Editor-reviewed by Ahmad Zaidi based on analysis by TransforML's proprietary AI

CEO, TransforML Platforms Inc. | Former Partner, McKinsey & Company

The Race for the Robotic Operating Room: How are Intuitive Surgical, Stryker, and Medtronic shaping the future of surgery?

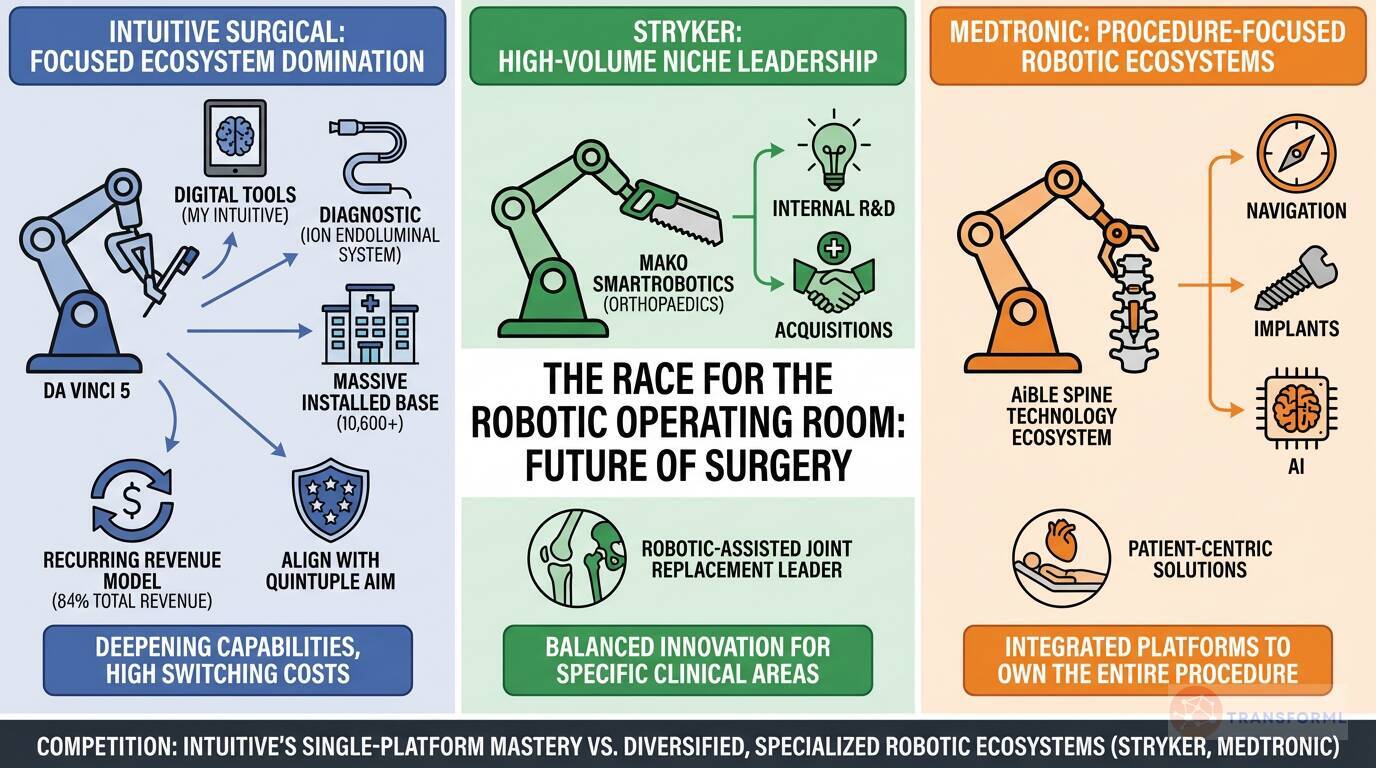

The future of the robotic operating room is being shaped by three distinct strategies. Intuitive Surgical, the established market leader, is pursuing a strategy of focused ecosystem domination. With a massive installed base of over 10,600 da Vinci systems, its focus is on deepening the platform's capabilities with innovations like the da Vinci 5, enhancing digital tools like My Intuitive, and expanding into new diagnostic areas with its Ion endoluminal system. Intuitive aims to make its comprehensive ecosystem indispensable to hospitals by aligning with the "Quintuple Aim" (improving outcomes, patient experience, care team experience, access, and lowering cost), thereby creating high switching costs and a powerful recurring revenue model that accounts for 84% of its total revenue.

In contrast, Stryker and Medtronic are leveraging their strengths in specific clinical areas to challenge Intuitive's dominance. Stryker has successfully carved out a leadership position in a high-volume niche with its Mako SmartRobotics platform for orthopaedic surgery. Its "Healthcare innovation" strategy balances internal R&D with acquisitions to enhance this stronghold, making it the go-to provider for robotic-assisted joint replacement. Medtronic is adopting a broader ecosystem approach, aiming to go "beyond devices to deliver patient-centric solutions." It is building integrated platforms like the AiBLE spine technology ecosystem, which combines robotics, navigation, implants, and AI to own the entire procedure. This positions the race as a contest between Intuitive's deep, single-platform mastery and the more specialized, procedure-focused robotic ecosystems being built by diversified giants like Stryker and Medtronic.

Review detailed strategy and competitive analysis of companies in Medical-Device Makers

Source and Disclaimer: This article is based on publicly available information and research. For informational purposes only (not investment, legal, or professional advice). Provided 'as is' without warranties. Trademarks and company names belong to their respective owners.