Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

How are ExxonMobil, Chevron, and ConocoPhillips investing differently in low carbon solutions like hydrogen, carbon capture, and renewable fuels?

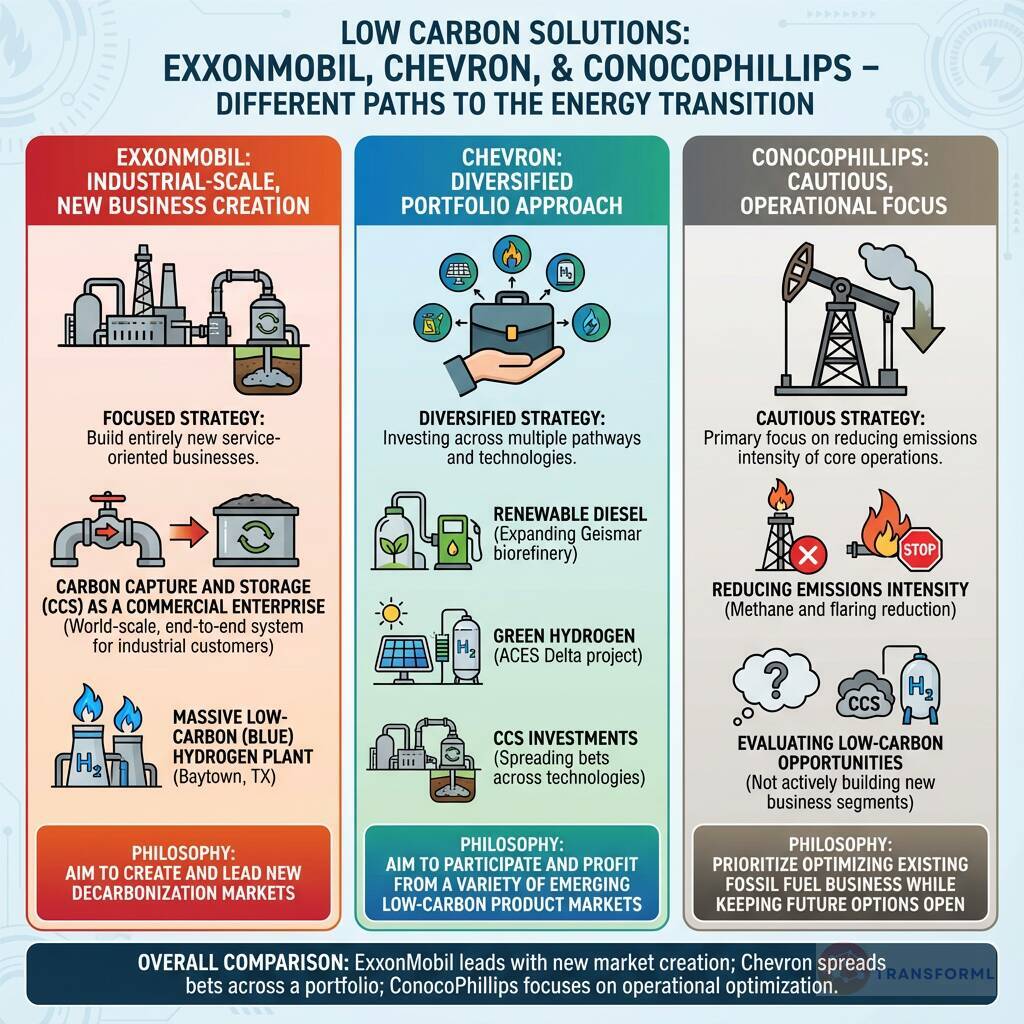

ExxonMobil, Chevron, and ConocoPhillips are taking distinct strategic paths in their investments into low-carbon solutions, reflecting different philosophies on the energy transition. ExxonMobil is pursuing a focused, industrial-scale strategy centered on building entirely new service-oriented businesses. Its "Low Carbon Solutions" division is making an unparalleled bet on Carbon Capture and Storage (CCS) as a commercial enterprise, aiming to build a world-scale, end-to-end system to serve industrial customers. This is paired with developing a massive low-carbon (blue) hydrogen plant in Baytown. In contrast, Chevron is taking a more diversified, portfolio approach. It is investing across multiple pathways, including tangible projects in renewable diesel (expanding its Geismar biorefinery), green hydrogen (the ACES Delta project), and CCS, spreading its bets across various technologies rather than concentrating on one dominant solution.

ConocoPhillips, as a pure-play exploration and production company, represents the most cautious approach of the three. Its primary focus is on reducing the emissions intensity of its core operations, such as methane and flaring reduction. While its strategy includes "evaluating" low-carbon opportunities like CCS and hydrogen for future investment, it is not actively building new business segments around them in the same way as its larger, integrated peers. This highlights a fundamental difference: ExxonMobil aims to create and lead new decarbonization markets, Chevron aims to participate and profit from a variety of emerging low-carbon product markets, and ConocoPhillips prioritizes optimizing its existing fossil fuel business while keeping future options open.

Review detailed strategy and competitive analysis of companies in Energy

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.