Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

Beyond the Device: How are Medtronic, Intuitive Surgical, and Boston Scientific using AI and data to build the next generation of patient care?

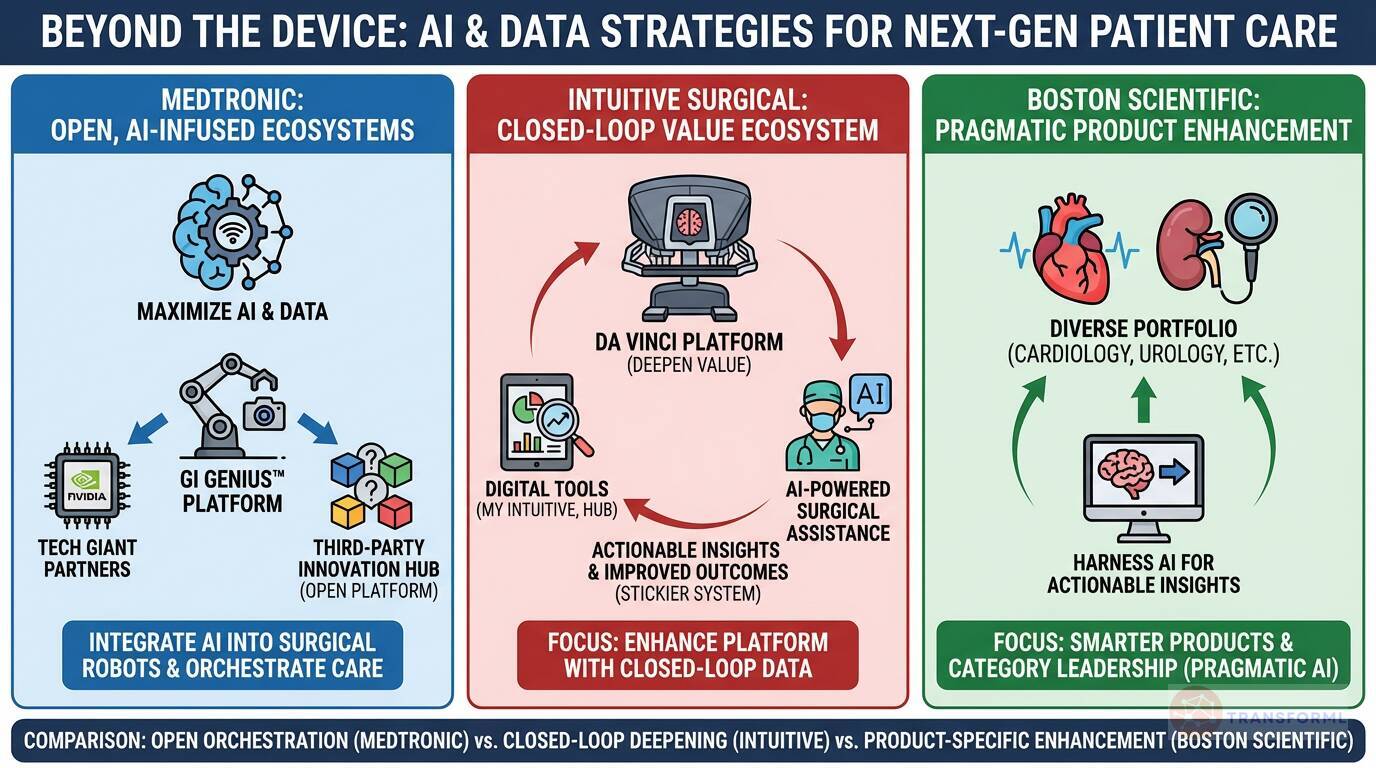

Medtronic, Intuitive Surgical, and Boston Scientific are moving beyond selling standalone devices by integrating AI and data, but their approaches differ significantly. Medtronic is pursuing the most open and ambitious strategy, aiming to create broad, AI-infused ecosystems. Its goal to "Maximize new technology, artificial intelligence (AI), and data" is exemplified by the GI Genius endoscopy module. Medtronic is not only partnering with tech giants like NVIDIA to enhance GI Genius but is also planning to "Open the GI Genius platform to third-party companies," effectively creating a collaborative innovation hub. This open-platform model, combined with efforts to "Integrate AI into Surgical Robots," positions Medtronic as a potential data-driven orchestrator of care in the specialties it serves.

Intuitive Surgical and Boston Scientific employ more focused AI strategies. Intuitive's approach is a closed-loop ecosystem designed to deepen the value of its da Vinci platform. It is investing in "AI-Powered Surgical Assistance" and enhancing its "Digital Tool Integration" with platforms like My Intuitive and Intuitive Hub. The goal is to use data to provide surgeons with actionable insights and improve outcomes, making the da Vinci system stickier and more powerful. Boston Scientific, with its diverse portfolio, uses AI more pragmatically to "Harness AI for Actionable Insights" and support its goal of "Category Leadership." For Boston Scientific, AI and data are tools to make specific products—like those in its cardiology and urology portfolios—smarter and more competitive, rather than building a single, all-encompassing digital platform.

Review detailed strategy and competitive analysis of companies in Medical-Device Makers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.