver sophisticated, high-touch service.

Review detailed strategy and competitive analysis of companies in Brokerage & Trading Platforms

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.