Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

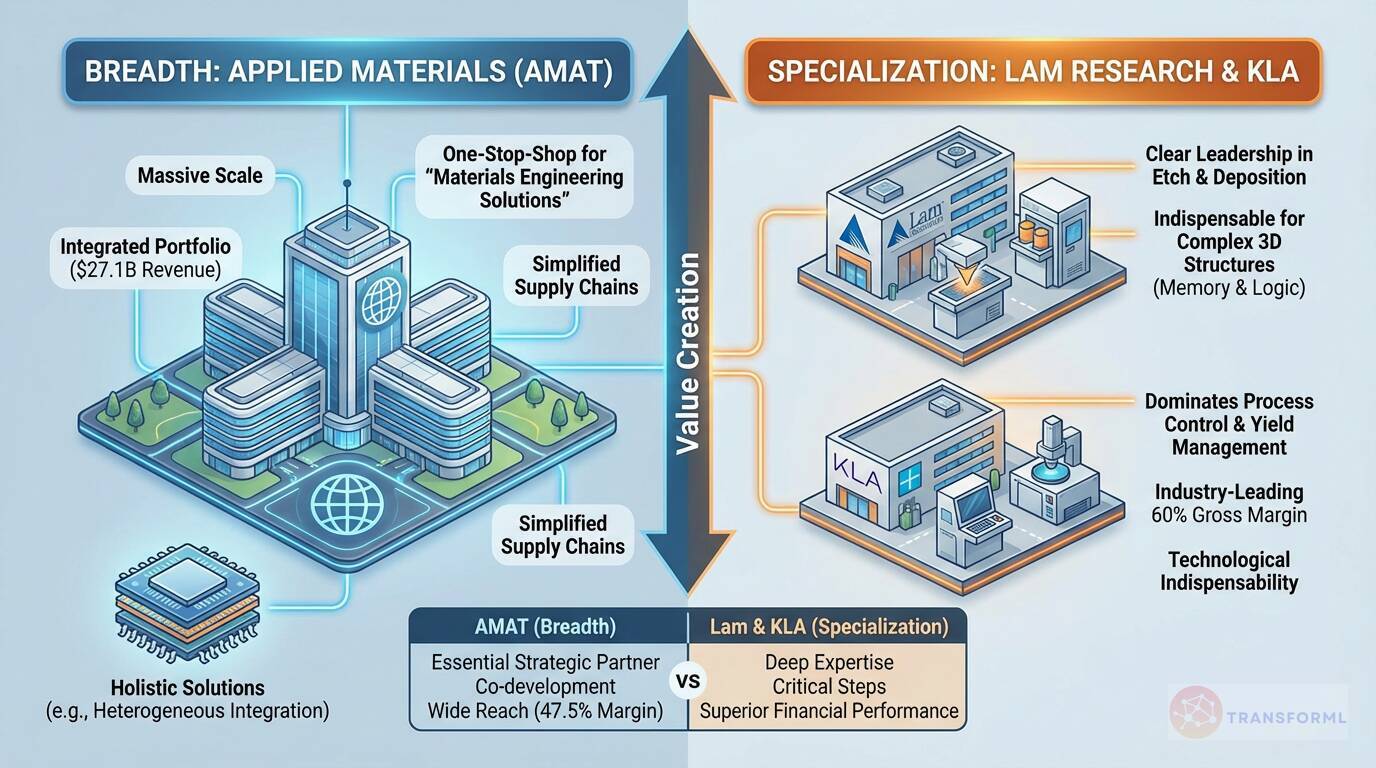

Breadth vs. Specialization: How do the different business models of Applied Materials, Lam Research, and KLA create value?

The semiconductor equipment market showcases two powerful value-creation models: breadth and specialization. Applied Materials epitomizes the "breadth" strategy, creating value through its massive scale and integrated portfolio. As the largest player with $27.1B in revenue, AMAT acts as a one-stop-shop for "materials engineering solutions." It offers a "comprehensive and connected portfolio" that allows chipmakers to simplify their supply chains and co-develop holistic solutions for complex challenges like "heterogeneous integration," making AMAT an essential strategic partner.

Lam Research and KLA, on the other hand, create value through deep "specialization." Lam Research has "clear leadership in the etch and deposition technologies," making it an indispensable partner for creating the complex 3D structures essential for modern memory and logic chips. KLA dominates the high-margin niche of "process control and yield management." This focus allows it to command an industry-leading 60% gross margin, far superior to AMAT's 47.5%. The value from these specialists comes not from being the biggest, but from being the undisputed best at a critical and non-negotiable step in the manufacturing process, which translates to technological indispensability and superior financial performance.

Review detailed strategy and competitive analysis of companies in Semiconductor-Equipment Makers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.