Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

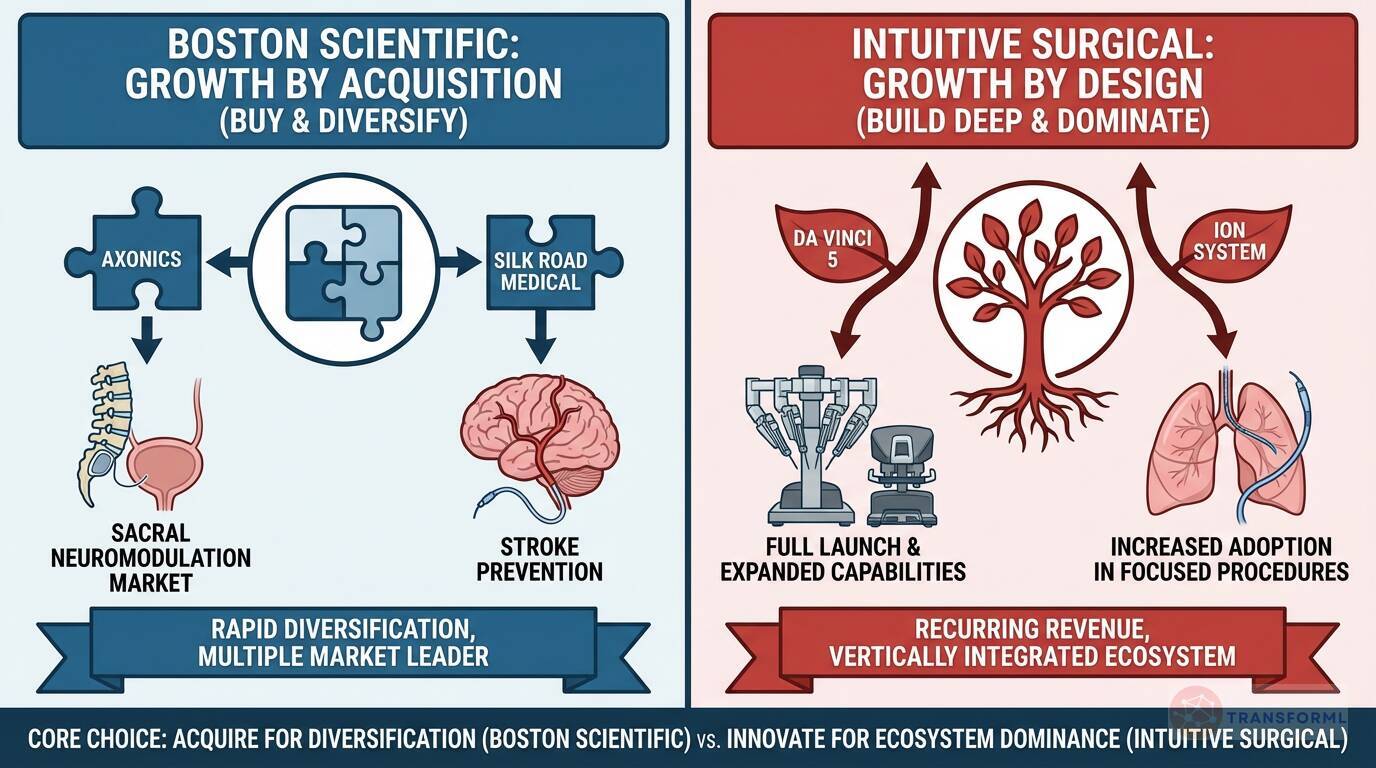

Growth by Design vs. Acquisition: How do the expansion strategies of Boston Scientific and Intuitive Surgical define the med-tech market?

The expansion strategies of Boston Scientific and Intuitive Surgical represent two fundamentally different, yet highly successful, models for growth in the med-tech market. Boston Scientific exemplifies growth by acquisition. Its strategy is explicitly built around "Strategic Acquisitions" to "Expand into High-Growth Adjacencies." The company's key initiatives, such as the plan to "Integrate Axonics Product Portfolio" to enter the sacral neuromodulation market and "Commercialize Silk Road Medical Platform" for stroke prevention, are direct results of buying its way into new categories. This approach allows for rapid diversification and the ability to quickly establish a leadership position in multiple high-growth, high-margin fields.

In stark contrast, Intuitive Surgical champions a strategy of growth by design, focusing on organic expansion from its core platform. With 84% of its revenue being recurring, Intuitive's entire strategy revolves around deepening the penetration and capabilities of its da Vinci and Ion systems. Its goals to "Focus on Full Launch of da Vinci 5" and "Pursue Increased Adoption of Focused Procedures" are not about entering new markets via M&A, but about expanding the use cases and technological superiority of its existing products. This creates an incredibly powerful competitive moat built on a massive installed base, extensive training programs, and a vertically integrated ecosystem. This strategic divergence highlights a core choice for med-tech firms: buy growth and diversify quickly, or build deep and dominate a single, lucrative ecosystem.

Review detailed strategy and competitive analysis of companies in Medical-Device Makers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.