Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

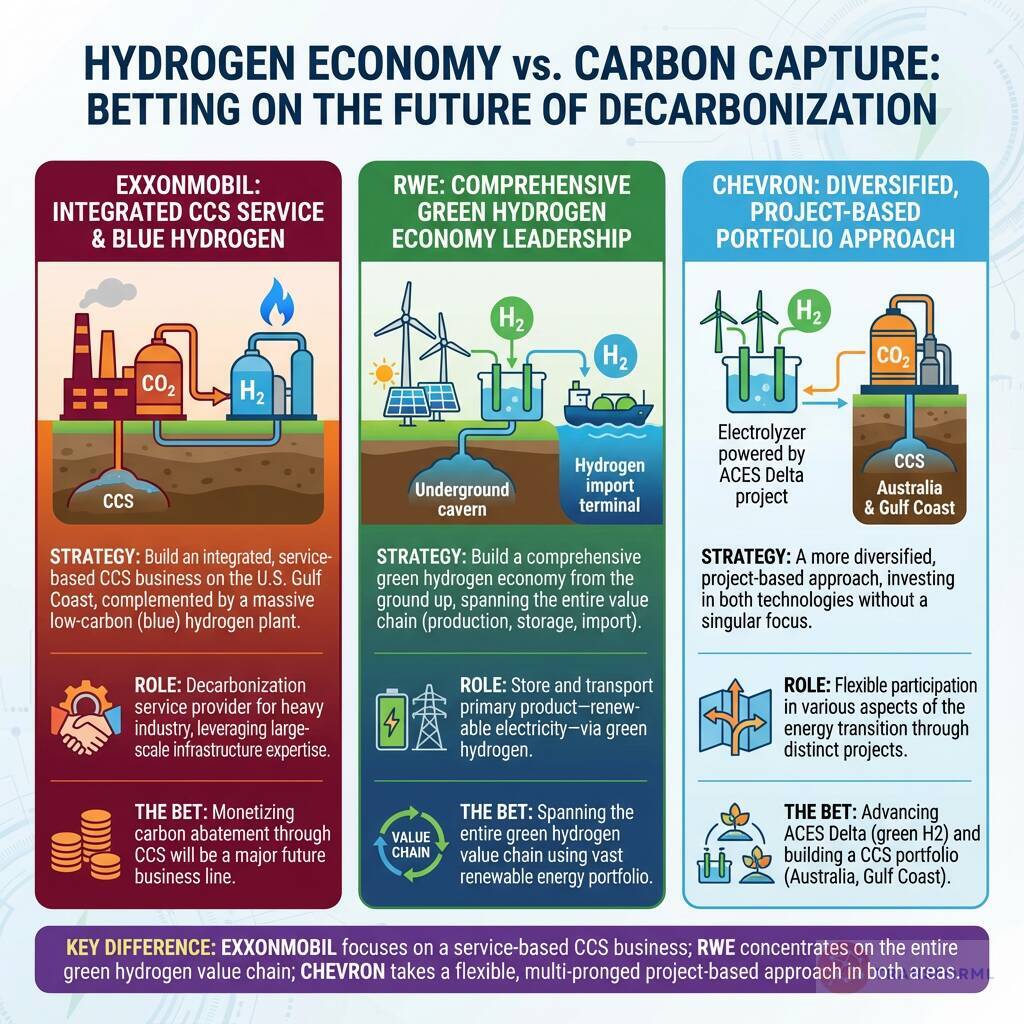

Hydrogen Economy vs. Carbon Capture: How are ExxonMobil, RWE, and Chevron betting on the future of decarbonization?

ExxonMobil, RWE, and Chevron are placing significant but fundamentally different bets on hydrogen and carbon capture. ExxonMobil's strategy is uniquely centered on building an integrated, service-based Carbon Capture and Storage (CCS) business on the U.S. Gulf Coast, complemented by a massive low-carbon (blue) hydrogen plant. This positions ExxonMobil not just as an energy producer, but as a decarbonization service provider for heavy industry, leveraging its expertise in large-scale infrastructure projects. Its investment is a concentrated bet that monetizing carbon abatement through CCS will be a major future business line.

In contrast, European utility RWE is focused on building a comprehensive green hydrogen economy from the ground up. Its "Hydrogen Economy Leadership" goal spans the entire value chain, using its vast renewable energy portfolio to power electrolysis (e.g., the 300 MW GET H2 project), developing storage infrastructure (Germany's first commercial hydrogen cavern), and establishing import terminals. For RWE, green hydrogen is a way to store and transport its primary product—renewable electricity. Chevron takes a more diversified, project-based approach, investing in both technologies without the singular focus of the other two. It is advancing the ACES Delta green hydrogen project in the U.S. while separately building a CCS portfolio in locations like Australia and the Gulf Coast, reflecting a more flexible, multi-pronged strategy to participate in various aspects of the energy transition.

Review detailed strategy and competitive analysis of companies in Energy

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.